- Islamic Letters of Credit

- Islamic Guarantees and Standby Letter of Credit

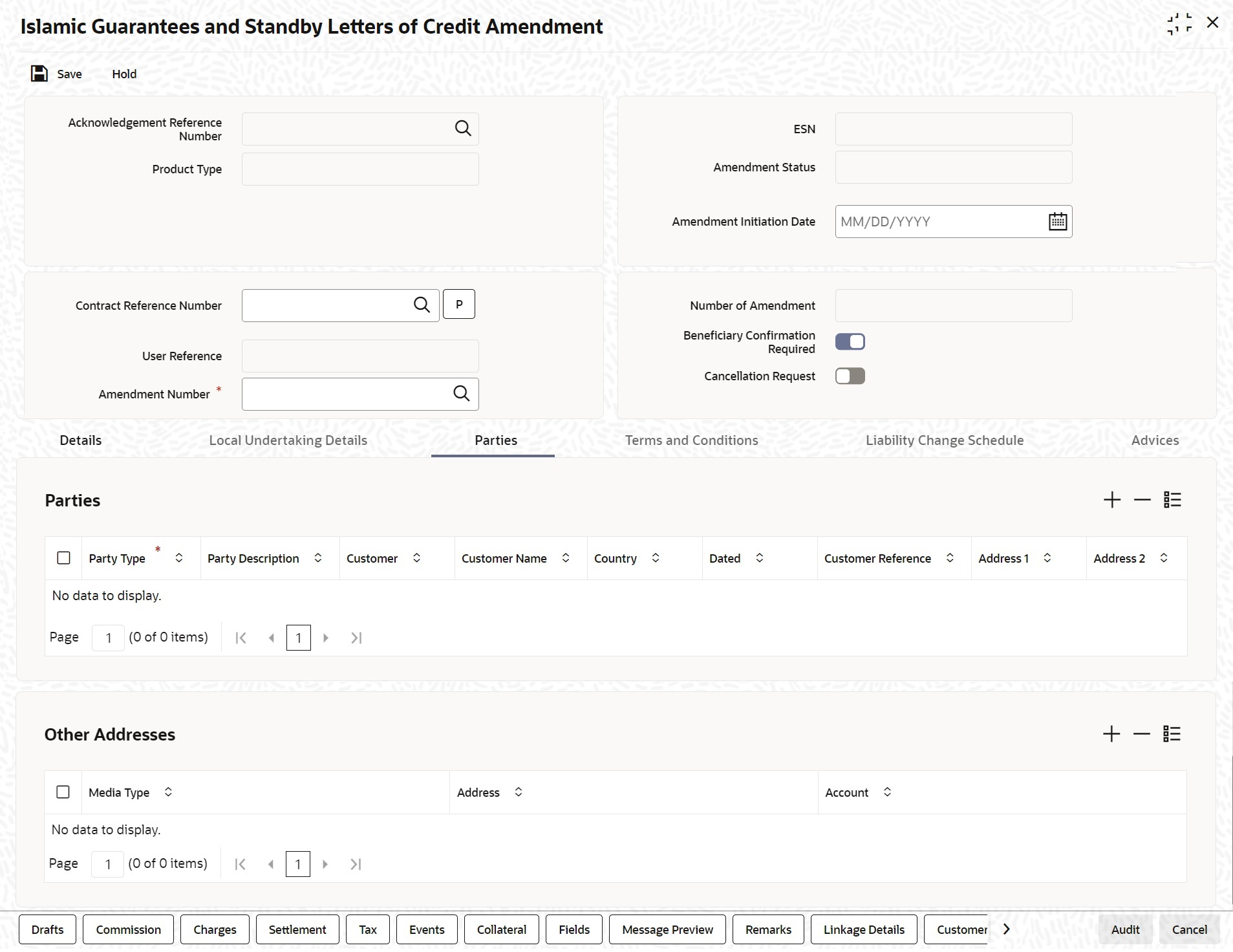

- Islamic Guarantees and Standby Letters of Credit Amendment

- Process Amendment of Islamic Guarantees and SBLC

10.3.1 Process Amendment of Islamic Guarantees and SBLC

This topic provides the systematic instructions to view Process Amendment of Islamic Guarantees and SBLC.

