- Islamic Letters of Credit

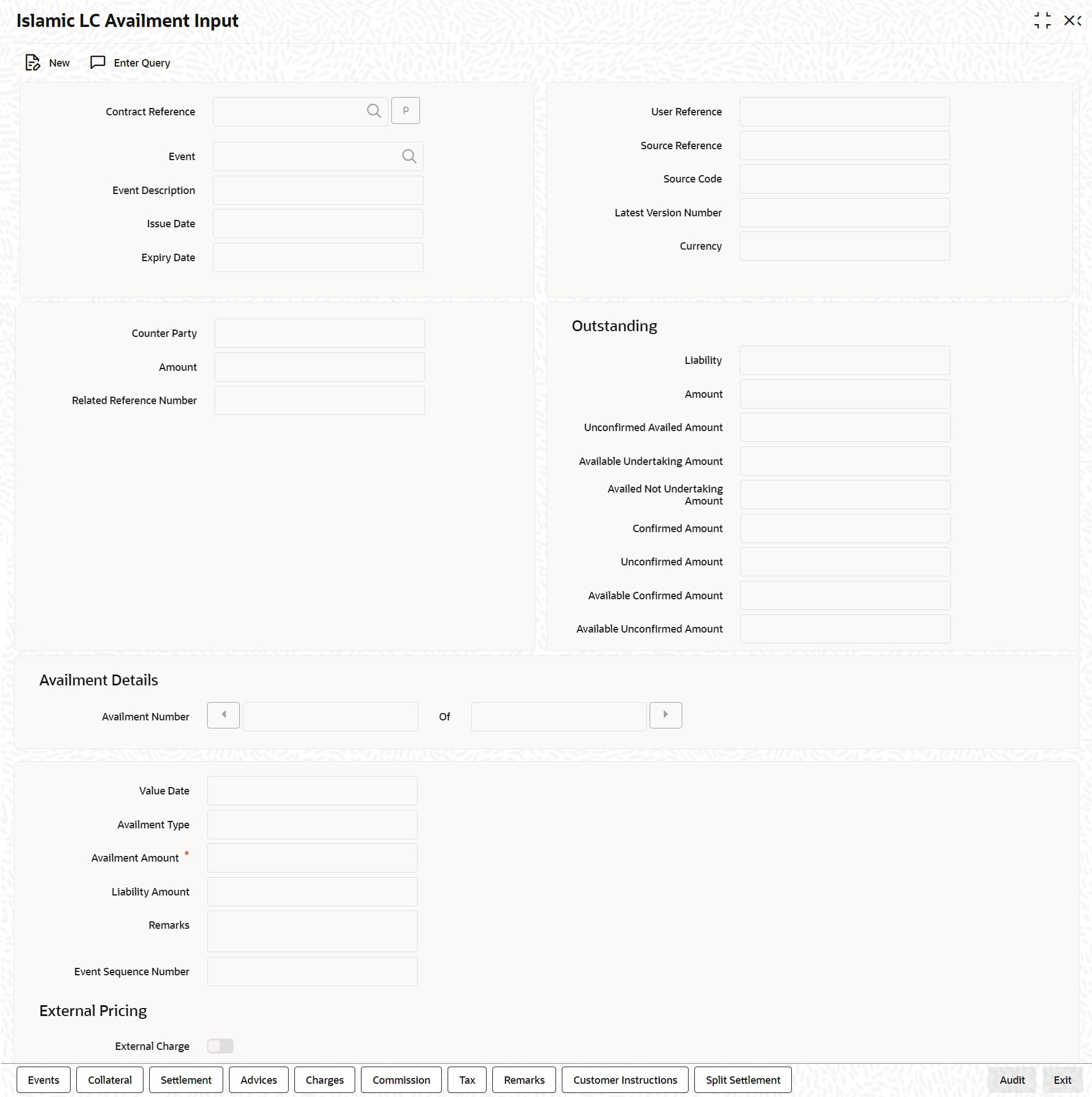

- Islamic LC Availment Input

- Islamic LC Contract Availment

6.2.1 Islamic LC Contract Availment

This topic provides systematic instruction to record an availment under an Islamic LC, upon receipt of bills or notification from the negotiating bank.

- On the homepage, type LIDAVMNT in the text box, and click the next

arrow.The Islamic LC Availment Input screen is displayed.

- On the Islamic LC Availment Input screen, click

New.The Islamic LC Availment Input screen is displayed with no details.

Enter the field details and click Save to maintain the details.

At the Contract Reference field, you can fetch the Islamic LC Contract on which you want to do an availment by either executing a query or through the option list available for the field.

If you pick it up through the option list then press <F8> after you get the Islamic LC Contract on which you want to make the availment.

For more information on fields, refer the Field Description table given below:Table 6-1 Islamic LC Availment Input - Field Description

Field Description Contract Reference Specify or select the contract reference number from the option list provided. Click ‘P’ button. This field is mandatory.

The following contract details will be displayed:- Event

- Event Description

- Issue Date

- Expiry Date

- Counter Party

- Amount

- Related Reference Number

- User Reference

- Source Reference

- Latest Version No

- Currency

- Liability

Availment Details Specify the availment details. Value Date An availment can be made either as of a date in the past or today. By default, the system displays the current date. You can change it to a date in the past. This field is optional.

Availment Type Specify the type of availment to be recorded under the LC. Click the drop-down list and select one of the following values: - Payment

- Acceptance

- Negotiation

Note:

If the entry to this field does not adhere to the conditions specified above you will be prompted for an override.This field is optional.

Availment Amount You can specify the amount being availed under the Islamic LC, in this screen. The availment amount that you specify cannot be greater than the Outstanding Islamic LC Amount displayed in this screen. Partial amounts can be availed against an Islamic LC. The availment thus need not always be the amount available under the Islamic LC. After an availment is made on an Islamic LC, the Islamic LC amount is automatically reduced. The Islamic LC amount after the availment is displayed in the Outstanding Islamic LC Amount field of the Islamic LC Contract screen.

This field is mandatory.

Liability Amount The Liability Amount refers to the customer’s liability to the bank. For an availment you can specify the amount that should be reduced, from the Outstanding Liability amount. The Outstanding Liability amount can be reduced by an amount that is greater or less than the amount currently being availed. By default, the availment amount specified in the Availment Amount field will be defaulted here.

Note:

The liability amount that you specify should not result in the Outstanding Liability Amount being less than the Outstanding LC Amount. If the values entered as the Availment Amount and the Liability Amount result in the liability amount being less than the LC amount, an error message will be flashed. The message will prompt you to re-enter values to the relevant fields.This field is optional.

Remarks Click the icon and enter information about the availment in the window that pops up. This information is intended for the internal reference of your bank. These remarks will be displayed when the details of the availment are retrieved or printed. However, this information will not be printed on any correspondence with the customer This field is optional.

Event Sequence Number The system displays the event sequence number. This indicates a number corresponding to the number of events for which the operation has been performed. This field is optional.

Outstanding Specify the Outstanding details. Liability On clicking ‘P’ button after specifying the contract reference number, the system displays the current liability amount. This field is optional.

Amount On clicking ‘P’ button after specifying the contract reference number, the system displays the current outstanding amount. This field is optional.

Unconfirmed Availed Amount The system displays the Unconfirmed Availed Amount on clicking 'P' button after specifying the contract reference number, Available Undertaking Amount The system defaults the latest availed undertaking amount on click of 'P' button after specifying the contract reference number. Availed Not Undertaking Amount The system defaults the latest availed non undertaking amount on click of 'P' button after specifying the contract reference number. Confirmed Amount On clicking ‘P’ button after specifying the contract reference number, the system displays the current confirmed amount. This field is optional.

Unconfirmed Amount On clicking ‘P’ button after specifying the contract reference number, the system displays the current unconfirmed amount. This field is optional.

Available Confirmed Amount On clicking ‘P’ button after specifying the contract reference number, the system displays the current available confirmed amount. This field is optional.

Available Unconfirmed Amount On clicking ‘P’ button after specifying the contract reference number, the system displays the current available unconfirmed amount. This field is optional.

External Pricing Specify the external pricing details such as external charge. External Charge During the availment for a contract for which external charges is enabled at product level, external charges is fetched from external pricing and billing engine. This field is optional.

A horizontal array of buttons is displayed. These buttons invoke the various functions necessary to make an availment on an Islamic LC.

The buttons have been briefly described below:Buttons Description Advices Click this button to define the advices that will be generated for the availment. Commission This button invokes the Commissions service. Charges This button invokes the Charges and fees service. The chapter titled Processing Charges on Islamic LCs details the procedure of maintaining charge rules. It also deals with the application of the scheme on an availment. Tax This button invokes the availment tax services. The tax details applicable for the availment will be shown and you can choose to waive it, if necessary. The chapter titled Processing Tax for Islamic LCs details the procedure of maintaining tax rules and schemes. It also deals with the linking and application of the scheme on an availment. Settlement Click on this button to invoke the Settlement screens. You can specify settlement details for the availment like: - the accounts to be used for the availment

- message details

- party details

Based on the details that you enter in the settlement screens, the availment will be settled. The details of these screens have been discussed under the head Maintaining Settlement Instructions in this chapter.

Collateral Specify the adjustments that you want to make, on the cash collected as collateral. Event Click on this button to view the details of the events and accounting entries that an availment entails. This icon also gives the details of other events on the Islamic LC. Remarks Click this button to view the ‘History of Remarks’ screen. Enter valid inputs into all the mandatory fields before you save the availment. Save the contract by either clicking on Save icon in the toolbar.

On saving the availment, your User Id will be displayed in the ‘Entry By’ field at the bottom of the screen. The date and time at which you saved the record will be displayed in the ‘Date Time’ field.

A user bearing a different User ID should authorize an availment that you have entered, before the EOD is run. The ID of the user who authorized the availment will be displayed in the ‘Auth By’ field. The date and time at which the availment has been authorized will be displayed in the ‘Date Time’ field.

