- Supply Chain Finance User Guide

- Maintenance for Supply Chain Finance

- Program Parameters Maintenance

- Create Program Parameters

2.3.1 Create Program Parameters

This topic describes the systematic instruction to create products and maintain its parameters.

- Basic Information

- Finance Parameters

- Link Spokes

- On Home screen, click Supply Chain Finance. Under Supply Chain Finance, click Maintenance.

- Under Maintenance, Click Program

Parameters. Under Program Parameters,

Click Create Program Parameters.The Create Program Parameters - Basic Information screen displays.

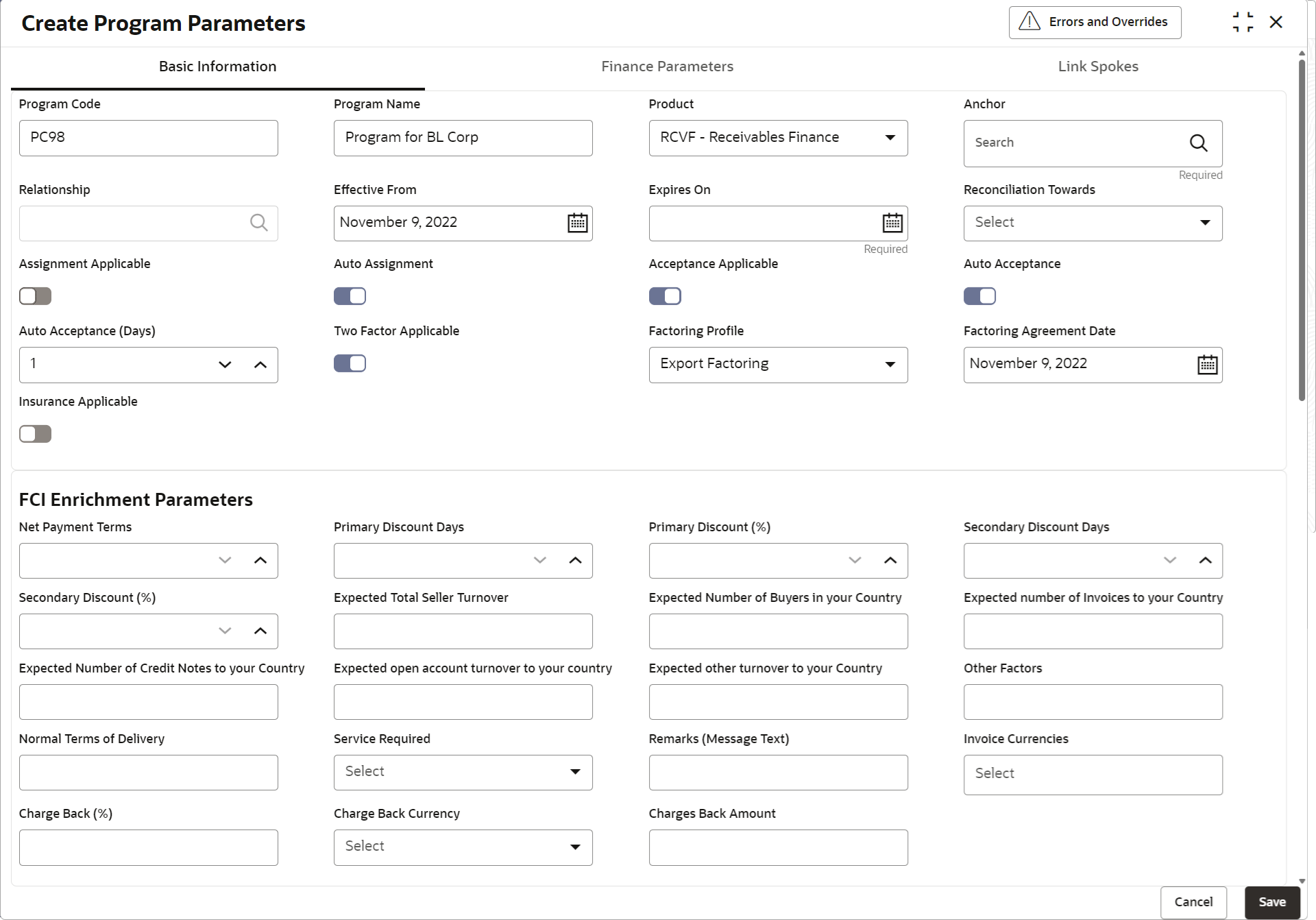

Figure 2-15 Create Program Parameters - Basic Information

- On Basic Information tab, specify the fields to

configure the basic information for the program being created.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-13 Basic Information - Field Description

Field Name Description Program Code Specify a unique code to identify the program. Program Name Specify a name for the program. Product † Select the underlying finance product to be associated with the program. Anchor Click the search icon to select the anchor for the program. An anchor can be a customer or a non-customer. Relationship Click the search icon to select the relationship associated with the selected anchor. Effective From Click the Calendar icon to select the date from when the program is active.