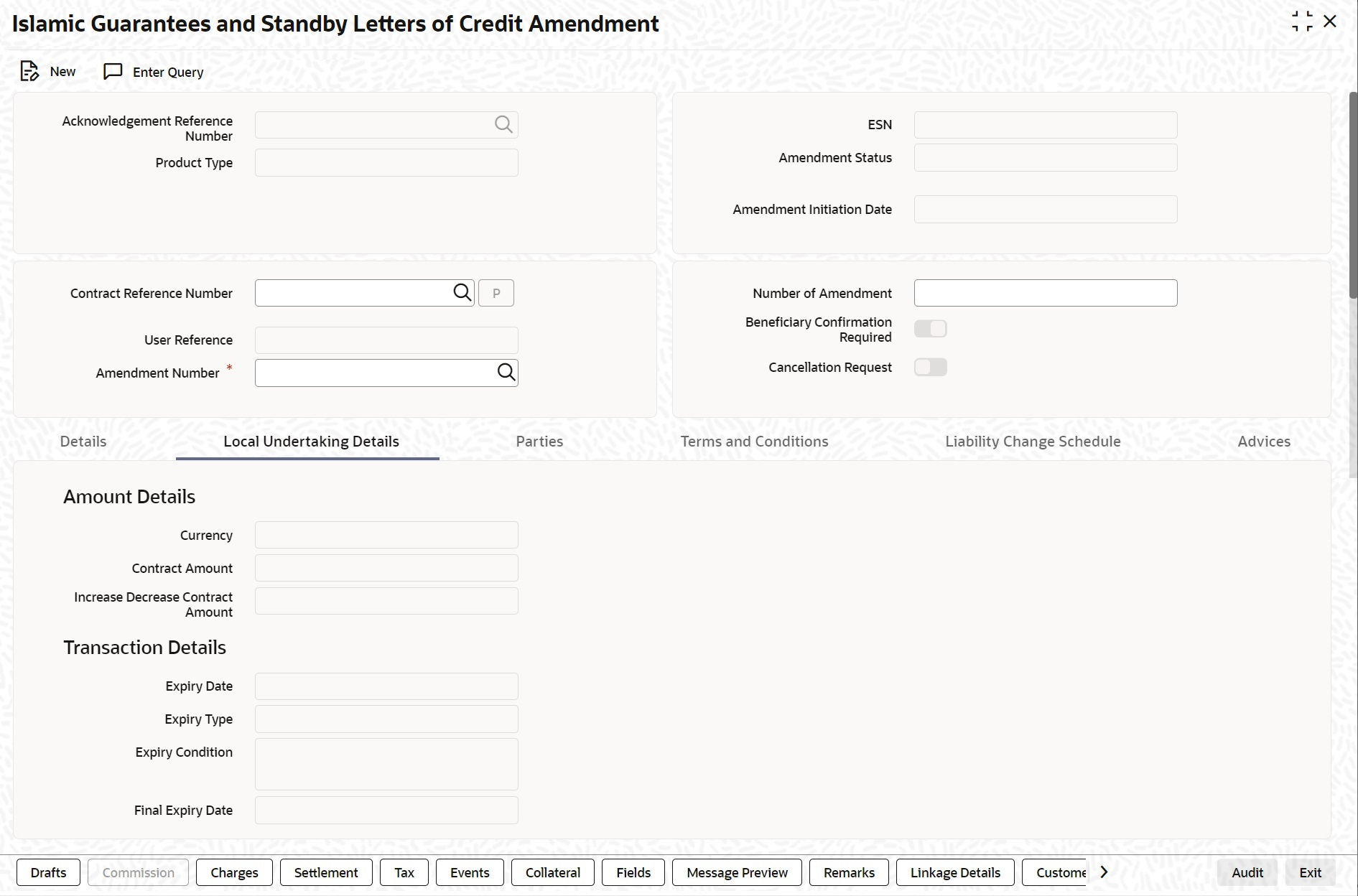

- On the Homepage, type LIDGUAMD in the text box, and click the next

arrow.The Islamic Guarantees and Standby Letters of Credit Amendment screen is displayed.

Figure 10-16 Islamic Guarantees and Standby Letters of Credit Amendment

Description of "Figure 10-16 Islamic Guarantees and Standby Letters of Credit Amendment" - On Islamic Guarantees and Standby Letters of Credit Amendment screen, click New.

- Islamic Guarantees and Standby Letters of Credit Amendment -

New screen, specify the details as required.For information on fields, refer to the field description table below:

Table 10-19 Islamic Guarantees and Standby Letters of Credit Amendment - New - Field Description

Field Description Hold button to support financial amendment [LIDGUAMD] Click Hold button to support financial amendment [LIDGUAMD] from the below given options: - Amendment without beneficiary confirmation

- Amendment without beneficiary confirmation and with Advice of Reduction

- Amendment with beneficiary confirmation

User can unlock amendments on Hold, modify details if required and save. Processing on Save will continue as existing.

‘Deletion of Hold’ will be supported. ‘Hold of Hold’ will be supported. Contract remains on Hold and in unauthorized status. Authorization is not supported for Contracts put on Hold

Note:

Hold will not be supported for amendment with beneficiary confirmation and Advice of reduction, amendment with Cancellation flag or Confirmation / Rejection of amendmentAcknowledgment Reference Number Specify the acknowledgment reference number. Alternatively, you can select the reference number from the option list. The list displays all the acknowledgment reference numbers for contract amendment registered in the system. ESN The system displays the event sequence number. Product Type The system displays the product type of Islamic Guarantee/SBLC. Amendment Status The system displays the amendment status. Amendment Initiation Date The system displays the amendment initiation date. Contract Reference Number Select the reference number of the contract to be amended from the option list provided. This option list will display all contracts that are authorized. Number of Amendment The system displays the number of amendments based on the contract reference number.You can amend a Islamic Guarantee/SBLC multiple times before the previous amendment is confirmed or rejected. Financial amendment without Beneficiary Confirmation will not be allowed if there are unauthorized unconfirmed amendments.

Beneficiary Confirmation Required The system enables ‘Beneficiary Confirmation Required’ flag by default. When amendment is initiated with Beneficiary confirmation flag checked, then AMNV is triggered and MT767 is generated. When the amendment is confirmed then ACON and AMND is triggered and details are propagated to LIDGUONL. When amendment is initiated without Beneficiary confirmation flag checked, amendment details are propagated to LIDGUONL. You can modify the and guarantee details. The system triggers AMND event on save and MT767 is generated.