The current status of the Islamic LC contract on which you are processing the availment, is also displayed in the field ‘Contract Status’. The field will display one of the following:- Active

- Closed

- Reversed

- Cancelled

- Hold

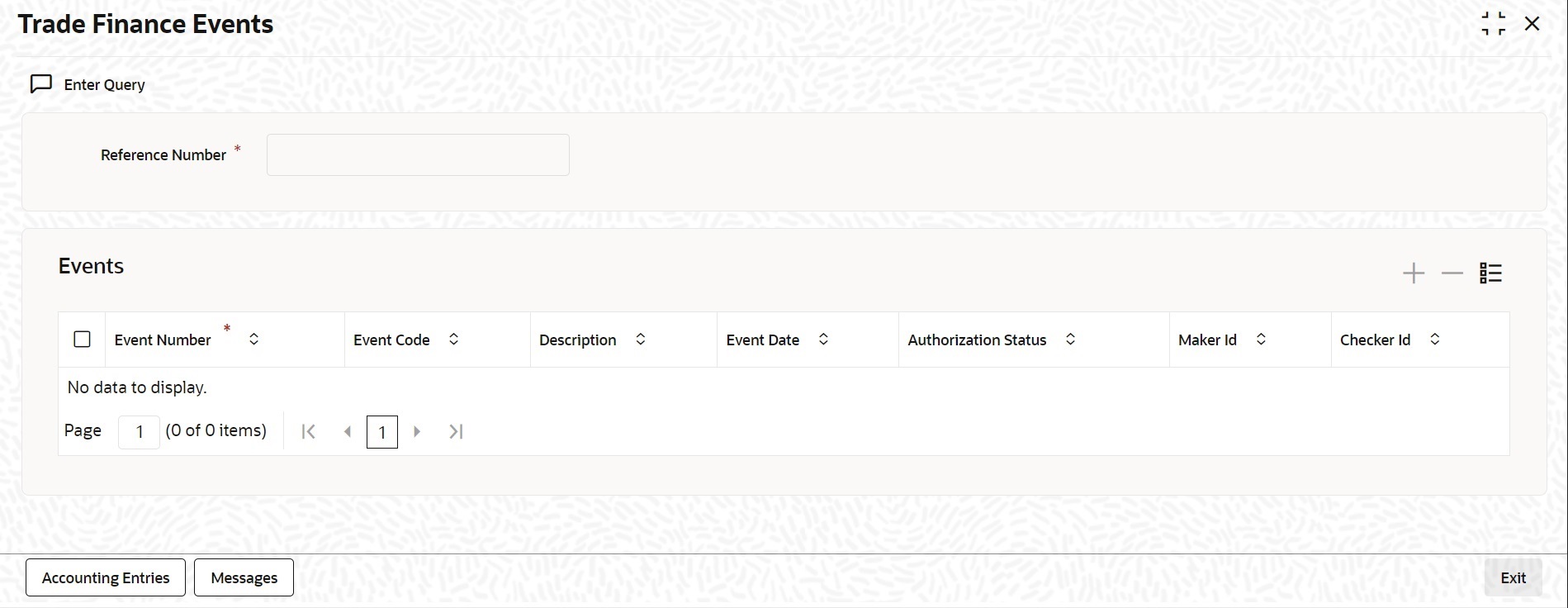

- On the Islamic LC Availment Input screen, click the

Events button.The Trade Finance Events screen is displayed. You can view the details of the events and accounting entries that an availment entails.It also provides the details of other events on the Islamic LC.

Note:

The details of events that have taken place on the contract including the last availment, that you are have just entered will be displayed. The date on which the event took place will also be displayed - On the Trade Finance Events screen, click the

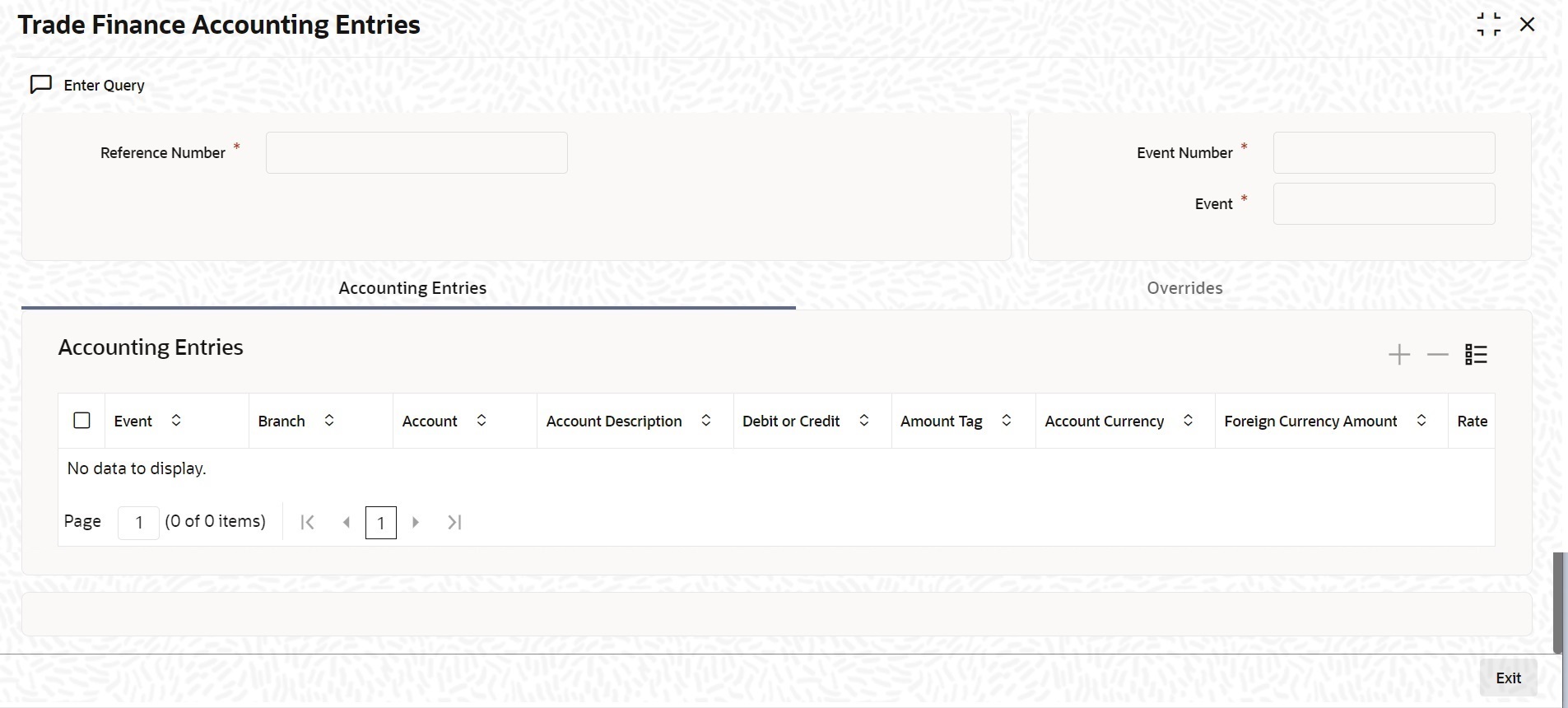

Accounting Entries.The Trade Finance Accounting Entries screen is displayed.

You can view the details of the accounting entries that were passed only for the event displayed in the availment - View Events screen.

Note:

The system displays the reference number, event number and event by default. - Click on Exit to go back to the Islamic LC

Availment Input screen.

Figure 6-3 Trade Finance Accounting Entries

Description of "Figure 6-3 Trade Finance Accounting Entries"The following information is provided for each event:- Event

- Branch

- Account

- Account Description

- Debit or Credit

- Amount Tag

- Account Currency

- Foreign Currency Amount

- Rate

- Local Currency Amount

- Date

- Value Date

- Txn Code

- All the overrides that were allowed for an event will also be displayed

Note:

The system will display an override message if the date when the availment is made i.e. the value date of the availment falls after the expiry date for the islamic LC issued. You may use your discretion to proceed or cancel the contract. You can also have this override configured as an error message in which case, the system will not allow you to proceed until you make the necessary changes. - On the Islamic LC Availment Input screen, click the

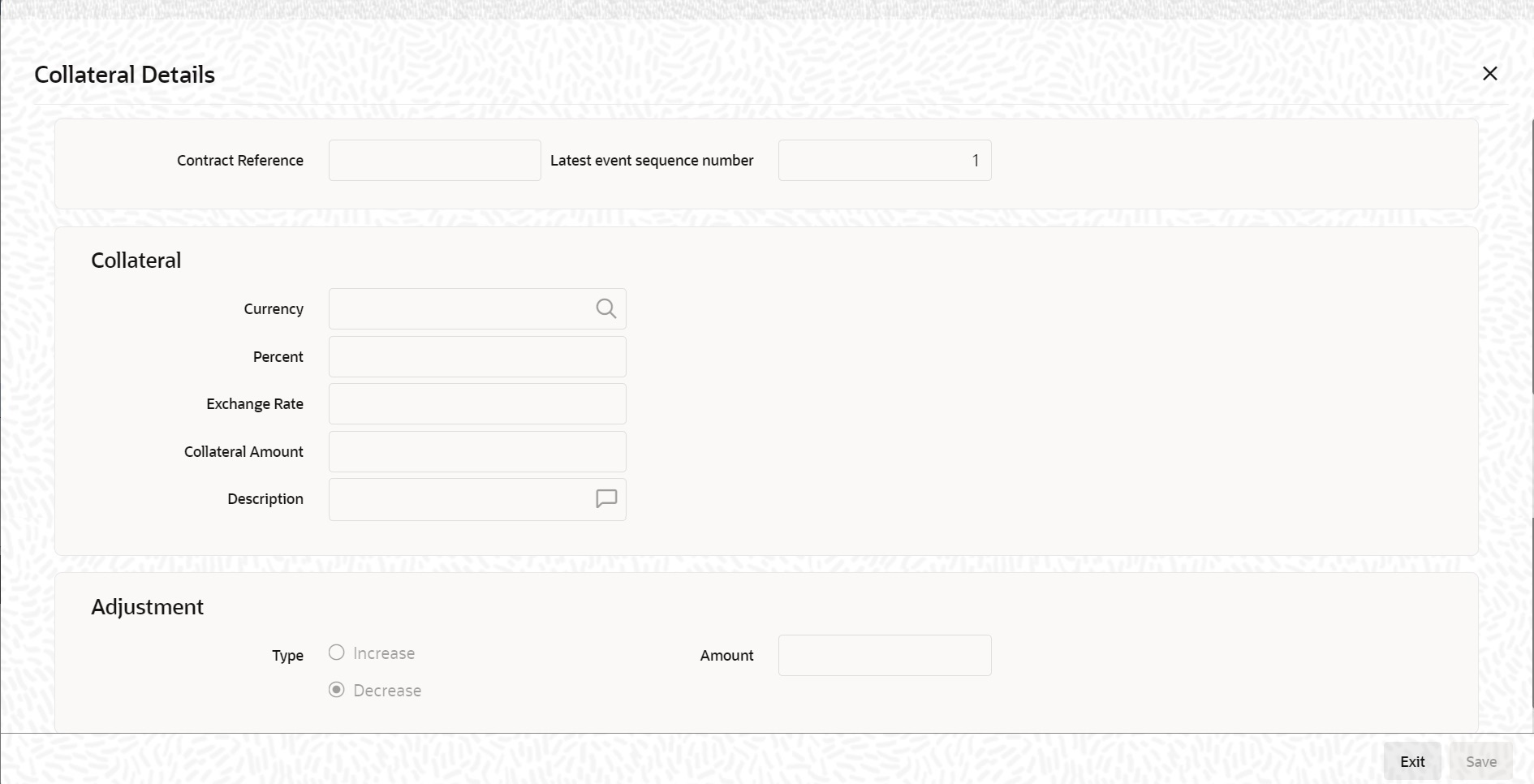

Collateral button.The Collateral Details screen is displayed.

