- Islamic Letters of Credit

- Define Attributes specific to an Islamic Product

- Create an Islamic LC Product

3.1 Create an Islamic LC Product

This topic describes the systematic instruction to create an Islamic LC Product.

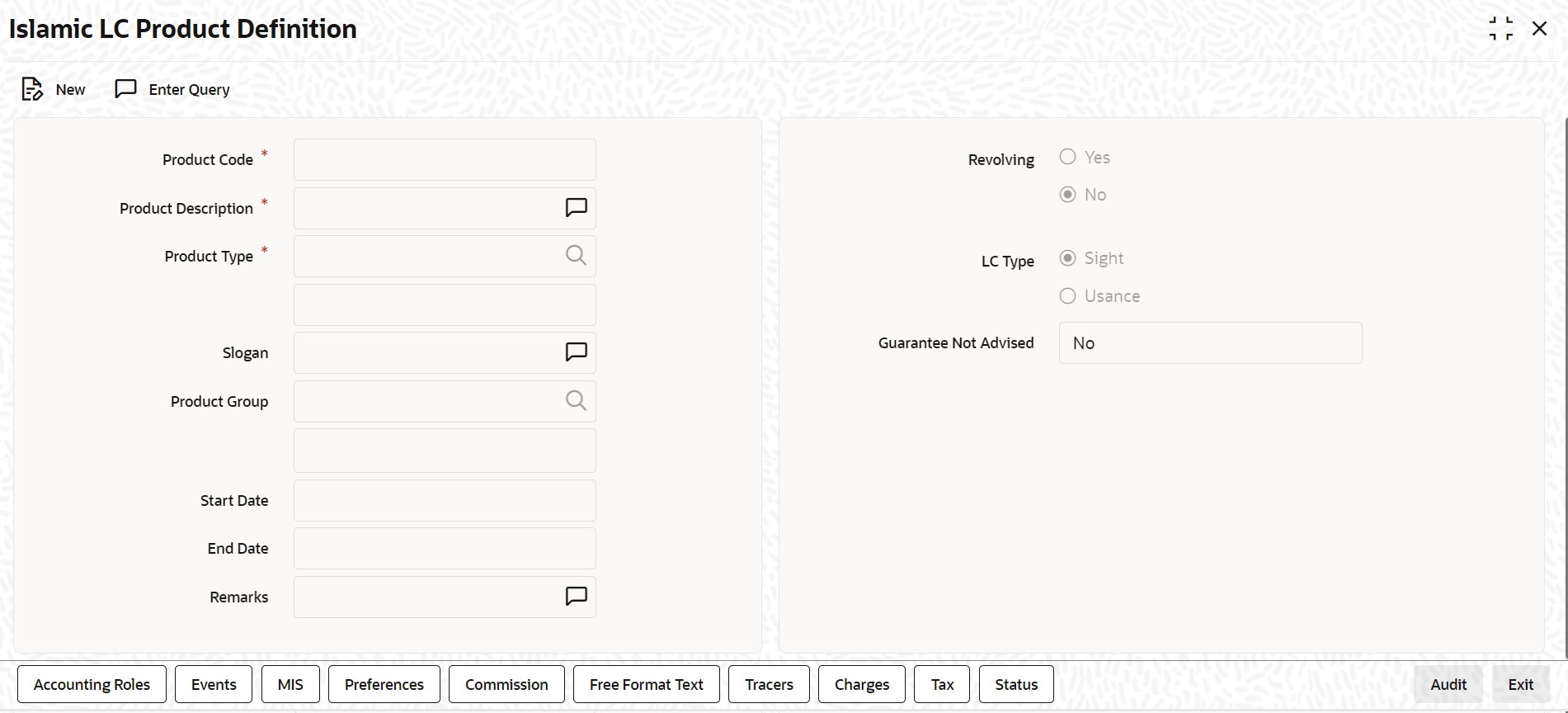

- On Homescreen, type LIDPRMNT in the text box, and click next arrow.The Islamic LC - Product Definition screen is displayed.

- On Islamic LC Product Definition screen, specify the

fields.Define the attributes specific to a letters of credit product in the ‘Islamic LC Product Definition’ screen and the ‘Islamic LC Product Preferences’ screen. In these screens, you can specify the product type and set the product preferences respectively.

