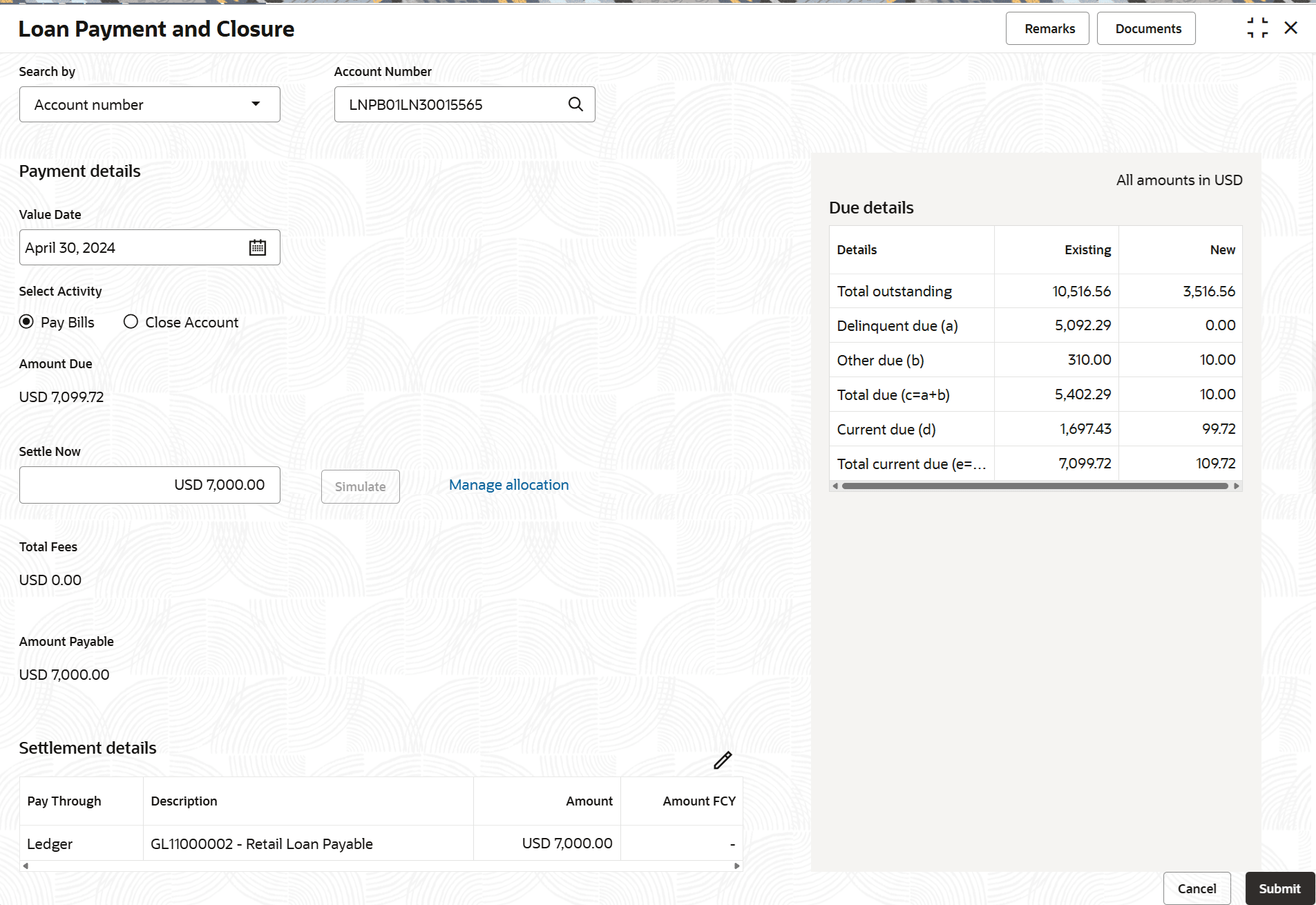

3.8.3.1.1.1 Paying by Pay Bills Option

You can pay the due loan amount by full payment or managing the allocation. This topic describes the systematic instructions for paying the bills.

To pay towards bills:

- From the Loan Payment and Closure screen, select the

Pay Bills option from the Select Activity

field.The fields related to Pay Bills are displayed.

- Perform the required payment actions. For more information on fields, refer to field

description table below:

Table 3-59 Pay Bills – Field Description

Field Description Select Activity Select the Pay Bills for paying the payment. Note:

For information on Close Account, refer Paying by Close Account Option.Amount Due Displays the total loan amount to be paid. Settle Now Displays the amount to be paid and it is editable. Once the amount is updated, the Simulate button is enabled. Also, the due details are adjusted and displayed.