If the Islamic LC that you are processing has been backed by cash collateral, you can specify the cash collateral to be released as a result of the availment.

By default, the collateral amount proportional to the amount availed will be adjusted automatically. This default amount can be reduced or increased.If the LC that you are processing has been backed by cash collateral, you can specify the cash collateral to be released as a result of the availment.

By default, the collateral amount proportional to the amount availed will be adjusted automatically. This default amount can be reduced or increased.

For more information on fields, refer the Field Description table given below:Table 6-2 Collateral Details - Field Description

Field Description Contract Reference The system displays the contract reference number. This field is optional.

Latest Event Sequence Number The system displays the latest even sequence number. This field is optional.

Collateral Details Provide the collateral details: Currency The currency of the collateral is displayed here. This field is optional.

Percent The system displays the percentage of islamic LC amount that should be considered for the collateral amount. This field is optional.

Exchange Rate The exchange rate to be used in the conversion is displayed here. The value of the collateral is determined based on this exchange rate. This field is optional.

Collateral Amount The collateral amount is displayed here. Description A brief description of the collateral is displayed here. Adjustment Details Specify the Adjustment Details. This field is optional.

Type You can increase the collateral amount that is calculated by default. Choose ‘Increase’ option and enter the amount by which the cash collateral should be increased. You can decrease the collateral amount that is calculated by default. Choose the Decrease option and enter the amount by which the cash collateral should be decreased.

If you are adjusting the collateral against an availment, you should have defined the appropriate accounting entries for the event code AVAL.

Not invoking the Cash Collateral screen during the availment session will mean that you do not want to adjust the collateral. This would be so even if you have defined the accounting entries for availment reduction. An override to this effect will be displayed when you save the availment.

This field is optional.

Amount You can increase the collateral amount that is calculated by default. Choose Increase option and enter the amount by which the cash collateral should be increased. This field is optional.

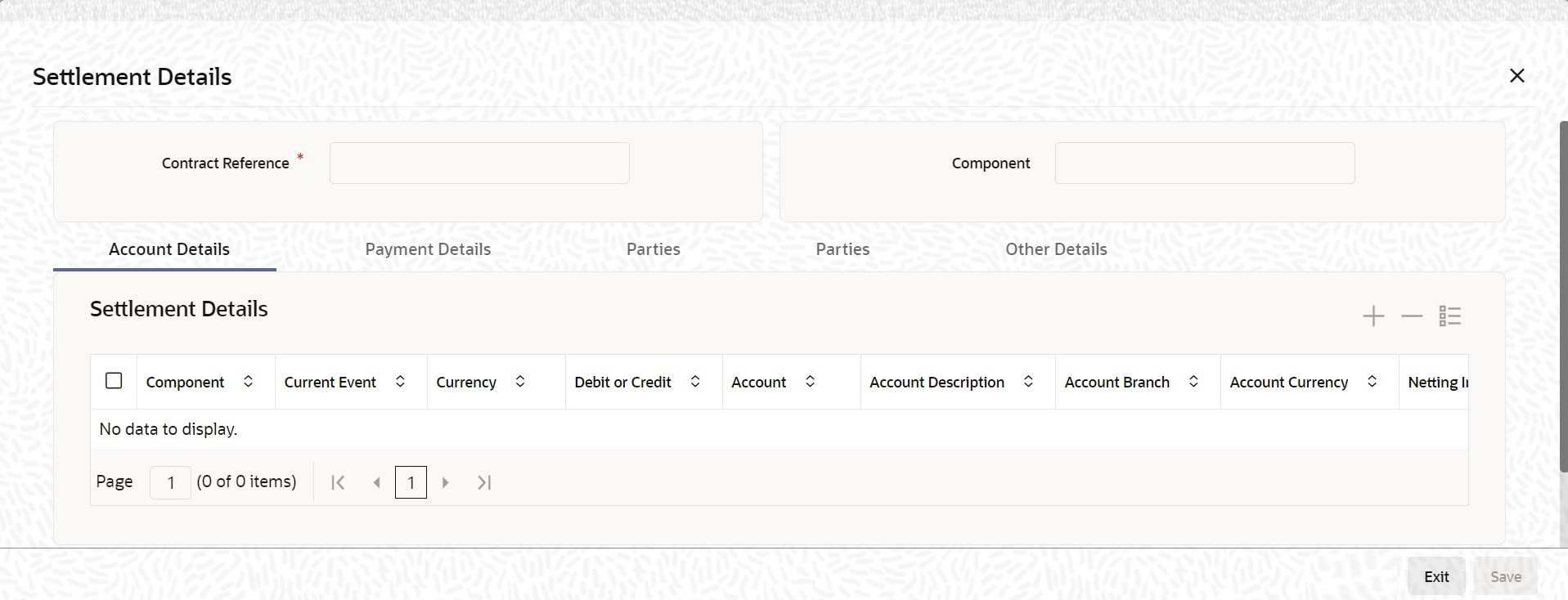

- On the Islamic LC Availment Input screen, click the

Settlement button.The Settlement Details screen is displayed.

- Account details - The details about the accounts involved in the availment that have to be either debited or credited in your branch

- Current Event:

Current event of settlements will be checked for the amount tags pertaining to the current event and will be unchecked for the amount tags not pertaining to the current event.

- Payment details - The details about the payments involved in the availment.

- Party details - The details about the various parties involved in the transfer, to be a part of the message generated.

- Other Details - Other details about the contract is included.

- On the Settlement Details screen, click the Account Details tab.

- Specify the field details and click Ok.

- On the Settlement Details screen, click the

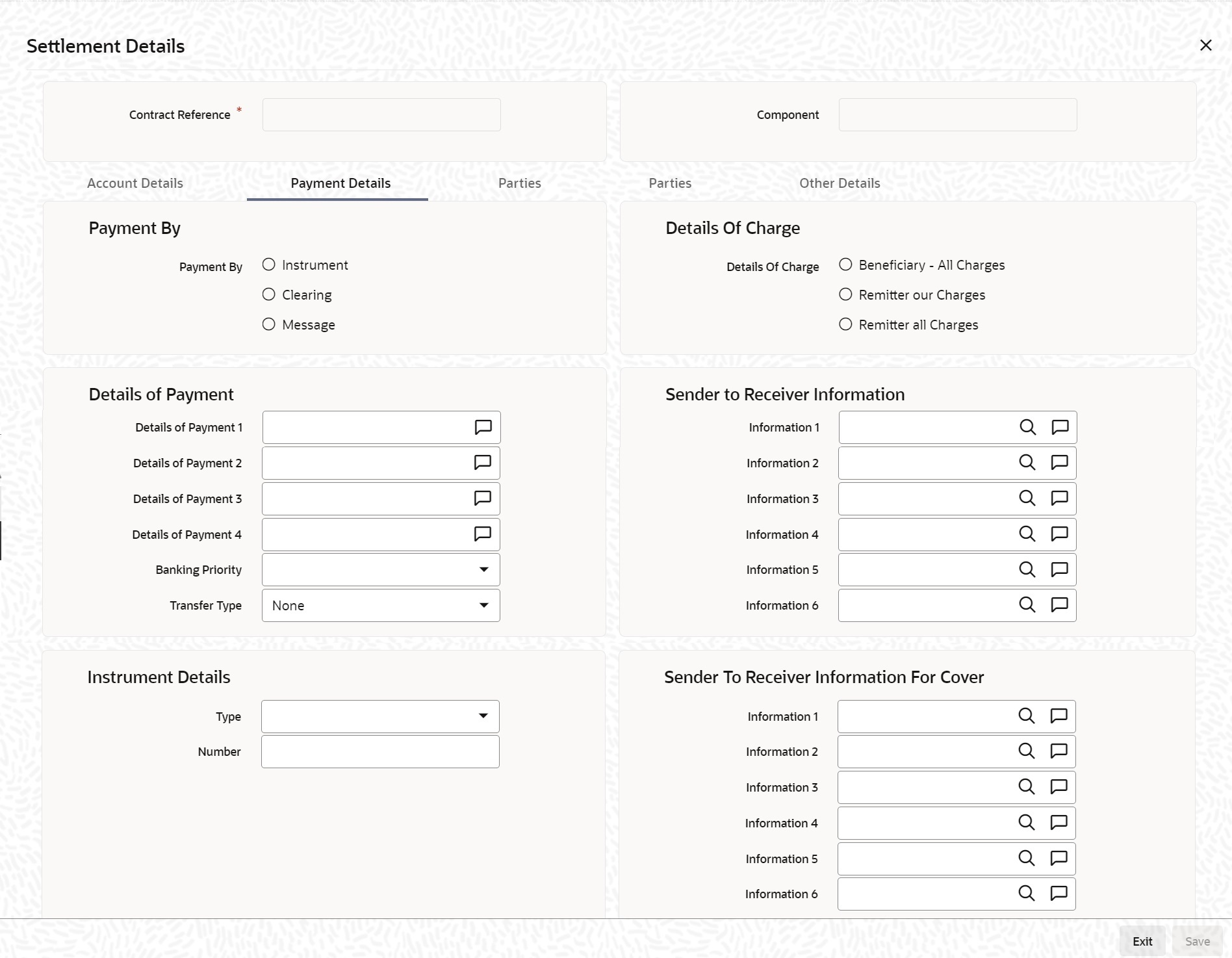

Payment Details tab.The Payment Details screen is displayed.

The Payment Details screen is displayed.

A Letter of Credit can be settled either in the form of an instrument or a Message (a SWIFT, TELEX or Mail message to be sent to the concerned party). The details regarding the instrument or message have to be specified in the Message Details screen.

The Islamic that you specify in this screen are applicable only for SWIFT type of SWIFT message that is generated depends on the parties involved in the Islamic LC.

Based on the method of settling the Islamic LC, you should input either Instrument or Message details.