Table 3-1 Button - Description

Field Description Accounting Roles

Click this button to define the accounting role to accounting head mapping. Events Click this button to select the events for the product and then maintain event-wise accounting entries and advices. Preference Click this button to define preferences like tenor, Prepayment option

etc.

MIS Click this button to capture MIS related parameters. Commission Click this button to define the Commission details. Charges Click this button to define charge components, rules, events and other associated details. Tax Click this button to associate tax rules and select tax currencies. Free Format Text Click this button to attach the Documents and Free format text required for the Product Tracers Click this button to enter details of the tracers that should be generated for all Islamic LCs under this product For any product you create in Oracle Trade Finance Banking, you can define generic attributes, such as branch, currency, and customer restrictions, Profit details, tax details, etc., by clicking on the appropriate icon in the horizontal array of icons on this screen. You can define product restrictions for branch, currency, customer category and customer in Product Restrictions (CSDTFPDR) screen. For details on the product, restrictions refer to the Product Restriction Maintenance chapter in the Core Service User Manual. You can define User Defined Fields in the ‘Product UDF Mapping’ screen (CSDTFUDF). For details on User Defined Fields screen refer Other Maintenances chapter in Core Service User Manual. For letters of credit product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this chapter.Table 3-2 Islamic LC Product Definition - Field Description

Field Description Product Code The code you assign to a product will identify the product throughout the module. The code should contain four characters. You can follow your own convention for devising the code. However, at least one of the characters should be a letter of the English alphabet. Since the code that you define is used to identify the product, it should be unique across the modules of Oracle Trade Fince. For instance, if you have assigned the code ‘Islamic LC01’ to a particular product in this module, you cannot use it as a code in any other module. Product Description Enter a brief description of the product, which will be associated with the product for information retrieval purposes. Product Type The product type identifies the basic nature of a product. An Islamic LC product that you create in Oracle Trade Fince can be of the following types: - Import Islamic LC

- Export Islamic LC

- Guarantee

- Standby Guarantee

- Shipping Guarantee

- Shipping Guarantee

- Clean Islamic LC

- Advice of Guarantee

The entries that are passed, the messages that are generated and the processing of contracts involving the product, is determined by your input to this field.

Slogan Specify a marketing punch-line to be associated with the product. This slogan will be printed on all the advices that are sent to the customer, for an Islamic LC involving this product. Product Group Each product is classified under a specific group. The different groups are defined in the Product Group Definition table. Start Date and End Date A product can be set up for use over a specific period, by defining a start and an end date. The Issue Date of an Islamic LC involving a product should be: - The same as or later than the Start Date

- The same as or earlier than the End Date

The start and end dates of a product come in handy when you are defining a product for a scheme, which is open for a specific period.

Remarks You can enter information about the product, intended for the internal reference of your bank. The remarks are displayed when the details of the LC are displayed or printed. However, this information will not be printed on any correspondence with the customer. To maintain the allowed and disallowed customer and customer categories, you have to click the button and invoke the ‘Customer and Customer Restrictions’ screen.

Module All the modules (like Loans & Deposits, Letters of Credit, Bills & Collections etc.) in Oracle Trade Fince are represented by a code. This code is displayed in the module field. The product code that you assign to a product will identify the product throughout this module. Resolving Islamic LC products can be revolving or non-revolving. If you indicate that the product is revolving, you can associate the product with only revolving Islamic LCs. While actually processing revolving you can indicate whether the Islamic LC should revolve in time or in value. Similarly if you indicate that the product is non-revolving, you can associate the product to only non-revolving Islamic LCs.

Note:

All Islamic LCs will be of irrevocable nature.LC Type LC products can be sight or usance. If you indicate that the LC type is sight, then you can select the credit mode as: - Sight Payment

- Negotiation

If you indicate that the LC type is Usance, then you can choose the credit mode as- Acceptance

- Deferred Payment

- Mixed Payment

- Negotiation

The system displays an override message if the credit mode is not applicable for LC product.

