6.4 Processing Amendment Reversal Task

This topic describes the steps to process the amendment transaction reversal record.

When a reversal for amendment transaction is initiated, a amendment reversal task is created in the system based on the associated system parameters.

Note:

Only authorized users can process and authorize the amendment reversal tasks.- Basic Info

- Party

- Interest

- Charges

- Accounting

- Summary

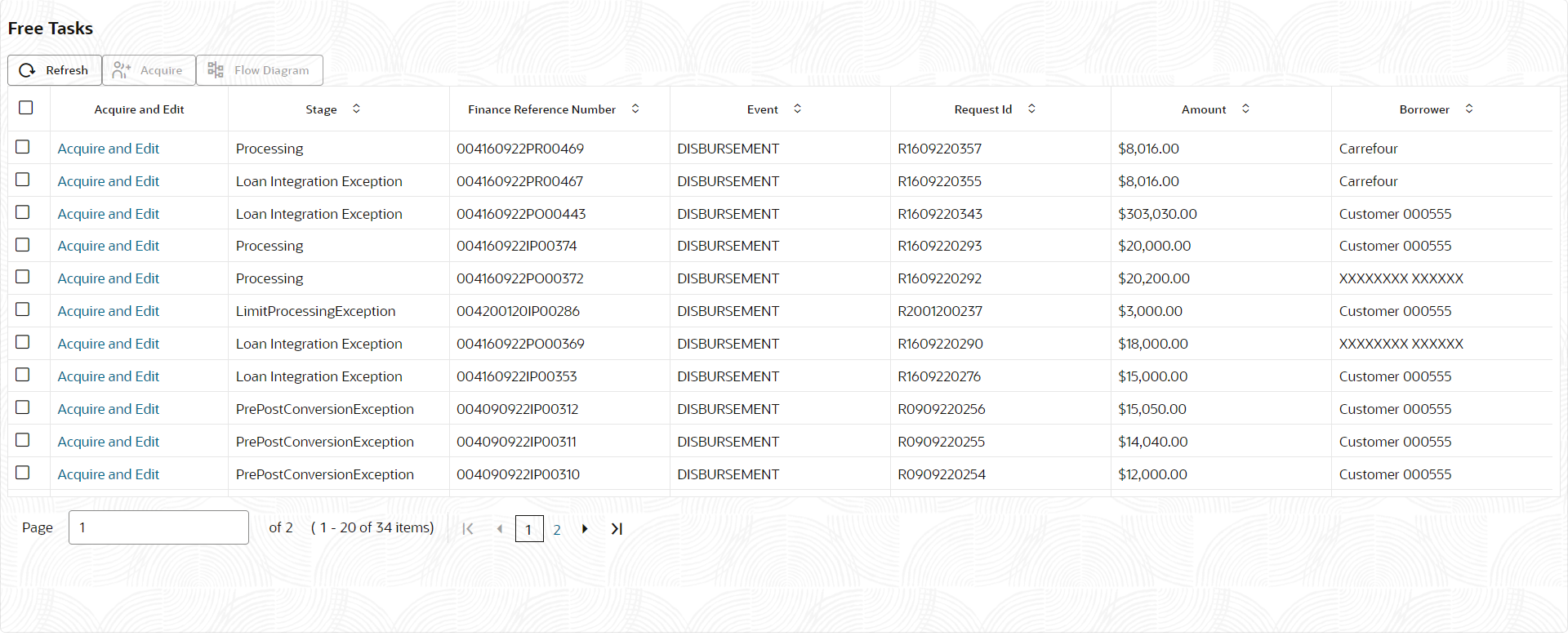

- On Home screen, click Supply Chain Finance. Under Supply Chain Finance, click Tasks.

- Under Tasks, click Finance. Under

Finance, click Free

Tasks.The Finance - Free Tasks screen displays.

- Perform any of the below action from the Free Tasks

screen.

- Click the Acquire and Edit link beside the required amendment reversal tasks to process.

- Select the check-box, and click the Acquire button above the grid to get multiple tasks. After acquiring a task, it will be moved to your My Tasks list. You can go to the My Tasks screen and click the Edit link next to the tasks you need to reverse to process them.

Note:

The following information is displayed at the top of the amendment reversal tasks screen for each data segment.- The reference number, the stage, and the operation name of the transaction acquired for processing.

- Click Remarks button to add any comments about the transaction .

- Click Documents button to upload any new documents or view the uploaded documents relevant to the transaction.

