1.6.6 For Floating Rate Products

For Floating Rate products, you should specify the Minimum and Maximum spread that can be applied on the floating rate.

If the spread specified during contract processing is less than the value specified as the minimum spread, this value will be picked up as the spread. Similarly, if the spread specified during contract processing is more than the value specified as maximum spread, this value will be picked up as the spread.

Note:

If you specify a rate/spread that does not fall within the limits maintained, the system will display an override message.In the Default Spread field, you are allowed to specify both positive and negative spread as

default for the product you are maintaining. The system validates this spread against the

minimum and maximum spread you have specified for the currency. Subsequently, the

spread will be defaulted to the contract.

This field is specific to Deposits. Based on the Pre Payment Method chosen at the product level, the penalty rate is derived. The derived penalty rate defaults in to the Payment Input screen and you can choose to change it there.

The prepayment rate will be treated as spread if you have chosen prepayment method as Banking Trade Finance i.e. the prepayment rate is subtracted from the contract interest rate.

The day count for which penalty needs to be calculated is the number of days the deposit has run.

Note:

The Amount Tag MAININT_ADJ should be picked up while you define the accounting entries for the Penalty Amount, at the product level

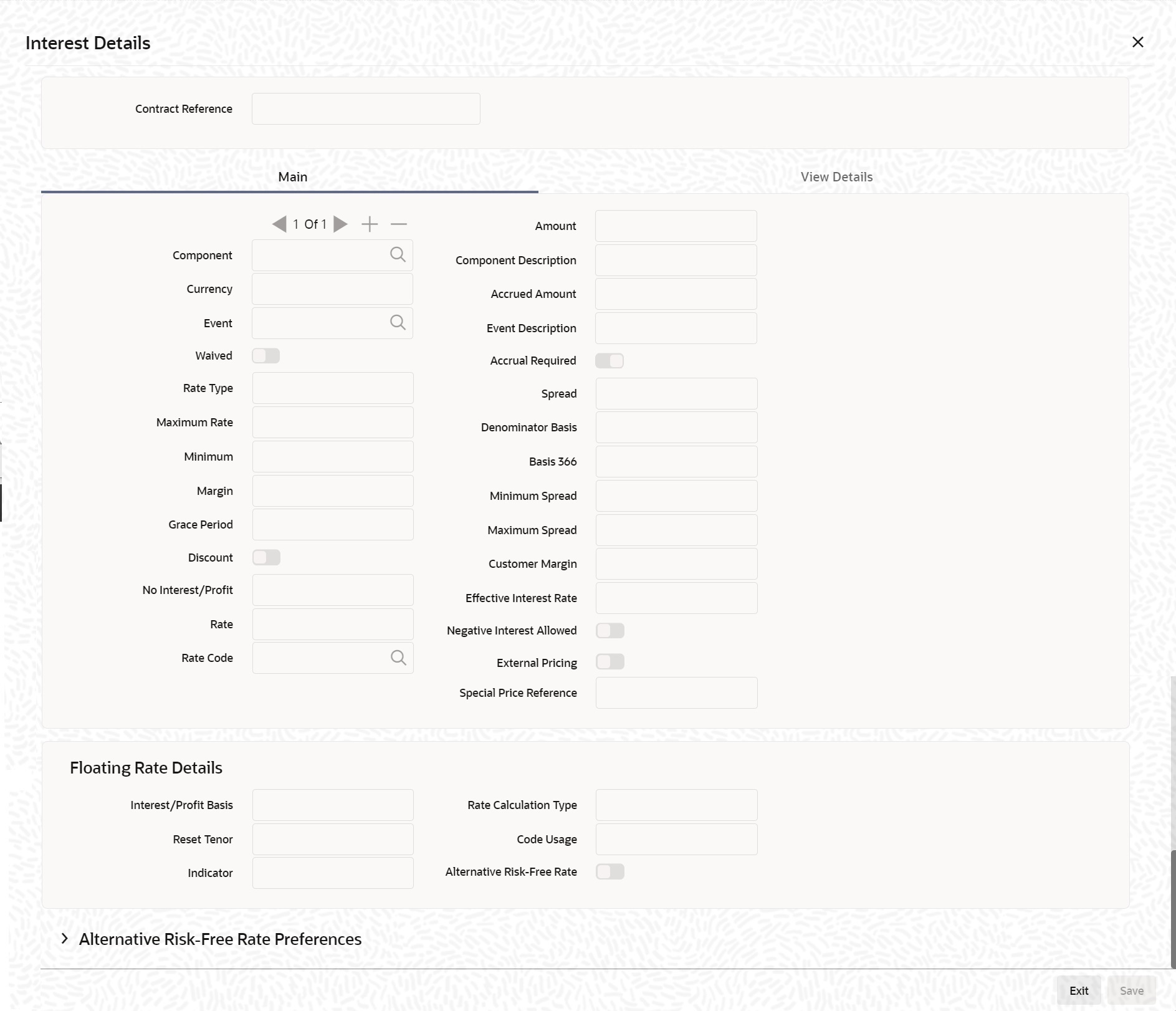

When the details of a contract are captured, the interest details defined for the product involved will automatically be applied on the contract. However, you can change certain attributes.

- The rate for contracts with a fixed rate

- The rate code for contracts with floating rate. The spread defined for a rate code can also be changed.

It is possible to define more than one interest rule. You can have several interest rules, which you link to a product. The contract involving the product, in turn, will be linked to these interest rules.

For example, there can be one interest rule for the main interest (for example, 14%). You can have a tenor-based commission defined as an interest rule for the same product (for example, 3%). Both these will be applicable to the contract.

In the Contract ICCB Screen use the set of arrow buttons to go to the next or previous or the first or last rule that has been linked.

Table 1-7 Interest Details - Field Description

| Field | Description |

|---|---|

| Contract Reference Number | The reference number of the contract you are processing. |

| Event | The event is to which the component should be applied together with its description. |

| Component | The component for which you are entering details together with its description. |

| Currency | The settlement currency which is defined in the Interest Class screen will be displayed in this field. This is a display only field. |

Parent topic: Interest Details for the Product