- On the Settlement Details screen, specify the method of

settling the Islamic LC.You should input either Instrument or Payment details. For more information on fields, refer to the field description table below:

Table 6-3 Payment Details - Field Description

Field Description Instrument Details Specify the following details. This field is optional.

Instrument Type If the payment is through an instrument, indicate the type of instrument. It could be Manager’s Check, Check or a Demand Draft. This field is optional.

Number Specify the number that will identify the instrument. This number will be printed on the instrument. If the settlement is through an instrument, the party details cannot be specified for the transfer. Typically, an Islamic LC availment entails the debiting or crediting of the customer account, for the settlement amount. If the customer is being credited (in the case of your customer being the beneficiary, of the availment,) you may want to generate an instrument.

This field is optional.

Details of Charge Specify who should bear charges for the message. Choose one of the following options: - Remitter all Charges

- Beneficiary all Charges

- Remitter our Charges

This field is optional.

Message Details For a SWIFT message, you have to specify the following: - Whether a Cover has to be sent to the Reimbursement Bank, along with the payment message to the receiver

- Bank to bank payment details (these can be in the form of instructions or additional information to any of the parties involved in the transfer)

- Sender to Receiver information. The 72 tag will be used to specify the sender to receiver information. This tag is applicable to MT740 message type

Details of Payment 1 to 4 Specify bank to bank payment details (these can be in the form of instructions or additional information to any of the parties involved in the transfer). This field is optional.

Sender to Receiver Information 1 to 6 Tag 72 will be used to specify the sender to receiver information. This tag is applicable to MT740 message type. This field is optional.

RTGS Payment Check this box to indicate the payment mode is RTGS. This field is optional.

RTGS Network Specify the RTGS Network used for the transaction. This field is optional.

Banking Priority Indicate the priority for the payment. Choose any one of the following options: - Highly Urgent Payments

- Urgent Payment

- Normal Payment

This field is optional.

Transfer Type Specify the type of transfer. It can be any one of the following: - Bank Transfer

- Customer Transfer

- Bank Transfer for own A/c

- Direct Debit Advice

- MCK

- Customer transfer with cover

- None

This field is optional.

- On the Settlement Details screen, click the

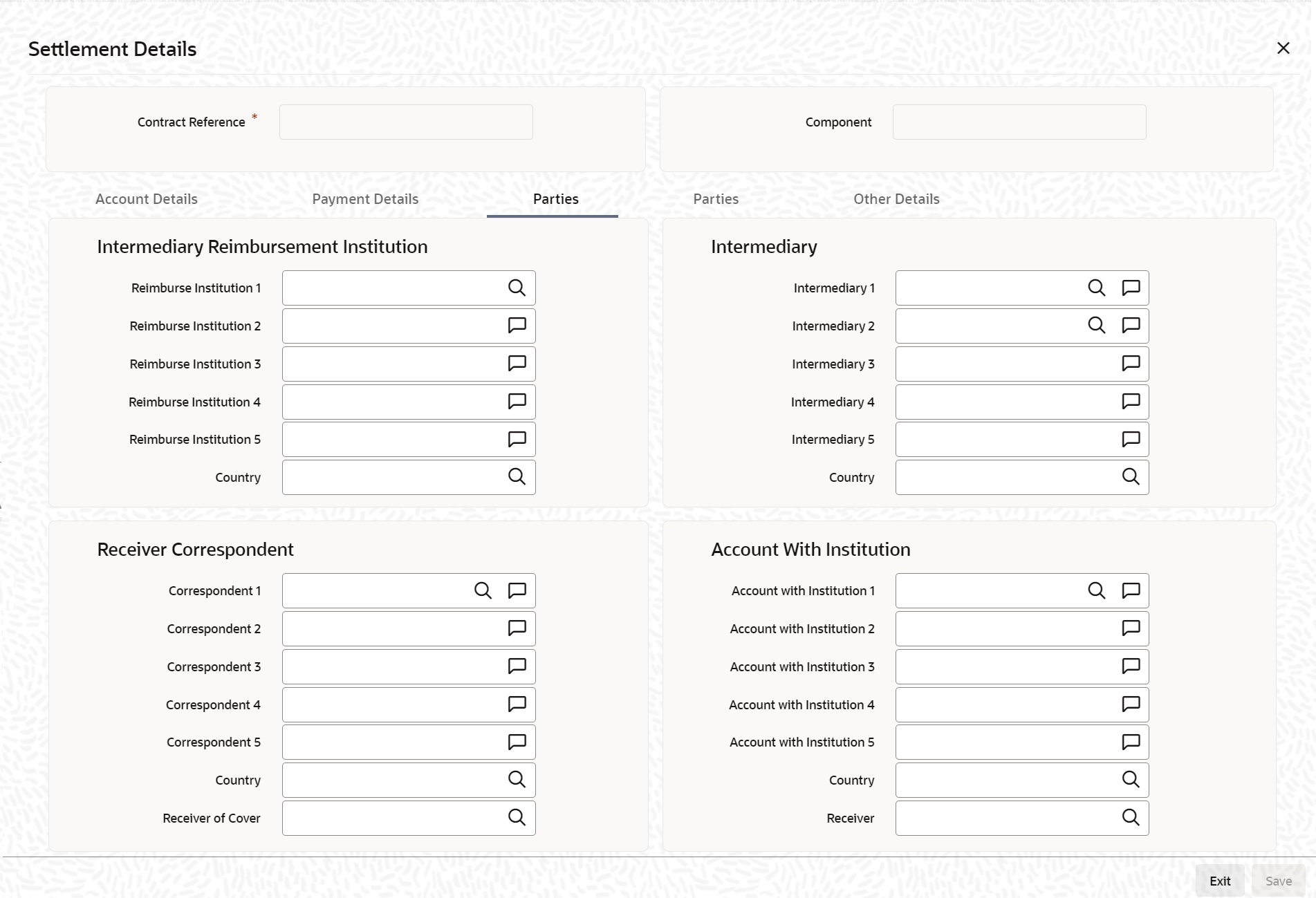

Parties tab.The Parties screen is displayed.

To process an availment on an Islamic LC, the funds may have to pass through a series of banks, before it actually reaches the Ultimate Beneficiary. Through the Parties screen you can capture details of all the parties that are involved in the transfer of funds. The details you enter in these screens depend on the type of LC being processed.

An Intermediary Reimbursement Institution is the financial institution between the Sender’s Correspondent and the Receiver’s Correspondence. For more information on fields, refer to the field description table below:Table 6-4 Parties1 - Field Description

Field Description Reimburse Institution 1 to 5 Specify the institution through which reimbursement of the funds should take place. This field is optional.

Intermediary 1 to 5 The Intermediary in a Islamic LC refers to the financial institution, between the Receiver and the Account With Institution through which the funds must pass.The Intermediary may be a branch or affiliate of the Receiver or the account with Institution or an altogether different financial institution. This field corresponds to field 56a of S.W.I.F.T. Here you can enter either the: - ISO Bank Identifier Code of the bank

- Name and address of the bank

This field is optional.

Receiver’s Correspondent 1 to 5 The Receiver’s Correspondent is the branch of the Receiver or another financial institution, at which the funds will be made available to the Receiver. This field corresponds to field 54a of SWIFT. You can enter one of the following: - ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

This field is optional.

Country Select the country from the list. Account With Institution 1 to 5 An Account With Institution refers to the financial institution at which the ordering party requests the Beneficiary to be paid. The Account With Institution may be a branch or affiliate of the Receiver, or of the Intermediary, or of the Beneficiary Institution, or an entirely different financial institution. This field corresponds to field 57a of SWIFT. This field is optional.

Country Select the country from the list. Receiver of Cover You can enter one of the following: ISO Bank Identifier Code of the bank- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

- Other identification codes (for example, account number)

This field is optional.

Receiver The ID of the receiver in the transaction will be displayed. You can change the same. This field is optional.

Specifying Intermediary Reimbursement Institution Details An Intermediary Reimbursement Institution is the financial institution between the Sender’s Correspondent and the Receiver’s Correspondence. The reimbursement of the funds will take place through this institution. Intermediary Details The Intermediary in an Islamic LC refers to the financial institution, between the Receiver and the Account With Institution through which the funds must pass. The Intermediary may be a branch or affiliate of the Receiver or the account with Institution or an altogether different financial institution. This field corresponds to field 56a of SWIFT

Here you can enter either the:- ISO Bank Identifier Code of the bank

- Name and address of the Bank

Country Select the country from the list. Receiver’s Correspondent Details The Receiver’s Correspondent is the branch of the Receiver or another financial institution, at which the funds will be made available to the Receiver. This field corresponds to field 54a of SWIFT You can enter one of the following: - ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

Account With Institution Details An Account With Institution refers to the financial institution at which the ordering party requests the Beneficiary to be paid. The ‘Account With Institution’ may be a branch or affiliate of the Receiver, or of the Intermediary, or of the Beneficiary Institution, or an entirely different financial institution. This field corresponds to field 57a of SWIFT. You can enter one of the following:- ISO Bank Identifier Code of the bank

- The branch of the Receiver’s Correspondent

- Name and address of the Receiver’s Correspondent

- Other identification codes (for example, account number)

Country Select the Country from the list. Receiver Select the Receiver from the list. - On the Settlement Details screen, click

