- Receivables and Payables User Guide

- Dynamic Discount Management

7 Dynamic Discount Management

This topic describes the systematic instruction to create discount rate rules on behalf of supplier or buyer and link them to instruments such as invoices and debit notes..

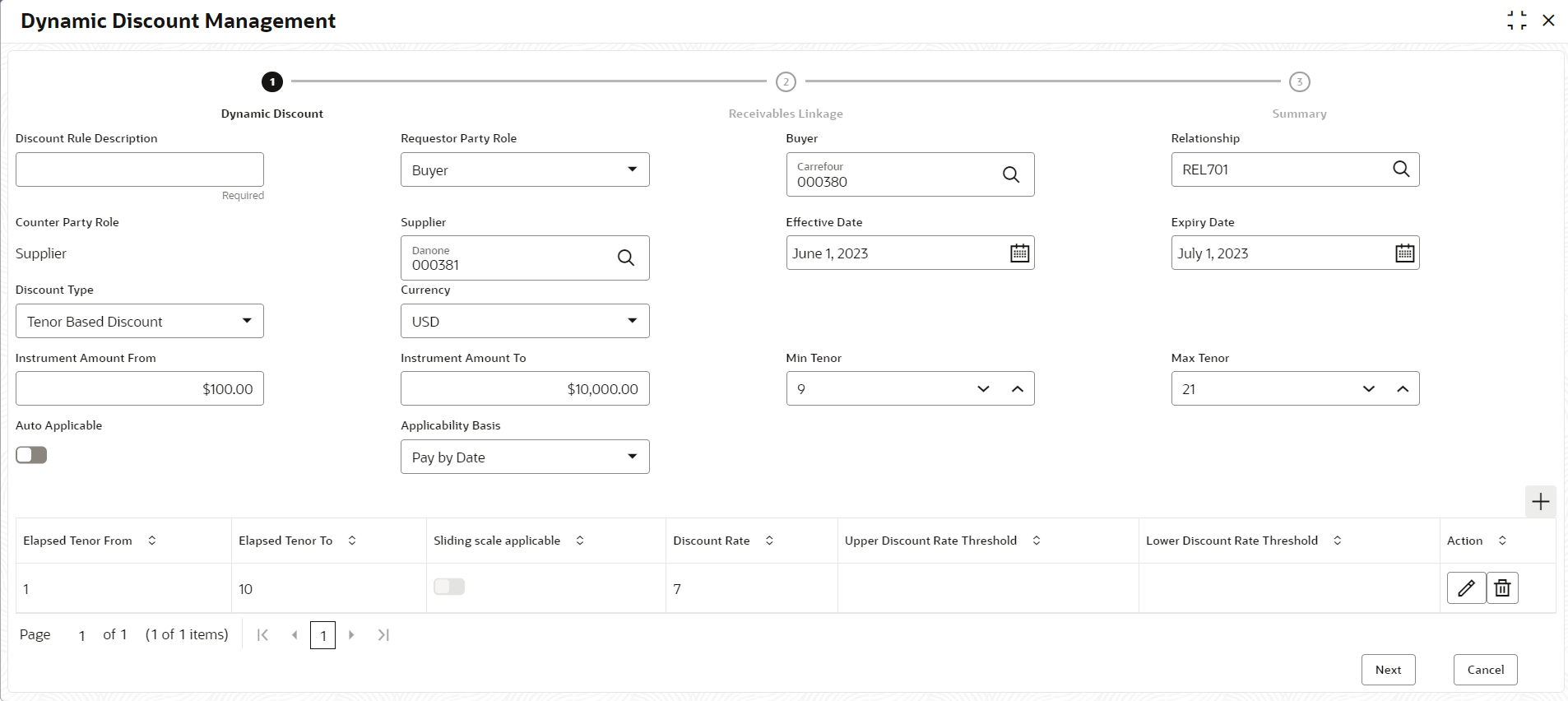

Dynamic Discount

- On Home screen, click Receivables And Payables. Under Receivables And Payables, click Dynamic Discount Management.The Dynamic Discount step in the Dynamic Discount Management screen displays.

- Specify the fields on Dynamic Discount step to create a

discounting rule.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 7-1 Dynamic Discount - Field Description

Field Name Description Discount Rule Description Specify a description for the discount rule.

This field cannot be modified once authorized.

Requestor Party Role Select role of the requestor party as buyer or supplier. Buyer Click the search icon and select the buyer party. This field is displayed only if Requestor Party Role is selected as Buyer.

Supplier Click the search icon and select the supplier party. This field is displayed only if Requestor Party Role is selected as Supplier.