Consider for future bills Select to consider the bill for future calculation. Total Fees Displays the fees amount to be paid. Amount Payable Displays the total payment loan amount. Note:

You should specify amount less than or equal to the total dues to proceed ahead successfully.Settlement Details Displays the settlement details. Note:

- If already the settlement details are added for the account, then the details are displayed in this section. If required, you can click Edit, to edit any settlement details.

- If no settlement details are present, then you can click Add Settlement and proceed ahead.

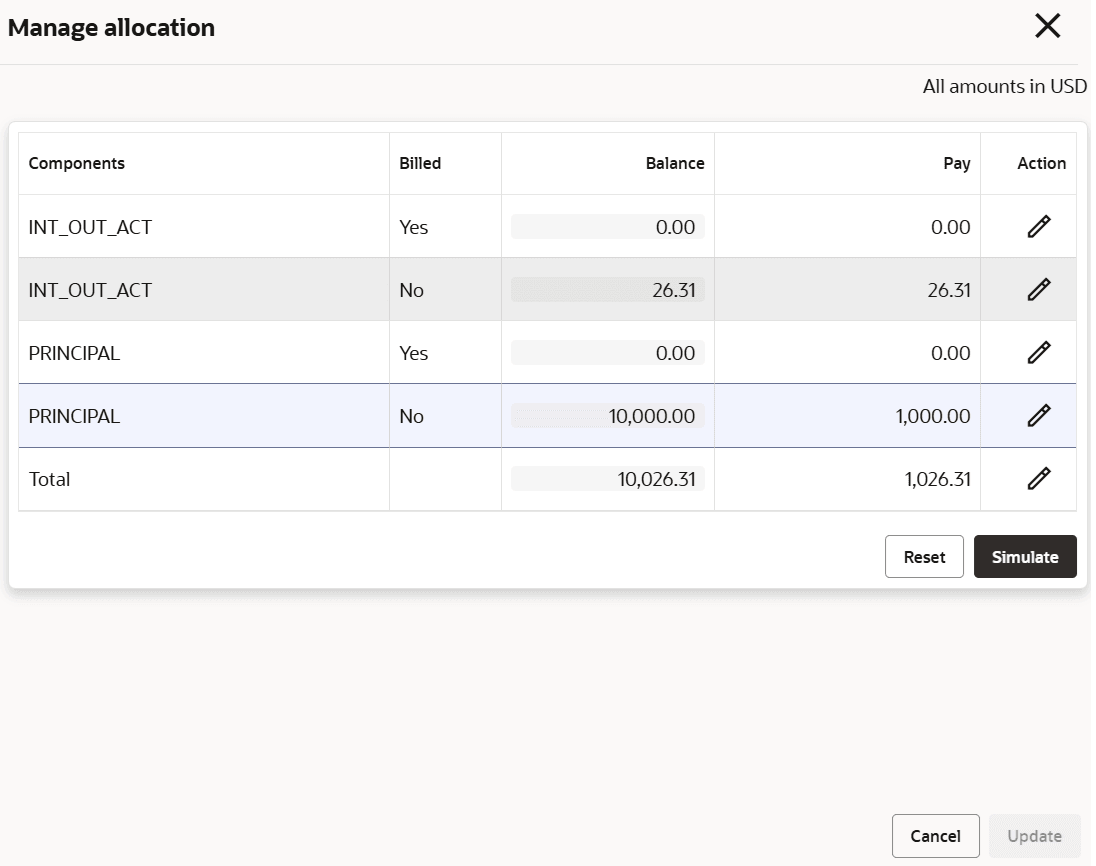

To manage the allocation:- click the Manage allocation link.

For more information on fields, refer to field description table

below:Table 3-60 Manage Allocation – Field Description

Field Description Component Displays the components for the allocation. Billed Displays whether the particular component is billed or not. Balance Displays the balance amount. Pay Displays the amount to be paid. You can edit the amount by double clicking the row. Action Displays the following icons: - Edit: Click this icon to edit the Pay amount.

- Save: Click this icon to save the updates. This icon is displayed only after the Edit icon is displayed.

Excess Amount Displays the excess amount, if any. If a payment transaction results in an excess amount after appropriation, that excess amount is captured for the specific transaction.

Note:

This field is displayed if there is a difference between the amount specified in the Settle Now and Pay fields. - Click Simulate.

