2.7 Multi Level Approval

This topic helps you quickly get acquainted with the Multi Level Approval process.

The Approval user can approve the Transaction.

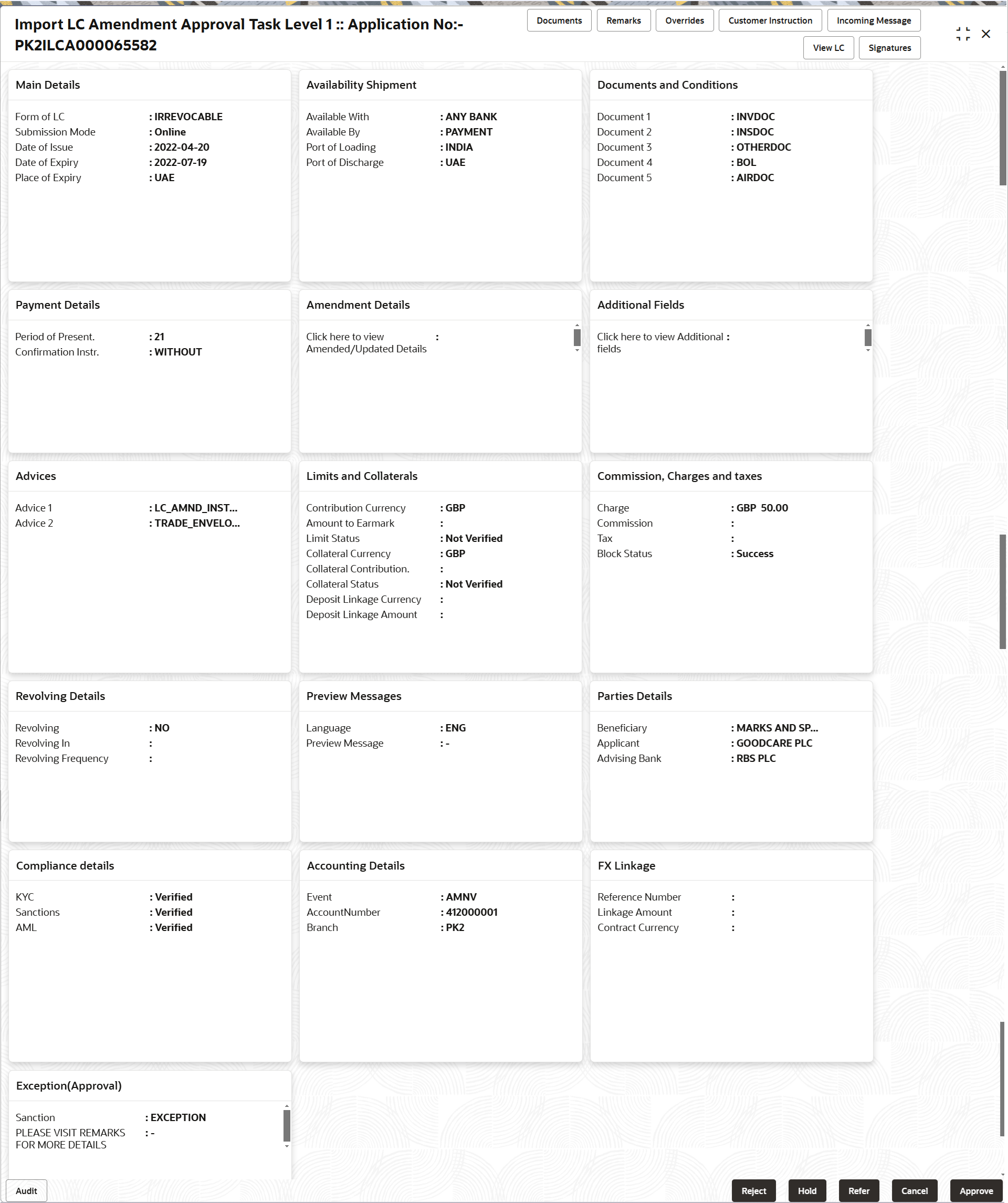

The Approval summary screen displays the summary tiles. The tiles displays a list of important fields with values. User must be able to drill down from summary Tiles into respective data segments to verify the details of all fields under the data segment.