- On Islamic Product Definition screen, click

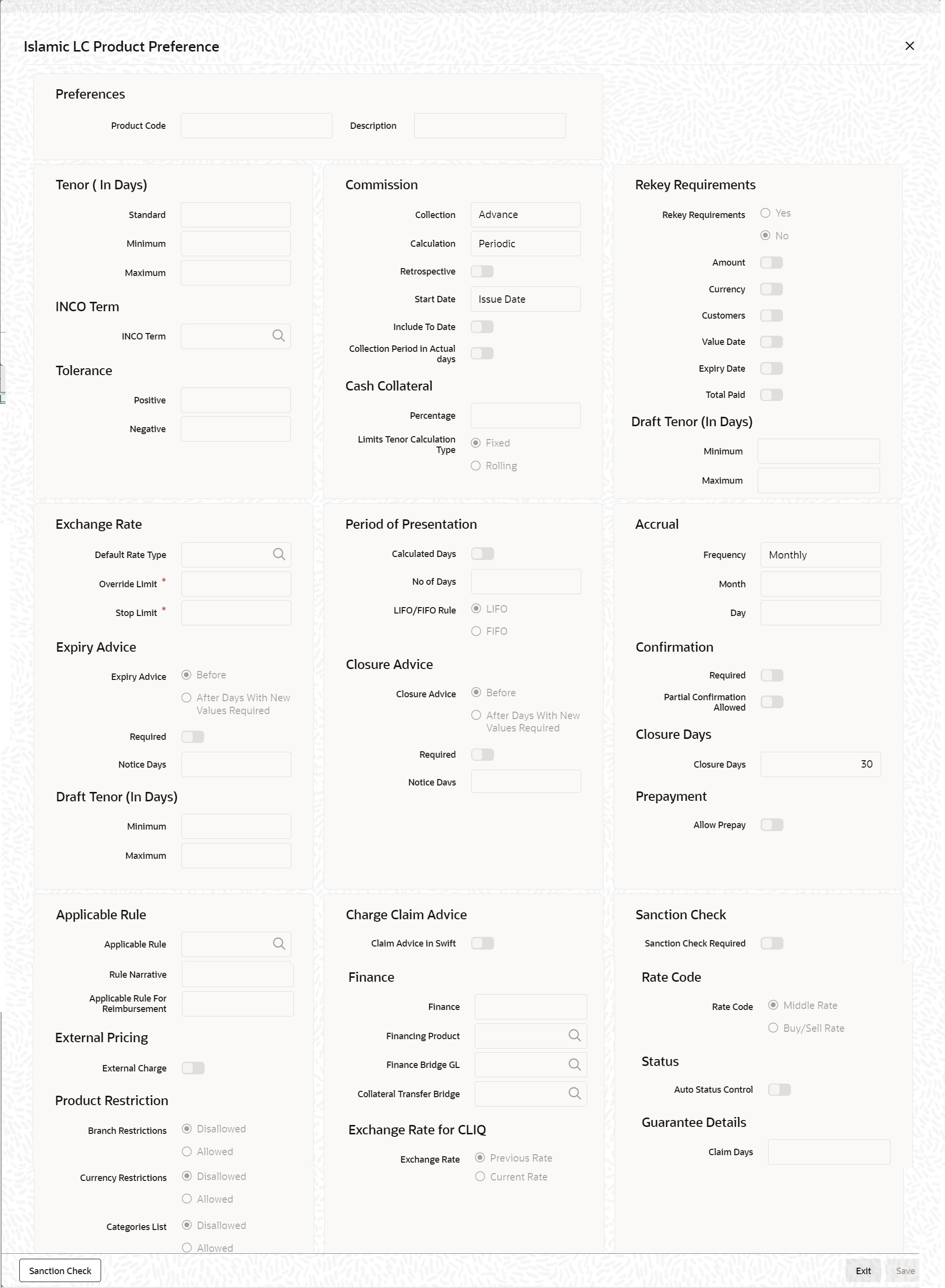

Preference.The Letters of Credit Preference screen is displayed.

- On Preference screen, specify the fields.

The preferences that you define for a product will be applied to all the Islamic LC contracts involving the product.

