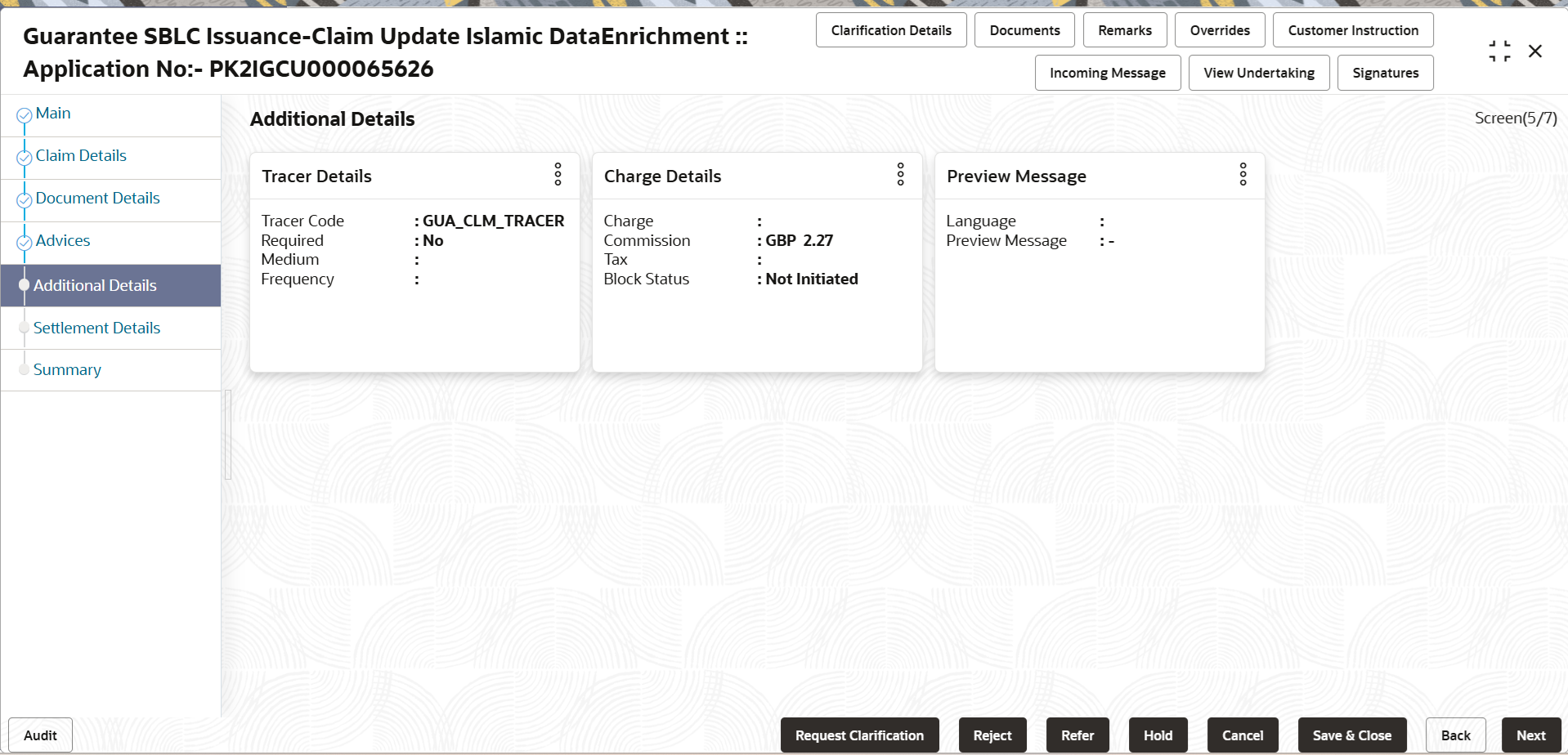

2.3.5 Additional Details

This topic provides the systematic instructions to capture the additional details in Data Enrichment stage of Guarantee SBLC Issuance Claim Update - Islamic process.

If any of the fields in the financial section of the pop up screen is checked then the limits and collaterals screen will be enabled.

- On Additional Details screen, click the 3 dots on any

Additional Details tile to view the details.