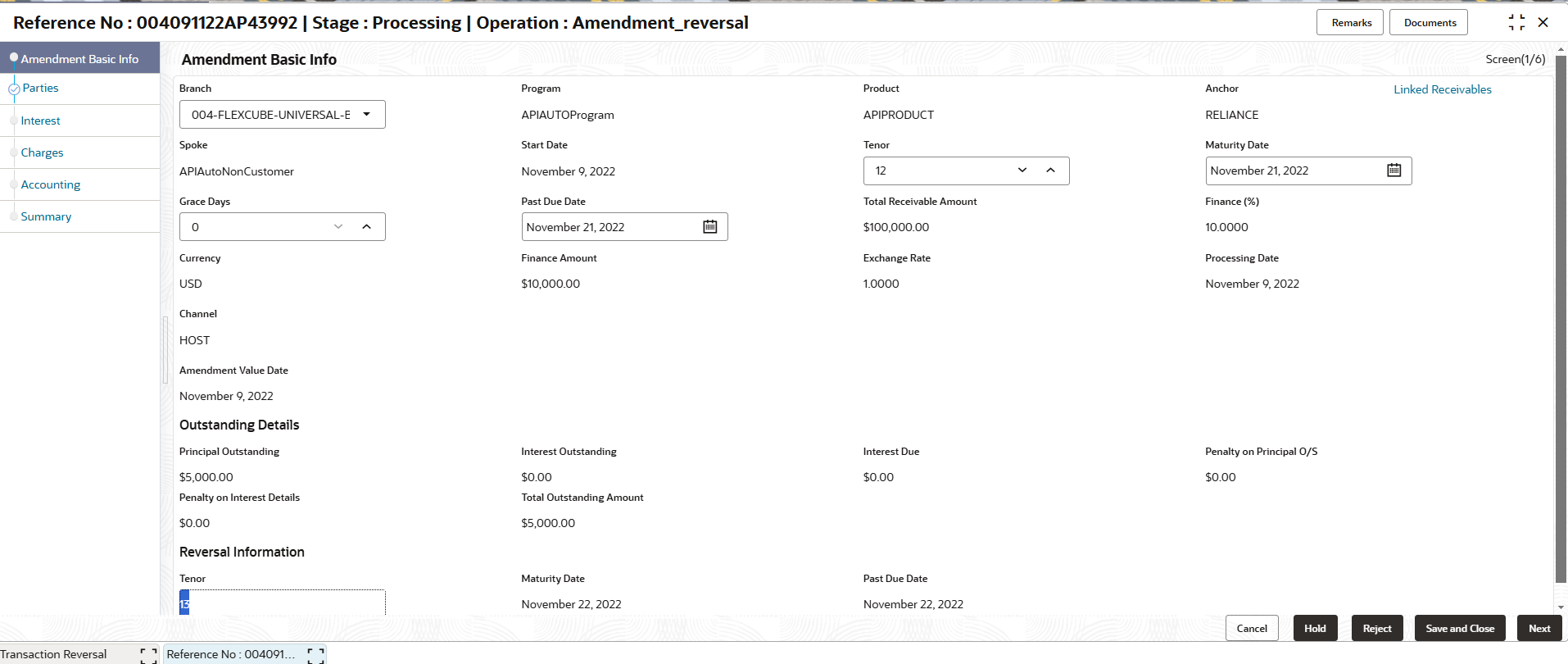

Basic Info

- Click the Acquire and Edit link beside the required amendment tasks.The Basic Info screen displays.

Figure 6-25 Amendment Reversal - Basic Info

- Specify the fields on Basic Info screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 6-16 Basic Info - Field Description

Field Name Description Basic Info Basic information of the amendment transaction being reversed is displayed in this section. Branch Displays the branch where the amendment reversal is being processed. By default, the logged-in user’s branch is displayed. Program Displays the name of the program that is linked to the receivables that have been financed. Product Displays the name of the product associated with the program. Anchor Displays the name of the anchor party in the program. Linked Receivables/PO Click the link to view a list of receivables (invoices/debit notes) / PO that have been financed. Spoke Displays the name of the counter party in the program. Start Date Displays the start date of the finance. By default, it is the current business date. Tenor Displays the tenor of the finance. The tenor of the finance gets defaulted basis start date and maturity date. Maturity Date Displays the maturity date of the finance. Maturity date gets calculated basis maturity date parameter selected at product level. Total Receivable/PO Amount Displays the total amount of the receivables/PO that have been financed. Finance (%) Displays the percentage of the total receivable/PO amount that have been financed. Currency Displays the currency of the finance amount. Finance Amount Displays the amount that has been financed. By default, this field displays the Finance (%) value of the Total Receivable Amount. Exchange Rate Displays the exchange rate between the receivable/PO amount currency and the finance currency. Channel Displays the source application from which the transaction is initiated. Amendment Reversal Details Amendment Reversal details of the finance is displayed in this section. Amendment Ref No Displays the reference number of the amendment. Payment Mode Displays the mode of payment of the amendment amount. Payment Amount Displays the total amount being paid by the payment party. Payment Party Displays the name of the party making the payment. Amendment Processing Date Displays the date of processing the amendment. Amendment / Value Date Displays the date on which the amendment process was initiated. Exchange Rate Displays the exchange rate between the finance currency and the amendment currency. Appropriated Payment Amount Displays the amount that is appropriated for the amendment of the selected finances. Grace Days Displays the number of days past the finance due date, within which the finance can be settled without penalty. Past Due Date Displays the new due date post the initial finance maturity date. Amendment Reversal Amount Displays the amendment amount that is reversed. Reversal Date Displays the date when the amendment transaction is reversed. Post-Shipment Disbursement Details This section is displayed only when post-shipment disbursement proceeds are used to liquidate a pre-shipment finance. Finance Reference Number Displays the reference number of the post-shipment finance. Click the hyperlink in the Finance Reference Number field to view more details on the finance Amendment Processing Date Displays the date of processing of the amendment. Finance Start Date Displays the start date of the finance. Finance Maturity Date Displays the maturity date of the finance. Finance Amount Displays the amount financed. Pre-Shipment Amendment Amount Displays the total pre-shipment amendment amount appropriated against the relevant outstanding pre-shipment finances. Net Disbursed Amount Displays the disbursed amount from post-shipment finance i.e., Net Disbursed Amount = Post-Shipment Finance Amount – Pre-Shipment amendment Amount. Outstanding and Appropriation details Outstanding and Appropriation details of the settled finance settled is displayed in this section. O/S as on Date Outstanding details of the finance on the current date is displayed in this section. Principal O/S Displays the outstanding principal amount as on the current date. Interest O/S Displays the outstanding interest as on the current date. Interest Due Displays the monthly interest due as on the current date.