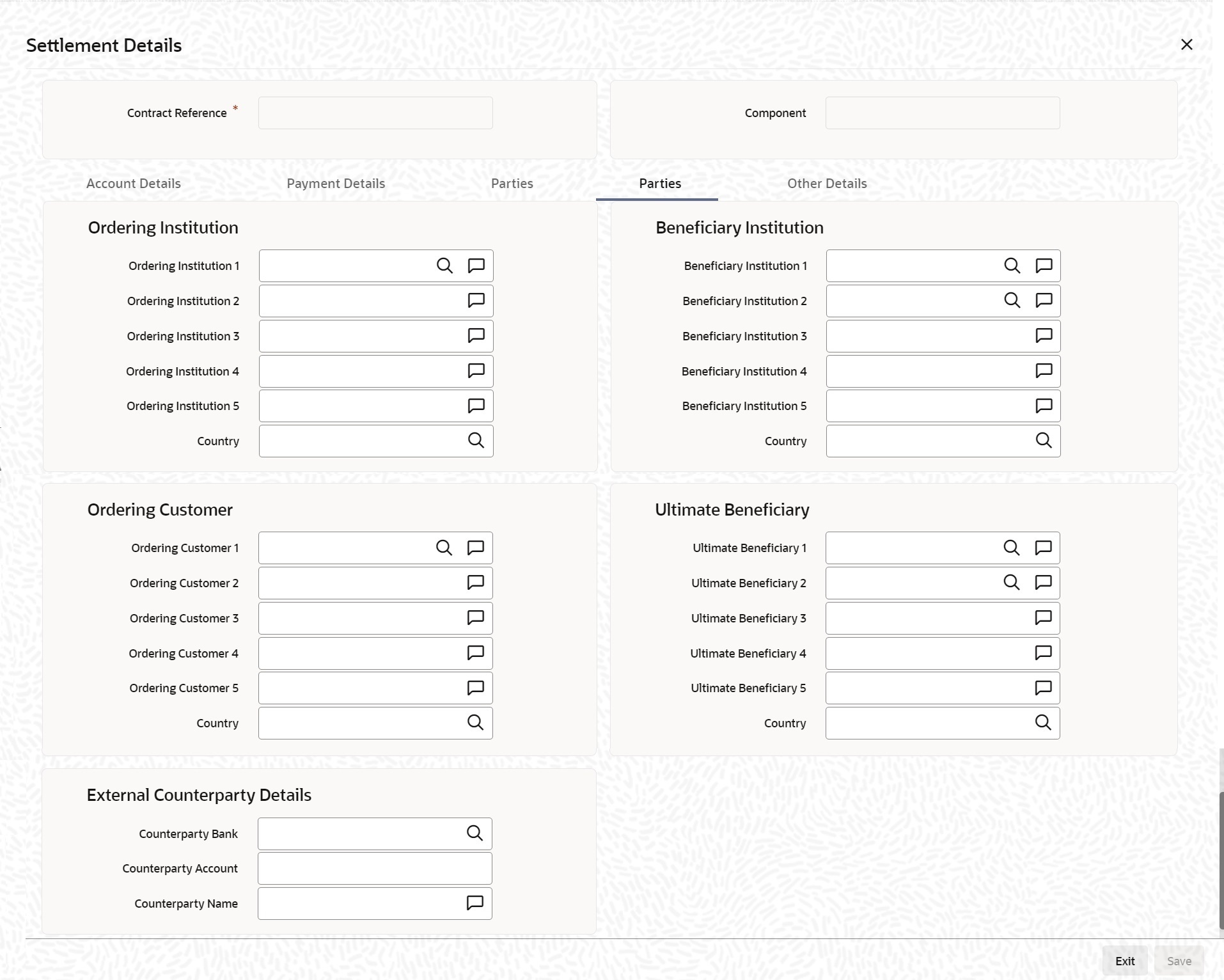

Parties.he Parties details is displayed. For more information on the fields, refer the Field Description table given below:

Table 6-5 Parties 2- Field Description

Field Description Ordering Institution 1 to 5 The Ordering Institution is the financial Institution that is acting on behalf of itself, or a customer, to initiate the transaction. This field corresponds to 52a of SWIFT. In this field, you can enter one of the following: - The ISO Bank Identifier Code of the Ordering Institution

- The branch or city of the Ordering Institution

- The Name and address of the Bank

This field is optional.

Country Select the country from the list. Ordering Customer Specify the Ordering Customer details. Ordering Customer 1 to 5 The Ordering Customer refers to the customer ordering the transfer. Here you can enter the name and address or the account number of the Customer, ordering the transaction. This field corresponds to field 50 of SWIFT. You will be allowed to enter details in this field only if you have initiated a customer transfer (MT 100 and MT 102). This field is optional.

Country Select the country from the list. Ultimate Beneficiary Details The Ultimate Beneficiary refers to the Customer to whom the availment amount is to be paid. This field refers to field 59 of SWIFT Entries into this field are permitted only for a customer transfer (MT 100 and MT 202). The number of banks involved in the transfer would therefore depend on the following:- Relationships and arrangements between the sending and receiving banks

- Customer instructions

- Location of parties

- The banking regulations of a country

This field is optional.

Beneficiary Institution 1 to 5 In this field you can enter details of the institution in favor of which the payment is made. It is in reality the bank that services the account of the Ultimate Beneficiary. This field corresponds to field 58a of SWIFT. Entries into this field are permitted only for Bank Transfers (when the remitter and beneficiary of the transfer are financial institutions - MT 100 or MT 202). Here you can enter either of the following:- The ISO Bank Identifier Code of the Beneficiary Institution

- The Name and Address of the Beneficiary Institution

This field is optional.

Ultimate Beneficiary 1 to 5 The Ultimate Beneficiary refers to the Customer to whom the availment amount is to be paid. This field refers to field 59 of SWIFT. Entries into this field are permitted only for a customer transfer (MT 100 and MT 202). The number of banks involved in the transfer would therefore depend on the following: - Relationships and arrangements between the sending and receiving banks

- Customer instructions

- Location of parties

- The banking regulations of a country

This field is optional.

Country Select the country from the list. Beneficiary Institution For Cover 1 to 5 Select the institution in favor of which the payment is made, from the option list. If you click on the button, a notepad editor emerges. You can specify further details about the institution here. This field is optional.

Counterparty Bank The clearing bank code here gets populated with the value specified in the contract screen. However you can change it. Select the relevant clearing bank code from the option list. This field is optional.

Counterparty Account Specify the counterparty account. All the counterparty accounts pertaining to the selected Counterparty Bank will appear for selection in the adjoining option list. On selecting the Counterparty Account, the system will default the Counterparty Name as maintained for that account. If at the time of selecting Counterparty Account, Counterparty Bank is Null, then the Counterparty Bank will also appear by default.

This field is optional.

Counterparty Name Specify the name of the counterparty. This field is optional.

Agreement Identification For processing direct debits on transactions you will also need to capture the Agreement ID of the counterparty in order to facilitate a cross-referencing between the contract payment and the direct debit instruction when a reversal of payment is carried out due to rejection of the outbound DD. Specify the Agreement ID in this field. Typically, you will need to specify this only for the Receive leg. This field is disabled for the Pay leg.

This field is optional.

Clearing Network Specify a clearing network during settlement instruction maintenance for the Pay Leg. Post Accounting Check this option to indicate that accounting entries maintained for the product should be posted. This field is optional.

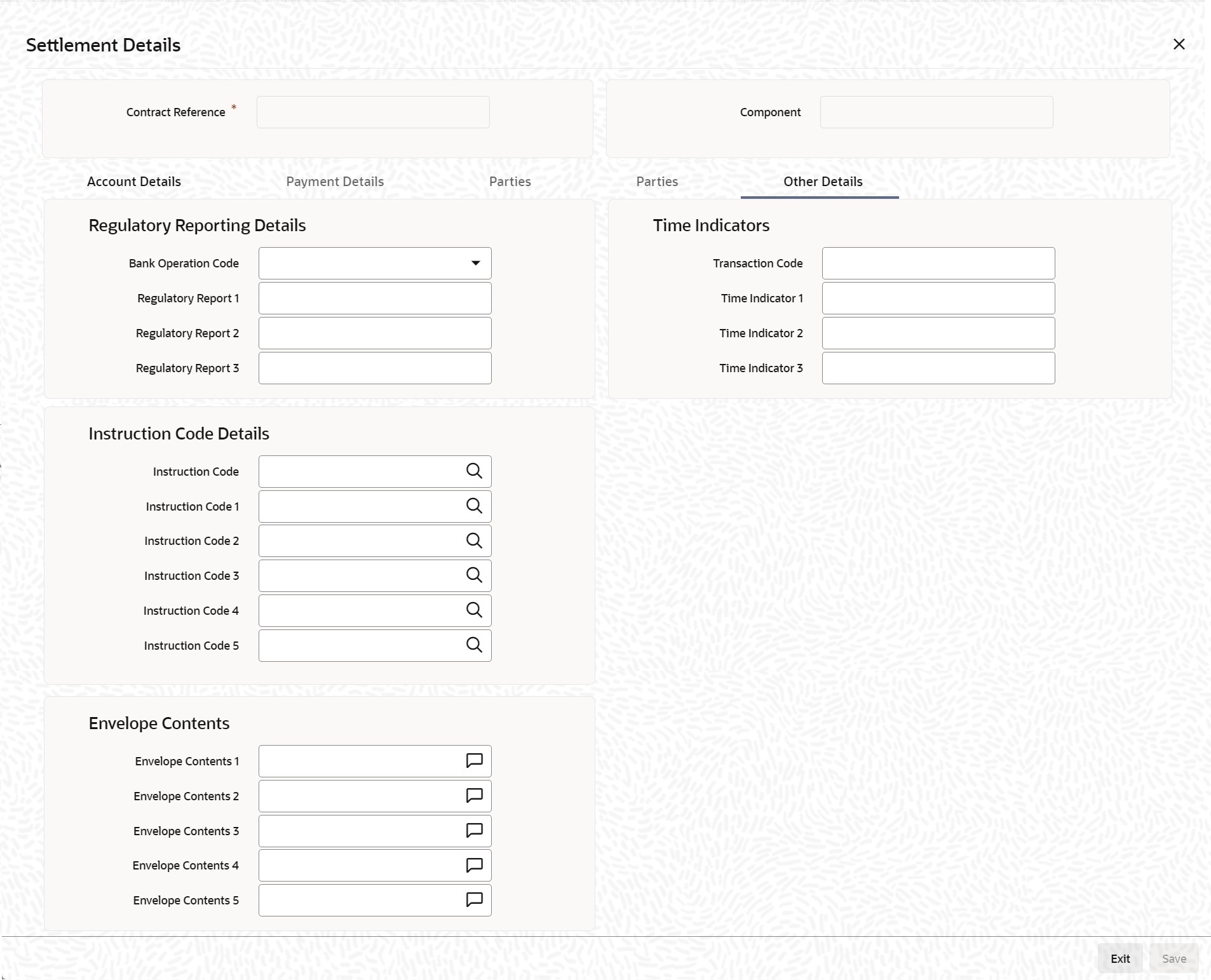

- On the Settlement Details screen, click the

Other Details tab.The Other Details is displayed. For more information on fields, refer to the field description table below:

Table 6-6 Other Details- Field Description

Field Description Bank Operation Code Select the bank operation code that should be inserted in field 23B of an MT103 message, from the drop-down list. The list contains the following codes: - SPRI

- SSTD

- SPAY

- CRED

This specification is defaulted from the settlement instructions maintained for the customer, currency, product, branch and module combination. However, you can change it.

This field is optional.

Regulatory Report 1 to 3 Select the Regulatory Reporting Details from the drop-down list displaying the following values: - /BENEFRES/

- /ORDERRES/

This field is optional.

Transaction Code The transaction code maintained in the settlement instructions is defaulted here. However, you can change the code. This field is optional.