Figure 2-12 Additional Details

Description of the illustration deadditionaldetails.pngLimits and Collaterals

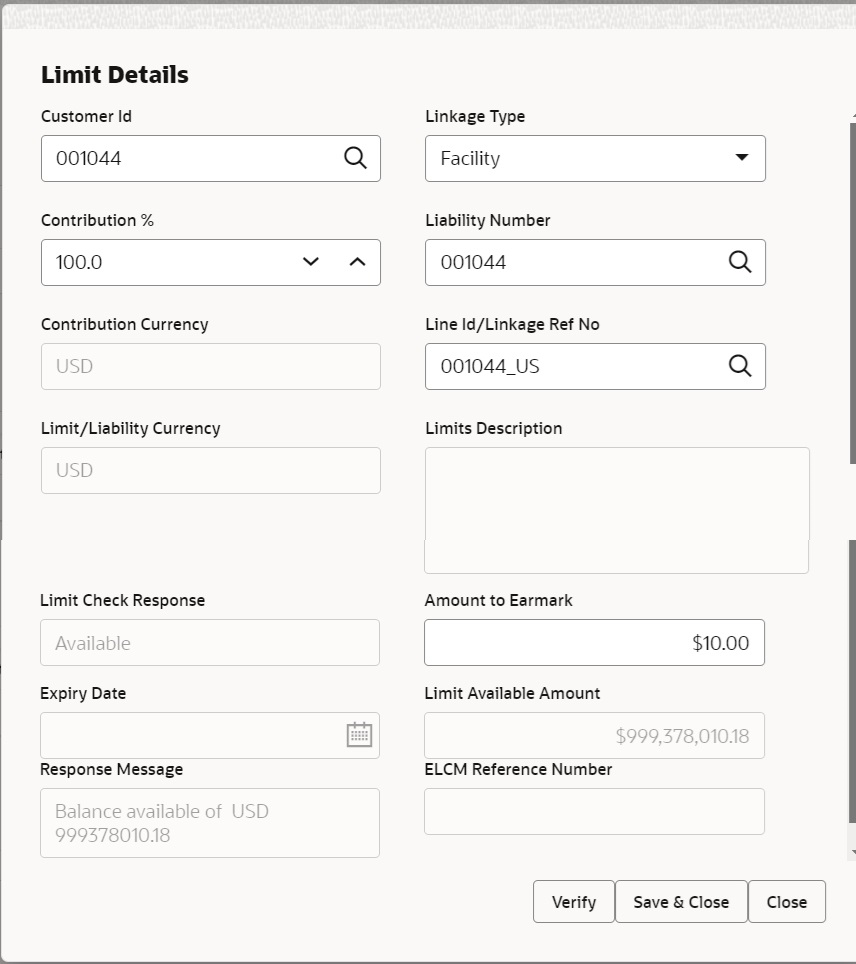

Provide the Limit Details based on the description in the following table.

