2.7.2 Defining a Tax scheme

Any transaction on which tax is applicable is linked to a Tax Scheme. A Tax Scheme describes the method in which the tax has to be applied on a transaction.

A tax scheme can have a number of Tax Rules linked to it. The attributes of all these rules will be applied on the transaction. Thus, a Tax Rule is made applicable on a contract through the Tax Scheme. For instance, let us assume we are building a tax scheme, which should be used for the BC module of Oracle Banking Trade Finance.

You have defined the following Tax Rules (only the fields relevant to the example are discussed):

Table 2-10 Tax Rule 1

| Rule Code | TaxP1 |

|---|---|

| Effective Date | 1 Jan 2002 |

| Component | Transfer amount |

| Tax Rate | 10 |

Table 2-11 Tax Rule 2

| Rule Code | TaxP1 |

|---|---|

| Effective Date | 1 April 2002 |

| Component | Transfer amount |

| Tax Rate | 12 |

Table 2-12 Tax Rule 3

| Rule Code | TaxP1 |

|---|---|

| Effective Date | 1 Jan 2002 |

| Component | Charges Earned |

| Tax Rate | 10 |

Table 2-13 Tax Rule 4

| Rule Code | TaxP1 |

|---|---|

| Effective Date | 1 April 2002 |

| Component | Charges Earned |

| Tax Rate | 12 |

When all these rules are linked to a single tax scheme, the tax will be applied in the following manner:

If you initiate a transfer from 1 Jan 2002 to 31 Mar 2002, the transfer amount will be charged at 10%. If you initiate a transfer from 1 April 2002 onwards, the transfer amount will be charged at 12%. This is because, after Tax Rule 1, Tax Rule 2 is for transfer and it has an Effective Date of 1 April 2002. All transfers will continue to be taxed at 12% till another rule for the transfer amount with a different Effective Date is added to the scheme.

The charges will also be taxed in the same manner as the transfer amount as two rules have been linked to the Tax Scheme that have exactly the same Effective Date and rates as the ones for the transfer amount.

Note:

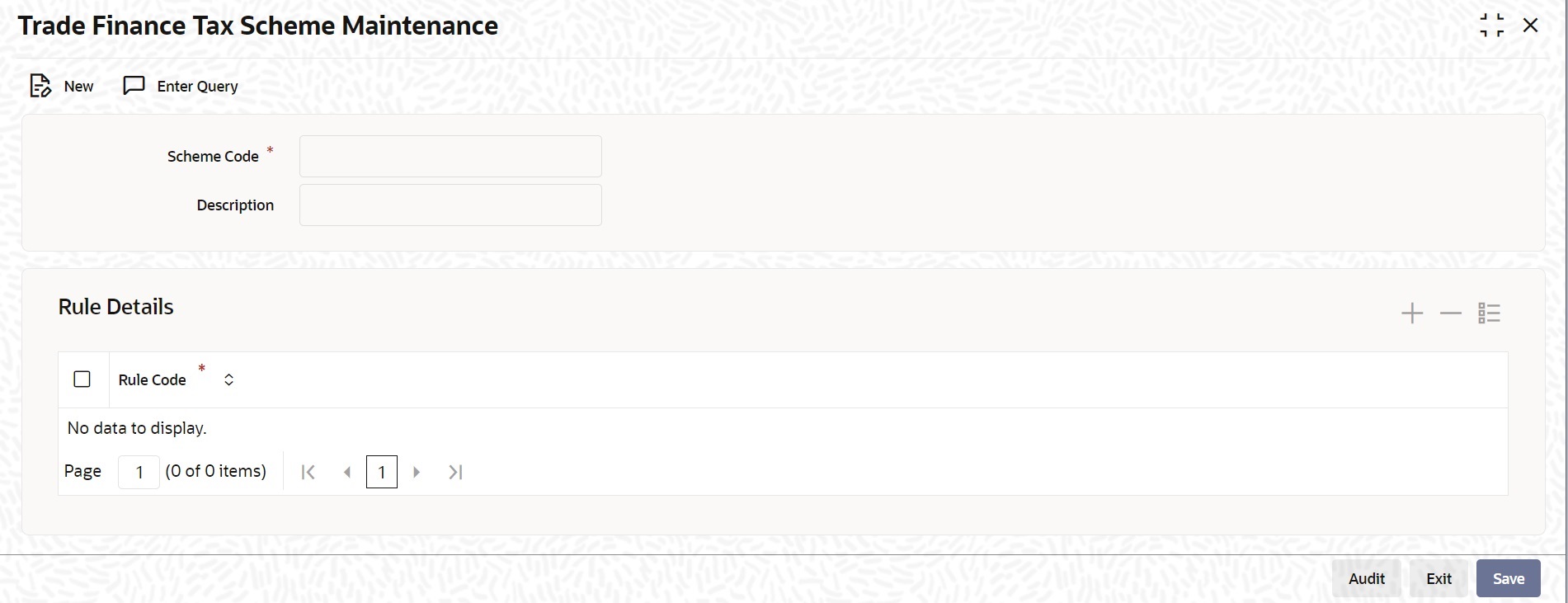

The basis component on which the tax should be applied (principal, interest, transfer amount etc) is specified through the ‘Trade Finance Tax Scheme Maintenance’ screen. Tax Schemes too are linked to a product through this screen.Parent topic: Tax Component Groups