If the field is left blank, then the branch date is considered by default.

Expires On Click the calendar icon and select the date up to when the program is valid. Reconciliation towards Select whether the reconciliation is towards Invoice or Finance. Assignment Applicable Switch the toggle ON to enable assignment on invoice applicable for financing. Auto Assignment Switch the toggle ON to enable assignment automatically post invoice upload. Acceptance Applicable Switch the toggle ON to enable acceptance for invoice applicable for financing. Auto Acceptance Switch the toggle ON to enable automatic acceptance of an instrument for the program. Auto Acceptance (Days) Specify the number of days after which the instrument is automatically deemed as accepted under this program.

This field is displayed only if Auto Acceptance Applicable toggle is switched ON.

Two Factor Applicable Switch the toggle ON to enable a two-factor system for the program in case the anchor is trading with foreign buyers/suppliers. Factoring Profile Select the profile for factoring as Import Factoring or Export Factoring.

This field is displayed only if Two Factor Applicable toggle is switched ON.

Factoring Agreement Date Select the factoring agreement date signed between the export factor and the import factor.

This field is displayed only if Two Factor Applicable toggle is switched ON.

Insurance Applicable Switch the toggle ON to enable insurance for the program. FCI Enrichment Parameters This section is displayed only if Two Factor Applicable toggle is switched ON.

Note:

An FCI Message 1 - Seller’s Information is generated upon the onboarding of a new Seller in the application (Program Parameters) for a Factoring Program with Factoring Profile designated as Export Factoring. This message is subsequently transmitted to the Import Factor via an FCI message batch job.Net Payment Terms Specify the number of days after which the invoices can be due for payment. Primary Discount Days Specify the number of days applicable for the primary discount. Primary Discount % Specify the primary discount percentage. Secondary Discount Days Specify the number of days applicable for the secondary discount. Secondary Discount % Specify the secondary discount percentage. Expected Total Seller Turnover Specify the total turnover expected from the seller. Expected Number of Buyers in your Country Specify the number of buyers expected in the import factor's country for this seller. Expected Number of Invoices to your Country Specify the expected number of invoices which will be raised on the import factor's country for this seller. Expected Number of Credit Notes to your Country Specify the expected number of credit notes which will be raised on the import factor's country for this seller. Expected open account turnover to your country Specify the open account turnover to on the import factor's country for this seller. Expected other turnover to your Country Specify any other turnover to on the import factor's country for this seller. Other Factors Specify the import factors involved in the factoring i.e., if more one than factor is involved for the same seller in the same country. Normal Terms of Delivery Specify the delivery terms, if any. Services Required Specify the services required from the import factor. The available options are:- Full Service, non recourse

- Recourse

- Collection only

- Special service (RESCUE, POM, IV)

- Non-notification

- Buyer to pay directly to EF/Seller

- Agency Agreement

Remarks (Message Text) Specify the comments regarding the factoring, if any. Invoice Currencies Select the currency for invoice. You can select multiple currencies in this field. Charge Back % Specify the charge back percentage in cases of dispute. Charge Back Currency Specify the currency of the charge back amount. Charge Back Amount Specify the charge back amount in cases of dispute. Note:

† On maintenance screens where program selection is required, programs linked to the products that are relevant to the logged-in user's branch gets displayed. - Click Finance Parameters tab.The Create Program Parameters - Finance Parameters screen displays.