- Log in into Oracle Banking Trade Finance Process Management Cloud Service application and acquire the task available in the approval stage in free task queue. Authorization User can acquire the task for approving.

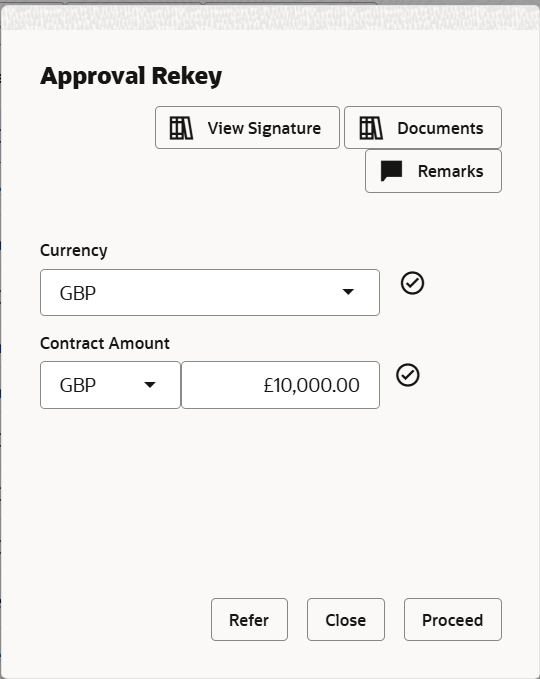

Authorization Re-Key (Non-Online Channel)

For non online channel, application will request approver for few critical field values as an authorization step. If the values captured match with the values available in the screen, system will allow user to open the transaction screens for further verification. If the re-key values are different from the values captured, then application will display an error message.

- Applicant Party

- Application Date

Figure 2-36 Authorization Re-Key

Description of the illustration approvalrekey.png

Approval Summary

- Main Details - User can view and modify details about application details and LC details, if required.

- Availability Shipment - User can view and modify availability and shipment details, if required.

- Documents and Conditions - User can view and modify the documents required grid and the additional conditions grid, if required.

- Payment Details - User can view and modify all details related to payments, if required.

- Amendment Details - User can view the amendment details of the issued LC.

- Additional Fields - User can view the details of additional fields.

- Advices - User can view the details of advices.

- Limits and Collaterals - User can view and modify limits and collateral details, if required.

- Commission and Charges and Taxes - User can view and modify commission, charge and tax details, if required.

- Revolving Details - User can view and modify revolving details on revolving LC, if applicable

- Preview Messages - User can view and modify preview details, if required.

- Parties Details - User can view and modify party details like beneficiary, advising bank etc., if required

- Compliance Details - User can view compliance details. The status must be verified for KYC and to be initiated for AML and Sanction Checks.

- FX Linkage - User can view the FX Linkage details.

- Exception (Approval) - User can view the exception (Approval) details.

- Click Approve.

Table 2-36 Approval Summary - Action Buttons - Field Description

| Field | Description |

|---|---|

| Documents | View/Upload the required

document.

Application displays the mandatory and optional documents. |

| Remarks | Specify any additional information regarding the

collection. This information can be viewed by other users processing

the request.

Content from Remarks field should be handed off to Remarks field in Backend application. |

| Checklist | Click to view the list of items that needs to be completed and acknowledge. If mandatory checklist items are not selected, system will display an error on submit.. |

| Overrides | Click to view the overrides accepted by the user. |

| Customer Instructions | Click to view/ input the following

|

| Incoming Message | This button displays the multiple messages (MT760 +

up to 7 MT761.

In case of MT798, the User can click and view the MT798 message(770,700/701). |

| View LC | Click to view the details of the LC. |

| Hold | The details provided will be saved and status will be

on hold.User must update the remarks on the reason for holding the

task.

This option is used, if there are any pending information yet to be received from applicant. |

| Reject | On click of Reject, user must select a Reject Reason

from a list displayed by the system.

Reject Codes are:

Select a Reject code and give a Reject Description. |

| Refer | Select a Refer Reason from the values displayed by

the system.

Refer Codes are:

|

| Approve | On approve, application must validate for all mandatory field values, and task must move to the next logical stage. If there are more approvers, task will move to the next approver for approval. If there are no more approvers, the transaction is handed off to the back end system for posting. |

Parent topic: Import LC Amendment