2.4 Multi Level Approval

This topic helps you quickly get acquainted with the Multi Level Approval process.

The Approval summary screen displays the summary tiles. The tiles displays a list of important fields with values. User must be able to drill down from summary tiles into respective data segments to verify the details of all fields under the data segment.

- Log in into OBTFPMCS application and acquire the

task available in the approval stage in free task queue. Authorization User can

acquire the task for approving.

Note:

The user can simulate/recalculate charge details and during calling the handoff, if handoff is failed with error the OBTFPMCS displays the Handoff failure error during the Approval of the task.Authorization Re-Key (Non-Online Channel)

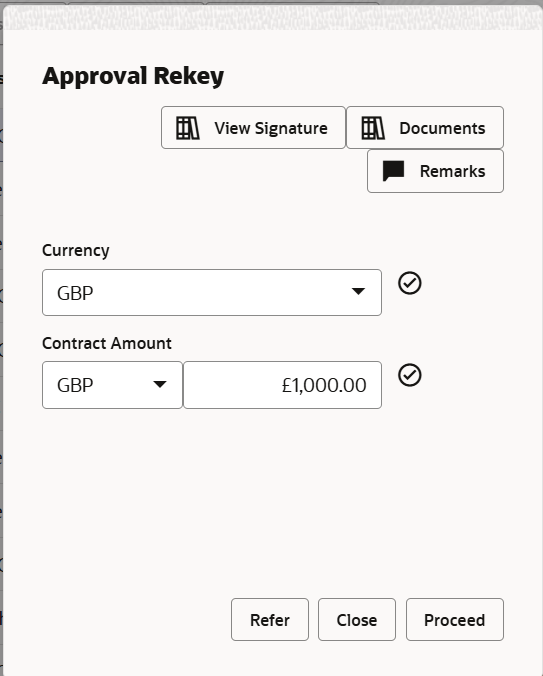

For non online channel, application will request approver for few critical field values as an authorization step. If the values captured match with the values available in the screen, system will allow user to open the transaction screens for further verification. If the re-key values are different from the values captured, then application will display an error message.

- Open the task and specify (re-key) some of the critical field values from the

request in the Re-key screen. Some of the fields below will dynamically be

available for re-key.

