1.9.1 Maintain Customer Spreads

This topic describes the systematic instructions to maintain customer spreads.

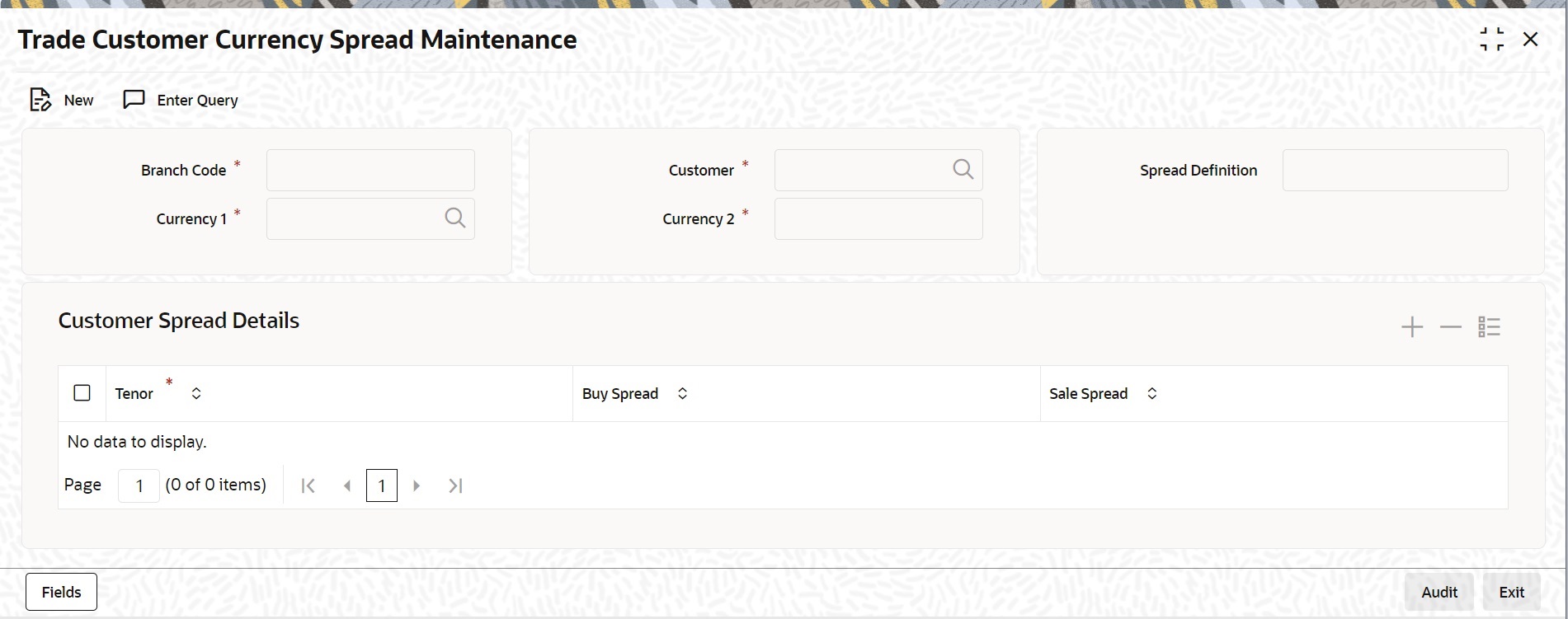

- On Homescreen, specify CYDTFCSP in the text box, and click next

arrow.Trade Customer Currency Spread Maintenance screen is displayed.

Figure 1-11 Trade Customer Currency Spread Maintenance

Description of "Figure 1-11 Trade Customer Currency Spread Maintenance" - On Trade Customer Currency Spread Maintenance screen,

specify the fields. In this screen, for a customer and currency pair, you can

maintain buy and sell spreads for different tenors. You need to maintain

customer spreads in each branch. Transactions initiated in a branch will pick up

the spread(s) maintained for that branch.

Note:

Funds Transfer, Loans and Deposit contracts have tenor = 0 (zero). Therefore, you need to maintain Customer Spreads for zero tenor also.The tenor is specified in daysTable 1-11 Trade Customer Currency Spread Maintenance - Field Description

Field Description Branch Code Specify the field Currency Code 1, 2 Specify the field. The field is mandatory Spread Definition Specify the field. Specify Spread Details When processing an FX deal involving a customer (for whom you have maintained spread details), the system picks up the customer spread corresponding to the tenor of the deal and builds it into the exchange rate. If spread details are unavailable for a specific tenor, the system picks up the spread defined for the nearest lower tenor. For example, assume for a customer and currency pair you maintain spread details for the following tenors: ‘3’, ‘5’, and ‘10’ days. When processing a deal with a tenor of ‘4’ days (involving the customer and the currency pair), the system picks up the spread details defined for a tenor of three days. This is because spread details for a ‘4’ day tenor is unavailable for the customer and currency pair. Note:

You can also maintain customer spreads for the wildcard entry – ALL. If spread details for a specific counterparty (for the currency pair) are unavailable, the System looks for the customer spread maintained for the wildcard ALL entry. If even that is not available, then the customer spread defaults to zero.Computing Buy and Sell Spreads Using percentage system -- suppose the bank wants to make a profit of 5% over and above the mid rate quoted. Suppose the dealing currencies are USD and AUD. 1USD = 1.4166 AUD for Standard rate type. (Mid rate being 1.4166). Now to arrive at the spread the bank will use the following formula Spread = 5 / 100 x Mid rate (1.4166) = 0.07083

Using the points system -- suppose the point quoted by the bank is 708.3.

The points multiplier in this case would be 0.0001 (depends on the decimal points that the mid rate extends to. Usually it is 4 decimal places).

Spread = Points (708.3) x Points Multiplier (0.0001)

Now coming to the buy and sale rate computing, there are two ways of computing the buy and sale rates -- Direct and Indirect. Depending upon the quotation method you have specified in the Currency pair screen, the system computes the spreads.

In the Direct method, the buy and sell rates are calculated as follows:

Buy Rate = Mid-Rate - Buy Spread

Sell Rate = Mid-Rate + Sell Spread

For cross currency contracts, the rate for the currency pair is:

1 unit of Ccy 1 = Rate * 1 unit of Ccy 2

In the Indirect method, the buy and sell rates are calculated as follows:

Buy Rate = Mid-Rate + Buy Spread

Sell Rate = Mid-Rate - Sell Spread

For cross currency contracts, the rate for the currency pair is:

1 unit of Ccy 2 = Rate * 1 unit of Ccy 2

The method of spread definition – percentage or points – that you have maintained for the currency pair is displayed on this screen.

Parent topic: Maintain Parameters for Integrated Liquidity Management