6.3.1 Compute the Net Discount Accrual Amount

The following details are stored in the system during Discount Accrual:

- Outstanding bill amount

- Outstanding arrears interest accrued

- Discounted interest to be accrued

- Premium to be accrued

- Discount to be accrued

- Interest adjustment accrued already

- Premium accrued till date

- Discount accrued till date

Catch-Up of Discount Accrual is done during a BC contract rollover also. The

net Discount Accrual amount for a processing day is computed as follows:

- All future cash flows are discounted to the processing day using

the IRR useful as of the processing day, and the net present value (NPV) of the

contract as of the processing day is obtained. The NPV is calculated based on

the acquisition type as follows:

- If the acquisition type is Discount, NPV is given by NPV = outstanding bill amount + outstanding arrears interest accrued + outstanding acquired interest – (discounted interest to be accrued – discounted interest accrued) – (discount to be accrued - discount accrued).

- If the acquisition type is Premium, the NPV is given by NPV = outstanding bill amount + outstanding arrears interest accrued + outstanding acquired interest - (discounted interest to be accrued – discounted interest accrued) + (discount to be accrued - discount accrued).

- If the acquisition type is Par, the NPV is given by NPV = outstanding bill amount + outstanding arrears interest accrued + outstanding acquired interest – (discounted interest to be accrued – discounted interest accrued) + (interest adjustment accrued already + interest adjustment accrued).

- Outstanding arrears accrued interest is only for arrears (bearing) type contracts. The discounted interest is only for discounted type contracts.

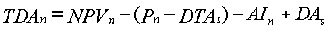

- The till date Discount Accrual amount is computed using the

following expression:

- where,

- TDAn represents the Till Date Discount Accrual for nth Accrual Date

- NPVn, the Net Present Value of the contract as of nth Accrual Date

- Pn, the Outstanding Principal of the contract as of nth Accrual Date

- DTAs, the Discount to be accrued as of current IRR Effective Date

- AIn, the Current Period Accrued Interest as of nth Accrual Date, and

- DAs, the Discount Accrued as of current IRR Effective Date

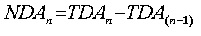

- The difference between the Till date Discount Accrual amount as of

the previous processing day and the Till date Discount Accrual amount as of the

current processing day is the Net Discount Accrual amount is realized as income

as of the processing day. The expression used would be

Where,

- NDAn represents the Accrual for nth Accrual Date,

- TDAn, the Till Date Discount Accrual for nth Accrual Date and

- TDAn-1, the Till Date Discount Accrual for n-1th Accrual Date.