- Supply Chain Finance User Guide

- Maintenance for Supply Chain Finance

- Interest Maintenance

- Interest Rate Decisioning

- Create Interest Rate Decisioning

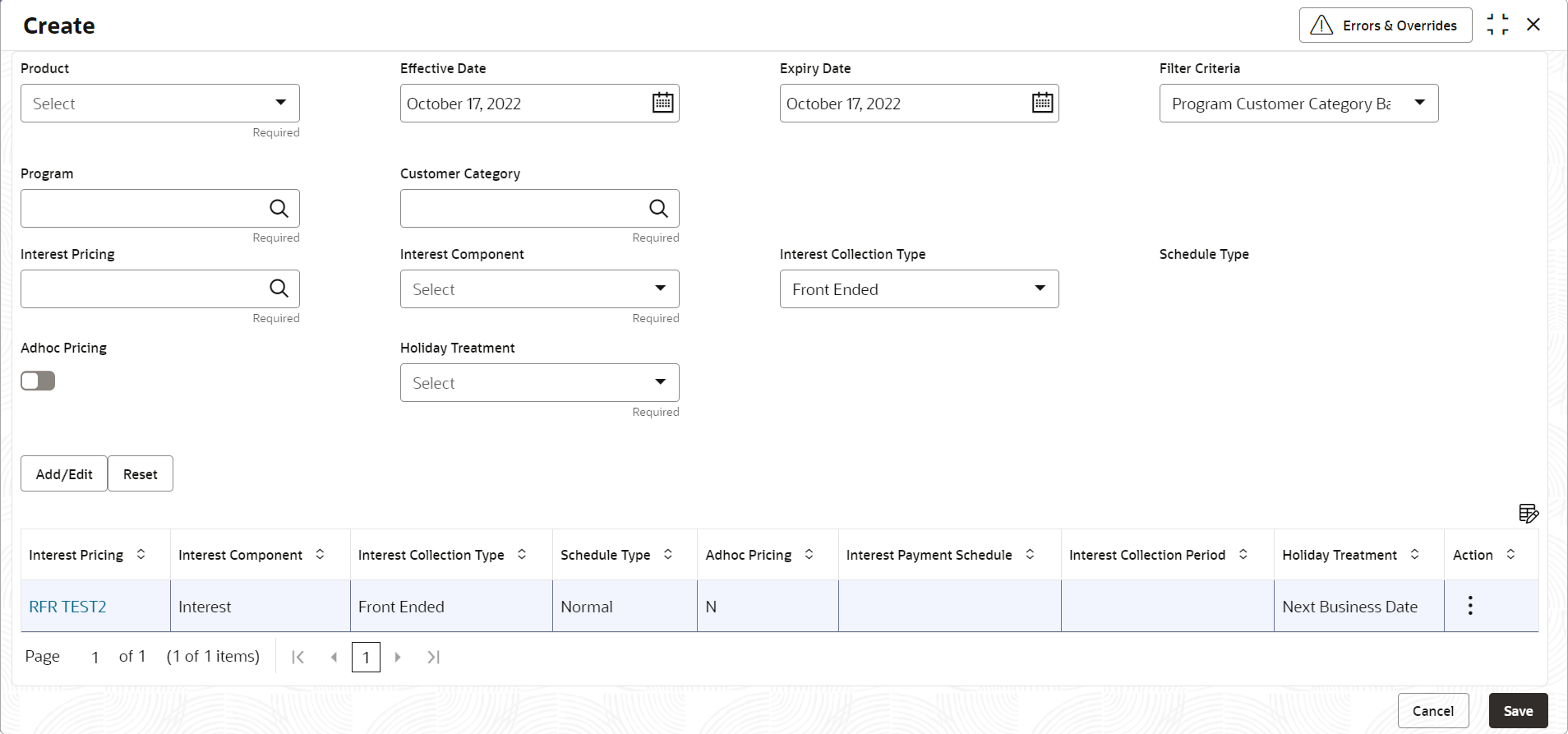

2.8.2.1 Create Interest Rate Decisioning

This topic describes the systematic instruction to map the interest pricing rule or template to appropriate product/program/party.