For more information on fields, refer the field description table below:Table 3-3 Preference Screen - Field Description

Field Description Tenor (In Days) You can set the Standard, Minimum and the Maximum limits for tenor based Islamic LCs. The tenor details that you specify for an Islamic LC product is always expressed in days. Standard The standard tenor is the tenor that is normally associated with an Islamic LC involving a product. The standard tenor of an Islamic LC is expressed in days and will apply to all Islamic LCs involving the product. If you do not specify any specific tenor while processing an Islamic LC, the standard tenor will by default apply to it. The default standard tenor applied on an Islamic LC can be changed during Islamic LC processing. An expiry date will be calculated based on the tenor, as follows:

Expiry Date = Effective Date + Tenor

Minimum The minimum tenor of a product can be fixed. The tenor of the Islamic LCs that involves the product should be greater than or equal to the minimum tenor that you specify. If not, an override will be required before the Islamic LC is stored. Maximum You can fix the maximum tenor of a product. The tenor of the Islamic LCs that involves the product should be less than or equal to the Maximum tenor specified. If not, an override will be required before the Islamic LC is stored. Cash Collateral Details In this section specify the following details: Percentage For a product, specify the percentage of the Islamic LC amount that should be taken as cash collateral. This percentage will be applied by default and can be changed when the Islamic LC is processed. In addition, the currency in which the collateral is to be collected can be specified in the Islamic LC Contract Collateral screen, while processing an Islamic LC. Limits Tenor Calculation Type Specify the calculation type for the limits tenor. You can select one of the following options. - Fixed

- Rolling

Collateral Transfer Bridge Specify the GL/account to be used for transfer of collateral between Islamic LC and the Bill upon availment of the Bill against the Islamic LC. The GL/account specified here will be used as the bridge during the transfer accounting. Rekey Requirements All operations on an Islamic LC (input, modification, reversal, etc.) have to be authorized by a user other than the one who carried out the operation. Authorization is a method of cross checking the inputs made by a user. All operations on an Islamic LC, except placing it on hold, should be authorized before beginning the End of Day operations. You have the option to specify whether certain important details of an Islamic LC need to be rekeyed, at the time of authorization. If you indicate positively, you should also specify the fields that will have to be rekeyed at the time of contract authorization. You can specify any or all of the following as rekey fields:- Amount

- Currency

- Customer

- Value Date

- Expiry Date

- Total Paid

When you process an Islamic LC for authorization; - as a cross-checking mechanism to ensure that you are calling the right Islamic LC, you can specify that the values of certain fields should be entered before the other details are displayed. The complete details of the Islamic LC will be displayed only after the values to these fields are entered.

This is called the ‘rekey’ option. The fields for which the values have to be given are called the ‘rekey’ fields. If no rekey fields have been defined, the details of the Islamic LC will be displayed immediately once the authorizer calls the Islamic LC for authorization. The rekey option also serves as a means of ensuring the accuracy of inputs.

Draft Tenor in Days Specify the fields. Minimum Specify the minimum draft tenor for an Islamic LC product.The value you enter must be non-decimal numeric value > = 0 and < Maximum Draft Tenor. Maximum Specify the maximum draft tenor for an Islamic LC product. The value you enter must be non-decimal numeric value > 0 and > = Minimum Draft Tenor. Note:

If the LC Type of an LC product is selected as 'Sight':- On save of LC product definition, system will validate that the value defined for minimum and maximum Draft Tenor fields in preferences sub-system is either 0 or null. If the validation fails, system will display a configurable override message.

- During LC contract creation, on

save, system will validate that the value entered

for Draft Tenor field in Drafts sub-system is

either 0 or null. If the validation fails, system

will display a configurable override message. The

said validation is also performed on save of LC

amendment using LC contract online function

Note:

If the LC Type of an LC product is selected as 'Usance': - On save of LC product definition, system will validate that value defined for minimum Draft Tenor is either null or 0 or any positive non-decimal

- numeric value > 0 but < = maximum draft tenor and the value defined for maximum Draft Tenor is a positive non-decimal numeric value > 0 and >= minimum draft tenor. If the validation fails, system will display an error message.

- During LC contract creation, on save, system will validate that the values entered for draft tenor field in drafts sub-system is between minimum & maximum draft tenor values defined for the product. If the validation is not successful, system will display a configurable override message. The said validation is also performed on save of LC amendment using LC contract online function.