Relationship Click the search icon and select the relationship code of the requestor party. Counter Party Role Counterparty is auto-populated based on selected requestor party role. Buyer Click the search icon and select the counterparty. This field is displayed is auto-populated based on selected requestor party role.

Supplier Click the search icon and select the counterparty. This field is displayed is auto-populated based on selected requestor party role.

Effective Date Click the calendar icon and select the date from when the discount template takes effect. Expiry Date Click the calendar icon and select the date till when the discount template can be used. Discount Type Select whether the discount should be fixed or tenor based. Discount Rate Specify the rate of discount.

This field is displayed only when ‘Fixed Discount’ is selected as the discount type.

Currency Select the currency of the instrument to apply the discount rule to. Instrument Amount From Specify the starting amount of the range for the instrument. The discount rate is applied to those instruments whose amounts are greater than or equal to the specified amount. Instrument Amount To Specify the ending amount of the range for the instrument. The discount rate is applied to those instruments whose amounts are less than or equal to the specified amount. Min Tenor Specify the minimum tenor for the instrument. Max Tenor Specify the maximum tenor for the instrument. Auto Applicable Switch the toggle ON if the discount rule should be applied automatically to eligible instruments, once created and authorized. Applicability Basis Select the basis for applicability of the discount rule.

The options are:- Pay by Date

- Fixed Payment Date

- Both

This field is editable only if the Auto Applicable toggle is disabled.

Auto Applicable Basis Select the basis for auto-applicability of the discount rule.

The options are:- Pay by Date

- Fixed Payment Date

This field is editable only if the Auto Applicable toggle is enabled.

Early Payment Date Click the calendar icon and select the date for early payment.

This field is displayed only when value for ‘Auto Applicable Basis’ is selected as ‘Fixed Payment Date’.

Grid This grid is displayed only if the selected discount type is ‘Tenor Based Discount’. Add Click Add icon to add the tenors and their respective discounts. Elapsed Tenor From Select the number of days from the start of the tenor after which the discount offer should be applicable. Elapsed Tenor To Select the number of days from the start of the tenor up to which the discount offer should be applicable. Sliding scale applicable Switch this toggle ON, to enable a sliding discount rate. Specify the upper and lower discount rate thresholds if this toggle is enabled. Discount Rate Specify the discount percentage. This column is displayed only if the Sliding scale applicable toggle is disabled.

Upper Discount Rate Threshold Specify the upper discount percentage applicable for the sliding rate. Lower Discount Rate Threshold Specify the lower discount percentage applicable for the sliding scale. Action Displays the following options to edit or delete the tenor record.- Click Edit to edit a row.

- Click Delete to remove a row.

- Perform any of the below action from the Dynamic

Discount step.

- Click Next to go to the Receivables Linkage step.

- Click Cancel to cancel the creation of the discounting rule.