Figure 2-13 Limit Details

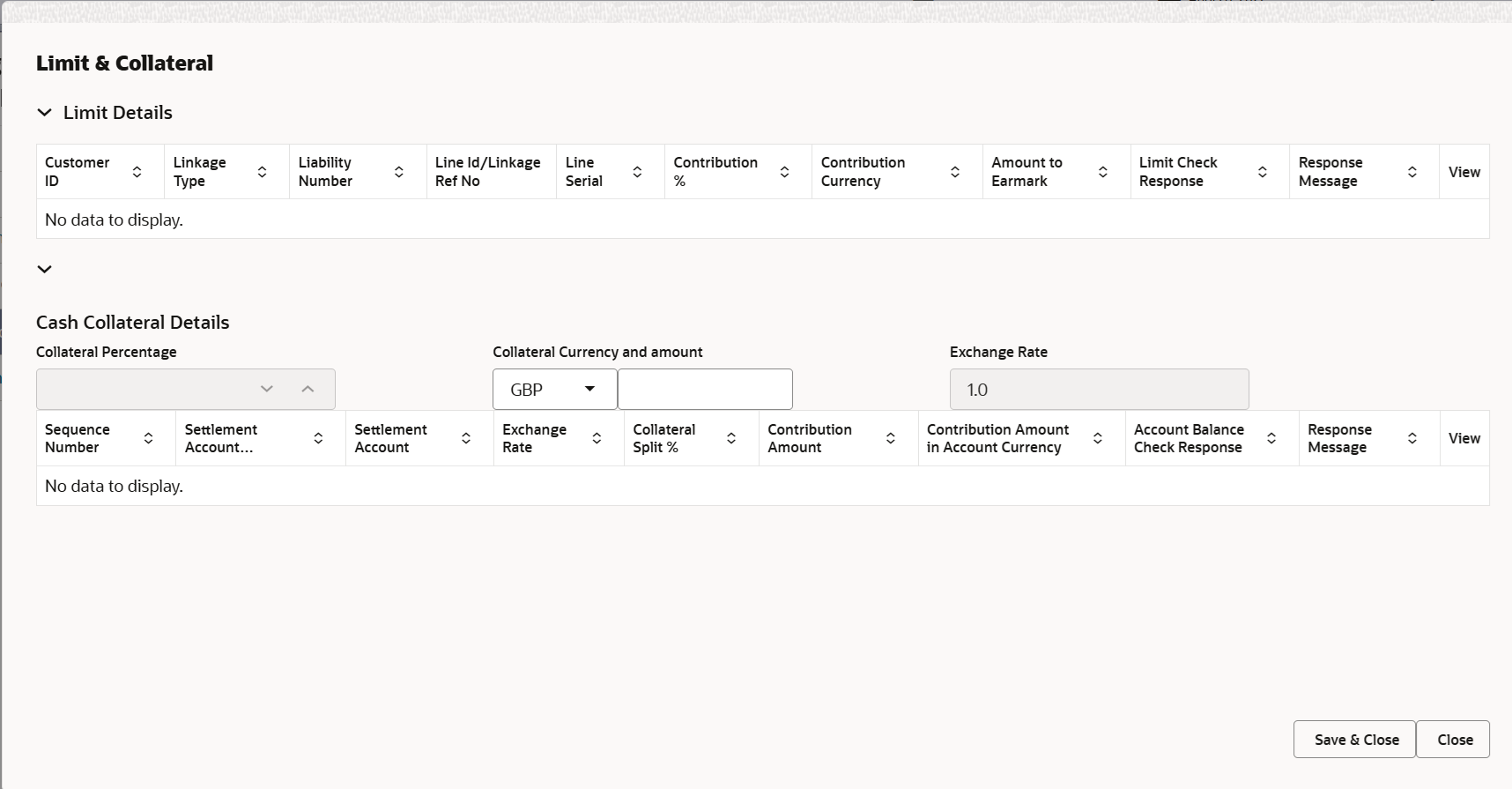

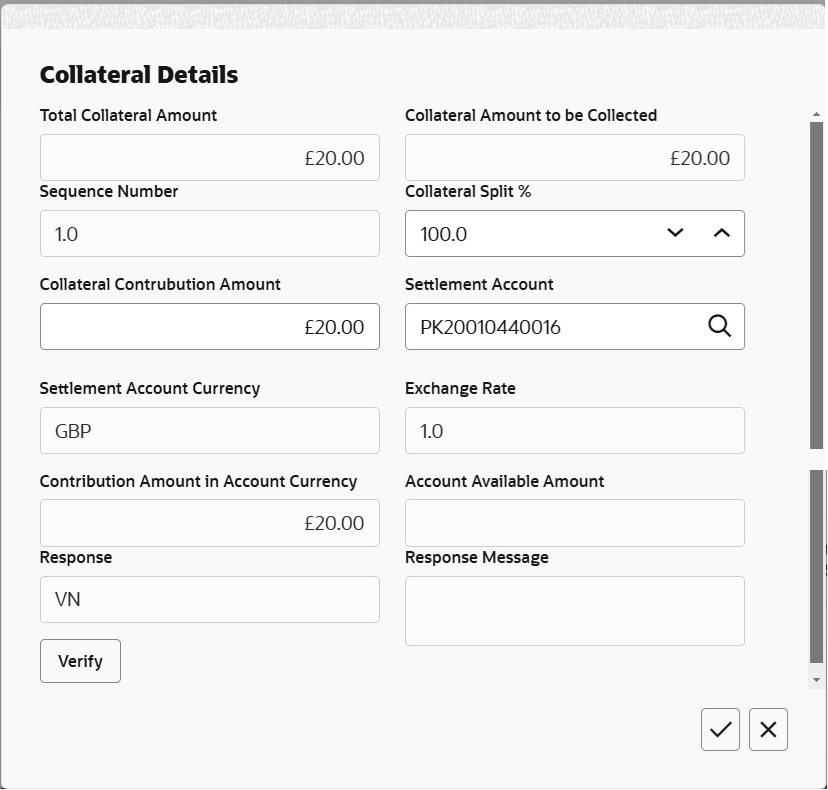

Description of the illustration delimitdetails1.pngFigure 2-14 Collateral Details

Description of the illustration decollateraldetails1.pngFor more information on fields, refer to the field description table below.

Table 2-17 Limit Details - Field Description

Field Description Limit Details Click plus icon to add new limit details. Below fields are displayed on the Limit Details pop-up screen, if the user clicks plus icon.

Edit Click edit link to edit the limit details. Click + plus icon to add new limit details.

Customer ID This field displays the applicant’s/applicant bank customer ID defaulted from the application. Linkage Type Select the linkage type. Linkage type can be:- Facility

- Liability

Contribution % System will default this to 100%. User can modify, if contribution is more than 100%. System will display an alert message, if modified. Once contribution % is provided, system will default the amount.

System to validate that if Limit Contribution% plus Collateral% is equal to 100. If the total percentage is not equal to 100 application will display an alert message.

Liability Number Click Search to search and select the Liability Number from the look-up. Contribution Currency This field displays the contribution currency. Line ID/ Linkage Ref No Click Search to search and select from the various lines available and mapped under the customer id gets listed in the drop down. LINE ID-DESCRIPTION will be available for selection along with Line ID. When you click on 'verify', the system will return value if the limit check was successful or Limit not Available. If limit check fails, the outstanding limit after the transaction value will be shown in the limit outstanding amount. Note:

User can also select expired Line ID from the lookup and on clicking the verify button, system should default “The Earmarking cannot be performed as the Line ID is Expired” in the “Response Message” field.Line Serial Displays the serial of the various lines available and mapped under the customer id. This field appears on the Limits grid.