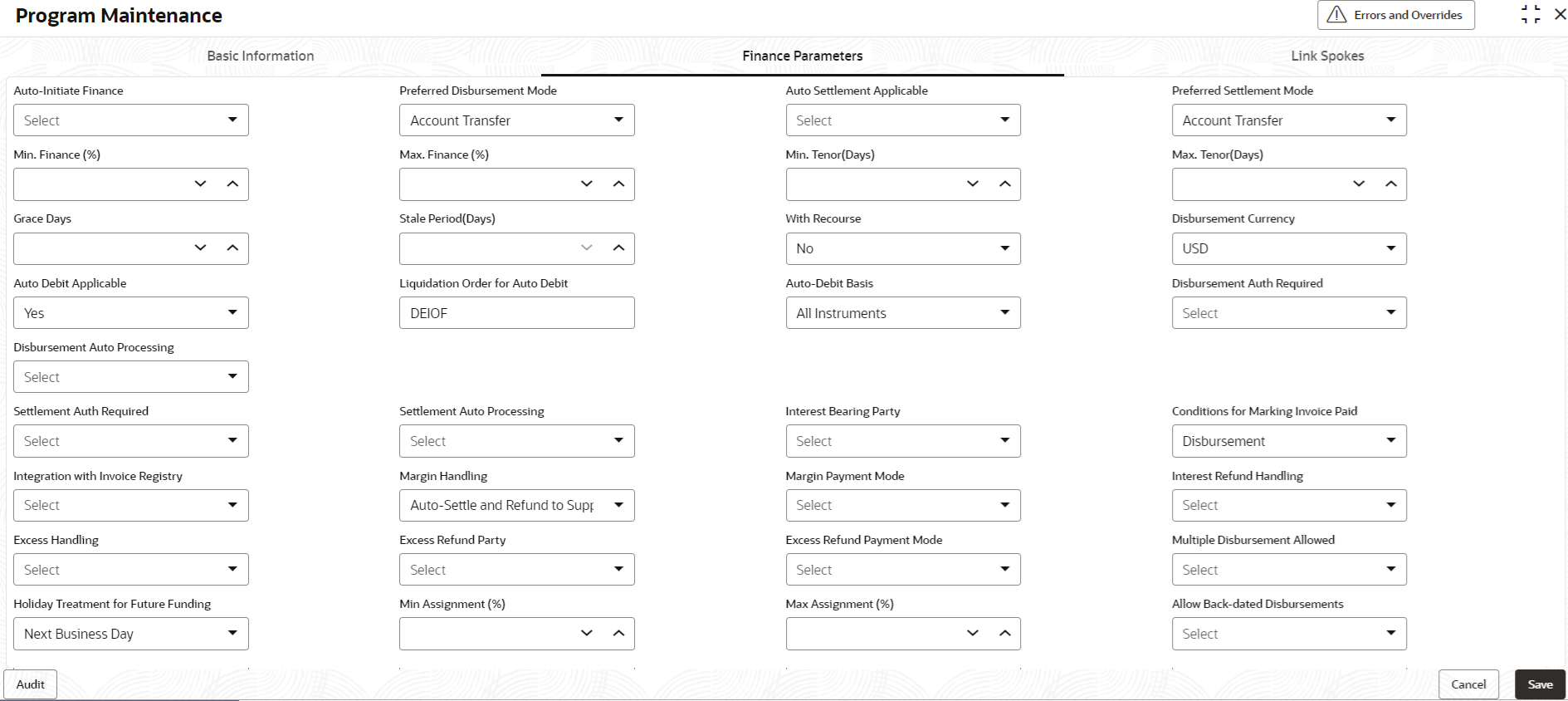

Figure 2-16 Create Program Parameters - Finance Parameters

- On Finance Parameters tab, specify the fields to

configure the finance parameters for the program being created.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-14 Finance Parameters - Field Description

Field Name Description Auto-Initiate Finance Select Yes to enable auto financing under this program. Else select No. Preferred Disbursement Mode Select the preferred mode of disbursement for this program.

The available options are:- Account Transfer

- Cheque

- EFT

This field is mandatory if Auto-Initiate Finance is enabled.

Auto Settlement Applicable † Select Yes to enable automated settlement (repayment), under this program. Else select No. Preferred Settlement Mode Select the preferred mode of settlement for this program.

The available options are:- Account Transfer

- Cheque

- EFT

Min. Finance (%) Specify the minimum finance percentage allowed for financing a transaction of this program. Max. Finance (%) Specify the maximum finance percentage allowed for financing a transaction of this program. Min. Tenor (Days) Specify the minimum tenor allowed for financing a transaction of this program. Max. Tenor (Days) Specify the maximum tenor allowed for financing a transaction of this program. Grace Days Specify the number of grace days.

This is the period post the finance due date, within which the finance can be settled without penalty.

Stale Period (Days) Specify the number of stale days.

This is the period post the invoice date, after which the invoice becomes stale and will not be financed automatically any more for this program.

With Recourse Select Yes to specify that the finance is allowed with recourse, else select No. Disbursement Currency Select the currency in which the finance should be disbursed.

This field is mandatory when Auto-Initiate Finance is enabled.

Auto Debit Applicable Select Yes to enable auto debit to recover the outstanding finance due from the borrower for this program. Else select No. Liquidation Order for Auto Debit Specify the default auto-debit liquidation order to be applied in case partial funds are debited from the payment party on auto-debit.

The available options are:- E - Penalty on Interest Outstanding

- O - Penalty on Principal Outstanding

- I – Monthly Interest Due

- D - Overdue Finance (Delinquent finances)

- F - Finance Due or Overdue (Outstanding Finances)

This field is mandatory if Auto Debit Applicable is enabled.

Auto-Debit Basis Select the basis on which of the instruments should be auto-debited on the finance/invoice due date.

The available options are:- Accepted Instruments - The account is auto-debited when the invoice/debit note is in the Accepted status, and Reconciliation Towards is set to Invoice.

- Financed Instruments - The account is auto-debited when the invoice/debit note is financed, irrespective of acceptance status, and Reconciliation Towards is set to Invoice.

- Accepted or Financed Instruments - The account is auto-debited when the invoice/debit note is either accepted or financed, and Reconciliation Towards is set to Invoice.