Penalty on Principal O/S Displays any penalty on the outstanding principal as on the current date.

A hyperlink for the Penalty on Principal O/S field is enabled only if any penalty on principal O/S is applicable. Click the hyperlink to open the pop-up screen to view the breakup.

Penalty on Interest O/S Displays any penalty on the outstanding interest as on the current date.

A hyperlink for the Penalty on Interest O/S field is enabled only if any penalty on interest O/S is applicable. Click the hyperlink to open the pop-up screen to view the breakup.

Total O/S Displays the total outstanding amount as on current date. O/S as on Value/Amendment Date Outstanding details of the finance on the amendment date is displayed in this section. Principal O/S Displays the outstanding principal as on the amendment date. Interest O/S Displays the outstanding interest as on the amendment date. Interest Due Displays the monthly interest due as on the amendment date.

The link for the Interest Due field is active only when there is interest owed. Click the link to see a pop-up with the detailed date-wise calculations for the interest due.

Penalty on Principal O/S Displays any penalty on the outstanding principal as on the amendment date.

A link for the Penalty on Principal O/S field is active only when a penalty on principal O/S is applicable. Click the link to see a pop-up screen to view a detailed breakup.

Penalty on Interest O/S Displays any penalty on the outstanding interest as on the amendment date.

A link for the Penalty on Interest O/S field is active only when a penalty on interest O/S is applicable. Click the link to see a pop-up window view a detailed breakup.

Total O/S Displays the total outstanding amount as on the amendment date. Appropriation Details as on Amendment Value Date Appropriation details of the payment towards the finance on the amendment value date is displayed in this section. Liquidation Order Displays the actual order in which the components are liquidated.- I - Interest due Date

- E - Penalty on Interest Start Date

- O - Penalty on Principal Start Date

- F - Finances (Outstanding Finances)

- D - Overdue Finance (Delinquent)

Appropriation Sequence Displays the appropriation sequence of amendment amount. - P - Principal Amount

- I - Interest amount

- O - Penalty on Principal

- E - Penalty on Interest

Payment Towards Principal Displays the amount settled against the principal of the finance.

By default, the value entered as the payment amount in the amendment Details section is auto-populated.

Payment Towards Interest Displays the amount settled against the interest of the finance. Payment Towards Penalty on Principal Displays the amount settled against the penalty on principal of the finance. Payment Towards Penalty on Interest Displays the amount settled against the penalty on interest of the finance. Interest Refund Displays any interest amount refunded. O/S Post Amendment Reversal as on Amendment Value Date Outstanding details of the finance post amendment reversal on the amendment value date is displayed in this section. Principal O/S Displays the principal amount that will be outstanding, post amendment reversal. Interest O/S Displays the interest amount that will be outstanding, post amendment reversal. Interest Due Displays the monthly interest due amount that will be outstanding, post amendment reversal.

A hyperlink for the Interest Due field is enabled only if any interest is due. Click the hyperlink to open the pop-up screen to view the date-wise calculation details for interest due.

Penalty on Principal O/S Displays the penalty on principal amount that will be outstanding, post amendment reversal.

A hyperlink for the Penalty on Principal O/S field is enabled only if any penalty on principal O/S is applicable. Click the hyperlink to open the pop-up window to view the breakup.

Penalty on Interest O/S Displays the penalty on interest that will be outstanding, post amendment reversal.

A hyperlink for the Penalty on Interest O/S field is enabled only if any penalty on interest O/S is applicable. Click the hyperlink to open the pop-up window to view the breakup.

Total O/S Displays the total amount that will be outstanding, post amendment reversal. - Perform any of the below actions from the Basic Info

screen.

- Click Next to go to the Party screen.

- Click Save and Close to save the details and complete the processing stage of the amendment reversal.

Note:

If the Reversal Auth Required toggle is enabled in the system parameters, an approval task is created in the system. - Click Reject to purge the amendment reversal transaction.

- Click Hold to move the transaction to the Hold Tasks list.

- Click Cancel to cancel the transaction and return to the Free Tasks screen.