Time Indicator 1 to 3 Time Indication, specifies one or several time indication(s) related to the processing of the payment instruction. Select the time indication code from the following values available in the option list: /CLSTIME/ - Time by which funding payment must be credited, with confirmation, to the CLS Bank's account at the central bank, expressed in CET.

/RNCTIME/ - Time at which a TARGET payment has been credited at the receiving central bank, expressed in CET

/SNDTIME/ - Time at which a TARGET payment has been debited at the sending central bank, expressed in CET

This field is optional.

Instruction Code 1 to 6 Select the instruction code that should be inserted in field 23E of an MT103 message involving the customer of the contract, from the adjoining drop-down list. This list contains the following codes: - CHQB

- TELE

- PHON

- PHOI

- REPA

- INTC

- TELI

- SDVA

- PHOB

- TELB

- HOLD

- CORT

- BONL

This specification is defaulted from the settlement instructions maintained for the customer, currency, product, branch and module combination. However, you can change it.

This field is optional.

Description Specify additional information that should be inserted to qualify the Instruction Code in field 23E of an MT103 message involving the customer of the contract. For instance, if the Instruction Code is REPA and the description is “Repayment” then the text ‘REPA/Repayment’ will be inserted in Field 23E. You can give a description for the following instruction codes only: - PHON

- PHOB

- PHOI

- TELE

- TELB

- TELI

- HOLD

- REPA

This specification is defaulted from the settlement instructions maintained for the customer, currency, product branch and module combination. However, you can change it.

This field is optional.

Envelope Contents 1 to 5 Specify details of envelope contents, if required. This field is optional.

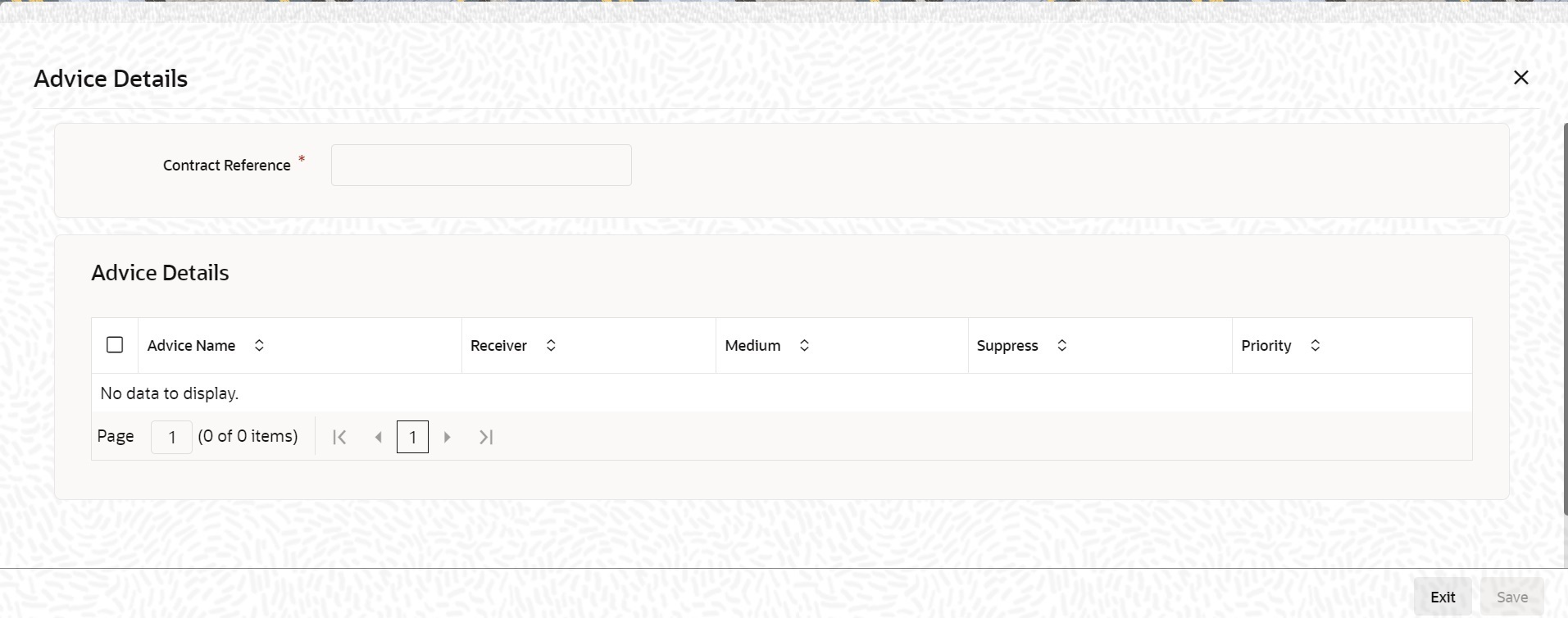

- On the Islamic LC Availment Input screen, click the

Advices button.The Advice Details is displayed.

Note:

You can view advices generated for the contract during availment. - On the Islamic LC Availment Input screen, click the

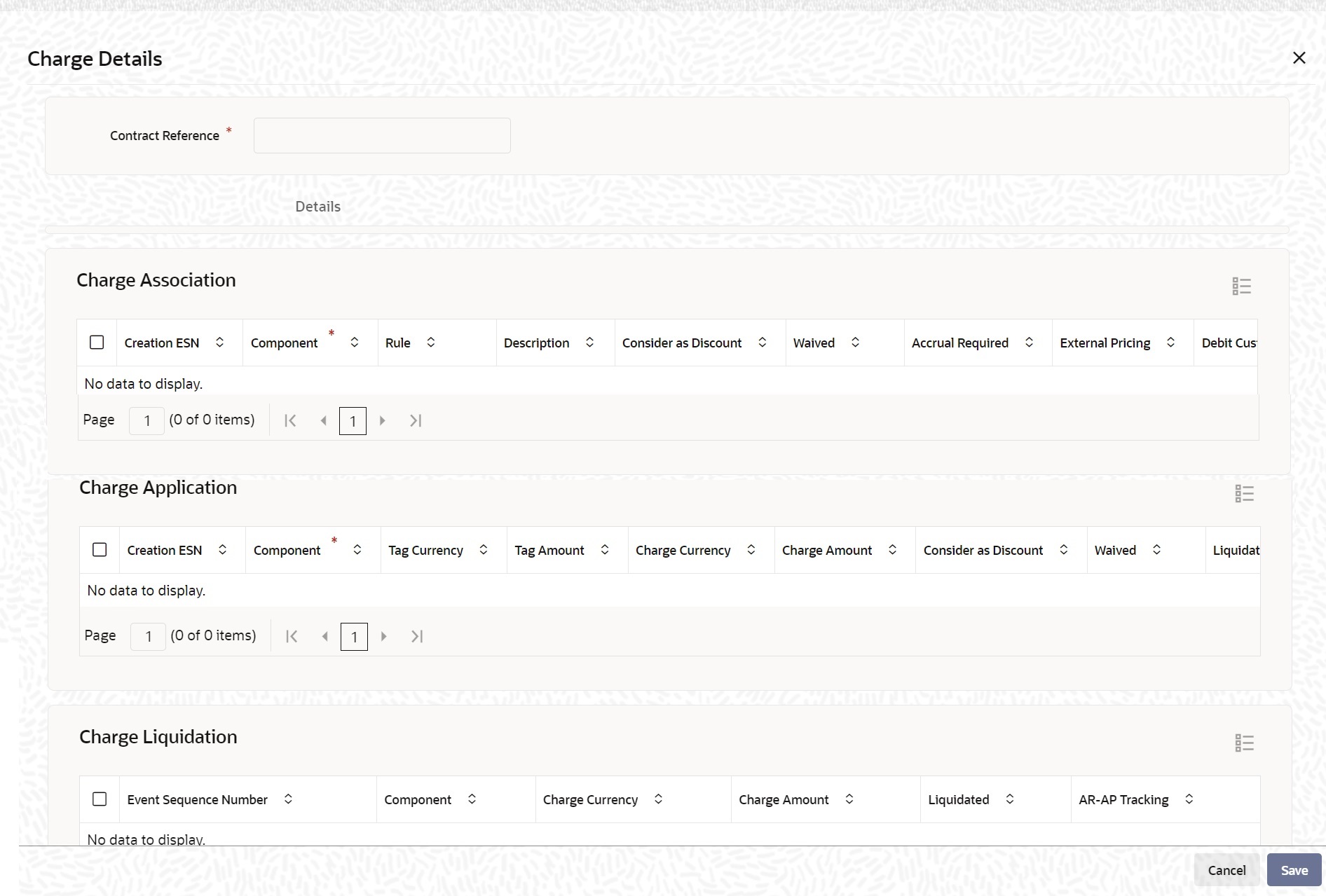

Charges button.The Charge Details screen is displayed.

Note:

Refer the Charges and Fees User Manual under Modularity for further details about charge maintenance. - On the Islamic LC Availment Input screen, click the