Limit/ Liability Currency This field displays the limit currency. Limit Currency will be defaulted in this field, when you select the Liability Number.

Limits Description This field displays the limits description. Limit Check Response This field displays the limit check response. Response can be ‘Success’ or ‘Limit not Available’ based on the limit service call response.

Amount to Earmark Amount to earmark will default based on the contribution %. User can change the value.

Expiry Date This field displays the date up to which the Line is valid. Limit Available Amount This field displays the value of available limit, i.e., limit available without any earmark. The Limit Available Amount must be greater than the Contribution Amount. The value in this field appears, if you click the Verify button.

Response Message This field displays the detailed response message. The value in this field appears, if you click the Verify button.

ELCM Reference Number This field displays the ELCM reference number. Cash Collateral Details Collateral Percentage System populates the Collateral % maintained in the Customer / Product for the counter party of the contract. User can modify the collateral percentage.

Collateral Currency and amount System populates the contract currency as collateral currency by default. User can modify the collateral Currency and amount.

Exchange Rate System populates the exchange rate maintained. User can modify the collateral Currency and amount.

System validates for the Override Limit and the Stop limit if defaulted exchange rate is modified.

Click + plus icon to add new collateral details. Below fields are displayed on the Cash Collateral Details pop-up screen, if the user clicks plus icon.

Total Collateral Amount Read only field. This field displays the total collateral amount provided by the user.

Collateral Amount to be Collected Read only field. This field displays the collateral amount yet to be collected as part of the collateral split.

Sequence Number Read only field. The sequence number is auto populated with the value, generated by the system.

Collateral Split % Specify the collateral split% to be collected against the selected settlement account.

Collateral Contribution Amount Collateral contribution amount will get defaulted in this field. The collateral % maintained for the customer is defaulted into the Collateral Details screen. If collateral % is not maintained for the customer, then system should default the collateral % maintained for the product. User can modify the defaulted collateral percentage, in which case system should display a override message “Defaulted Collateral Percentage modified.

Settlement Account Click Search to search and select the settlement account for the collateral. Settlement Account Currency Read only field. This field displays the settlement account currency and will be auto-populated based on the Settlement Account selection.

Exchange Rate Read only field. This field displays the exchange rate, if the settlement account currency is different from the collateral currency.

Contribution Amount in Account Currency Read only field. This field displays the contribution amount in the settlement account currency as defaulted by the system.

Account Available Amount Read only field. System populates the account available amount on clicking the Verify button.

Response Read only field. System populates the response on clicking the Verify button.

Response Message Read only field. System populates the response message on clicking the Verify button.

Verify Click to verify the account balance of the Settlement Account. Save & Close Click to to save and close the record. Cancel Click to cancel the entry. Below fields appear in the Cash Collateral Details grid along with the above fields. Collateral % Specify the percentage of collateral to be linked to this transaction. If the value is more than 100% system will display an alert message. The collateral % maintained for the customer is defaulted into the Collateral Details screen. If collateral % is not maintained for the customer, then system should default the collateral % maintained for the product.

User can modify the defaulted collateral percentage, in which case system should display a override message “Defaulted Collateral Percentage modified.

Contribution Amount This field displays the collateral contribution amount. The collateral % maintained for the customer is defaulted into the Collateral Details screen. If collateral % is not maintained for the customer, then system should default the collateral % maintained for the product. User can modify the defaulted collateral percentage, in which case system should display a override message “Defaulted Collateral Percentage modified.

Account Balance Check Response This field displays the account balance check response. Edit Click edit link to edit the collateral details. - Click Save and Close to save the details and close the

screen.