- All Instruments - The account is auto-debited when Reconciliation Towards is set to Invoice, irrespective of whether the invoice/debit note is accepted or financed.

This field is displayed only if Auto Debit Applicable is enabled. By default, All Instruments is selected.

Disbursement Auth Required Select Yes to enable authorization for the disbursement transactions under this program. Else select No. Disbursement Auto Processing Select Yes to enable automatic processing of disbursement transactions under this program. Else select No. Amendment Auth Required Select Yes to enable authorization for the amendment transactions under this program. Else select No.

This field appears only if the Product selected has Amendment Applicable enabled.

Amendment Auto Processing Select Yes to enable automatic processing of amendment transactions under this program. Else select No.

This field appears only if the Product selected has Amendment Applicable enabled.

Settlement Auth Required Select Yes to enable authorization for the settlement transactions under this program. Else select No. Settlement Auto Processing Select Yes enable automatic processing of settlement transactions under this program. Else select No. Interest Bearing Party Select the party that bears the interest.

The available options are:- Anchor

- Spoke

Conditions for Marking Invoice Paid Select whether the financed invoice should be marked as Paid during Disbursement or during Settlement.

This field appears only when the Product selected in the Basic Information tab has one of the following configurations:- Product Type = Buyer Centric; Product Category = Invoice; Borrower = Anchor

- Product Type = Supplier Centric; Product Category = Invoice; Borrower = Spoke

The options available in this field are:- Disbursement:

- If the invoice is financed to the maximum finance percentage, then during disbursement it is marked as Paid. The outstanding invoice amount, if any, is handled as per margin handling settings.

- If the invoice is not financed to the maximum finance percentage, then during disbursement, the invoice is marked as Partially Paid. Once the outstanding invoice amount is settled based on margin handling settings, then the invoice is marked as Paid.

- Settlement:

- If an invoice is financed to the maximum finance percentage, and if all underlying finances are fully paid off during settlement, then the invoice is marked as Paid.

- If the invoice is not financed to the maximum finance percentage, then during settlement the invoice is marked as Partially Paid. It is then marked as Paid, after the outstanding payment is made.

Margin Handling Select how the margin should be handled.

The available options are:- Auto-Settle and Refund to Supplier

- Manually Settle O/s Finances

- Refund to the Supplier

- Settle with Outstanding Finances

This field is displayed only if the Product selected in this program has Product Category selected as Invoice.

Margin Payment Mode Select the mode of payment for the margin amount.

The available options are:- Account Transfer

- Cheque

- EFT

This field is displayed only if Margin Handling is selected as Refund to the Supplier or Auto-Settle and Refund to Supplier.

Interest Refund Handling Select how the interest refund should be handled.

The available options are:- Auto-Settle and Refund to IBP

- Manually Settle O/s Finances

- Refund to the Interest Bearing Party

- Settle with Outstanding Finances

Interest Refund Payment Mode Select the mode of payment for the interest refunds.

The available options are:- Account Transfer

- Cheque

- EFT

This field is displayed only if Interest Refund Handling is selected as Refund to the Interest Bearing Party or Auto-Settle and Refund to IBP.

Excess Handling Select how excess payment made towards settling of outstanding invoice/finance, should be handled.

The available options are:- Auto-Reconcile

- Auto-Reconcile and Refund

- Manually-Reconcile

- Refund to beneficiary or payment party

Excess Refund Party Select the party to refund the excess amount to.

The available options are:- Beneficiary/Counter Party

- Payment Party

Excess Refund Payment Mode Select the mode of payment for the excess payment refund.

The available options are:- Account Transfer

- Cheque

- EFT

Multiple Disbursement Allowed Select Yes to enable multiple finance disbursements for an invoice. Else select No. Holiday Treatment for Future Funding Select the day to consider if the finance disbursement falls on a holiday.

The available options are:- Next Business Day

- Previous Business Day

Min Assignment (%) Specify the minimum percentage of the assignment amount allowed for financing a transaction of this program. Max Assignment (%) Specify the maximum percentage of the assignment amount allowed for financing a transaction of this program. Credit Cover (%) Specify the credit cover percentage allowed for the transaction under this program.

This field is displayed only if Assignment event in the Credit limit Mapping tab of Product Parameters is same as the limit type maintained in the Limit Type for Invoice Approval in System Parameters.

Credit Cover Start Date Specify the credit cover start date for the transaction under this program.

This field is displayed only if Assignment event in the Credit limit Mapping tab of Product Parameters is same as the limit type maintained in the Limit Type for Invoice Approval in System Parameters.

Credit Cover End Date Specify the credit cover end date for the transaction under this program.

This field is displayed only if Assignment event in the Credit limit Mapping tab of Product Parameters is same as the limit type maintained in the Limit Type for Invoice Approval in System Parameters.