Cancellation Request Check this box to request cancellation. If Cancel flag is checked, only cancel information shows a message on authorization of amendment.

If Cancel flag is enabled, other field amendments are not considered and CANCEL event is triggered on amendment confirmation.

The amendment of Islamic Guarantees and SBLC can be simulated only through gateway. The Guarantee Amendment Simulation does not have screen, so user cannot invoke Guarantee Amendment Simulation from the application front. All operations are supported for Guarantee Amendment Simulation is same as Guarantees and Standby Letters of Credit Amendment.

User Reference The system displays the contract reference number as user reference number. Amendment Number The system displays the amendment number. - On the Islamic Guarantees and Standby Letters of Credit

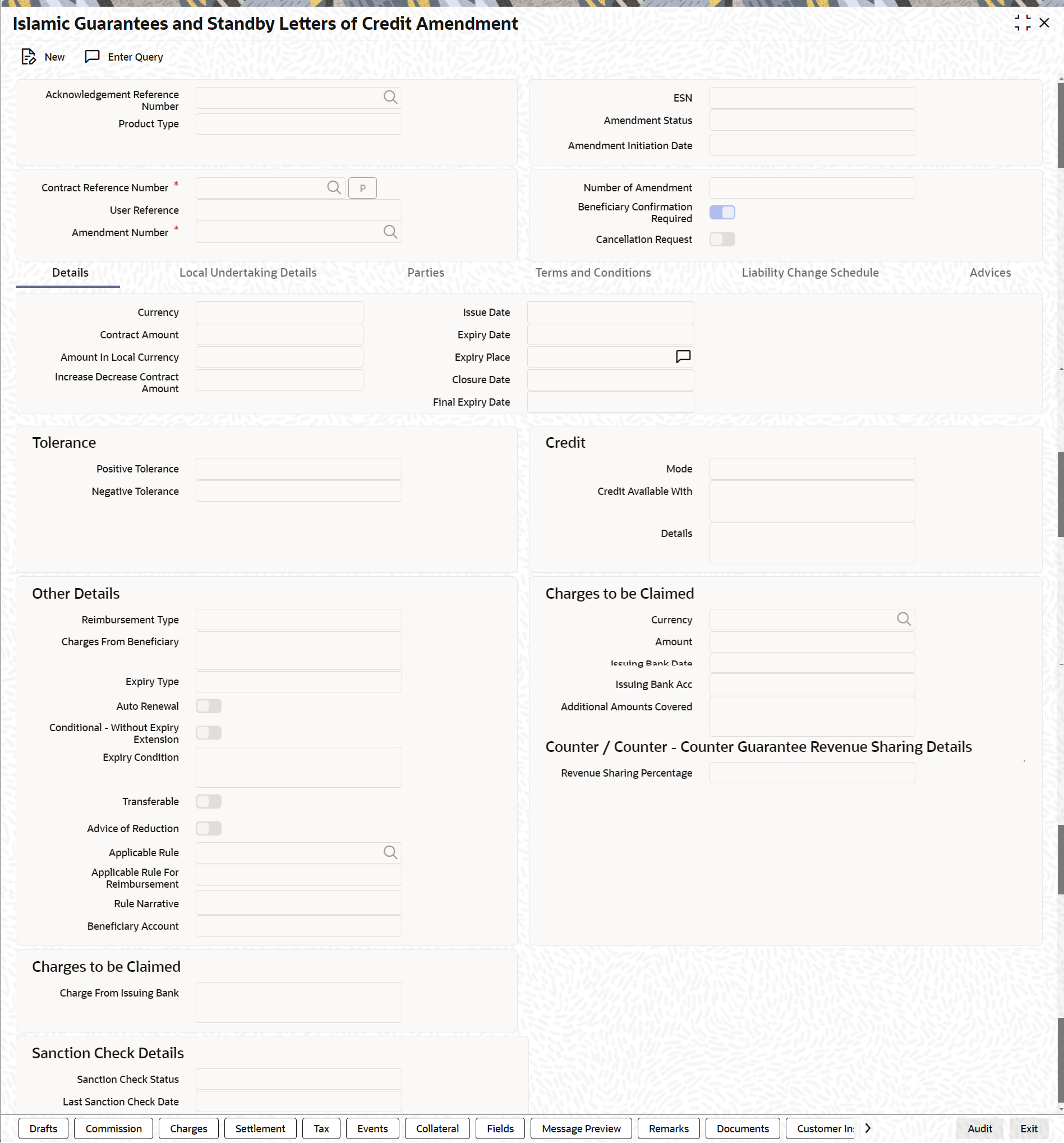

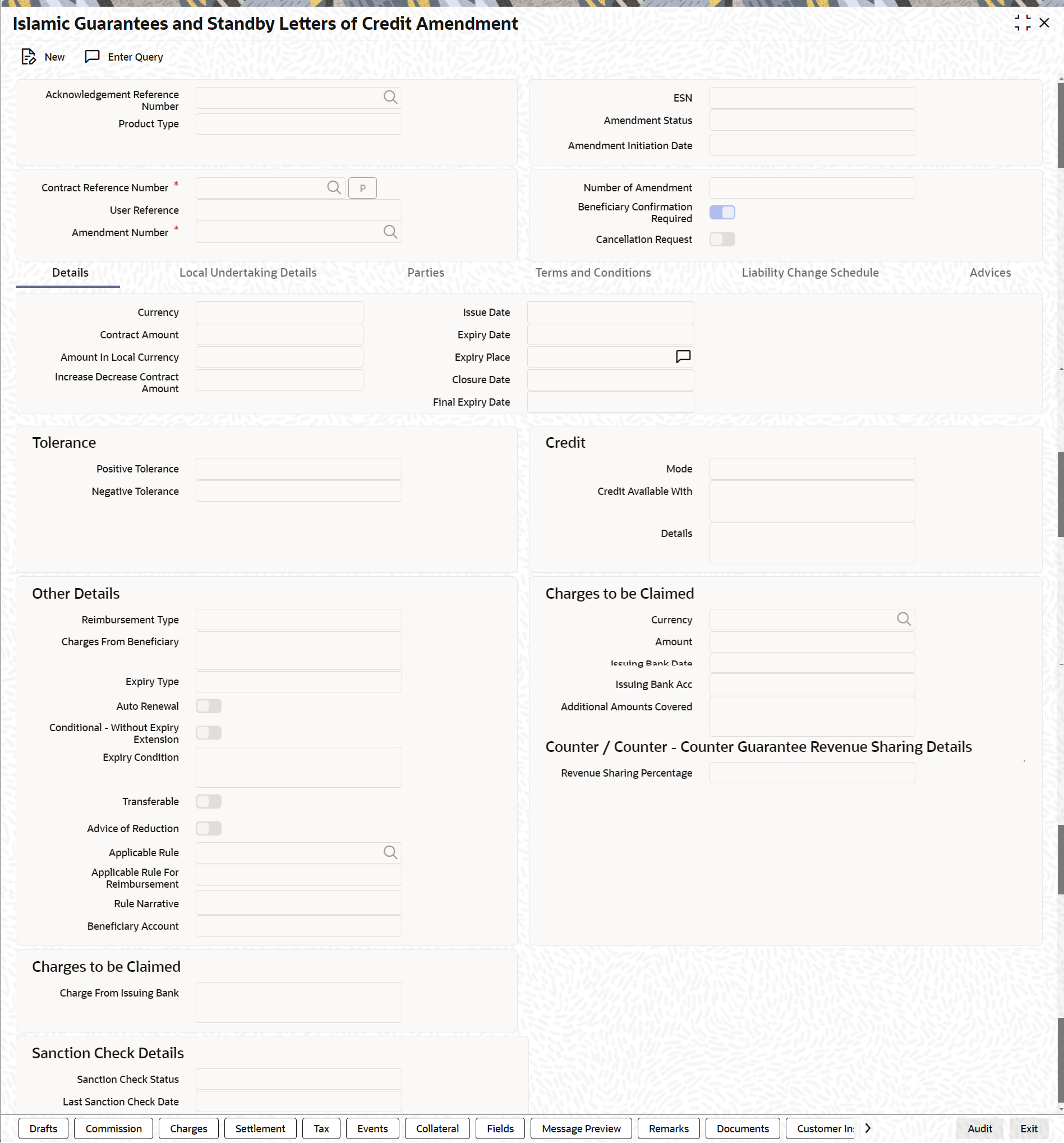

Amendment screen, click Details.Islamic Guarantees and Standby Letters of Credit Amendment - Details tab screen is displayed.

Figure 10-17 Islamic Guarantees and Standby Letters of Credit Amendment - Details tab

Description of "Figure 10-17 Islamic Guarantees and Standby Letters of Credit Amendment - Details tab" - On the Details tab, specify the details as

required.For information on fields, refer the following field description table:

Table 10-20 Details - Field Description

Field Description Currency The system displays the currency. Contract Amount The system displays the contract amount. Amount in Local Currency When FCY amount is given in 'Contract Amount' field for Islamic Guarantee during Amendment, system converts in local currency and respective value is displayed in this screen. This field is mandatory for FCY contracts. Increase Decrease Contract Amount The system displays the contract amount increased or decreased. Issue Date The system displays the