3 File Upload

The file upload process facilitates users in submitting flat files containing pre-filled data to initiate the migration process. Flat files are specific to entities. This streamlined approach ensures a seamless and accurate transfer of information during the data migration.

- On the Home screen, click Loan Services. Under Loan Services, click Data Migration.

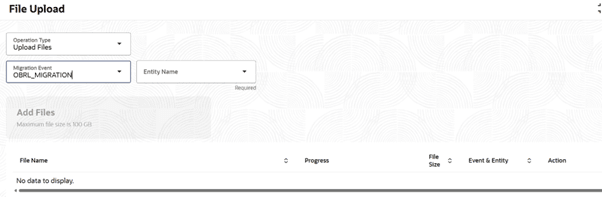

- Under Data Migration, click File Upload.The File Upload screen is displayed.The File Upload screen allows users to:

- Upload File - To upload a new file.

- View File - To view previously uploaded files.

Upload File

- Select the operation type as Upload File from the drop-down values.

- Select Migration Event as OBRL_Migration .

- Select Entity Name

from the drop-down values. The available options

and their applicability with respect to the

respective data being mandatory or conditional are

detailed below :

Table 3-1 Entity Name & their applicability

Entity Details Mandatory/Optional Disbursement Instructions Optional Disbursement Settlement Details Optional Bundle Details Optional Insurance Details Optional AccountMaster Mandatory Account Component Mandatory Interest Spreads Mandatory Bill Details Optional Bill Transaction Details Optional Additional Preference Details Optional InterestPreferences Mandatory CommonSettlementDetails Mandatory CollateralDetails Optional AccountDisbursement Mandatory AccountPartyRelationship Mandatory Preferences Mandatory Stagedefinition Mandatory LendingBalanceBasisDetails Mandatory AccountAddress Optional PaymentInstruction Mandatory AccountFeesPreference Optional StatementMaster Optional Statement Entries Optional Schedule Fees Optional Amendment Counter Optional - Disbursement Instructions

This entity is about the disbursements that has happened on the account in question. It also provides information for scheduled disbursements, if any.

- Disbursement Settlement Details

This entity is an extension of the previous one on disbursement wherein it provides the settlement data, as applicable to the said account.

- Bundle Details

A product may have a bundle associated to it. The account may or may not be extended the bundle benefits, depending on the bundle definition and the customer involved. This entity provides a comprehensive information on the bundle associated to the account in terms of its contents and applicability.

- Insurance Details

Insurance is one of the many components applicable to a loan product. If applicable, this entity provides details on the type of insurance and related aspects.

- AccountMaster

This entity provides a complete repository of the loan account in terms of the branch, product segment and product that it falls under, alongside further details in the form of currency and associated party.

- Account Component

An account will have multiple components derived from the Product. This data represents the applicability of the respective component to the account and related details in terms of interest basis, accrual applicability, waiver – to name a few.

- Interest Spreads

A Product can have multiple spreads, an account may or may not inherit all the applicable spreads depending on the applicable circumstances, the said entity provides details regarding all the relevant spreads for the account.

- Bill Details

As the name suggests, this entity provides comprehensive information on the bills generated for the customer with the due dates and amounts.

- Bill Transaction Details

This entity is an extension of the Bill details data wherein it provides further information on the bills getting satisfied on the customer making a payment against the same.

- InterestPreferences

Interest preferences are details with respect to the applicability of interest rates and index to the account considering the type of index, rate application and refresh frequency along with the final rate.

- CommonSettlementDetails

Details regarding the settlement and liquidation mode for transactions like disbursement and repayment are provided under this entity.

- CollateralDetails

Details regarding the collateral applicable to the account during disbursement are stored in this entity. The collateral details are in the form of collateral particulars and the amount that is considered for the loan account in question.

- AccountDisbursement

This entity provides details about the disbursement taken place on the account along with additional details on the transaction date and amount considering other components that may be involved during disbursement.

- AccountPartyRelationship

This entity, as the name suggests provides details about the party’s relationship with the account from a borrowing perspective – type of relationship, primary or secondary .

- Preferences

The retail lending product enables defining quite a few basic as well as advanced customer facing preferences that are in the form of events in a loan life cycle. This entity provides data regarding the said preferences since onboarding so as to validate the same in the future life cycle in retail lending.

- Stagedefinition

A loan account can have multiple repayment stages starting with equated periodic instalment, moratorium and interest only stages. Each stage can have its own features and interest distribution treatment, as applicable. This entity provides details regarding all such repayment stages, as applicable to the account.

- LendingBalanceBasisDetails

This entity holds the details of the past schedules of interest in terms of basis balance used and also the amount, since it is not going to be calculated in OBRLS. OBRLS also expects at present the due dates for all the future schedules to be present in this table. Schedules which are entirely in the future need not have the amounts populated here as OBRLS calculates them. For schedules within which migration date falls work on a hybrid mode – amount till the migration date is expected to be populated in the amount_due column and the rest of it would be calculated in OBRLS and the sum of the two would become the total interest amount due for the schedule. This table can also hold the data for the past unpaid fees, which OBRLS applies as-it-is.

- AccountAddress

As the name suggests, this entity provides the address of the account

- PaymentInstruction

Payment instructions are about the pre-configured auto-payment instructions applicable for an account for a certain date range. The auto payment instructions are effected based on the payment instructions.

- AccountFeesPreference

This entity provides details regarding fee components associated to the loan account. Details are in the form of the component details and frequency of fees to be levied for the said account.

- StatementMaster

This entity provides the master details of the statements generated for the account considering the statement frequencies defined at the Product level.

- Statement Entries

This entity is an extension of the Statement master wherein it provides the detailed data extracts of the statement for the account for the same to be stored and made available, as required, based on customer request. It can also hold the historical data, for inquiry purposes.

- Schedule Fees

This entity provides details about the periodic fees associated with the loan account along with the periodicity of the same

- Amendment Counter

The counters as applicable in the existing system need to be populated in this entity, since they are used for validations during future amendments being done in OBRLS.

- Disbursement Instructions

- View File

The View File is to view previously uploaded migration flat files.