2.3.2 Claim Details

This topic provides the systematic instructions to capture the additional details in Data Enrichment stage of Lodge Claim Guarantee Advised process.

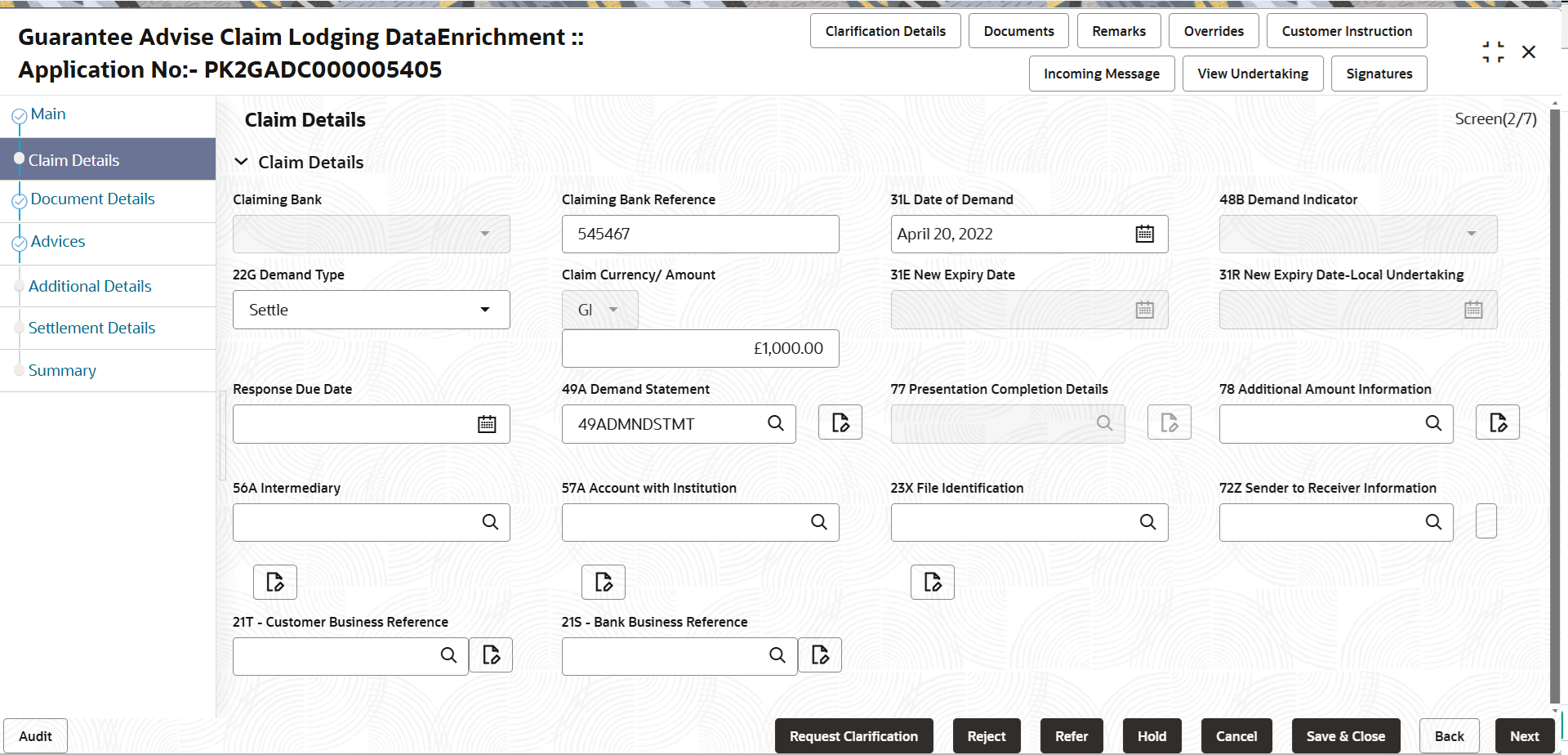

- On Claim Details screen, specify the fields.

Figure 2-9 Claim Details

Description of the illustration declaimdetails.pngFor more information on fields, refer to the field description table below.

Table 2-10 Claim Details - Field Description

Field Description Claiming Bank Select the Claiming Party from whom the claim under the Bank Guarantee issued is received while lodging the Guarantee Claim. The options are:

- Advising Bank

- Others

Claiming Bank Name & Address This field is read only and displays the claiming bank details, if Advising Bank option is selected in Claiming Bank field. Click the Search icon to search and select the claiming bank customer id from the look-up, if it is a customer of the bank and if not select the WALKIN id and manually capture Bank name and address.

This field is editable if Others option is selected in Claiming Bank field.

This field is disabled for beneficiary.

This field is mandatory if Claiming Bank field has values.

Claiming Bank Reference Specify the claiming bank reference details, if the claimed is not received from Beneficiary. This field is disabled for beneficiary.

In case of SWIFT MT 765, system populates the Tag 20, Transaction Reference Number from the incoming MT 765.

This field is mandatory if Claiming Bank field has values.

Date of Demand Specify the date on which the demand is issued by the beneficiary. Note:

The date cannot be a future date.In case of STP of Incoming MT 765, the System to populate the value in tag 31L, Date of Demand from incoming MT 765.

Demand Indicator Read Only field. System defaults value from Guarantee /SBLC Advise.

Demand Type The demand type is defaulted by the system. The values are: - Extend or Settle

- Settle

The user can change the value.

In case of STP of Incoming MT 765, the demand type is defaulted from the incoming MT 765 message.