issue date. Expiry Place Specify the expiry place in the text box and click Ok. Expiry Date Select the date on which the Islamic Guarantee/SBLC is scheduled to expire. On confirmation of guarantee amendment, revised Expiry Date is propagated to ‘LIDGUONL’. System derives Claim Expiry date based on the new Expiry Date. Closure Date Specify the date LC is scheduled to be closed. You can modify this. Final Expiry Date Specify the final expiry date from the calendar. Positive Tolerance Specify the positive tolerance. Negative Tolerance Specify the negative tolerance. Mode Specify the mode from the drop-down list. The available options are: - Sight Payment

- Acceptance

- Deferred Payment

- Mixed Payment

- Negotiation

Credit Available With Specify the credit available with in the text box and click Ok. Details Specify the details in the text box and click Ok. Charges from Beneficiary Specify the charge amount borne by the beneficiary. - Limited

- Unlimited

Expiry Type Select the expirytype from the drop-down list. The list displays the following options: - Fixed

- Open

- Conditional - With Expiry

- Conditional - Without Expiry

Auto Renewal This flag specifies if the Open ended guarantee is to be auto renewed on EOD. Conditional - Without Expiry Extension Specify whether for a Conditional - Without Expiry type Islamic guarantee, expiry date is to be extended. Expiry Condition Specify the details for conditional guarantee. Transferable Check this box to indicate that the Islamic Guarantee/SBLC is transferable. Advice of Reduction Check this box to send Advice of Reduction (MT 769) message. Advice of Reduction cannot be enabled if ‘Beneficiary Confirmation Required’ flag is enabled. You can amend ‘Advice of Reduction’ check box, after disabling Beneficiary Confirmation Required flag and choosing Contract Reference number from the option list and clicking ‘P’ (Populate) button.

