1 Retail Lending Servicing - An Overview

This topic describes the overview about Retail Lending Servicing application.

Oracle Banking Retail Lending Servicing Cloud Service has been purposefully crafted to address the diverse challenges faced by banks and financial institutions at every stage of their lending processes, ranging from initial design to final execution.

Oracle Banking Retail Lending Servicing Cloud Service caters to the multifaceted needs of banks and financial lending institutions by offering a comprehensive suite of capabilities spanning lending and leasing domains. This solution encompasses extensive functionalities that enable banks and financial institutions to swiftly introduce sophisticated products, expand their customer base, reduce overall ownership and transaction costs, all while enhancing security, reliability, performance, and scalability in their operations.

It has been meticulously developed from the ground up, incorporating microservices, Event-Driven Architecture, and a cloud-first approach. This design allows organizations to rapidly adapt to evolving market demands and evolving customer expectations, providing them with a competitive edge.

The unique value proposition of Oracle Banking Retail Lending Servicing Cloud Service lies in its ability to provide your business with entirely customizable processes and a top-tier framework that supports all your lending requirements. It offers unparalleled functional coverage and harnesses enterprise data to assist you in making informed decisions regarding product offerings and lending.

- loans (such as closed-end, fixed-rate, variable-rate, secured, and unsecured programs for vehicles, personal, and home equity loans)

- lines of credit (equipped with tools to manage revolving credit programs like home equity and unsecured lines of credit)

- leases (covering consumer financial and operating leases with comprehensive and sophisticated termination programs and processing capabilities).

This service offers multiple access channels, including traditional customer service models and web-based self-service options. Its customer-centric data model promotes transparency throughout the entire customer relationship, enabling banks and financial lending institutions to swiftly identify new revenue opportunities while encouraging cross-selling of products.

Moreover, Oracle Banking Retail Lending Servicing Cloud Service provides standard API's and web services to facilitate 24x7 customer self-service for all user transactions.

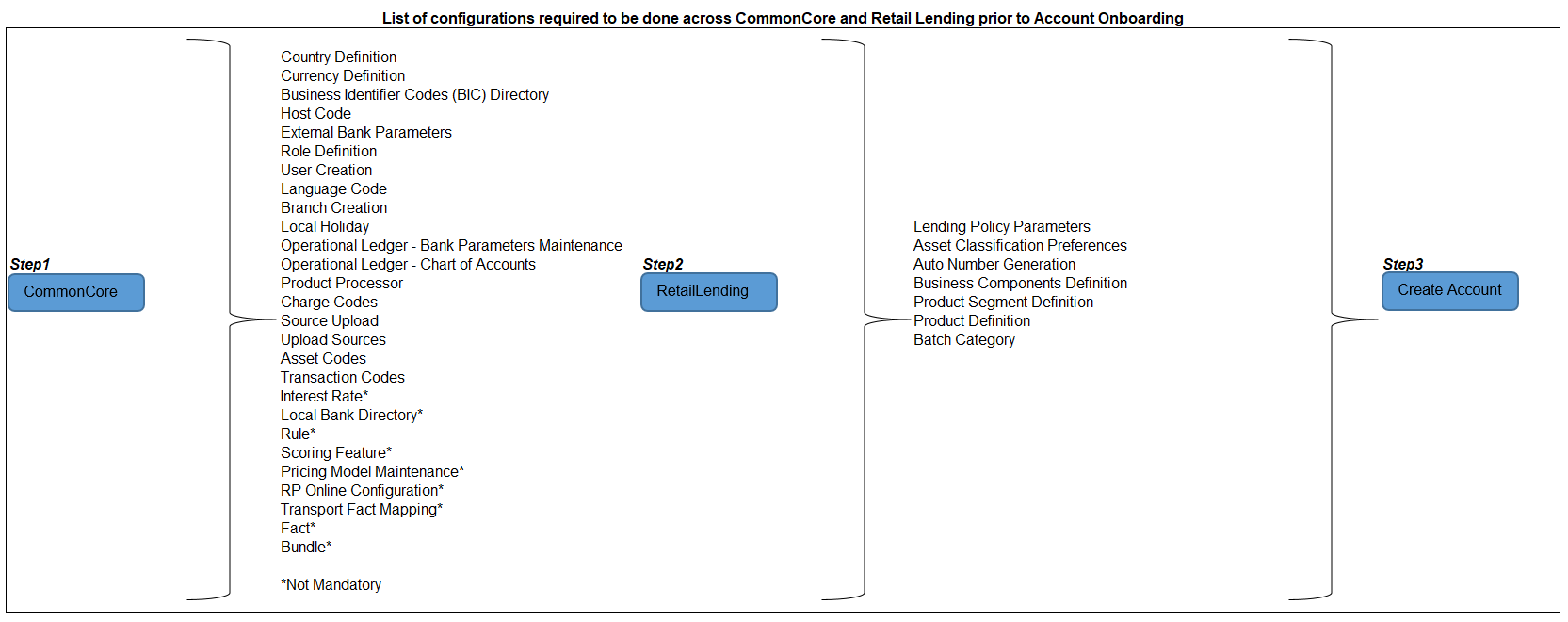

Figure 1-1 List of configurations required to be done across CommonCore and Retail Lending Servicing prior to Account Onboarding