Claim Currency/ Amount The claim amount is defaulted by the system. The user can change the value. New Expiry Date System defaults value from Guarantee /SBLC Advise. Specify the new expiry date, if Demand Type field is Extend or Settle.

The New Expiry Date is not earlier than the Expiry Date or not earlier than Branch Date.

In case of SWIFT MT 765, system populates the Tag 31E, Transaction Reference Number from the incoming MT 765.

New Expiry Date-Local Undertaking System defaults value from Guarantee /SBLC Advise. Specify the new expiry date, if Demand Type field is Extend or Settle.

Response Due Date System defaults value from Guarantee /SBLC Advise, if Demand Type field is Settle. The user can change the value. Specify the response due date, if Demand Type field is Extend or Settle

Demand Statement This field specifies the narrative text that constitutes the demand. In case of STP of Incoming MT 765, this field is defaulted from the incoming MT 765 message. In case of Non-Online, User can specify the value as per claim.

Presentation Completion Details Specify the presentation of completion details, if demand statement is provided. This field specifies information about the presentation documentation. If the presentation is incomplete, this must specify how the presentation will be completed. In case of Online, this field is defaulted from the incoming message.

In case of Non-Online, as per the value in the incoming message.

In case of SWIFT MT 765, system populates the Tag 77, Transaction Reference Number from the incoming MT 765

Additional Amount Information System defaults value from Guarantee /SBLC Advise. The user can change the value.

In case of Online, this field is defaulted from the incoming message

In case of Non-Online, User can input the value as per claim.

In case of STP of Incoming MT 765, this field is defaulted from the incoming MT 765 message.

Intermediary Specify the Intermediary bank details or click Search to search and select the Intermediary bank details from the look-up. This field specifies the financial institution through which the amount claimed must pass to reach the account with institution.

In case of Online, this field is defaulted from the incoming message.

In case of Non-Online, as per the value in the incoming message.

In case of SWIFT MT 765, system populates the Tag 56A, Transaction Reference Number from the incoming MT 765

Account with Institution Specify the details of Account with Institution or click Search to search and select the Account with Institution from the look-up. This field specifies the financial institution at which the amount claimed is to be settled.

In case of Online, this field is defaulted from the incoming message.

In case of Non-Online, as per the value in the incoming message.

In case of SWIFT MT 765, system populates the Tag 57A, Transaction Reference Number from the incoming MT 765.

Sender to Receiver Information Specify the details of sender to receiver Information or click Search to search and select the Sender to Receiver Information from the look-up. In case of Online, this field is defaulted from the incoming message.

In case of Non-Online, as per the value in the incoming message.

In case of SWIFT MT 765, system populates the Tag 72Z, Transaction Reference Number from the incoming MT 765.

Customer Business Reference Specify the Customer Business Reference details or click Search to search and select the Customer Business Reference from the look-up. Bank Business Reference Specify the Bank Business Reference details or click Search to search and select the Bank Business Reference from the look-up. - Click Next.The task will move to next data segment.

For more information on the action buttons, refer to the field description table below.

Table 2-11 Action Buttons - Field Description

Field Description Clarification Details Clicking the button opens a detailed screen, user can see the clarification details in the window and the status will be ‘Clarification Requested’. Documents Click to View/Upload the required document. Application displays the mandatory and optional documents.

The user can view and input/view application details simultaneously.

When a user clicks on the uploaded document, Document window get opened and on clicking the view icon of the uploaded document, Application screen should get split into two. The one side of the document allows to view and on the other side allows to input/view the details in the applicationNote:

Not applicable for STP of SWIFT MT 765.Remarks Specify any additional information regarding the Lodge Claim Guarantee Advised. This information can be viewed by other users processing the request. Content from Remarks field should be handed off to Remarks field in Backend application.

Overrides Click to view the overrides accepted by the user. Customer Instruction Click to view/ input the following - Standard Instructions – In this section, the system will populate the details of Standard Instructions maintained for the customer. User will not be able to edit this.

- Transaction Level Instructions – In this section, OBTFPM user can input any Customer Instructions received as part of transaction processing. This section will be enabled only for customer initiated transactions.

Incoming Message Clicking this button allows the user to see the message in case of STP of incoming MT 767. View Undertaking Clicking this button allows the user to view the undertaking details. Signatures Click the Signature button to verify the signature of the customer/ bank if required. The user can view the Customer Number and Name of the signatory, Signature image and the applicable operation instructions if any available in the back-office system.

If more than one signature is required, system should display all the signatures.

Request Clarification Clicking this button allows the user to submit the request for clarification to the “Trade Finance Portal” for the transactions that are initiated offline. Reject On click of Reject, user must select a Reject Reason from a list displayed by the system. Reject Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Select a Reject code and give a Reject Description.

This reject reason will be available in the remarks window throughout the process.

Refer Select a Refer Reason from the values displayed by the system. Refer Codes are:

- R1- Documents missing

- R2- Signature Missing

- R3- Input Error

- R4- Insufficient Balance/Limits

- R5 - Others

Hold The details provided will be saved and status will be on hold.User must update the remarks on the reason for holding the task. This option is used, if there are any pending information yet to be received from applicant.

Cancel Cancel the Data Enrichment stage inputs. The details updated in this stage are not saved. The task will be available in 'My Task' queue. Save & Close Save the details provided and holds the task in ‘My Task’ queue for further update. This option will not submit the request. Back Clicking on Back button, takes the user to the previous screen. Next On click of Next, system validates if all the mandatory fields have been captured. Necessary error and override messages to be displayed. On successful validation, system moves the task to the next data segment.

Parent topic: Data Enrichment