If ‘Advice of Reduction’ is enabled along with Beneficiary Confirmation flag then the system provides appropriate error message.

Applicable Rule The system displays the applicable rule by default. Applicable Rule for Reimbursement Select the applicable rule for Reimbursement from the drop-down list. The available options are - URR Latest Version

- Not URR

Rule Narrative The system displays the rule narrative by default. Beneficiary Account Specify the account details of beneficiary. This field is read only.

Currency Specify the currency in which the charges attributed to the issuing bank is expressed. Amount Specify the charge amount. Issuing Bank Date Specify the date of charge collection. Issuing Bank Account Specify the account from which charge should be collected. Additional Amount Covered Specify the additional amount covered. Details applicable to ‘Advice of Reduction’ will be propagated to ‘Islamic Guarantees and Standby Letters of Credit Contract Input’ screen and it can be modified.

STP of MT769 will initiate amendment or cancellation of Islamic Guarantees/Counter Guarantees in LIDGUAMD without Beneficiary Confirmation.- If value in tag 33B is equal to Guarantee amount cancellation will be initiated.

- If value in tag 33B is lesser than Guarantee amount then amendment will be initiated.

Expiry Date Select the expiry date of the local guarantee from the adjoining calendar. Final Expiry Date Select the final expiry date of the local guarantee from the calendar. Sanction Check Status The system displays the sanction check status. Last Sanction Check Date The system displays the last sanction check date. Revenue Sharing Percentage Specify the Revenue sharing percentage provided for the contract. - On the Islamic Guarantees and Standby Letters of Credit

Amendment screen, click the Local Undertaking

Details tab.

The Local Undertaking Details is displayed.

For information on fields, refer to the field description table below:

Table 10-21 Local Undertaking Details - Field Description

Field Description Amount Details Specify the Amount Details. Currency The system displays the currency details by default. The field is optional.

Contract Amount Enter the contract amount. Note:

BIC code appears next to the Customer No only if the BIC code is mapped with the customer number. If the BIC Code is not mapped with that customer number, then the BIC Code will not appear next to the Customer No in the option list.The field is optional.

Increase Decrease Contract Amount The system defaults the customer name. The field is optional.

Transaction Details Specify the Transaction Details: Expiry Date Select the expiry date from the calendar icon. The field is optional.

Expiry Type Select the expiry type from the option list. The available options are: - Fixed

- Open

- Conditional - With Expiry

- Conditional - Without Expiry

The field is optional.

Expiry Condition Specify the expiry condition and click Ok. The field is optional.

Final Expiry Date Select final expiry date from the calendar. The field is optional.

- On the Islamic Guarantees and Standby Letters of Credit

Amendment screen, click Parties.Islamic Guarantees and Standby Letters of Credit Amendment - Parties tab screen is displayed.

Note:

Click on add icon to add required number of rows and click on minus icon to delete the rows.Figure 10-19 Islamic Guarantees and Standby Letters of Credit Amendment - Parties

Description of "Figure 10-19 Islamic Guarantees and Standby Letters of Credit Amendment - Parties" - On the Parties tab, specify the details as

required.For information on fields, refer to the field description table below:

Table 10-22 Parties- Field Description

Field Description Party Type The system defaults the party type. Party Description The system defaults the party description. Customer The system defaults the customer number. You can modify the customer number of the beneficiary. Specify the ‘Customer for which you need to maintain. Alternatively, you can select the ‘Customer No’ from the adjoining option list also.

Note:

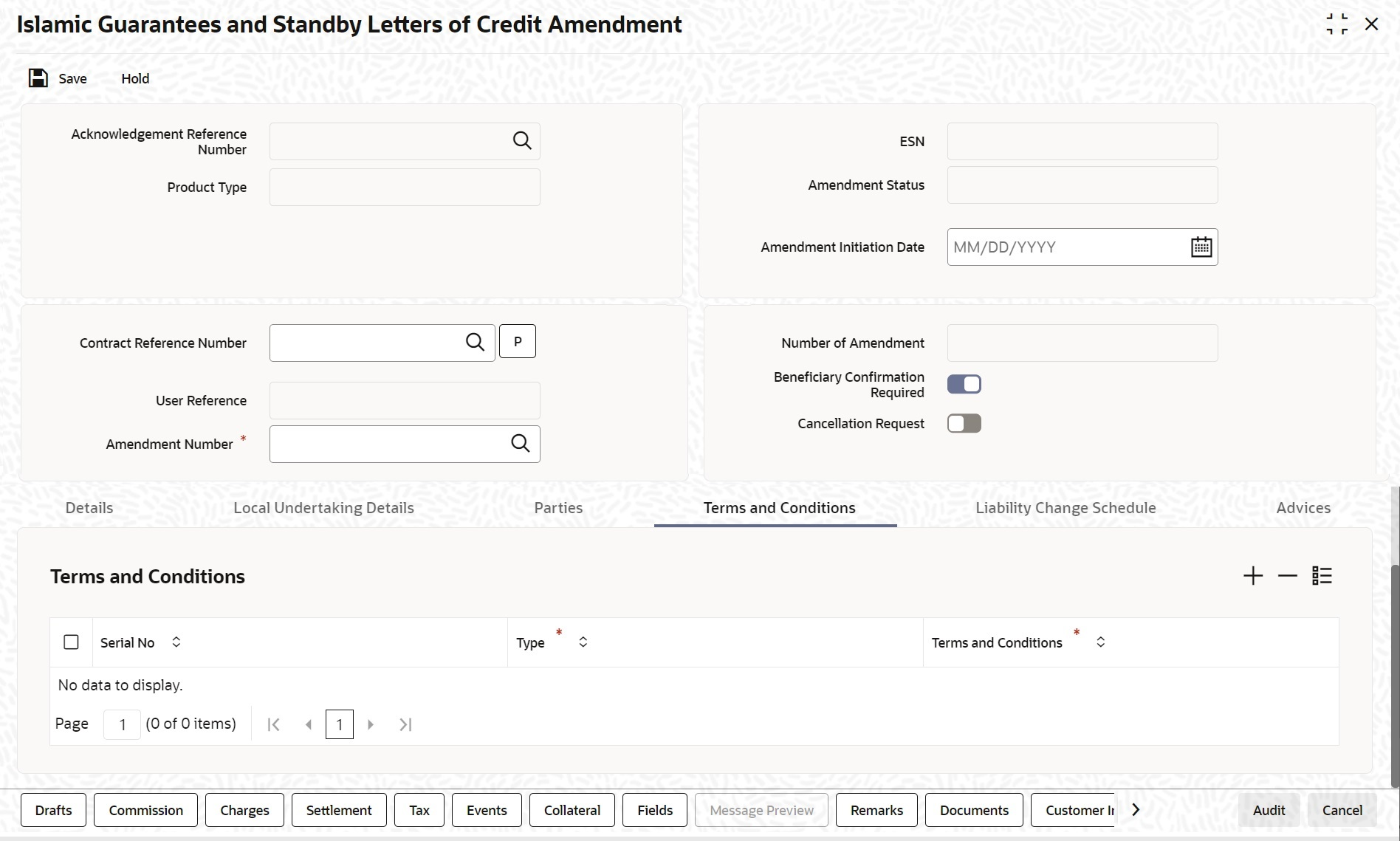

BIC code appears next to the ‘Customer No’ only if the BIC code is mapped with that customer number. If the BIC code is not mapped with that customer number, then the BIC Code will not appear next to the ‘Customer No’ in the adjoining option list.Customer Name The system defaults the customer name. Country The system defaults the country of the customer. Dated The system defaults the date on which the party joined. However, you can modify it. Customer Reference The system defaults the customer reference number. However, you can modify it. Address 1 to 4 The system defaults the address of the party. Language The system defaults the language in which advices are sent to the customer. Issuer Bank The system defaults the name of the issuer bank. Media Type The system defaults the media type. You can select a different medium from the adjoining option list. Address The system defaults the other address of the party. However, you can edit this field. Account The system defaults the account number. However, you can edit this field. - On the Islamic Guarantees and Standby letters of credit

Amendment screen, click Terms and

conditions.Islamic Guarantees and Standby letters of credit Amendment- Terms and conditions tab screen displayed.

Figure 10-20 Islamic Guarantees and Standby letters of credit Amendment- Terms and conditions

Description of "Figure 10-20 Islamic Guarantees and Standby letters of credit Amendment- Terms and conditions" - On the Terms and Conditions tab, specify the details as

required.On the Terms and Conditions tab, refer to the field description table below:

Table 10-23 Terms and Conditions - Field Description

Field Description Serial No Specify the serial number for terms and conditions. - Guarantee

- Local Guarantee

Type Select the guarantee type from the drop-down list. Available options are: Terms and Conditions Specify the terms and conditions. Note:

Terms and Conditions for Guarantee are mandatory. - On the Islamic Guarantees and Standby letters of credit