Allow Back-Dated Disbursements Select Yes to enable back-dated disbursements for the transaction under this program. Else select No. Note:

† Pre-Shipment settlement gets initiated only if the Auto Settlement Applicable is enabled.Note:

The application supports defining a specific assignment amount during a transaction. Similarly, a specific credit cover percentage can be defined against exposure on the import factor or buyer.Note:

For existing implementations, Conditions for Marking Invoice Paid is defaulted to Null i.e., the invoice gets marked as Paid if an invoice payment is directly received. Banks or Financial Institutions should modify the fields as per the table to achieve a different functionality, if required. - Click Link Spokes tab.The Create Program Parameters - Link Spokes screen displays.

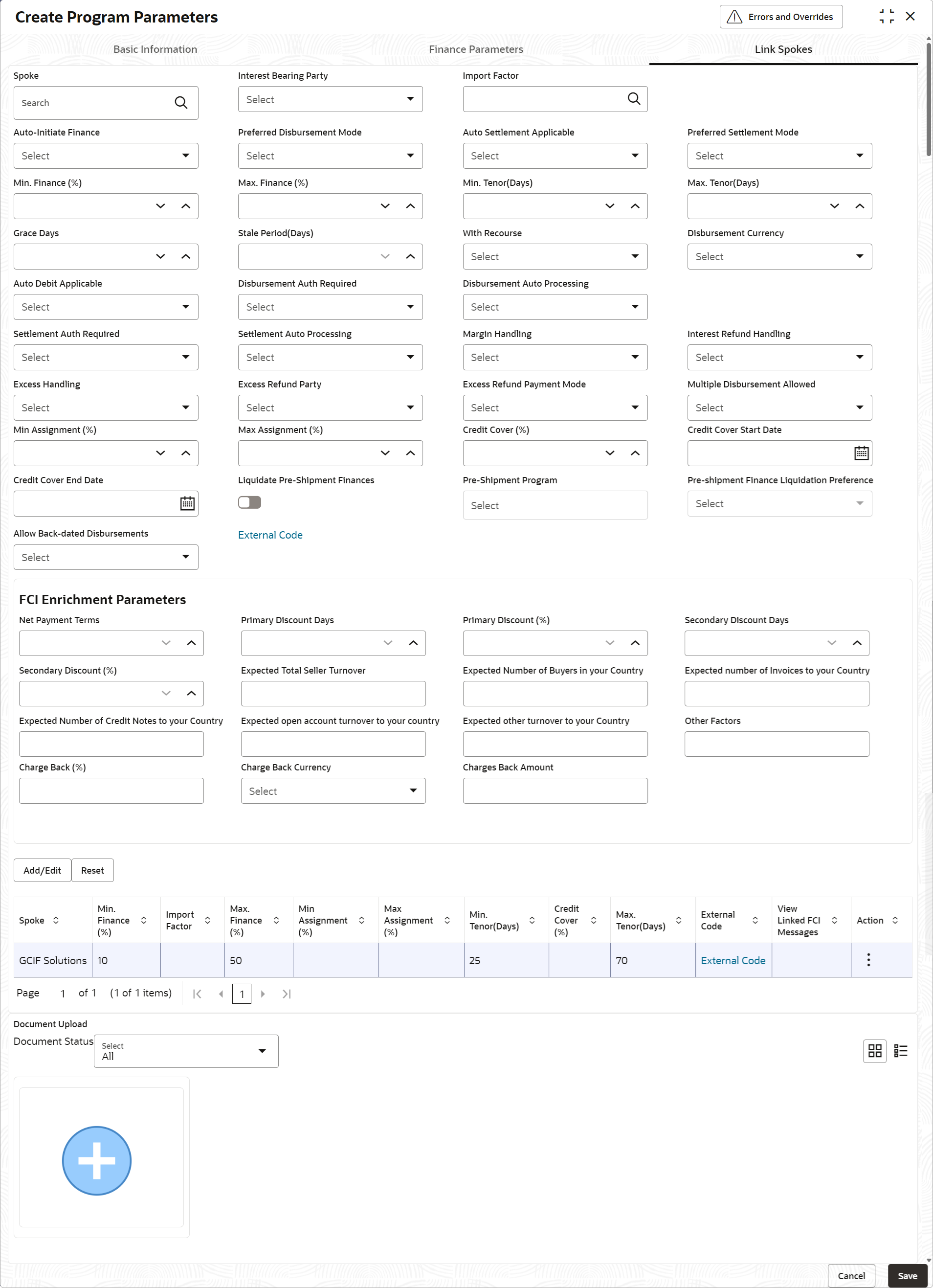

Figure 2-17 Create Program Parameters - Link Spokes

- On Link Spokes tab, specify the fields to link multiple

spokes/counterparties to the anchor and configure the finance parameters.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-15 Link Spokes - Field Description

Field Name Description Spoke Click the search icon to select a spoke for the program. A Spoke can be a customer or a non-customer. Interest Bearing Party Select the party that bears the interest.

The available options are:- Anchor

- Spoke

Import Factor Click the search icon to select the import factor to be linked to the spoke.