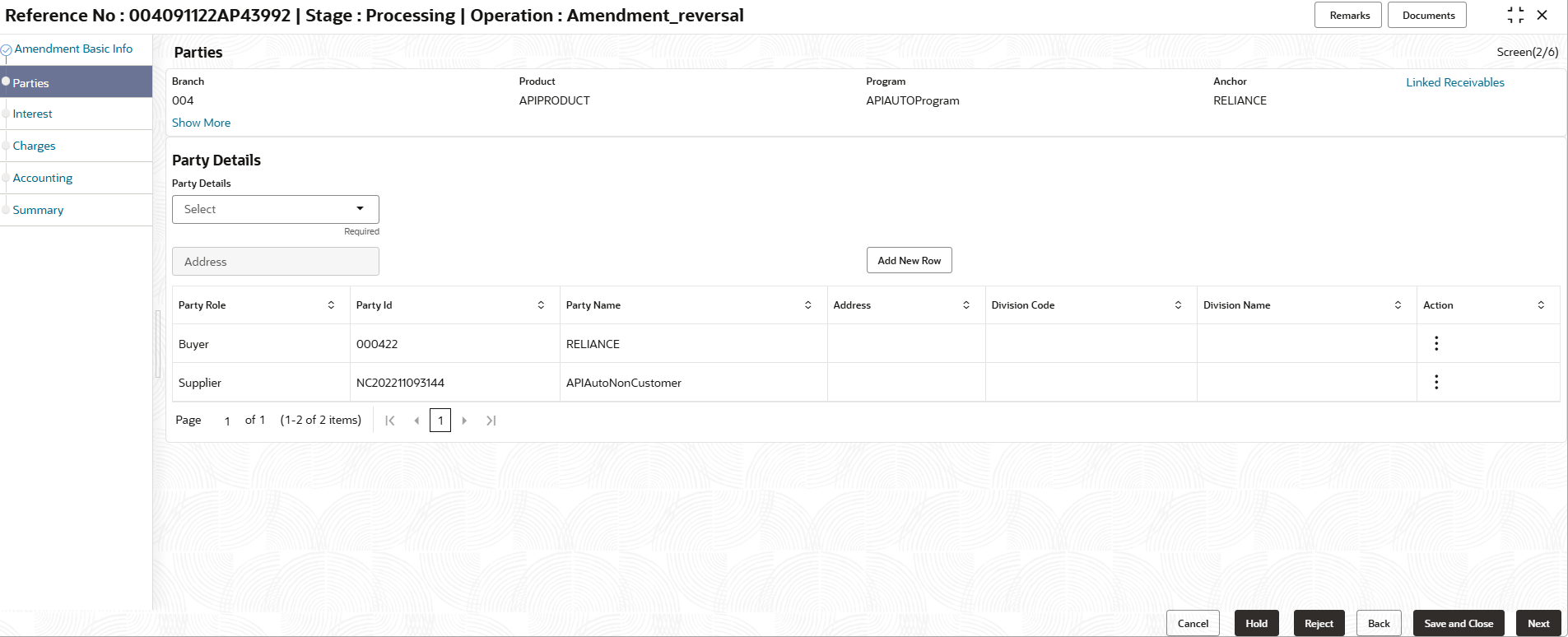

Party

- Click Next on the Basic Info

tab.The Party screen displays.

- Specify the fields on Party screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 6-17 Party - Field Description

Field Name Description Branch Displays the branch code where the amendment reversal is being processed. By default, the logged-in user’s branch code is displayed. Product Displays the name of the product associated with the program. Program Displays the name of the program that is linked to the receivables that have been financed. Anchor Displays the name of the anchor party in the program. Linked Receivables/PO Click the link to view a list of receivables (invoices/debit notes) / PO that have been financed. Spoke Displays the name of the counter party in the program. Amendment Processing Date Displays the date of processing the amendment. Amendment / Value Date Displays the actual date of amendment. Amendment Amount Displays the amount being settled. Party Details Parties with specific roles in the program can be added in this section. Party Details Select the party role to be added.

The available options are:- Buyer

- Supplier

- Import Factor

- Export Factor

- Insurance

- Beneficiary/Counter Party

Search Party Click the search icon to select the party. Division Click the search icon to select the division code of the party. Address Specify the address of the selected party. Add New Row Click this button to add the selected party to the grid. Party Role Displays the role of the party. Party Id Displays the unique ID of the party. Party Name Displays the name of the party Address Displays the address of the party. Division Code Displays the division code of the party. Division Name Displays the division name of the party. Action Click Options icon to view the actions that can be taken on the party record. - Perform the following steps to take action on the parties in the grid:

- Click Add New Row to add more parties.

- Select the record in the grid and click Options icon under the Actions column and then click Delete to remove the party.

- Perform any of the below actions from the Party

screen.

- Click Next to go to the Interest screen.

- Click Save and Close to save the details and complete the processing stage of the amendment reversal.

- Click Back to go to the Basic Info screen.

- Click Reject to purge the amendment transaction reversal.

- Click Hold to move the transaction to the Hold Tasks list.

- Click Cancel to cancel the transaction and return to the Free Tasks screen.