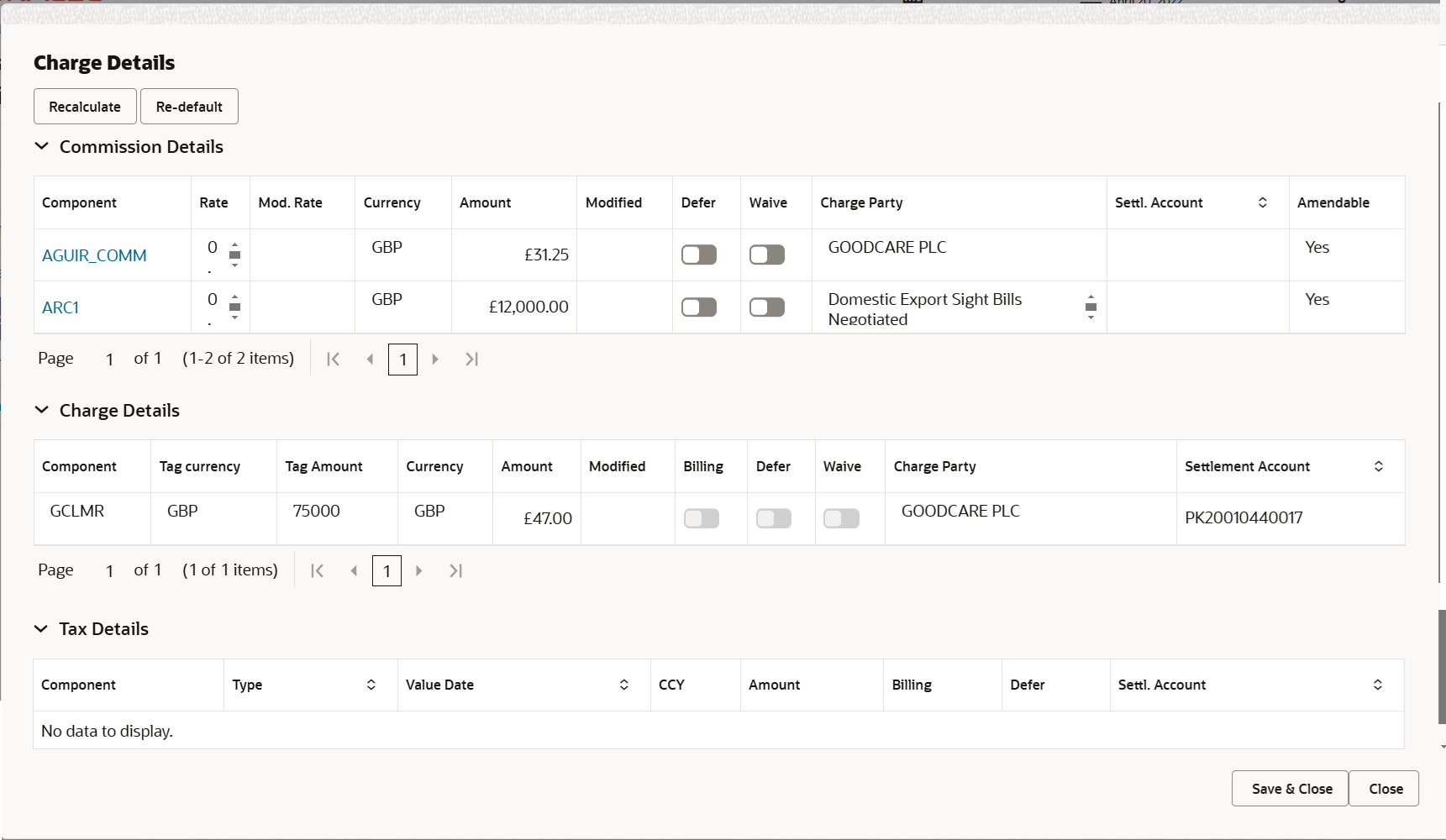

Charge Details

This section displays charge details. On landing the additional tab, charges and tax if any will get defaulted from Back end simulation. If default charges are available under the product, they should be defaulted here with values. If customer or customer group specific charges are maintained, then the same will be defaulted from back end system.

Description of the illustration dechargedetails.png

For more information on fields, refer to the field description table below.

Table 2-18 Charge Details - Field Description

Field Description Commission Details This section displays the commission details.

Component This field displays the commission component. Rate This field displays the rate that is defaulted from product. The commission rate, if available in Back Office defaults in OBTFPMCS. The user is able to change the rate.

If flat commission is applicable, then commission amount defaulted from back office is modifiable by the user. Rate field will be blank and the user cannot modify the Rate field.

Mod. Rate From the default value, if the rate is changed the value gets updated in this field. Currency This field displays the currency in which the commission have to be collected. Amount This field displays the amount that is maintained under the product code. The commission rate, if available in Back Office defaults in OBTFPMCS. The user is able to change the rate, but not the commission amount directly. The amount gets modified based on the rate changed and the new amount is calculated in back office based on the new rate and is populated in OBTFPMCS.

If flat commission is applicable, then commission amount defaulted from back office is modifiable by the user. Rate field will be blank and the user cannot modify the Rate field.

Modified From the default value, if the amount is changed, the value gets updated in the modified amount field. Defer If enabled, charges/commissions has to be deferred and collected at any future step. Waive Based on the customer maintenance, the charges/commission can be marked for Billing or Defer. If the defaulted Commission is changed to defer or billing or waive, system must capture the user details and the modification details in the ‘Remarks’ place holder.

Charge Party Charge party is 'Applicant' by default. User can change the value to Beneficiary. Settl. Accnt Select the settlement account. Amendable The value is auto-populated as the commission is amendable or not. Charge Details This section displays the charge details.