This field is displayed only if Two Factor Applicable is enabled in the Basic Information tab.

Insurance Company Click the search icon to select the insurance company to be linked to the spoke.

This field is displayed only if Insurance Applicable is enabled in the Basic Information tab.

Auto-Initiate Finance Select Yes to enable auto financing for this spoke. Else select No. Preferred Disbursement Mode Select the preferred mode of disbursement for this spoke.

The available options are:- Account Transfer

- Cheque

- EFT

This field is mandatory if Auto-Initiate Finance is enabled.

Auto Settlement Applicable † Select Yes to enable automated settlement (repayment) for this spoke. Else select No. Preferred Settlement Mode Select the preferred mode of settlement for this spoke.

The available options are:- Account Transfer

- Cheque

- EFT

Min. Finance (%) Specify the minimum finance percentage allowed for financing a transaction of this spoke. Max. Finance (%) Specify the maximum finance percentage allowed for financing a transaction of this spoke. Min. Tenor (Days) Specify the minimum tenor allowed for financing a transaction of this spoke. Max. Tenor (Days) Specify the maximum tenor allowed for financing a transaction of this spoke. Grace Days Specify the number of grace days.

This is the period post the finance due date, within which the finance can be settled without penalty.

Stale Period (Days) Specify the number of stale days.

This is the period post the invoice date, after which the invoice becomes stale and will not be financed automatically any more for this program.

With Recourse Select Yes to specify that the finance is allowed with recourse, else select No. Disbursement Currency Select the currency in which the finance should be disbursed for this spoke.

This field is mandatory when Auto-Initiate Finance is enabled.

Auto Debit Applicable Select Yes to enable auto debit to recover the outstanding finance due from the borrower for this spoke. Else select No. Liquidation Order for Auto Debit Specify the default auto-debit liquidation order to be applied in case partial funds are debited from the payment party on auto-debit.

The available options are:- E - Penalty on Interest Outstanding

- O - Penalty on Principal Outstanding

- I – Monthly Interest Due

- D - Overdue Finance (Delinquent finances)

- F - Finance Due or Overdue (Outstanding Finances)

This field is mandatory if Auto Debit Applicable is enabled.

Auto-Debit Basis Select the basis on which the account should be debited on the finance/invoice due date.

The available options are:- Accepted Instruments - The account is auto-debited when the invoice/debit note is in the Accepted state, and Reconciliation Towards is set to Invoice.

- Financed Instruments - The account is auto-debited when the invoice/debit note is financed, irrespective of acceptance status, and Reconciliation Towards is set to Invoice.

- Accepted or Financed Instruments - The account is auto-debited when the invoice/debit note is either accepted or financed, and Reconciliation Towards is set to Invoice.

- All Instruments - The account is auto-debited when Reconciliation Towards is set to Invoice, irrespective of whether the invoice/debit note is accepted or financed.

This field appears only if Auto Debit Applicable is set to Yes.

Disbursement Auth Required Select Yes to enable authorization for the disbursement transactions for this spoke. Else select No. Disbursement Auto Processing Select Yes to enable automatic processing of disbursement transactions for this spoke. Else select No. Amendment Auth Required Select Yes to enable authorization for the amendment transactions for this spoke. Else select No.

This field appears only if the Product selected has Amendment Applicable enabled.

Amendment Auto Processing Select Yes to enable automatic processing of amendment transactions for this spoke. Else select No.

This field appears only if the Product selected has Amendment Applicable enabled.

Settlement Auth Required Select Yes to enable authorization for the settlement transactions for this spoke. Else select No. Settlement Auto Processing Select Yes enable automatic processing of settlement transactions for this spoke. Else select No. Conditions for Marking Invoice Paid Select whether the financed invoice should be marked as Paid during Disbursement or during Settlement.

This field appears only when the Buyer is the borrower, for which the Product should have one of the following configurations:- Product Type = Buyer Centric; Product Category = Invoice; Borrower = Anchor

- Product Type = Supplier Centric; Product Category = Invoice; Borrower = Spoke

The options available in this field are:- Disbursement:

- If the invoice is financed to the maximum finance percentage, then during disbursement it is marked as Paid. The outstanding invoice amount, if any, is handled as per margin handling settings.

- If the invoice is not financed to the maximum finance percentage, then during disbursement, the invoice is marked as Partially Paid. Once the outstanding invoice amount is settled based on margin handling settings, then the invoice is marked as Paid.

- Settlement:

- If an invoice is financed to the maximum finance percentage, and if all underlying finances are fully paid off during settlement, then the invoice is marked as Paid.

- If the invoice is not financed to the maximum finance percentage, then during settlement the invoice is marked as Partially Paid. It is then marked as Paid, once the outstanding payment is made.

Margin Handling Select how the margin should be handled.