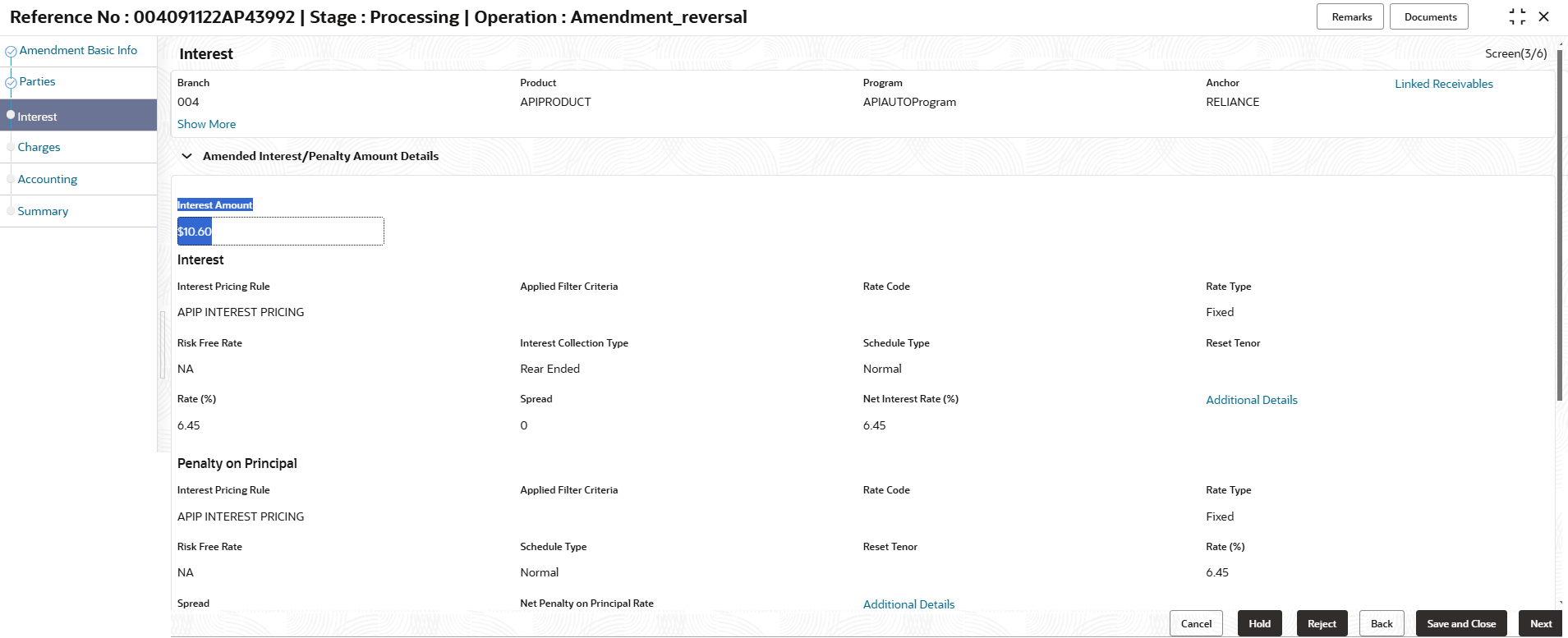

Interest

- Click Next on the Interest tab.The Interest screen displays.

- Specify the fields on Interest screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 6-18 Interest - Field Description

Field Name Description Branch Displays the branch code where the amendment reversal is being processed. By default, the logged-in user’s branch code is displayed. Product Displays the name of the product associated with the program. Program Displays the name of the program that is linked to the receivables that have been financed. Anchor Displays the name of the anchor party in the program. Linked Receivables/PO Click the link to view a list of receivables (invoices/debit notes) / PO that have been financed. Spoke Displays the name of the counter party in the program. Amendment Processing Date Displays the date of processing the amendment. Amendment / Value Date Displays the actual date of amendment. Amendment Amount Displays the amount being settled. Interest and Penalty Amount Details Interest, Penalty on Principal, and Penalty on Interest details of the finance is displayed in this section. Interest Amount Displays the interest amount that has been calculated. Penalty on Principal Displays the penalty on the outstanding principal that has been calculated, if any. Penalty on Interest Displays the penalty on the outstanding interest that has been calculated, if any. Interest Details Interest details of the finance is displayed in this section. Interest Pricing Rule Displays the pricing rule applied for the interest rate. Applied Filter Criteria Displays the filter criteria applied for the interest rate. Rate Code Displays the unique code associated with the interest rate. Rate Type Displays whether the rate is floating or fixed. Risk Free Rate Displays whether the interest rate applied is risk free. Interest Collection Type Displays the type of interest collection, whether rear-ended, or front-ended. Schedule Type Displays whether the interest collection schedule is normal or compounding. Reset Tenor Displays the tenor for applying the new interest rate, in case of floating rate type. Rate (%) Displays the base rate of interest. Spread Displays the spread or margin rate of interest. Net Interest Rate (%) Displays the total rate of interest. This is the sum of Rate (%) and Spread. Additional Details Click this link to view additional interest details.- Interest Additional Details - Displays additional information related to the interest.

- Interest Payment Schedule - Displays the details of periodic interest dues for monthly rest transactions.

Penalty on Principal Details Penalty on principal details of the finance is displayed in this section. Interest Pricing Rule Displays the pricing rule applied for the interest rate. Applied Filter Criteria Displays the filter criteria applied for the interest rate. Rate Code Displays the code of the penalty on principal. Rate Type Displays whether the rate is floating or fixed. Risk Free Rate Displays whether the interest rate applied is risk free. Schedule Type Displays whether the interest collection schedule is normal or compounding. Reset Tenor Displays the tenor for applying the new interest rate, in case of floating rate type. Rate (%) Displays the base rate of interest. Spread Displays the spread or margin rate of interest. Net Penalty on Principal Rate (%) Displays the total rate of interest. This is the sum of Rate (%) and Spread. Additional Details Click this link to view additional details related to penalty on principal. Penalty on Interest Details Penalty on interest details of the finance is displayed in this section. Interest Pricing Rule Displays the pricing rule applied for the interest rate. Applied Filter Criteria Displays the filter criteria applied for the interest rate. Rate Code Displays the code of the penalty on the penalty on interest. Rate Type Displays whether the rate is floating or fixed. Risk Free Rate Displays whether the interest rate applied is risk free. Schedule Type Displays whether the interest collection schedule is normal or compounding. Reset Tenor Displays the tenor for applying the new interest rate, in case of floating rate type. Rate (%) Displays the base rate of interest. Spread Displays the spread or margin rate of interest. Net Penalty on Principal Rate (%) Displays the total rate of interest. This is the sum of Rate (%) and Spread. Additional Details Click this link to view additional details related to penalty on interest. - Perform any of the below actions from the Interest

screen.