- Click Update.

- Click Submit.The screen is successfully submitted for authorization.

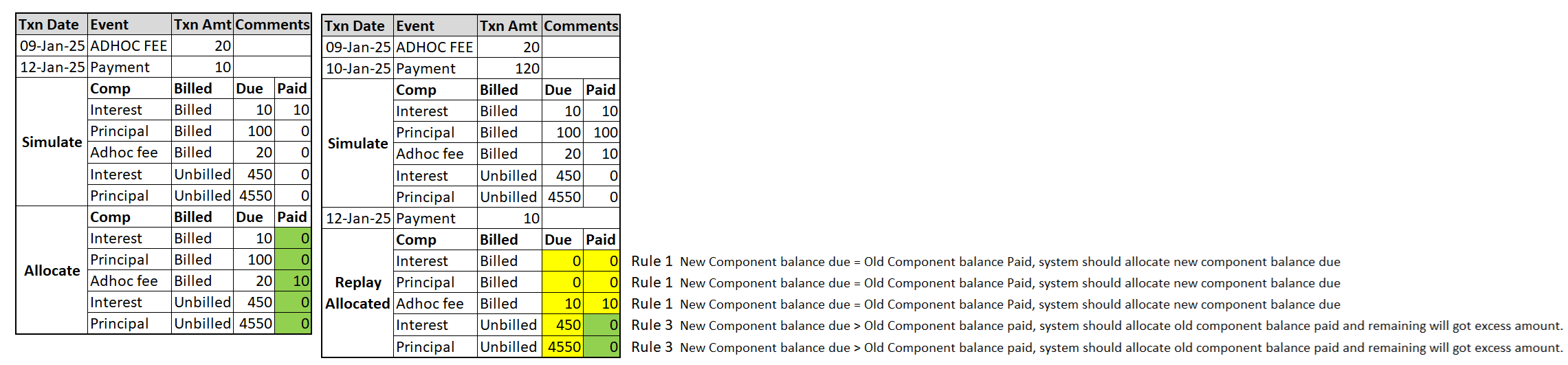

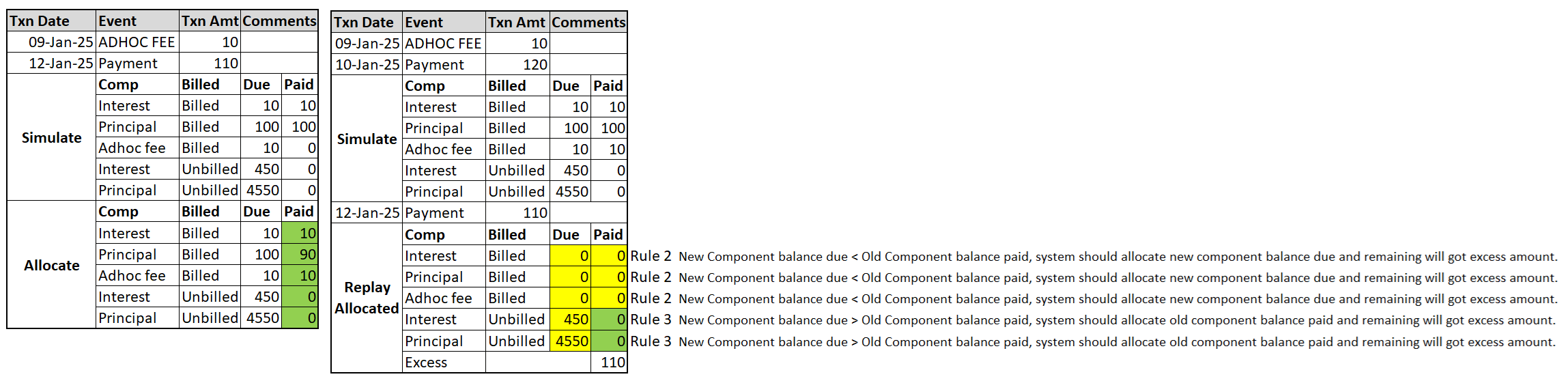

Allocated Payment Reversal Repost for Billing Accounts

Reversal and repost of allocated payment is based on below rules & the liquidation order:- Rule 1: New Component balance due = Old Component balance Paid, system should allocate new component balance due

- Rule 2: New Component balance due < Old Component balance paid, system should allocate new component balance due and remaining will got excess amount.

- Rule 3: New Component balance due > Old Component balance paid, system should allocate old component balance paid and remaining will got excess amount.