The available options are:- Auto-Settle and Refund to Supplier

- Manually Settle O/s Finances

- Refund to the Supplier

- Settle with Outstanding Finances

This field is displayed only if the Product selected in this program has Product Category selected as Invoice.

Margin Payment Mode Select the mode of payment for the margin amount.

The available options are:- Account Transfer

- Cheque

- EFT

This field is displayed only if Margin Handling is selected as Refund to the Supplier or Auto-Settle and Refund to Supplier.

Interest Refund Handling Select how the interest refund should be handled.

The available options are:- Auto-Settle and Refund to IBP

- Manually Settle O/s Finances

- Refund to the Interest Bearing Party

- Settle with Outstanding Finances

Interest Refund Payment Mode Select the mode of payment for the interest refunds.

The available options are:- Account Transfer

- Cheque

- EFT

This field is displayed only if Interest Refund Handling is selected as Refund to the Interest Bearing Party or Auto-Settle and Refund to IBP.

Excess Handling Select how excess payment made towards settling of outstanding invoice/finance, should be handled.

The available options are:- Auto-Reconcile

- Auto-Reconcile and Refund

- Manually-Reconcile

- Refund to beneficiary or payment party

Excess Refund Party Select the party to refund the excess amount to.

The available options are:- Beneficiary/Counter Party

- Payment Party

Excess Refund Payment Mode Select the mode of payment for the excess payment refund.

The available options are:- Account Transfer

- Cheque

- EFT

Multiple Disbursement Allowed Select Yes to enable multiple finance disbursements for an invoice. Else select No. Min Assignment (%) Specify the minimum percentage of the assignment amount allowed for financing a transaction of this spoke. Max Assignment (%) Specify the maximum percentage of the assignment amount allowed for financing a transaction of this spoke. Credit Cover (%) Specify the credit cover percentage allowed for the transaction for this spoke.

This field is displayed only if Assignment event in the Credit limit Mapping tab of Product Parameters is same as the limit type maintained in the Limit Type for Invoice Approval in System Parameters.

Credit Cover Start Date Specify the credit cover start date for the transaction for this spoke.

This field is displayed only if Assignment event in the Credit limit Mapping tab of Product Parameters is same as the limit type maintained in the Limit Type for Invoice Approval in System Parameters.

Credit Cover End Date Specify the credit cover end date for the transaction for this spoke.

This field is displayed only if Assignment event in the Credit limit Mapping tab of Product Parameters is same as the limit type maintained in the Limit Type for Invoice Approval in System Parameters.

Liquidate Pre-Shipment Finances † † Switch the toggle ON to enable linking of Pre-Shipment and Post-Shipment programs. Pre-Shipment Program Displays the applicable pre-shipment programs auto populated for the selected supplier-buyer combination.

This field is enabled only if Liquidate Pre-Shipment Finances is enabled.

Pre-Shipment Finances Liquidation Preference † Select the liquidation preference for the settlement of pre-shipment finance.

The available options are:- Invoice Linked with PO

- FIFO

- Invoice Linked with PO and FIFO

This field is enabled only if Liquidate Pre-Shipment Finances is enabled.

Allow Back-Dated Disbursements Select Yes to enable back-dated disbursements for the transaction of this spoke. Else select No. FCI Enrichment Parameters This section is displayed only if Two Factor Applicable toggle is switched ON.

Note:

An FCI Message 1 - Seller’s Information is generated upon the onboarding of a new Seller in the application (Program Parameters) for a Factoring Program with Factoring Profile designated as Export Factoring. This message is subsequently transmitted to the Import Factor via an FCI message batch job.Note:

An FCI message is generated whenever a Spoke is newly added to the program.Net Payment Terms Specify the number of days after which the invoices can be due for payment. Primary Discount Days Specify the number of days applicable for the primary discount. Primary Discount % Specify the primary discount percentage. Secondary Discount Days Specify the number of days applicable for the secondary discount. Secondary Discount % Specify the secondary discount percentage. Expected Total Seller Turnover Specify the total turnover expected from the seller. Expected Number of Buyers in your Country Specify the number of buyers expected in the import factor's country for this seller. Expected Number of Invoices to your Country Specify the expected number of invoices which will be raised on the import factor's country for this seller. Expected Number of Credit Notes to your Country Specify the expected number of credit notes which will be raised on the import factor's country for this seller. Expected open account turnover to your country Specify the open account turnover to on the import factor's country for this seller. Expected other turnover to your Country Specify any other turnover to on the import factor's country for this seller. Other Factors Specify the import factors involved in the factoring i.e., if more one than factor is involved for the same seller in the same country. Normal Terms of Delivery Specify the delivery terms, if any. Services Required Specify the services required from the import factor. The available options are:- Full Service, non recourse

- Recourse

- Collection only

- Special service (RESCUE, POM, IV)