Component This field displays the charge component type. Tag Currency This field displays the tag currency in which the charges have to be collected. Tag Amount This field displays the tag amount that is maintained under the product code. Currency This field displays the currency in which the charges have to be collected. Amount This field displays the amount that is maintained under the product code. Modified From the default value, if the rate is changed or the amount is changed, the value gets updated in the modified amount field. Billing If charges are handled by separate billing engine, then by selecting billing the details to be available for billing engine for further processing. On simulation of charges/commission from Back Office, if any of the Charges/Commission component for the customer is ‘Billing’ enabled, ‘Billing’ toggle for that component should be automatically enabled in OBTFPMCS.

The user can not enable/disable the option, if it is de-selected by default.

This field is disabled, if ‘Defer’ toggle is enabled.

Defer If charges have to be deferred and collected at any future step, this check box has to be selected. On simulation of charges/commission from Back Office, if any of the Charges/Commission component for the customer is AR-AP tracking enabled, ‘Defer’ toggle for that component should be automatically checked in OBTFPMCS.

The user can enable/disable the option the check box. On de-selection the user has to click on ‘Recalculate’ charges button for re-simulation.

Waive Enble the toggle, if charges has to be waived. Based on the customer maintenance, the charges should be marked for Billing or for Defer.

This field is disabled, if Defer toggle is enabled.

Charge Party Charge party is applicant by default. User can change the value to beneficiary. Settlement Account Select the settlement account. Tax Details The tax component is calculated based on the commission and defaults if maintained at product level. User cannot update tax details and any change in tax amount on account of modification of charges/ commission will be available on click of Re-Calculate button or on hand off to back-end system.

Component This field displays the tax component. Type This field displays the type of tax component. Value Date This field displays the value date of tax component. Currency This field displays the currency in which the tax have to be collected. The tax currency is the same as the commission.

Amount This field displays the tax amount based on the percentage of commission maintained. You can edit the tax amount, if applicable.

Billing If taxes are handled by separate billing engine, then by selecting billing the details to be available for billing engine for further processing. This field is disabled, if ‘Defer’ toggle is enabled.

Defer If taxes have to be deferred and collected at any future step, this option has to be enabled. The user can enable/disable the option the check box. On de-selection the user has to click on ‘Recalculate’ charges button for re-simulation.

Settl. Accnt System defaults the settlement account. The user can modify the settlement account.

