2.8.1 Linking a Tax Scheme to a Product

A tax scheme is linked to a product, only if tax is applicable to the product. This linkage is established through the tax screen, of product definition. The tax scheme thus linked will be applicable on a contract processed under the product by default. However, you have the option of waiving the application of tax, for a specific contract.

A Tax Rule represents the method in which a specific tax has to be calculated. The amount based on which the tax has to be applied is not specified for a Tax Rule. This is specified only when the Tax Scheme is linked to a product.

The system thus offers you flexibility in terms of the method in which tax has to be calculated. For example, for one type of product, you could use a Tax Rule to apply tax on interest earned, while for another product, the same rule could be used to apply tax on the principal (if the method of tax calculation is the same for both the components).

A Tax Scheme is applicable on a product by linking the two rates mentioned above. Once the Tax Scheme is specified for linkage, you should indicate the component on which the two rules are applicable, the event when the tax should be liquidated and the type of tax - withholding or expense.

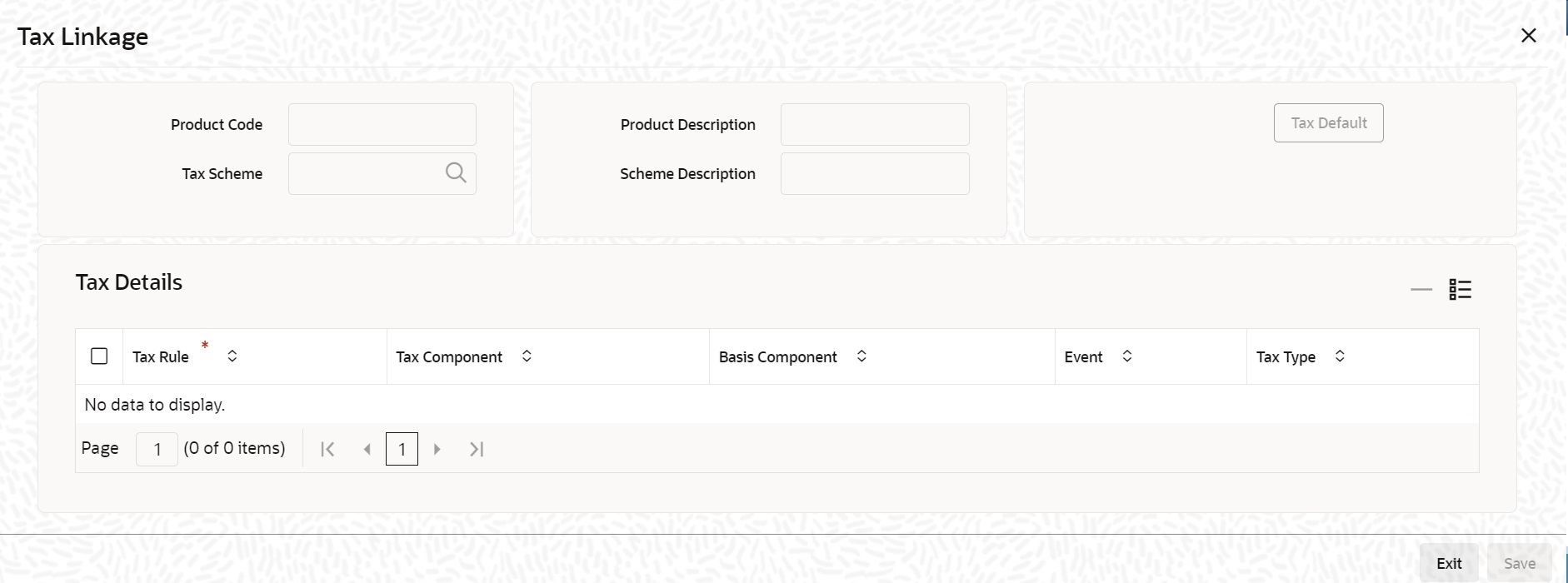

To specify the linkage of a tax scheme to a product you have to load the Product-Tax

Linkage Definition screen from the BC Product Definition screen. Click

‘Tax’ button in the respective ‘Product Definition’

screen.

Description of the illustration cddprmnt__cvs_tax_detail.jpg

Parent topic: Tax Scheme to a Product Linkage