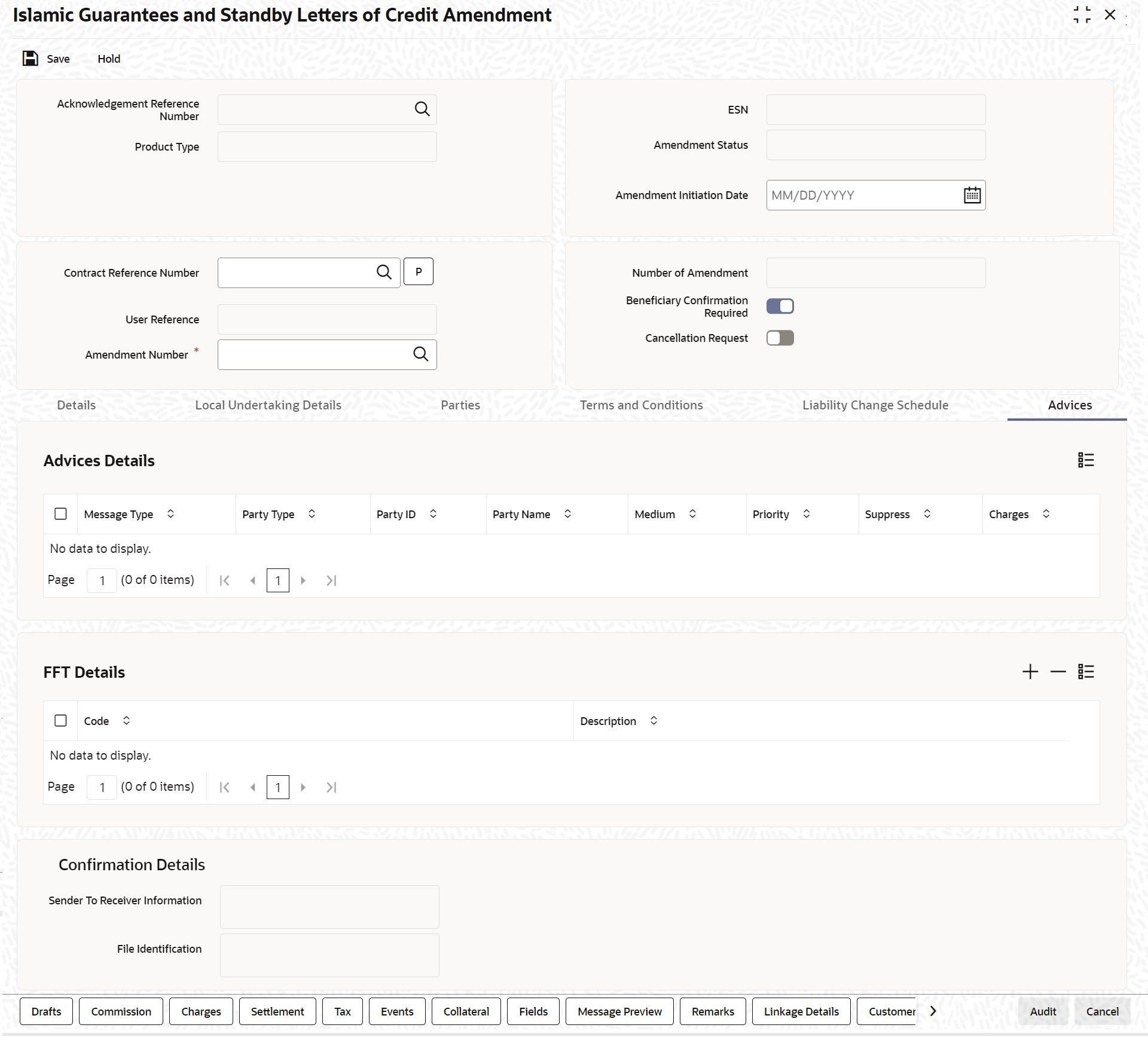

Amendment screen, click Advices.Islamic Guarantees and Standby letters of credit Amendment - Advices tab screen is displayed.

Figure 10-21 Islamic Guarantees and Standby letters of credit Amendment - Advices

Description of "Figure 10-21 Islamic Guarantees and Standby letters of credit Amendment - Advices"(Optional) Enter the result of the step here. - On the Advices tab, specify the details as

required.For information on fields, refer to the field description table below:

Table 10-24 Advices - Field Description

Field Description Message type Check the box to view the advice details. Party type The system displays the party type for which the advice is generated. Party Id The system displays the party id for which the advice is generated. Party Name The system displays the name of the party for which the advice is generated. Medium The system displays the medium through which the advice is sent. The user can select a different medium from the list. If the medium is modified, the user must provide the new address in the ‘Other Addresses’ section, in the ‘Parties’ tab. Priority The system displays the priority of sending the advice. However, you can change the priority. Suppress The system displays if the advice is suppressed or not. However, you can edit this field. Charges The system displays the charges involved. However, you can edit the charges. - On the Islamic Guarantees and Standby Letters of Credit Amendment