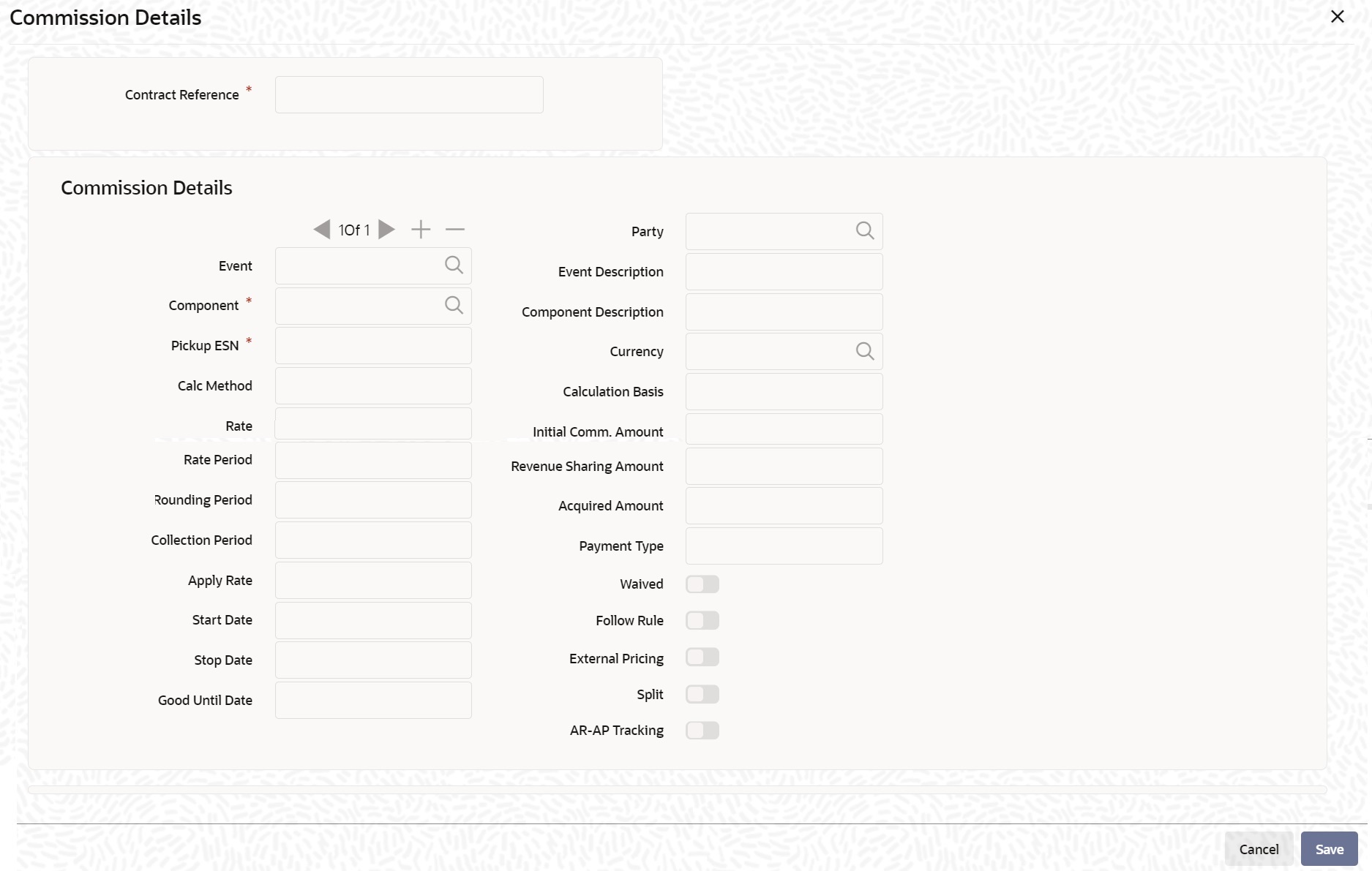

Commission button.The Commission Details screen is displayed Refer the Commission User Manual under Modularity for further details about commissions processing.

- On the Islamic LC Availment Input screen, click the

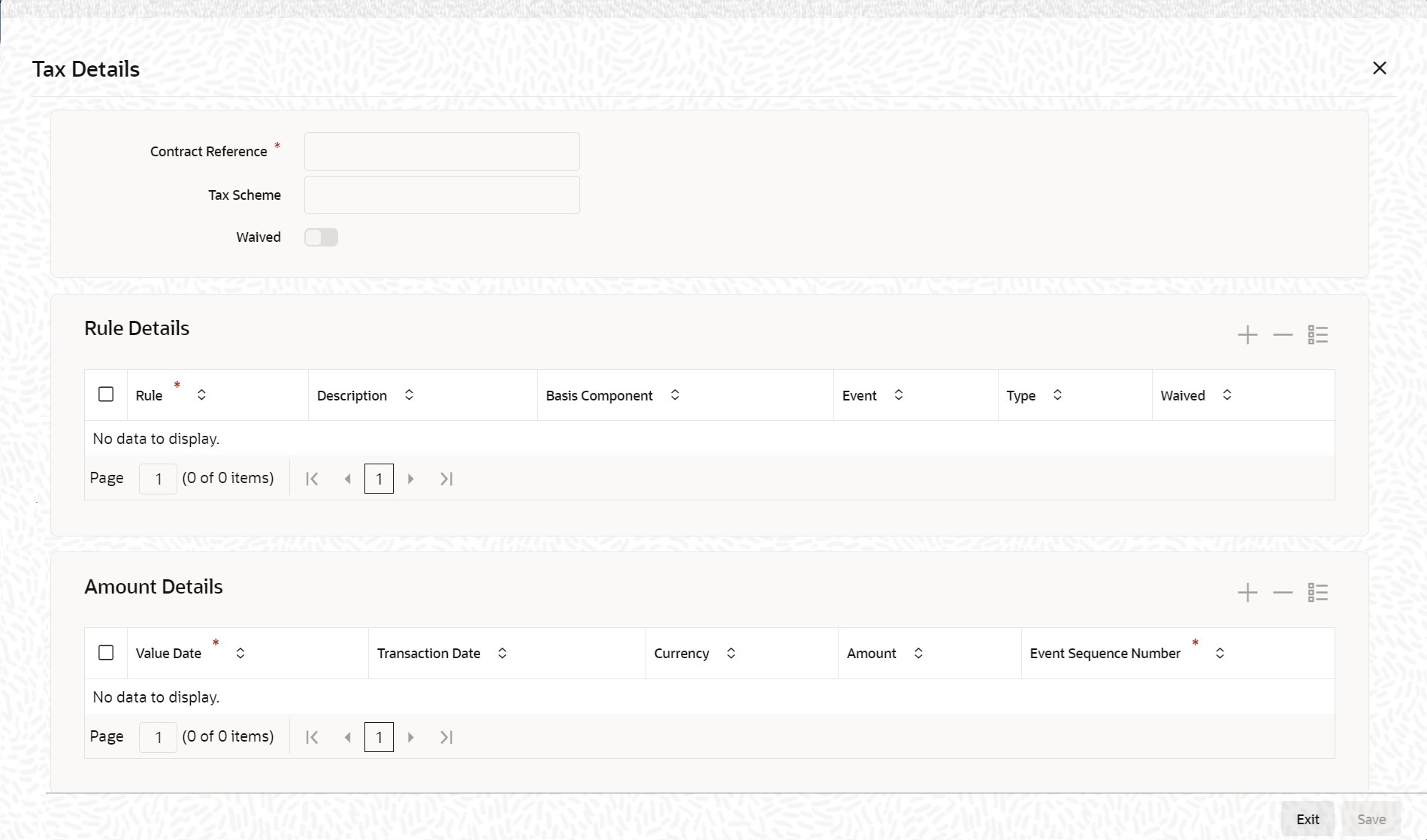

Tax button.The Tax Details screen is displayed.

Note:

Refer the Tax User Manual under Modularity for further details about tax processing.Note:

Refer the Tax User Manual under Modularity for further details about tax processing. - On the Islamic LC Availment Input screen, click the

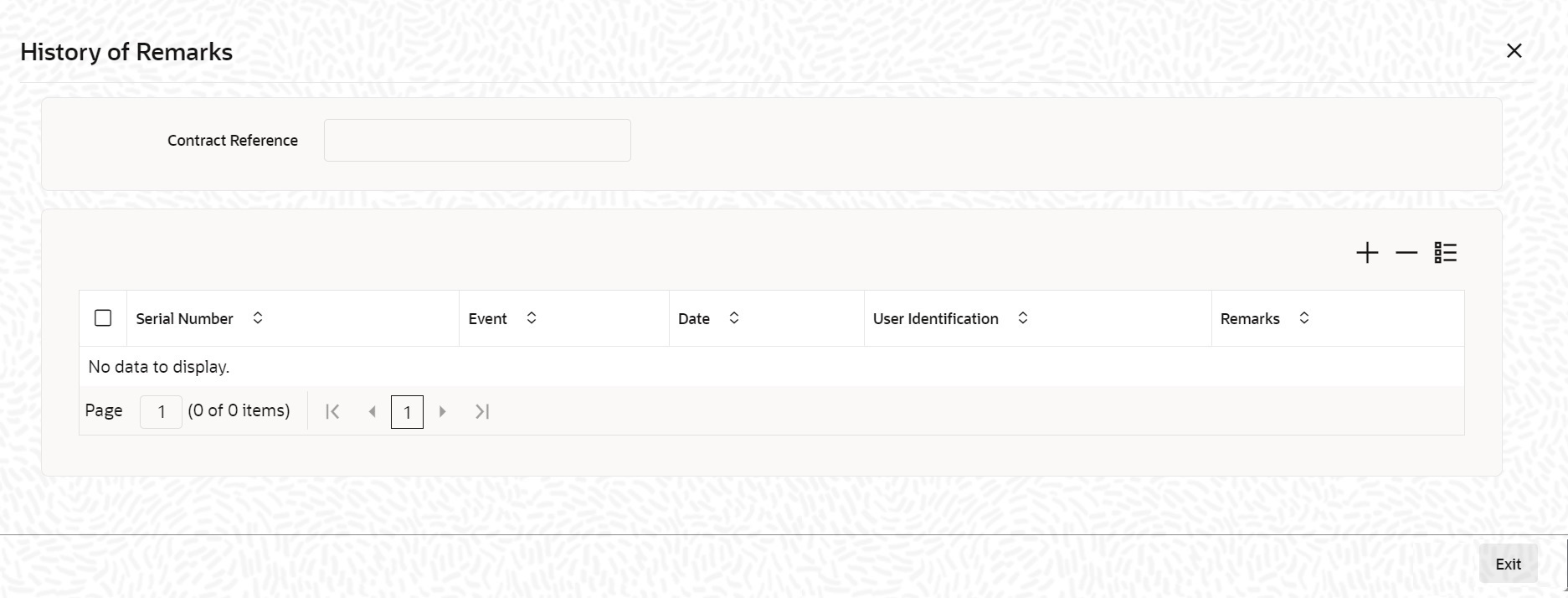

Remarks button.The History of Remarks screen is displayed. You can view all the instructions captured on every transaction of the contract.For more details on this screen, refer Remarks in this user manual.

Figure 6-14 History of Remarks - Field Description

Description of "Figure 6-14 History of Remarks - Field Description" - On the Islamic LC Availment Input screen, click

Save.The contract details are saved. On saving the availment, your User Id will be displayed in the Entry By field at the bottom of the screen. The date and time at which you saved the record will be displayed in the Date/Time field.

- On the Islamic LC Availment Input screen, click

Authorize icon.The ID of the user who authorized the availment will be displayed in the Auth By field. The date and time at which the availment has been authorized will be displayed in the Date/Time field. The current status of the Islamic LC contract on which you ares processing the availment, is also displayed in the field Contract Status.

Note:

A user bearing a different User ID must authorize an availment that you have entered, before the EOD is run. You cannot authorize an availment from the Islamic LC Availment Input screen in the following cases:- the contract has multilevel of authorization pending, the same will be done using the Multilevel Authorization Detailed screen

- the level of authorization is greater than or equal to ‘N’

- the ‘Nth’ or the final level of the users authorization limit is less than the difference between amount financed and sum of the limits of all the users involved in authorizing a transaction, this case holds good when the Cumulative field is checked in the Product Transaction Limits Maintenance screen.

