2.8.4 Processing Tax on a Contract

The taxes that apply on a contract can be of two types: ‘Expense’ and ‘Withholding’. The tax that your bank bears on a contract is referred to as an expense type of tax, whereby you book the tax component to a Tax Expense account. The tax that is borne by counter party of a contract is referred to as a withholding tax, whereby you debit the counter party’s account, and credit the tax component into a Tax Payable account (to be paid to the government on the counter party’s behalf).

For example,

A tax on a Letter of Credit (LC) can be levied either on the:

- Outstanding LC amount.

- On the commissions and charges that you earn to process the LC.

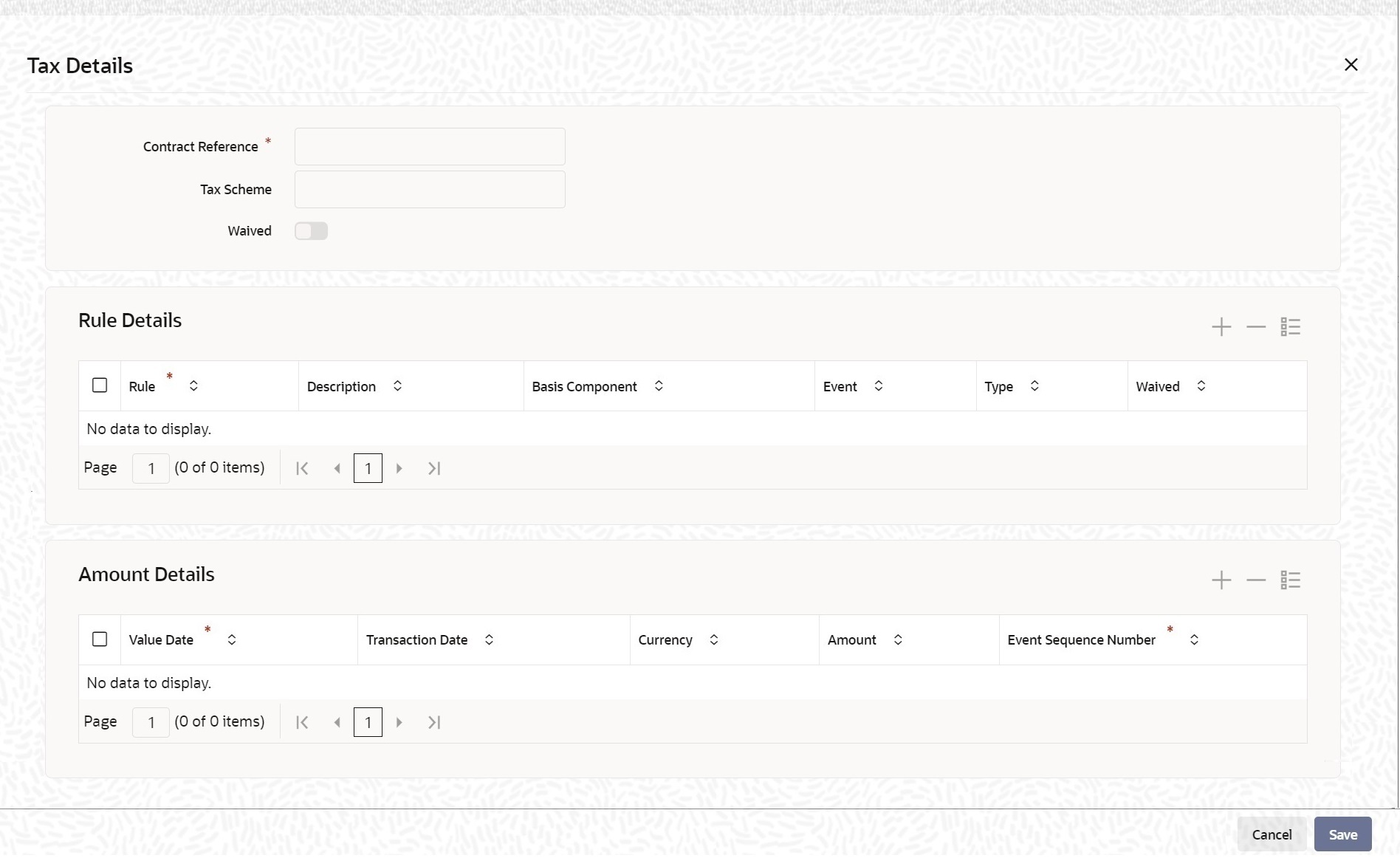

You can load the ‘Contract Tax Details’ screen while you are processing a contract.

Click ‘Tax’ button in the contract details screen.

You have a choice of waiving tax due to all the Tax Rule(s) linked to the Tax Scheme applicable to the product (and hence the contract) or that which is only due to specific Tax Rule(s).

You have a choice of waiving tax due to all the Tax Rule(s) linked to the Tax Scheme applicable to the product (and hence the contract) or that which is only due to specific Tax Rule(s).

Note:

Only the tax that has not yet been liquidated can be waived.

Parent topic: Tax Scheme to a Product Linkage