- Click Save and Close to save the details and close the

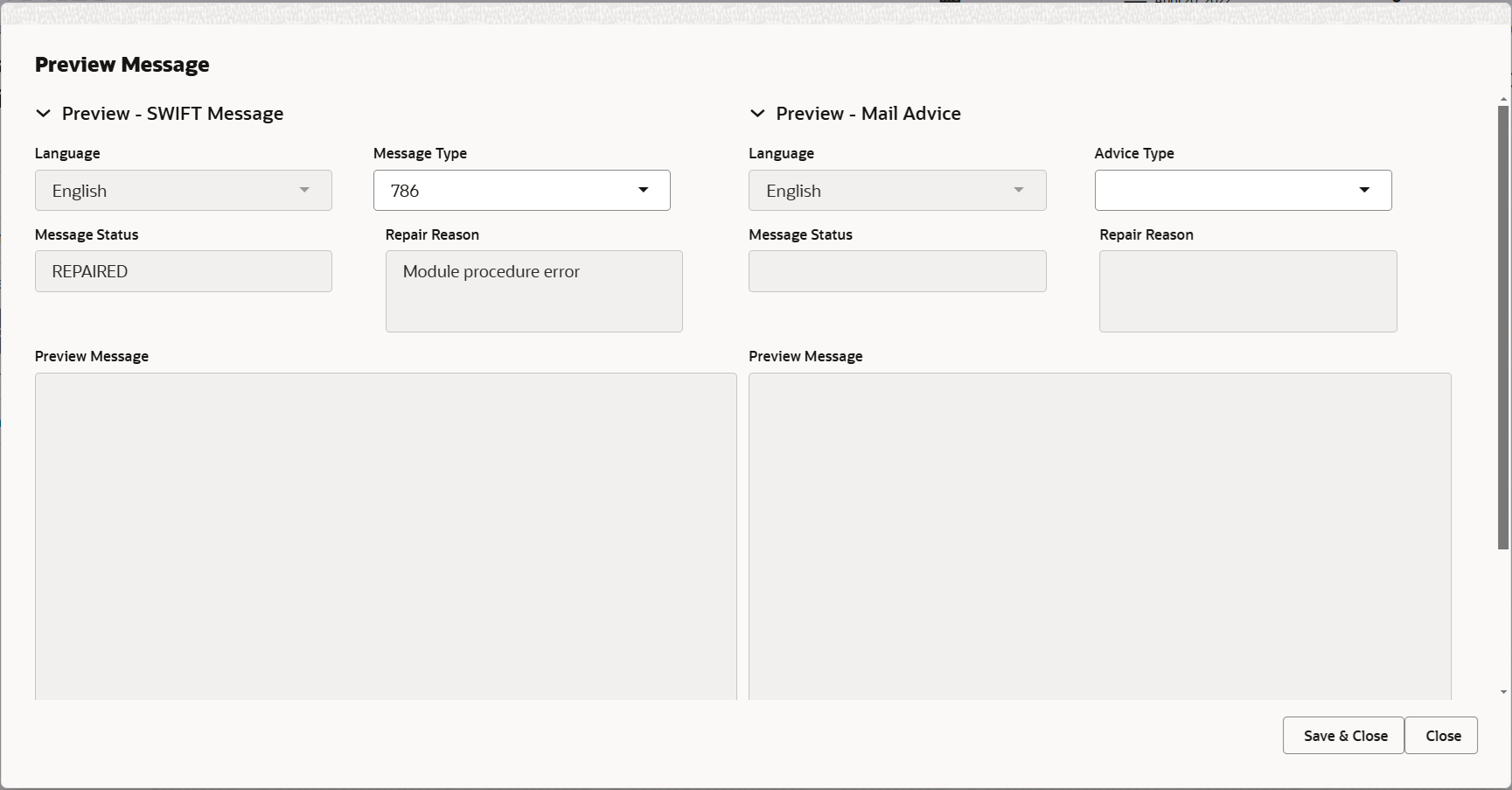

screen.Preview Mesage

The bank user can view a preview of the message and advice simulated from back office which is based on the guarantee Claim captured in the previous screen.

For more information on fields, refer to the field description table below.

Table 2-19 Preview Message - Field Description

Field Description Preview SWIFT Message Language Read only field. The language to preview the draft guarantee details.

English is set as default language for the preview.

Message Type Select the message type from the drop down. Message Status Read only field. Display the message status of draft message of guarantee details.

Repair Reason Read only field. Display the message repair reason of draft message of guarantee details.

Preview Message This field displays a preview of the draft message. Based on the guarantee text captured in the previous screen, guarantee draft is generated in the back office and is displayed in this screen.

Preview Mail Device Language Read only field. The language for the advice message.

English is set as default language for the preview.

Advice Type Select the advice type. Message Status Read only field. Display the message status of draft message of guarantee details.

Repair Reason Read only field. Display the message repair reason of draft message of guarantee details.

Preview Message This field displays a preview of advice. - Click Save and Close to save the details and close the

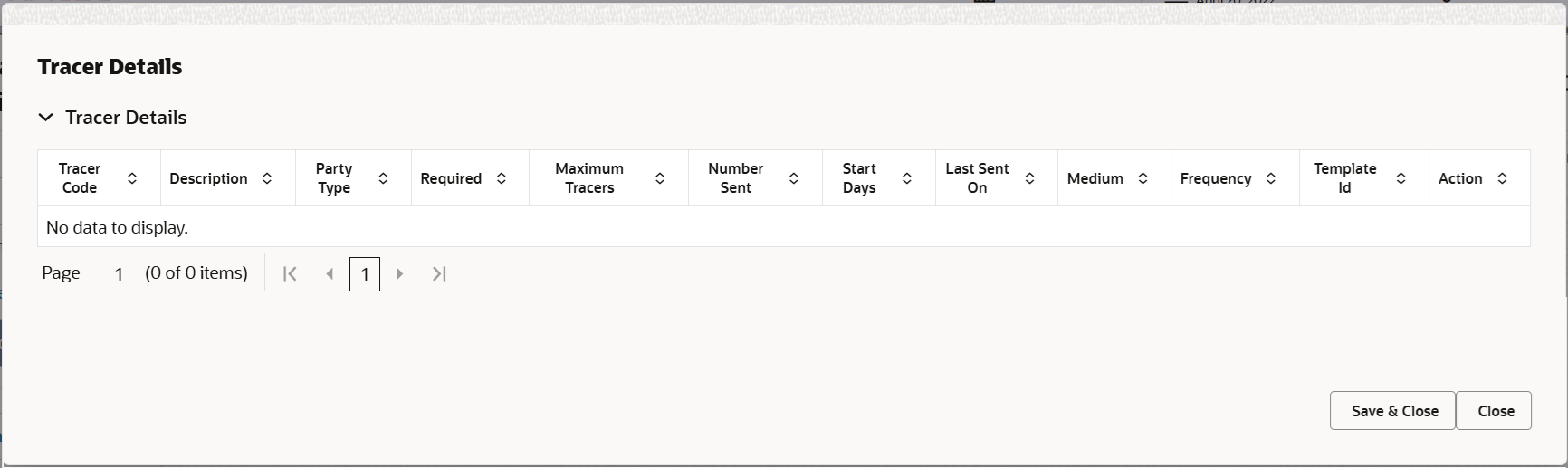

screen.Tracer Details

The bank users can capture these tracer details for Claim Lodgement in Guarantee and send the tracers to the customer till its Settled / Extended / Rejected / Injunction.