- the transaction amount is greater than the authorizer’s authorization limit if the Cumulative field is unchecked in the Product Transaction Limits Maintenance screen.

- On the Islamic LC Availment Input screen, click

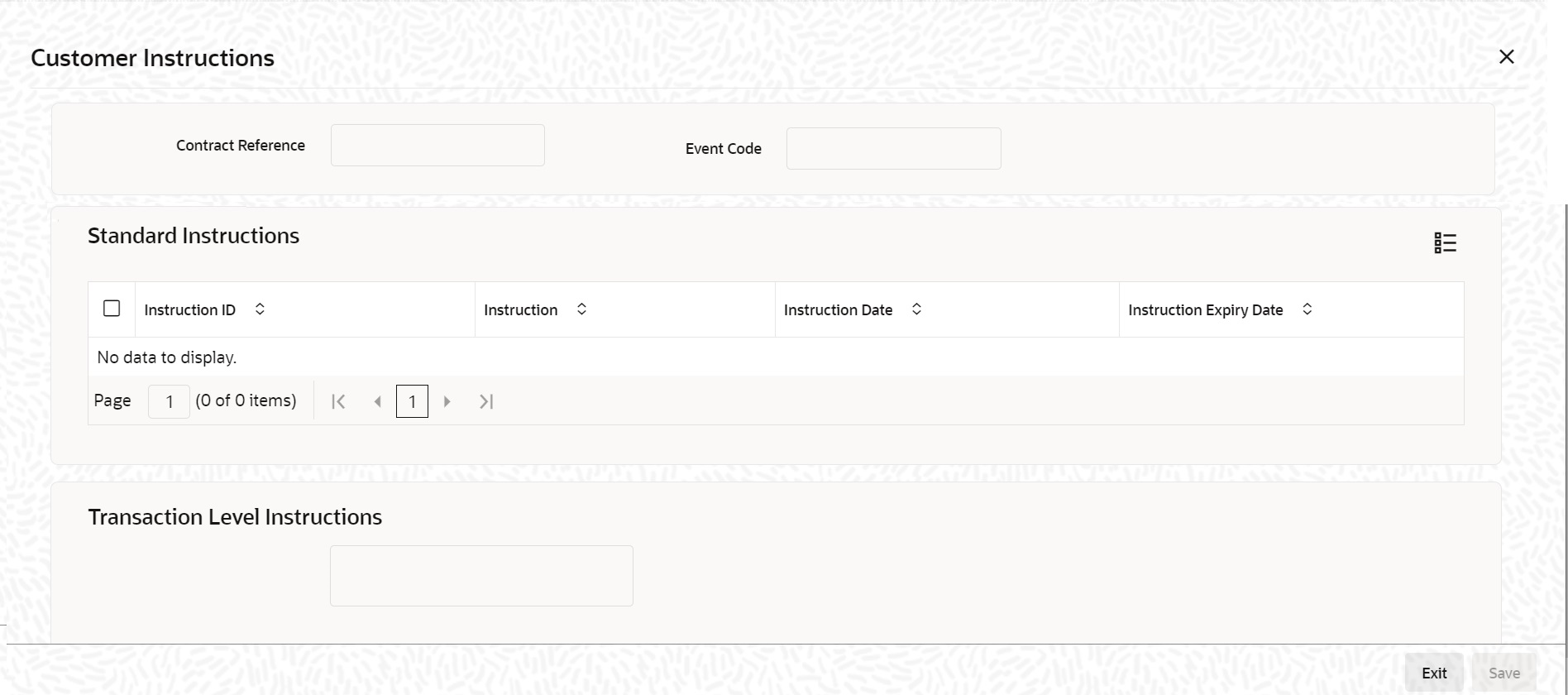

the Customer Instructions tab.

The Customer Instructions screen is displayed.

Table 6-7 Customer Instructions - Field Description

Field Description Contract Reference Number System displays the contract reference number. Event Code System displays the Event Code of the contract. Standard Instructions Customer would want to give Standard instructions in advance to the bank that need to be referred by the bank while processing certain type of transactions.

Instruction ID System displays the Instruction ID. Instruction System displays the customer standard instruction. Instruction Date System displays the start date of the customer instruction. Instruction Expiry Date System displays the expiry date of the customer instruction. Transaction Level Instruction Enter the transaction level instructions for the event. - On the Islamic Letters of Credit Availment Detail

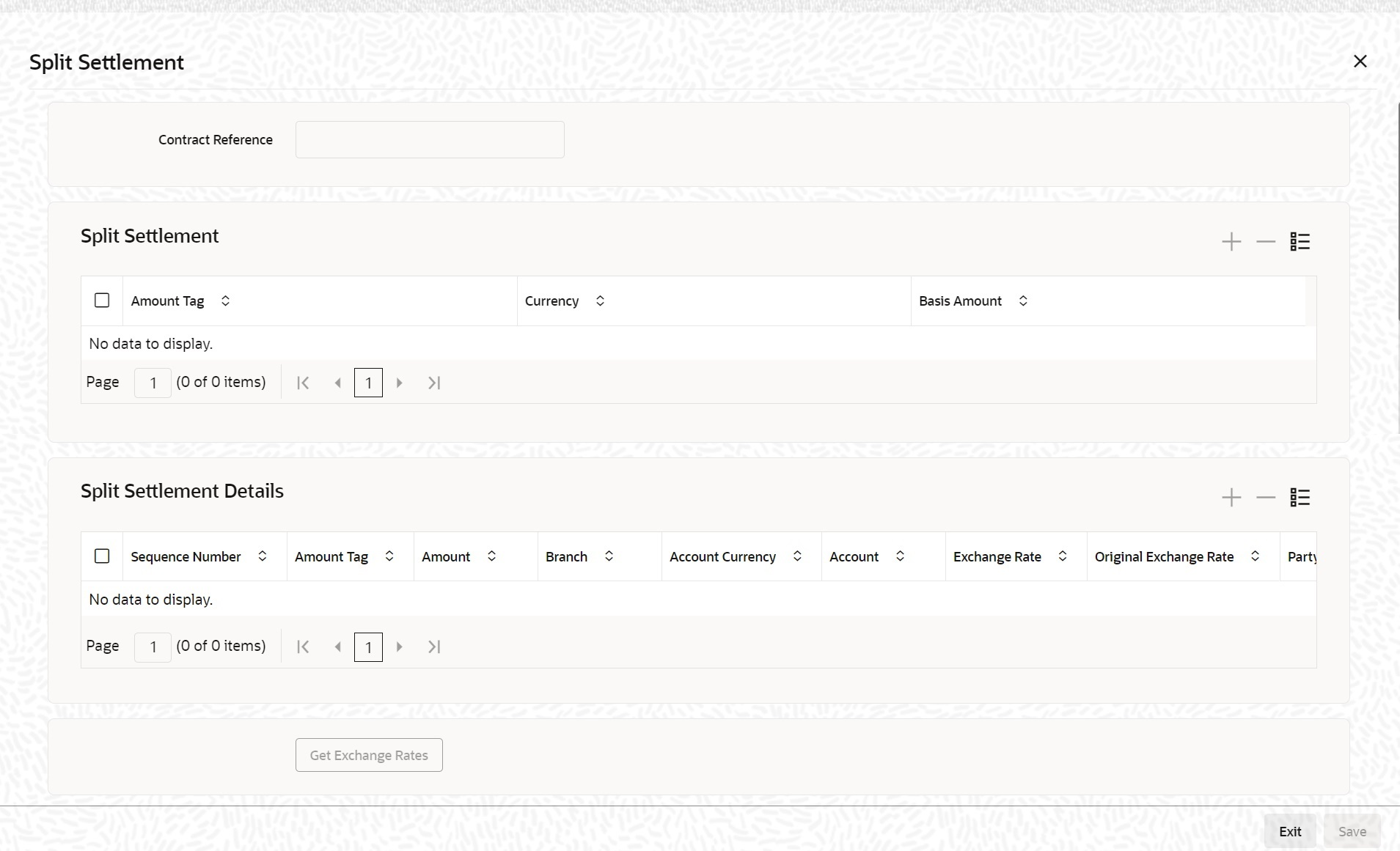

screen, click the Split Settlement button.Split Settlement Master and details get populated for the Cash collateral based upon the Availment amount.User cannot modify the details.The Split Settlement screen is displayed.For more information on fields, refer to the field description table below:

Table 6-8 Split Settlement - Field Description

Field Field Description Specify Settlement Split Master You can specify the details of the settlement split master in the following fields: Basis Amount Tag Specify the amount tag involved in the contract. The option list displays all valid amount tags maintained in the system. You can choose the appropriate one. For example, on booking a new contract, the only tag allowed is PRINCIPAL. This is referred to as the basis amount tag. This field is optional.

Currency The system displays the currency associated with the amount tag. This field is optional.

Basis Amount The system displays the basis amount associated with the amount tag. contract would be displayed against the amount tag PRINCIPAL. The amount is in terms of the currency associated with the amount tag. You can use Get Exchange Rate button to get the original exchange rates defaulted in the screen.

This field is optional.

Specify Settlement Split Details For each split amount tag, you need to specify the following details: This field is optional.

Amount Specify the amount for the split amount tag. This amount should not be greater than the amount of the corresponding basis amount tag. The split amount is in the currency of the basis amount tag. This is a mandatory field and you will not be allowed to save the details if you do not specify the amount. This field is optional if percentage of proceeds is provided. Amount will be derived based upon the percentage.

Branch Specify the branch. The list displays all valid values.This field is mandatory. Account Currency Specify the account currency. This field is mandatory. Account Specify the account. This list displays all the accounts. For Cash Collateral the account should be account of the counterparty. If the account selected is other than counterparty account, then system will throw error. This field is mandatory. Loan/Finance Account Check this box to indicate that the specified account should be the loan account. This field is optional.

Exchange Rate Specify the exchange rate that must be used for the currency conversion. Specify the destination to which the goods transacted under the LC should be sent by selecting the appropriate option from the list of values.

This field is optional.

Original Exchange Rate The base or the actual exchange rate between the contract currency and collateral currency gets displayed here. Customer Select the customer number from the list. Percentage of Proceeds Specify the percentage of proceeds. Negotiated Rate Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction. The system will display an override message if the negotiated rate is not within the exchange rate variance maintained at the product. This field is optional.

Negotiated Reference Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also. Note:

Oracle Banking Trade Finance books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.This field is optional.

Parent topic: Islamic LC Availment Input