Table 3-61 Liquidation Order

Component Billed Interest Y Principal Y Adhoc Fee Y Interest N Principal N Example 1:

Bill is raised on 01-Jan-25 for 110 (Principal - 100 and Interest 10)

Adhoc Fee of 20 is posted on 09-Jan-25

Payment of 10 is posted on 12-Jan-25. This appropriates to Interest based on liquidation order. During allocation 10 is allocated to Adhoc Fee.

On receiving, backdated payment of 120 on 10-Jan-25, system performs below:

- Reverse 20 payment as of 09-Jan-25

- Apply 120 Payment with values date of 10-Jan-25

Interest - 10

Principal - 100

Adhoc Fee - 10

- Reapply 10 Payment of 12-Jan-25

Interest - 0 Rule 1

Principal - 0 Rule 1

Adhoc Fee - 10 - Rule 1

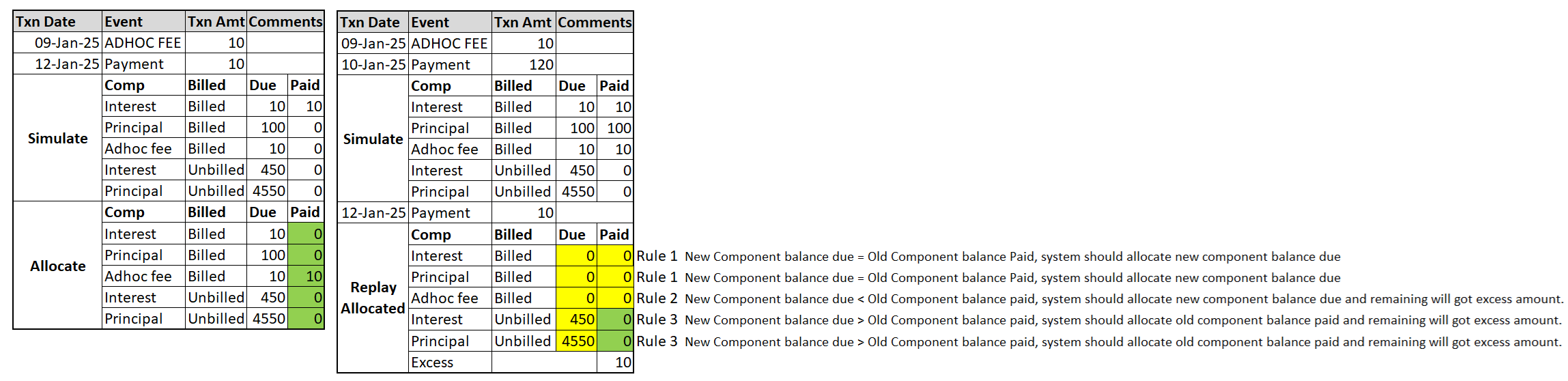

Example 2:

Bill is raised on 01-Jan-25 for 110 (Principal - 100 and Interest 10)

Adhoc Fee of 10 is posted on 09-Jan-25

Payment of 10 is posted on 12-Jan-25. This appropriates to Interest based on liquidation order. During allocation 10 is allocated to Adhoc Fee.

On receiving, backdated payment of 120 on 10-Jan-25, system performs below:- Reverse 10 payment as of 09-Jan-25

- Apply 120 Payment with value date of 10-Jan-25

Interest - 10

Principal - 100

Adhoc Fee - 10

- Reapply 10 Payment of 12-Jan-25

Interest - 0 Rule 1

Principal - 0 Rule 1

Adhoc Fee - 0 - Rule 2

Remaining goes to Excess - 10

Example 3:

Bill is raised on 01-Jan-25 for 110 (Principal - 100 and Interest 10)

Adhoc Fee of 110 is posted on 09-Jan-25

Payment of 10 is posted on 12-Jan-25. This appropriates to Interest, Prinicipal based on liquidation order. During allocation 110 is allocated as follow: P-90 I- 10, Adhoc Fee- 10

On receiving, backdated payment of 120 on 10-Jan-25, system performs below:

- Reverse 110 payment as of 09-Jan-25

- Apply 120 Payment with value date of 10-Jan-25

Interest - 10

Principal - 100

Adhoc Fee - 10

- Reapply 110 Payment of 12-Jan-25

Interest - 0 Rule 1

Principal - 0 Rule 1

Adhoc Fee - 0 - Rule 2

Remaining goes to Excess - 110

Parent topic: Payment and Closure Details for Billing Accounts