- Click Next to go to the Charges screen.

- Click Save and Close to save the details and complete the processing stage of the amendment reversal.

Note:

If the Reversal Auth Required toggle is enabled in the system parameters, an approval task is created in the system. - Click Back to go to the Parties screen.

- Click Reject to purge the amendment reversal transaction.

- Click Hold to move the transaction to the Hold Tasks list.

- Click Cancel to cancel the transaction and return to the Free Tasks screen.

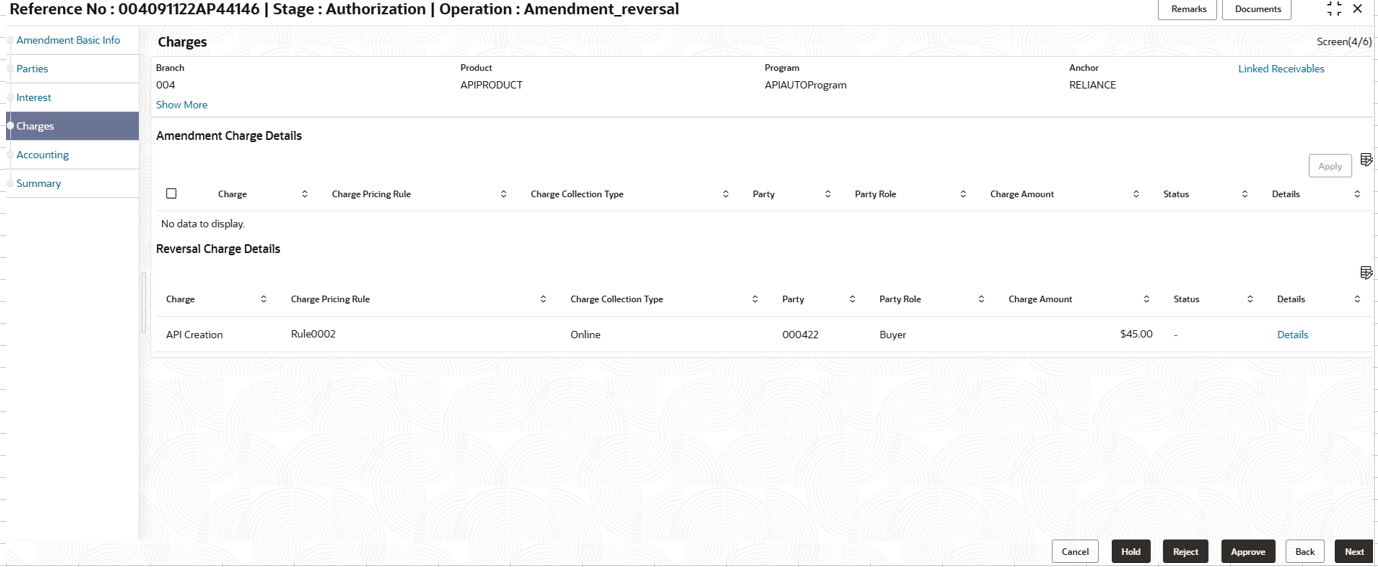

Charges

- Click Next on the Interest

tab.The Charges screen displays.

- Specify the fields on Charges screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 6-19 Charges - Field Description

Field Name Description Branch Displays the branch code where the amendment reversal is being processed. By default, the logged-in user’s branch code is displayed. Product Displays the name of the product associated with the program. Program Displays the name of the program that is linked to the receivables that have been financed. Anchor Displays the name of the anchor party in the program. Linked Receivables/PO Click the link to view a list of receivables (invoices/debit notes) / PO that have been financed. Spoke Displays the name of the counter party in the program. Amendment Processing Date Displays the start date of the finance. By default, it is the current business date. Amendment Processing Date Displays the date of processing the amendment. Amendment / Value Date Displays the actual date of amendment. Amendment Amount Displays the amount being settled. Charge Details Charge details of the finance is displayed in this section. Charge Displays the charge code. Charge Pricing Rule Displays the charge pricing rule applicable to the transaction.

Charge Collection Type Displays the type of charge collection applicable to the transaction. Party Displays the ID of the party that has been charged. Party Role Displays the role of the party that has been charged. Charge Amount Displays the amount charged along with the currency. If the charge is Auto Waived, then the charge amount field defaults to zero.

Status Displays the status of the charge and View Original Charges hyperlink is enabled. Click the link to view the system calculated charges.

This field is displayed only if Auto Waive is selected in the Charge Decisioning screen or if the amendment transaction is viewed from checker login.

Details Click the link to view the charge details, external pricing details, and schedule of periodic charges.

External Pricing Details tab is displayed only if External Pricing switch is enabled in the Charge Decisioning and Charge Preferential Pricing screens.

Schedule of Periodic Charges tab is displayed only if the Charge Collection Type or Charge Calculation Type is selected as Periodic.

Reversal Charge Charge details of the amendment reversal is displayed in this section. Charge Displays the charge code. Charge Pricing Rule Displays the charge pricing rule applicable to the transaction.

Charge Collection Type Displays the type of charge collection applicable to the transaction. Party Displays the ID of the party that has been charged. Party Role Displays the role of the party that has been charged. Charge Amount Displays the amount charged along with the currency. If the charge is Auto Waived, then the charge amount field defaults to zero.

Status Displays the status of the charge and View Original Charges hyperlink is enabled. Click the link to view the system calculated charges.