- Currency

- Contract Amount

Approval Summary

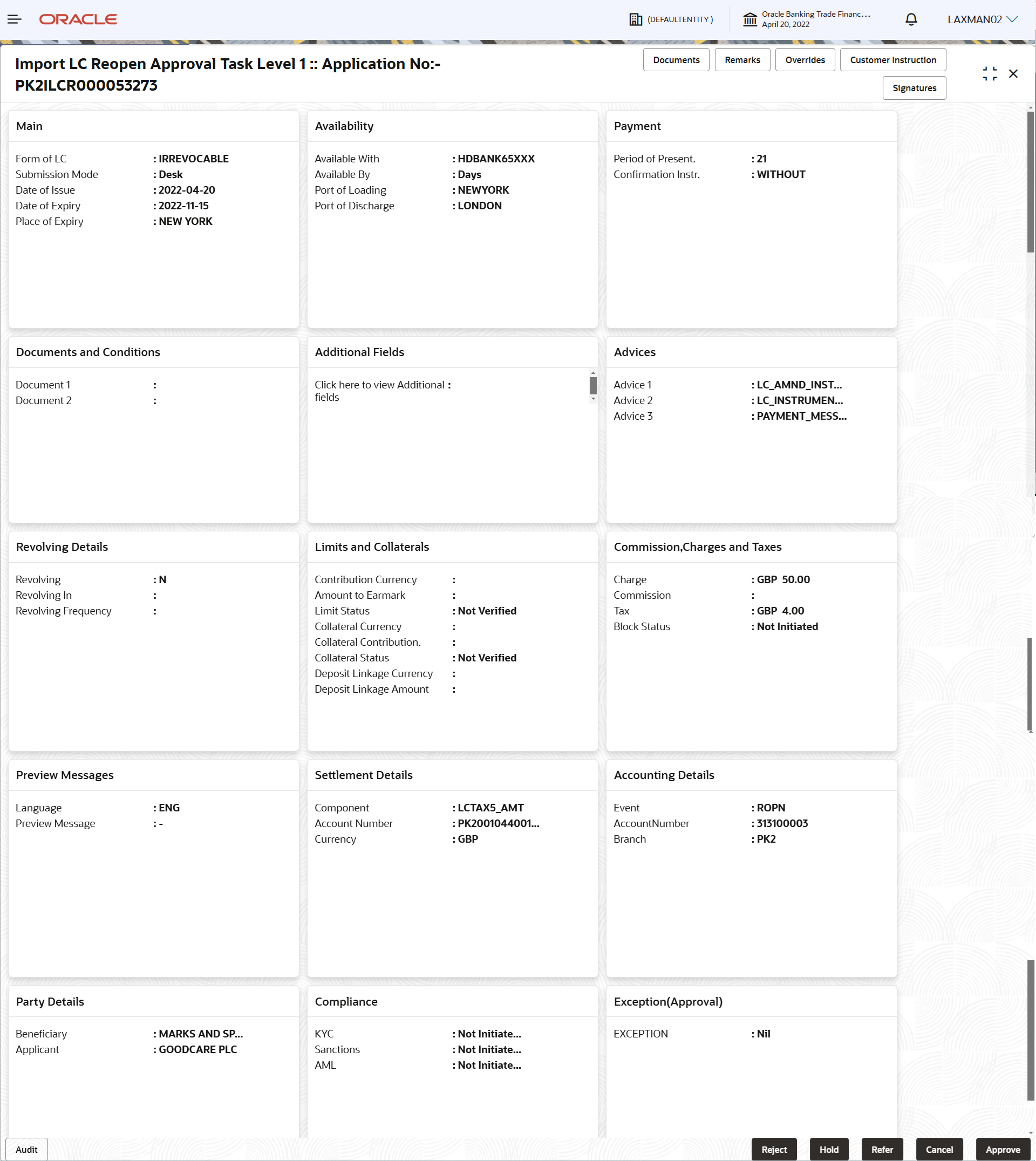

Description of the illustration approvalsummary.pngTiles Displayed in Summary:- Main - User can view the application and LC details.

- Availability - User can view already captured availability details.

- Payment: User can View all details related to payment.

- Documents and Conditions: User can to view the details of documents and conditions.

- Additional Fields - User can view the details of additional fields.

- Advices: User can view the advice details.

- Revolving Details: User can drill down into revolving details tile to see more information on revolving LC, if applicable.

- Limits and Collaterals: User can see captured details of limits and collateral.

- Commission, Charges and Taxes: User can see details provided for commission, charges and taxes.

- Preview Messages: User can see the SWIFT message and Mail Advice.

- Settlement Details - User can view the settlement details.

- Accounting Details - User can view the accounting

entries generated in back office.

Note:

When the Value Date is different from the Transaction Date for one or more accounting entries, system displays an Alert Message “Value Date is different from Transaction Date for one or more Accounting entries. - Party Details - User can view party details like applicant, advising bank etc.

- Compliance Details - User can view compliance details. The status must be verified for KYC and to be initiated for AML and Sanction Checks.

- Exception(Approval) - User can view the approval details.

Table 2-26 Multi Level Approval Details - Action Buttons - Field Description

Field Description Documents View/Upload the required document. Application displays the mandatory and optional documents.

The user can view and input/view application details simultaneously.

When a user clicks on the uploaded document, Document window get opened and on clicking the view icon of the uploaded document, Application screen should get split into two. The one side of the document allows to view and on the other side allows to input/view the details in the applicationRemarks Specify any additional information regarding the LC Reopen. This information can be viewed by other users processing the request. Content from Remarks field should be handed off to Remarks field in Backend application.

Overrides Click to view the overrides accepted by the user. Customer Instruction Click to view/ input the following - Standard Instructions – In this section, the system will populate the details of Standard Instructions maintained for the customer. User will not be able to edit this.

- Transaction Level Instructions – In this section, OBTFPMCS user can input any Customer Instructions received as part of transaction processing. This section will be enabled only for customer initiated transactions.

Signatures Click the Signature button to verify the signature of the customer/ bank if required. The user can view the Customer Number and Name of the signatory, Signature image and the applicable operation instructions if any available in the back-office system.

If more than one signature is available, system should display all the signatures.

Reject On click of Reject, user must select a Reject Reason from a list displayed by the system. Reject Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Select a Reject code and give a Reject Description.

This reject reason will be available in the remarks window throughout the process.

Hold The details provided will be saved and status will be on hold.User must update the remarks on the reason for holding the task. This option is used, if there are any pending information yet to be received from applicant.

Refer Select a Refer Reason from the values displayed by the system. Refer Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Select a Reject code and give a Reject Description.

This reject reason will be available in the remarks window throughout the process.

Cancel Cancel the Approval stage. Approve On approve, application must validate for all mandatory field values, and task must move to the next logical stage. If there are more approvers, task will move to the next approver for approval. If there are no more approvers, the transaction is handed off to the back end system for posting. - Click Approve to approve the transaction. The transaction is approved and handed off to the back end system for posting.

Parent topic: Import LC ReOpen