- In instances where multiple drafts are captured for a LC contract, system will validate that the 'Draft Tenor' entered for each individual draft is within the minimum and maximum range defined for the product.

- If minimum and maximum Draft tenor value is not defined for a LC product then on save of a LC contract, system will not perform the validation stated in point (ii) as no range is defined at the product level.

- When only one of the values i.e. either 'Minimum Draft Tenor' or 'Maximum Draft Tenor' is defined for the LC product, then on save of both LC contract creation and amendment, then the value defined i.e. the 'Draft Tenor' of LC contract will be validated against the 'Minimum Draft Tenor' if 'Minimum Draft Tenor' is defined or will be validated against 'Maximum Draft Tenor' if 'Maximum Draft Tenor' is defined. If the validation fails, system will display a configurable override message.

- The validations described for Draft Tenor field of an LC contract are applicable only if drafts information is captured in the Drafts sub-system. If drafts are not applicable / captured for an LC contract, the said validations are not applicable. The validations stated above are applicable for both Import and Export LC products.

Commission Commission related preferences have been discussed in the Commissions User Manual. Tolerance Tolerance denotes the variance that has to be built around the Islamic LC amount, to arrive at the Maximum Islamic LC amount. Positive Specify the percentage that should be added to the LC amount to arrive at the Maximum Islamic LC amount. When an Islamic LC is issued or advised, the Maximum Islamic LC amount will be the outstanding Islamic LC amount. This will be the maximum amount available for availment. Negative Specify the percentage that should be subtracted from the Islamic LC amount. The minimum tolerance is captured for information purposes only. Note:

The tolerance percentage can be changed when an Islamic LC is processed under a product.The positive and negative tolerance amounts will be a part of the Islamic LC instrument and the subsequent amendment instruments. You should use the positive tolerance to indicate the amount that is uncovered, in the Islamic LC amount. Instances could be of the freight or insurance not being paid.

Closure Days In this section specify the following details: Closure Days Specify the number of days after which all Islamic LCs processed under the product being defined, will be closed. The number of days specified here and the expiry date of the Islamic LC is used to arrive at the closure date, as follows: Islamic LC Closure Date = Islamic LC Expiry Date + Closure Days

By default, the system will display 30 days as the closure days. You are allowed to change this value.

At the time of capturing the details of an Islamic LC contract, the system will calculate the closure date, based on the closure days that you have maintained for the product involved in the contract. However, you can change the date to any other date after the expiry date.

Exchange Rate In this section specify the following details: Default Rate Type Specify the exchange rates to be picked up and used, when an Islamic LC in a foreign currency, is processed. You can indicate that the standard rate prevailing, as of the issue date of the LC should be used. You can also specify an exchange rate of your choice. The possible values for the rate pickup are:- As per Standard Rate

- As input in the Contract

If you specify as input in the contract, then the system computes the components of the LC, based on your input in the Exchange rate field, in the ‘LC Contract Main ‘screen.

If you choose ‘As per standard rate’ the system computes the applicable components, by picking up the exchange rates as of the transaction date, from the Currency table maintained in the Core Services module of Oracle Trade Fince.

Override Limit If the variance between the rate defaulted and the rate input is a percentage that lies between the Rate Override Limit and the Rate Stop Limit, the Islamic LC can be saved by giving an override. Stop Limit If the variance between the rate defaulted and the rate input is a percentage value greater than or equal to the Rate Stop Limit, the Islamic LC cannot be saved. Period of Presentation As part of the preferences you define for a product, you can specify the manner in which the Period of Presentation should be calculated for the documents that accompany Islamic LCs processed under the product. The period of presentation can be arrived at in two ways.

Firstly, you can specify it directly, in terms of days, in the Number of Days field. Typically, this would be 21 days. (However, you can change this to suit your need.) If you choose this option, the number of days specified will default to all Islamic LCs processed under the product. The value will default to the ‘Period For Presentation’ field in the Islamic LC Contract – Others screen.

Alternatively, you can opt to calculate the period of presentation as follows:

Expiry Date of the Islamic LC – Latest Shipment Date

(You would choose this option if the period of presentation varies for each Islamic LC processed under a product.) To specify this manner of calculating the period of presentation, choose the Calculated Days option in the Product Preferences screen.