This field is displayed only if Auto Waive is selected in the Charge Decisioning screen or if the amendment reversal transaction is viewed from checker login.

Details Click the link to view the charge details, external pricing details, and schedule of periodic charges.

External Pricing Details tab is displayed only if External Pricing switch is enabled in the Charge Decisioning and Charge Preferential Pricing screens.

Schedule of Periodic Charges tab is displayed only if the Charge Collection Type or Charge Calculation Type is selected as Periodic.

- Perform any of the below actions from the Charges

screen.

- Click Next to go to the Accounting screen.

- Click Save and Close to save the details and complete the processing stage of the amendment reversal.

Note:

If the Reversal Auth Required toggle is enabled in the system parameters, an approval task is created in the system. - Click Back to go to the Interest screen.

- Click Reject to purge the amendment reversal transaction.

- Click Hold to move the transaction to the Hold Tasks list.

- Click Cancel to cancel the transaction and return to the Free Tasks screen.

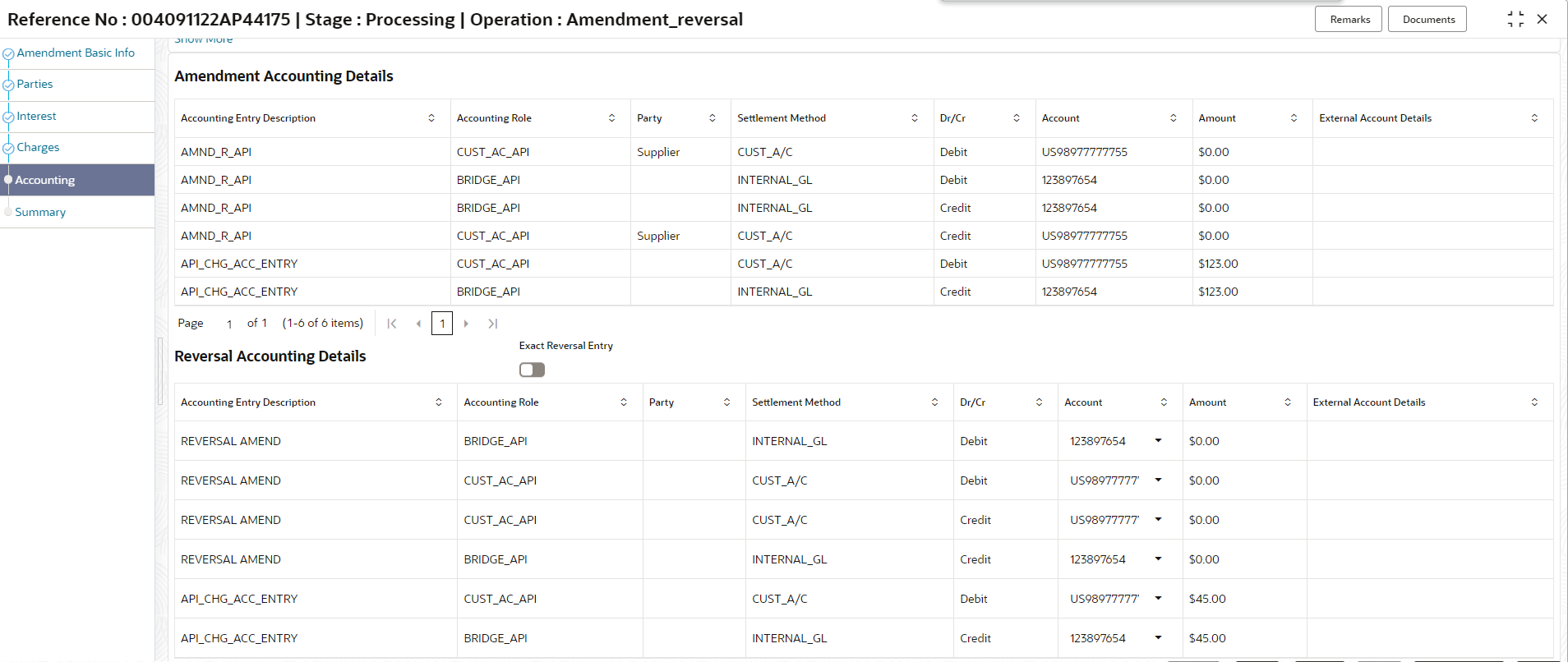

Accounting

- Click Next on the Charges

tab.The Accounting screen displays.

Figure 6-29 Amendment Reversal - Accounting

- Specify the fields on Accounting screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 6-20 Accounting - Field Description

Field Name Description Branch Displays the branch code where the amendment reversal is being processed. By default, the logged-in user’s branch code is displayed. Product Displays the name of the product associated with the program. Program Displays the name of the program that is linked to the receivables that have been financed. Anchor Displays the name of the anchor party in the program. Linked Receivables/PO Click the link to view a list of receivables (invoices/debit notes) / PO that have been financed. Spoke Displays the name of the counter party in the program. Amendment Processing Date Displays the start date of the finance. By default, it is the current business date. Amendment Processing Date Displays the date of processing the amendment. Amendment / Value Date Displays the actual date of amendment. Amendment Amount Displays the amount being settled. Accounting Details Accounting details of the finance is displayed in this section. Accounting Entry Description Displays the description of the accounting entry. Accounting Role Displays the accounting role code associated with the accounting entry. Party Displays the name of the party associated with the accounting entry. Amendment Method Displays the amendment mode of the transaction. Dr/Cr Displays whether the amount is debited or credited for the accounting entry. Account Displays the account number involved in the transaction. Amount Displays the amount of the transaction. External Account Details Displays the details of the account if it is an external account. Reversal Accounting Entry Accounting entries maintained for the amendment reversal of the finance is displayed in this section. Exact Reversal Entry Switch this toggle ON to reverse the original accounting entries of the amendment transaction. By default, this switch is OFF.