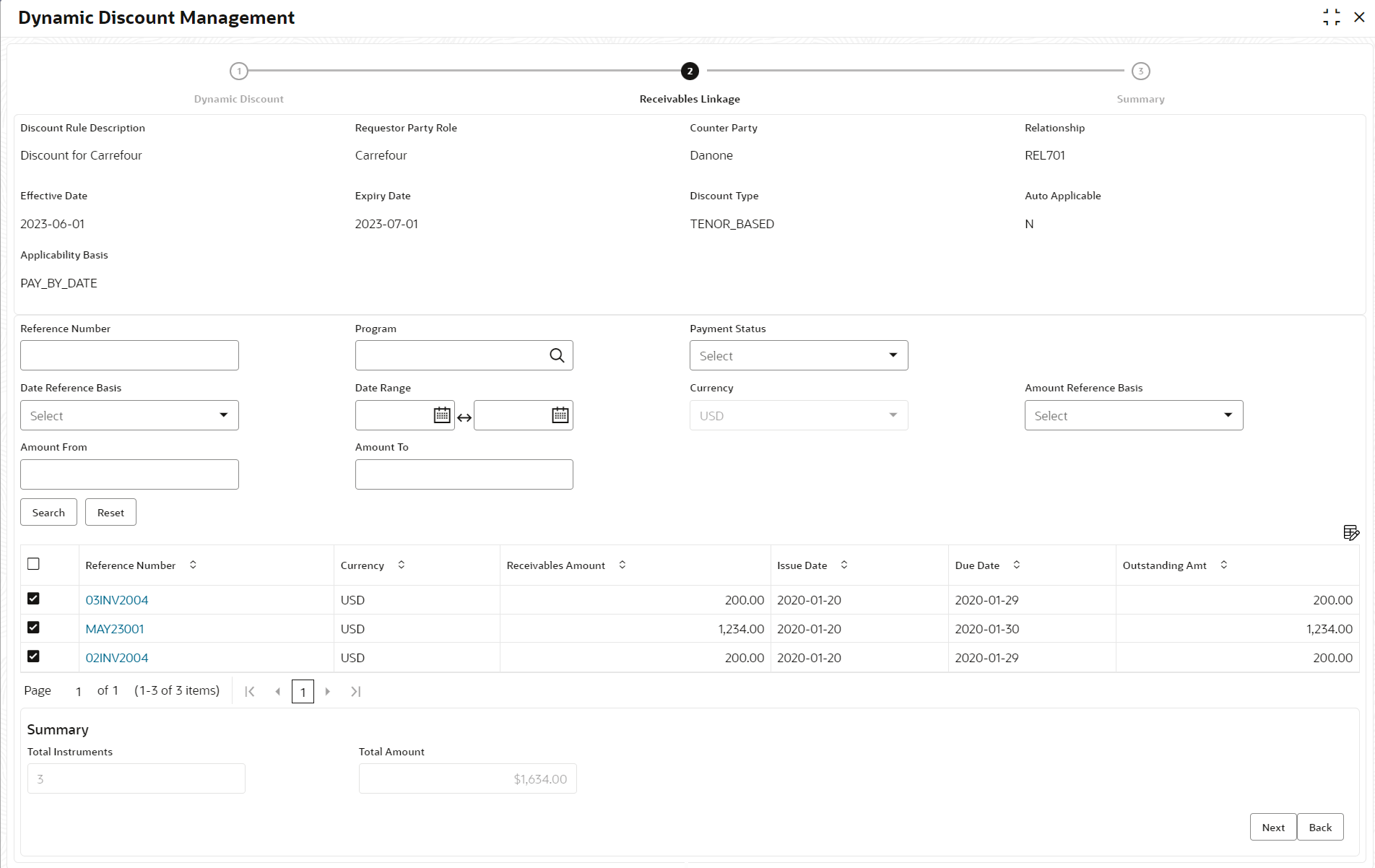

Receivables Linkage

This step displays a list of instruments that are eligible for discount rule linking.

- Click Next on Dynamic Discount

step.The Receivables Linkage step displays.

- Specify the fields on Receivables Linkage step.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 7-2 Receivables Linkage - Field Description

Field Name Description Discount Rule Description Displays the description of the discount rule being created. Requestor Party Displays the name of the requestor party. Counter Party Displays the name of the counter party. Relationship Displays the relationship code associated with the requestor and counter parties. Effective Date Displays the date from when the discount rule is effective. Expiry Date Displays the date up to which the discount rule is effective. Discount Type Displays the type of the discount, whether fixed or tenor based. Auto Applicable Displays Y if the discount rule is to be applied automatically, and N otherwise. Applicability Basis Displays the basis of discount applicability, if Auto Applicable is N. Auto Applicable Basis Displays the basis of discount applicability, if Auto Applicable is Y. Search fields This section displays various fields to search for instruments like invoices and debit notes, to link to the discount rule. Reference Number Specify the unique reference number to search for instruments. Program Click the search icon and select the program to search for instruments. Payment Status Select the payment status to search for instruments. Date Reference Basis Select the date reference basis to search for instruments based on a specific date, such as date of creation of the instrument, or due date, and so on. Date Range Click the calendar icons and select the start and end dates for the date range search. Currency Select the currency to search for instruments. Amount Reference Basis Select the amount reference basis to search for instruments based on a specific amount, such as acceptance amount, financeable amount. Amount From Specify the lower limit for the amount range search. Amount To Specify the upper limit for the amount range search. - Once you specify the search criteria, Click Search to

search the receivables records.The list of receivables records displays.

Table 7-3 Receivables Linkage - Field Description

Field Name Description Reference Number Displays the reference number of the instrument. This is a hyperlink which when clicked displays the details of the instrument. Currency Displays the currency of the instrument. Receivables Amount Displays the instrument amount. Issue Date Displays the date of issue of the instrument. Due Date Displays the due date of the instrument. Outstanding Amount Displays the amount which is yet to be paid. Total Instruments Displays the total number of instruments selected, for linking the discount rule to. Total Amount Displays the total outstanding amount of the selected instruments. - Select the receivables record to link the discount rule to.

- Perform any of the below action from the Receivables

Linkage step.

- Click Next to go to the Summary step.

- Click Back to go to the Dynamic Discount step.