- Non-notification

- Buyer to pay directly to EF/Seller

- Agency Agreement

Remarks (Message Text) Specify the comments regarding the factoring, if any. Invoice Currencies Select the currency for invoice. You can select multiple currencies in this field. Charge Back % Specify the charge back percentage in cases of dispute. Charge Back Currency Specify the currency of the charge back amount. Charge Back Amount Specify the charge back amount in cases of dispute. Note:

† Pre-Shipment settlement gets initiated only if Auto Settlement Applicable is enabled.Note:

†† For existing implementations of SCF, Liquidate Pre-Shipment Finances and Pre-Shipment Finances Liquidation Preference will be captured in Program Parameters basis their value in System parameters. System Parameters will be defaulted to ‘No’ but can be changed to ‘Yes’ at the discretion of the bank or Financial Institution during upgrade to current release version. In such cases the application will establish Pre-Post shipment finance linkage if a valid pre-shipment linkage is foundNote:

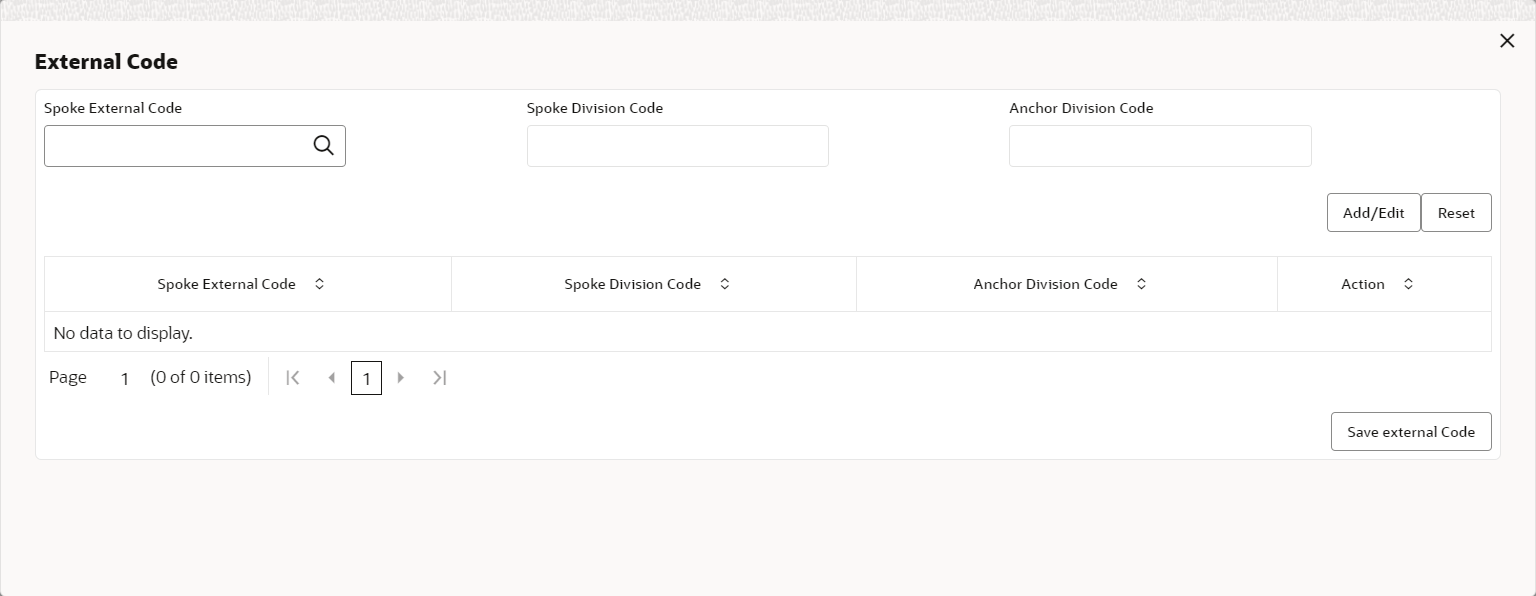

For existing implementations, Conditions for Marking Invoice Paid will be defaulted to blank implying that the invoice will be marked as Paid, only if an invoice payment is directly received. Banks or Financial Institutions should modify the field to - Click External Code link to specify the external spoke

codes.The External Code pop-up screen displays.

- In the Spoke External Code field, click the search icon to select the external spoke code. The corresponding Spoke Division Code and Anchor Division Code gets displayed in the adjacent columns.

- Click Add/Edit to add the details in the grid.

- Repeat these steps to add more external codes.

- If required, click Options icon under the Action column in the grid and then click Delete to remove the record.

- Click Save external Code to save the external code details.

- Click Add/Edit to add the record to the grid.

- Click Reset to clear the selected values, if required.

- Perform the following steps to take action on the records in the grid.

- Click Options icon in the Action column to edit or delete the row.

- In the Document Upload section, click

Add to upload the documents.

- Click the Document Status drop-down to filter the documents based on status.

- Click Save to save the record and send it for authorization (if applicable).

Parent topic: Program Parameters Maintenance