- On Home screen, click Supply Chain Finance. Under Supply Chain Finance, click Maintenance.

- Under Maintenance, click Interest. Under Interest, click Interest Rate Decisioning.

- Under Interest Rate Decisioning, click Create

Interest Rate Decisioning.The Create Interest Rate Decisioning screen displays.

Figure 2-55 Create Interest Rate Decisioning

- Specify the fields on Create Interest Rate Decisioning

screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-34 Create Interest Rate Decisioning - Field Description

Field Name Description Product Select the product to create the rate decisioning for. Effective Date Click the calendar icon to select the date from when the rate decisioning is effective. Expiry Date Click the calendar icon to select the date when the rate decisioning expires. Filter Criteria Select the appropriate filter criteria for the rate decisioning.

The available options are:- Program Party Based

- Party Based

- Program Based

- Program Customer Category Based

- Customer Category Based

- Default

Program Click the search icon to select the program for which the interest rate is to be mapped.

This field appears only if the Filter Criteria is selected as Program Based.

Party Click the search icon to select the party for which the interest rate is to be mapped.

This field appears only if the Filter Criteria is selected as Party Based.

Customer Category Click the search icon to select the customer category for which the interest rate is to be mapped.

This field appears only if the Filter Criteria is selected as Customer Category Based.

Interest Pricing Click the search icon to select the interest pricing to be applied for the rate decisioning. Interest Component Select the interest component.

The available options are:- Interest

- Penalty on Principal

- Penalty on Interest

This field is defaulted to Interest if the Interest Pricing selected is defined as a risk free rate, and the RFR Method is selected as Lockout or Interest Rollover.

Interest Collection Type Select whether the interest collection type is Front Ended or Rear Ended.

- This field is defaulted to the Rear Ended if the Interest Component is selected as Penalty on Principal or Penalty on Interest.

- This field is defaulted to Rear Ended if the Interest Pricing selected is defined as a risk free rate, and the RFR Method is selected as Look Back, Lockout, Interest Rollover or Plain.

Schedule Type Select whether the interest rate scheduling type is Compounding or Normal.

This field is defaulted to Normal if the Interest Collection Type is selected as Front Ended and the Interest Component is selected as Interest.

Spread/Margin Computation Method Select whether the spread/margin computation method is Compounding or Normal.

This field is displayed only if the Interest Pricing selected is defined as a risk free rate.

Spread Adjustment Computation Method Select whether the spread adjustment computation method is Compounding or Normal.

This field is displayed only if the Interest Pricing selected is defined as a risk free rate.

Rate Compounding Method Select the rate compounding method.

The available options are:- CCR (Cumulative Compounding Rate)

- NCCR (Non Cumulative Compounding Rate)

This field is displayed only if the Interest Pricing selected is defined as a risk free rate, and Rate Compounding checkbox is selected.

Adhoc Pricing Switch the toggle ON to enable adhoc pricing if the adhoc limits are utilized during finance disbursement. Interest Payment Schedule Select whether the interest collection schedule is Bullet or Monthly.

This field is displayed only if Interest Collection Type is selected as Rear Ended and Interest Component is selected as Interest.

Interest Collection Period Select the time period of the month for interest collection. This is calculated from the disbursement date.

The available options are:- End of Period - The interest will be collected on the last working day of the month.

- Beginning of Period - The interest will be collected on the 1st working day of the next month.

- Value Date - The interest will be collected on the same date as the disbursement for the subsequent months.

This field is displayed only if Interest Payment Schedule is selected as Monthly.

Holiday Treatment Select the day to consider if the interest date falls on a holiday.

The available options are:- Next Business Date

- Previous Business Date

- Click Add/Edit to add the details to the grid.

- Perform the following steps to take action on the records in the grid:

- Select the record in the grid and then click Options icon in the Action column.

- Click Edit to edit the selected row.

- Click Delete to delete the selected row.

- Click Save to save the record and send it for authorization.

Parent topic: Interest Rate Decisioning