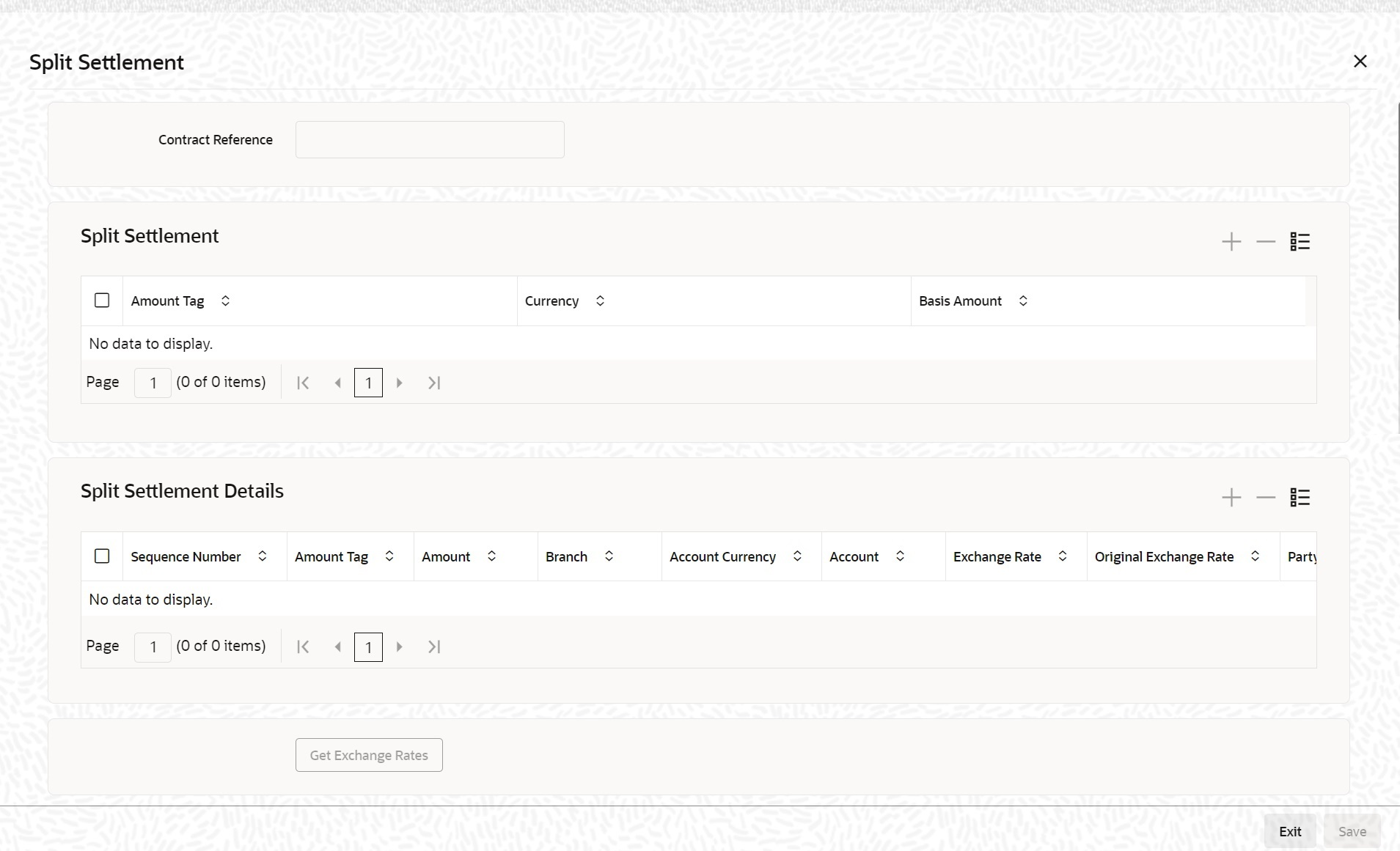

Input screen, click the Split Settlement

button.

Split Settlement Master and details get populated for the Cash collateral based upon on the Guarantee Issuance collateral split details.User can modify the details.

For subsequent amendments split details get populated for the Cash collateral based upon on the consolidated collateral split details.User can modify the details.

The Split Settlement screen is displayed.For information on fields, refer to the field description table below:Table 10-25 Split Settlement - Field Description

Field Description Specify Settlement Split Master You can specify the details of the settlement split master in the following fields: Basis Amount Tag Specify the amount tag involved in the contract. The option list displays all valid amount tags maintained in the system. You can choose the appropriate one. For example, on booking a new contract, the only tag allowed is PRINCIPAL. This is referred to as the basis amount tag. This field is optional.

Currency The system displays the currency associated with the amount tag. This field is optional.

Basis Amount The system displays the basis amount associated with the amount tag. For example, the amount involved in the contract would be displayed against the amount tag PRINCIPAL. The amount is in terms of the currency associated with the amount tag.

You can use Get Exchange Rate button to get the original exchange rates defaulted in the screen. This field is optional.

Specify Settlement Split Details For each split amount tag, you need to specify the following details: This field is optional.

Amount Specify the amount for the split amount tag. This amount should not be greater than the amount of the corresponding basis amount tag. The split amount is in the currency of the basis amount tag. This is a mandatory field and you will not be allowed to save the details if you do not specify the amount. This field is optional, if percentage of proceeds is provided. Amount will be derived based upon the percentage.

Branch Specify the branch. The list displays all valid values.This field is mandatory. Account Currency Specify the account currency. This field is mandatory. Account Specify the account. This list displays all the accounts. For Cash Collateral the account should be account of the counterparty. If the account selected is other than counterparty account, then system will throw error. This field is mandatory. Loan/Finance Account Check this box to indicate that the specified account should be the loan account. This field is optional.

Exchange Rate Specify the exchange rate that must be used for the currency conversion. Specify the destination to which the goods transacted under the LC should be sent by selecting the appropriate option from the list of values.

This field is optional.

Original Exchange Rate The base or the actual exchange rate between the contract currency and collateral currency gets displayed here. Customer Select the customer number from the list. Percentage of Proceeds Specify the percentage of proceeds Negotiated Rate Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction. The system will display an override message if the negotiated rate is not within the exchange rate variance maintained at the product.

This field is optional.

Negotiated Reference Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also. Note:

Oracle Banking Trade Finance books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.This field is optional.

- FFT Details

The user can select a message from the ‘Advices Details’ section and associate a code and a description to it.