Accounting Entry Description Displays the description of the accounting entry. Accounting Role Displays the accounting role code associated with the accounting entry. Party Displays the name of the party associated with the accounting entry. Amendment Method Displays the amendment mode of the transaction. Dr/Cr Displays whether the amount is debited or credited for the accounting entry. Account Displays the account number involved in the transaction. Amount Displays the amount of the transaction. External Account Details Displays the details of the account if it is an external account. - Perform any of the below actions from the Accounting

screen.

- Click Next to go to the Summary screen.

- Click Save and Close to save the details and complete the processing stage of the amendment reversal.

Note:

If the Reversal Auth Required toggle is enabled in the system parameters, an approval task is created in the system. - Click Back to go to the Charges screen.

- Click Reject to purge the amendment reversal transaction.

- Click Hold to move the transaction to the Hold Tasks list.

- Click Cancel to cancel the transaction and return to the Free Tasks screen.

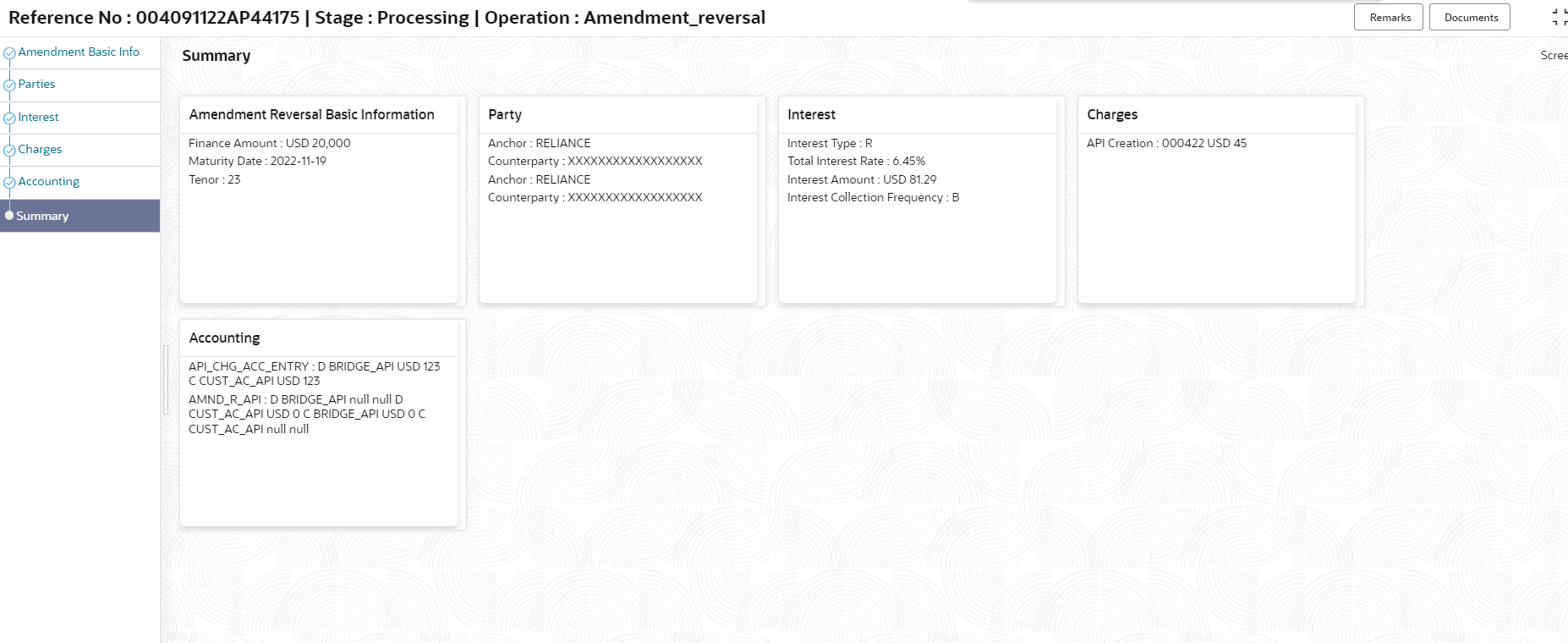

Summary

The Summary tab shows a snapshot of the complete amendment reversal transaction along with finance amount, interest applicable, terms, and so on. A tile is displayed for each data segment.

- Click Next on the Accounting

tab.The Summary screen displays.

- Check the details of the amendment reversal transaction and take any of the following actions from the Summary screen.

- Click each tile to view the detailed information of the data segments.

- Click Save and Close to save the details and complete the processing stage of the amendment reversal.

Note:

When the Reversal Auth Required option is turned on in the system settings, an approval task is generated. After approval, the finance is reversed in the main lending system, which then updates the Supply Chain Finance system with the reversed status. - Click Back to go to the Accounting screen.

- Click Reject to purge the amendment reversal transaction.

- Click Hold to move the transaction to the Hold Tasks list.

- Click Cancel to cancel the transaction and return to the Free Tasks screen.

Parent topic: Transaction Reversal