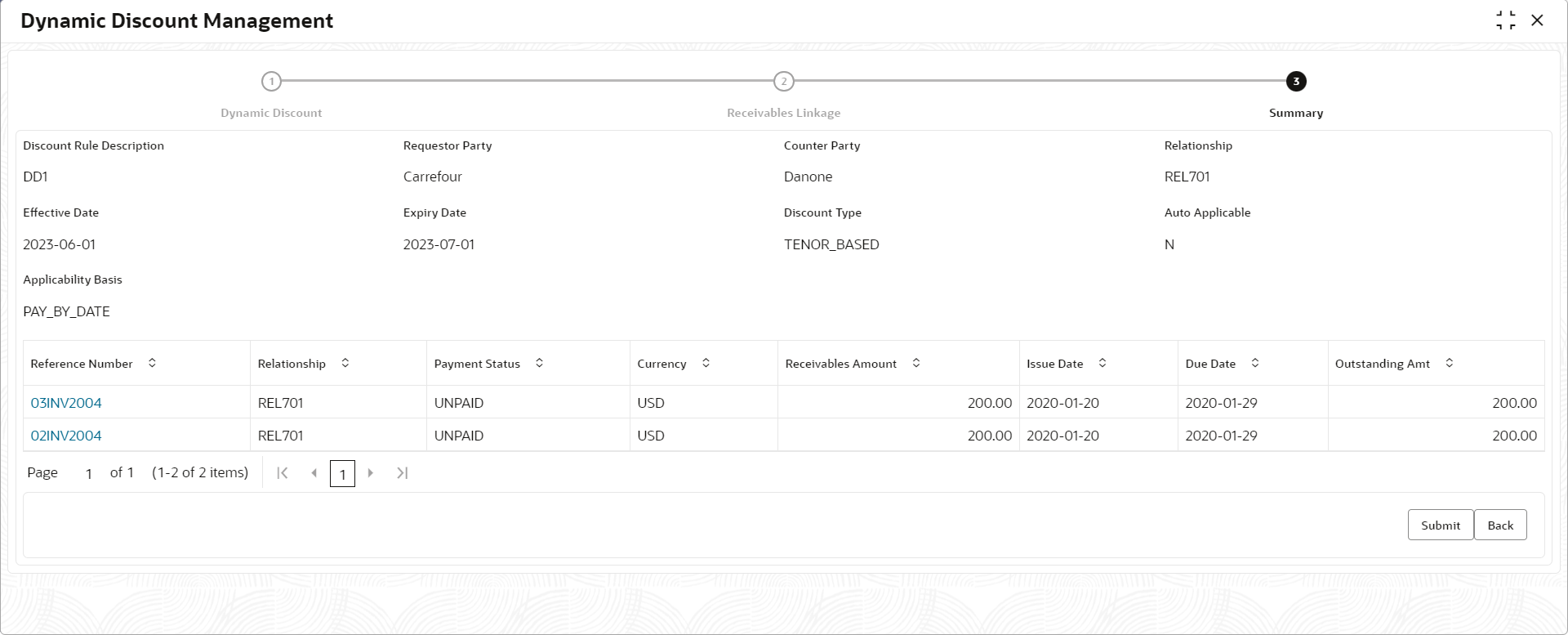

Summary

- Click next on Receivables Linkage step.The Summary screen displays.

Table 7-4 Summary - Field Description

Field Name Description Discount Rule Description Displays the description of the discount rule being created. Requestor Party Displays the name of the requestor party. Counter Party Displays the name of the counter party. Relationship Displays the relationship code associated with the requestor and counter parties. Effective Date Displays the date from when the discount rule is effective. Expiry Date Displays the date up to which the discount rule is effective. Discount Type Displays the type of the discount, whether fixed or tenor based. Auto Applicable Displays Y if the discount rule is to be applied automatically, and N otherwise. Applicability Basis Displays the basis of discount applicability, if Auto Applicable is N. Auto Applicable Basis Displays the basis of discount applicability, if Auto Applicable is Y. Reference Number Displays the reference number of the instrument. This is a hyperlink which when clicked displays the details of the instrument. Relationship Displays the relationship associated with the parties involved. Payment Status Displays the payment status of the instrument. Currency Displays the currency of the instrument. Receivables Amount Displays the instrument amount. Issue Date Displays the date of issue of the instrument. Due Date Displays the due date of the instrument. Outstanding Amount Displays the amount which is yet to be paid. - Review the details of the discount rule being created and perform any of the

following action from the Summary screen.

- Click Submit to save the discount details and submit it for authorization.

- Click Back to go to the Receivables Linkage screen.