Description of the illustration detracerdetails.pngFor more information on fields, refer to the field description table below.

Table 2-20 Tracer Details - Field Description

Field Description Tracer Code Read only field. Tracer code is defaulted by the system maintained in the Product level.

Description Read only field. Description of the tracer code is auto populated.

Party Type Specify the party type or click Search to search and select the receiver party type from the lookup. Required Enable the option, if tracer is required. - Toggle On: Required

- Toggle Off: Not required.

Maximum Tracers Specify the value for maximum number of tracers to be sent. Maximum allowed is 99 exceeding the same system should prompt an error message for the same “Maximum number of numerals allowed is: 2” and should clear the field to enter the correct value by the user.

Maximum Tracers cannot be less than the “Number Sent”, system needs to validate the same.

Number Sent Number Sent is defaulted by the System with the value, where the number of tracers sent so far. And it cannot be greater than the “Maximum Tracers”. Start Days Specify the number of days after which the tracer has to be sent from the Tracer Start date. It should be positive numeric value. Last Sent On Read only field. Tracer last sent date is defaulted by the system.

Medium Select the the medium in which the Tracer has to be generated. It lists all the possible mediums maintained in the system. The options are:

- SWIFT

Frequency Specify the medium in which the Tracer has to be generated. It should be positive numeric value. System should default the Frequency captured as part of the Contract here and should allow the user to modify the same.

Template ID Click Search to search and select the template ID, in which the tracer has to be generated from the lookup. It is a lookup which lists all the possible templates maintained in the system.

Template ID is nothing but the data that goes in Tag 79 in MT799.

This template ID is applicable only for medium 'SWIFT' Template lookup displays all the template ids applicable for the given Tracer Code.

Action Click Edit icon to edit the tracer details. - Click Save and Close to save the details and close the screen.

- Click Next.The task will move to next data segment. For more information refer Settlement Details.

For more information on action buttons, refer to the field description table below.

Table 2-21 Additional Details - Action Buttons - Field Description

Field Description Clarification Details Clicking the button opens a detailed screen, user can see the clarification details in the window and the status will be ‘Clarification Requested’. Documents Click to View/Upload the required document. Application displays the mandatory and optional documents.

The user can view and input/view application details simultaneously.

When a user clicks on the uploaded document, Document window get opened and on clicking the view icon of the uploaded document, Application screen should get split into two. The one side of the document allows to view and on the other side allows to input/view the details in the applicationRemarks Specify any additional information regarding the Guarantee Issuance Claim Update - Islamic. This information can be viewed by other users processing the request. Content from Remarks field should be handed off to Remarks field in Backend application.

Overrides Click to view the overrides accepted by the user. Customer Instruction Click to view/ input the following - Standard Instructions – In this section, the system will populate the details of Standard Instructions maintained for the customer. User will not be able to edit this.

- Transaction Level Instructions – In this section, OBTFPMCS user can input any Customer Instructions received as part of transaction processing. This section will be enabled only for customer initiated transactions.

Incoming Message Clicking this button allows the user should be able to see the message in case of STP of incoming MT 767. In case of MT798-MT726-MT759 request, user can view MT798 message(726-759) in this placeholder in Header of the task.

In case of MT798_MT788-MT799 request, user can view MT798 message (788-799) in this placeholder in Header of the process-task.

View Undertaking Clicking this button allows the user to view the undertaking details. Signatures Click the Signature button to verify the signature of the customer/ bank if required. The user can view the Customer Number and Name of the signatory, Signature image and the applicable operation instructions if any available in the back-office system.

If more than one signature is required, system should display all the signatures

Request Clarification Clicking this button allows the user to submit the request for clarification to the “Trade Finance Portal” for the transactions that are initiated offline. Reject On click of Reject, user must select a Reject Reason from a list displayed by the system. Reject Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Select a Reject code and give a Reject Description.

This reject reason will be available in the remarks window throughout the process.

Refer Select a Refer Reason from the values displayed by the system. Refer Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Hold The details provided will be saved and status will be on hold. User must update the remarks on the reason for holding the task. This option is used, if there are any pending information yet to be received from applicant.

Cancel Cancel the Data Enrichment stage inputs. The details updated in this stage are not saved. The task will be available in 'My Task' queue. Save & Close Save the details provided and holds the task in ‘My Task’ queue for further update. This option will not submit the request. Back Clicking on Back button, takes the user to the previous screen. Next On click of Next, system validates if all the mandatory fields have been captured. Necessary error and override messages to be displayed. On successful validation, system moves the task to the next data segment.

Parent topic: Data Enrichment