The system uses the Expiry Date and the Last Shipment Date specified for the Islamic LC you are processing, and arrives at the period of presentation. The period of presentation defined for the product - or calculated for the Islamic LC, as the case may be - will be displayed in the ‘Period For Presentation’ field in the Islamic LC Contract - Others screen. You can change the default to suit the Islamic LC you are processing.

LIFO/FIFO Rule Specify the order in which the availment under this contract should be processed. You can choose one of the following options: If multiple amendments are made to the Islamic LC contract amount, then the system applies the FIFO/LIFO rule when utilization is made against the Islamic LC contract.- LIFO – Islamic LC amount will be utilized in ‘First In First Out’ order when availment is triggered against the multiple amended Islamic LC contract.

- FIFO – Islamic LC amount will be utilized in Last In First Out order when availment is triggered against the multiple amended Islamic LC contract.

The system will calculate the commission accordingly

The system applies FIFO / LIFO rule when it finds that multiple amendment has been made to an Islamic LC contract against which utilization has been completed.

Finance Details Specify the finance details here. Note:

This is allowed only for Shipping Guarantee product.Guarantee Details Specify the details. Claim Days Specify the claim days for the bank guarantee and advice of guarantee.Collateral Funding by Finance Select this to indicate that the guarantee needs to be funded by a finance. Claim Settlement by Finance Select this to allow claim settlement by creating a finance in case of insufficient funds in customer account. Note:

This is applicable for Bank Guarantees.Finance Bridge GL Specify the bridge GL used for accounting between finance product and shipping/bank guarantee. The adjoining option list displays a list of all GLs. Choose the appropriate one. Financing Product Specify the finance product used for the creation of finance account. The adjoining option list displays a list of finance products. Choose the appropriate one. Collateral Transfer Bridge Specify the bridge GL used for collateral transfer from Islamic LC to shipping guarantee and shipping guarantee to Bill. The adjoining option list displays a list of all GLs. Choose the appropriate one. Status Specify the following status details: Auto Status Check this box to set automatic status control for the Islamic LC product. If you do not check this box, the system will not consider the Islamic LC contracts associated with this product for automatic status change. The status of this check box is defaulted to the field ‘Auto Status Change’ of every Islamic LC contract associated with this product. However, you can modify this at the contract level.

Accrual Specify the following accrual details. Frequency Specify the frequency of accrual for commission, charge or fees. The frequency can be one of the following: - Daily

- Monthly

- Quarterly

- Half Yearly

- Yearly

In case of monthly, quarterly, half yearly or yearly accruals, you should specify the date on which the accruals have to be done during the month. For example, if you specify the date as ‘30’, accruals will be carried out on the 30th of the month, depending on the frequency.

If you fix the accrual date for the last working day of the month, you should specify the date as ‘31’ and indicate the frequency. If you indicate the frequency as monthly, the accruals will be done at the end of every month -- that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February.

If you specify the frequency as quarterly and fix the accrual date as the last day of the month, then the accruals will be done on the last day of the month at the end of every quarter. It works in a similar fashion for half-yearly accrual frequency.

If you set the accrual frequency as quarterly, half yearly or yearly, you have to specify the month in which the first accrual has to begin, besides the date.

Month If you choose one of the following options for accrual frequency, specify the month in which the first accrual has to begin: - Quarterly

- Half-Yearly

- Yearly

Day If you choose one of the following options for accrual frequency, specify the date on which the accruals have to be done during the month: - Monthly

- Quarterly

- Half-Yearly

- Yearly

Confirmation Check the ‘Required’ option to indicate that confirmation message is required for all Islamic LCs under this product. Prepayment Check the ‘Allow Prepay’ option to indicate that prepayment should be allowed for commissions that are marked as ‘Arrears’. Sanction Check Specify the field. Fee Claim SWIFT Check this box to determine whether the Charge claim advice should be generated in SWIFT. Product Restriction Specify the fields. Branch List Indicate whether you want to create a list of allowed branches or disallowed branches by selecting one of the following options: - Allowed

- Disallowed

Currency Restriction Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options: - Allowed

- Disallowed

Categories List Indicate whether you want to create a list of allowed customers or disallowed customers by choosing one of the following options: - Allowed

- Disallowed