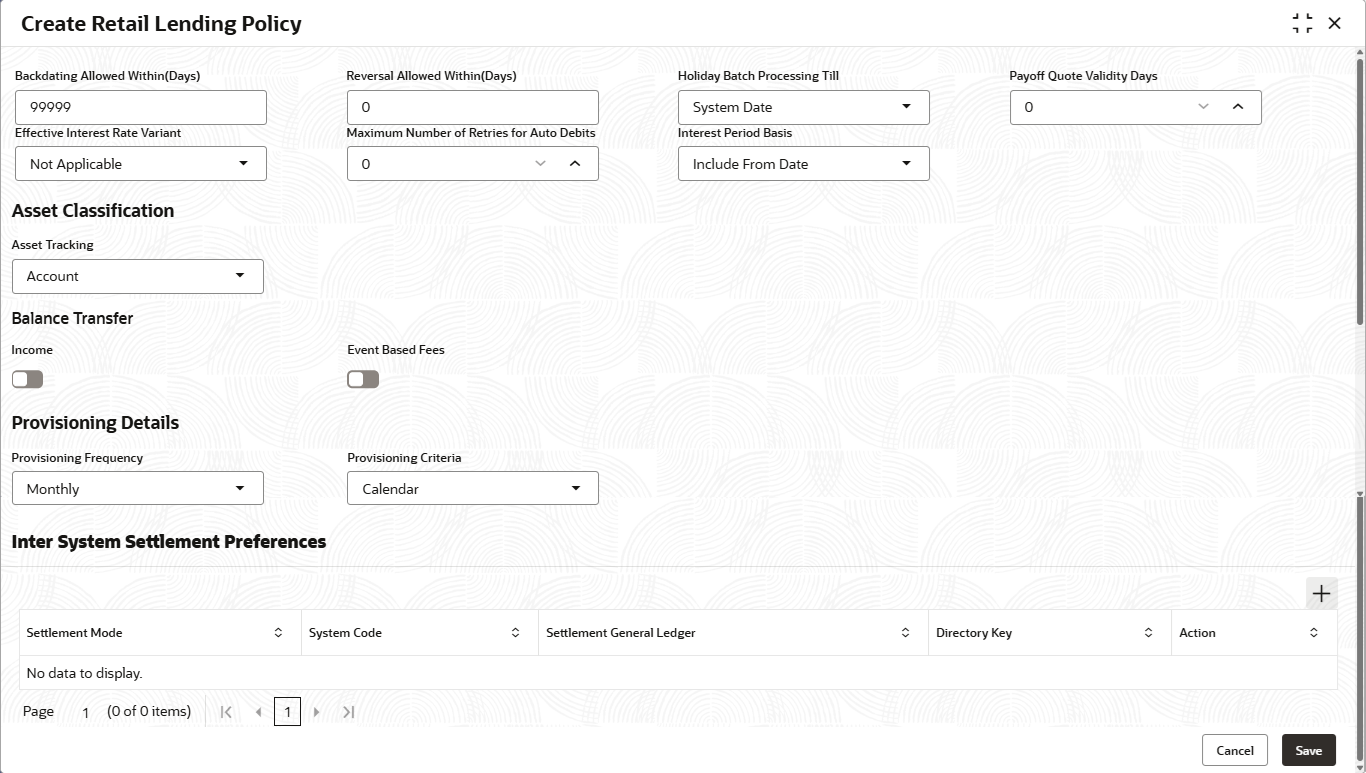

2.1.1 Create Retail Lending Policy

This topic describes the systematic instructions to create bank level Lending policy parameters.

- From Home screen, click Retail Lending. Under Retail Lending, click Maintenance.

- Under Maintenance, click Retail Lending

Policy, then click Create Retail Lending

Policy.The Create Retail Lending Policy screen is displayed.

- Specify the fields on Create Retail Lending Policy

screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-1 Create Retail Lending Policy - Field Description

Field Description Backdating Allowed Within(Days) Specify the number of days within which posting of back dated transaction is allowed. Reversal Allowed Within(Days) Specify the number of days within which reversal of a transaction is allowed. Holiday Batch Processing Till Select the end of day batch processing option in case of holidays. The allowed values are:- Next Working Day -

1

The bank will process until the next working day (minus one day), considering holidays.

- System Date

The bank will process up to the current system date.

The allowed values are defined by the lookup type HOLIDAY_PROCESS.

Payoff Quote Validity Days Specify the payoff quote validity days. During payoff quote generation, the bank derives the validity of the payoff quote using the logic Today + Future Payoff Days.

Effective Interest Rate Variant Select the interest rate variant from the drop-down list. The available options are:- Not Applicable

- APR (Annual Percentage Rate)

The allowed values are defined by the lookup type CASHFLOW_METHOD.

Maximum Number of Retries for Auto Debits Specify the maximum retries allowed in case of failure of auto debit of installment amount. Interest Period Basis Select the interest period basis from the drop-down list. The available options are:- Include From Date

- Include To Date

System will use this option to calculate the no of days for which interest will be computed, by including either start date of loan or including end date of loan.

The allowed values are defined by the lookup type INT_PERIOD_BASIS.

MAPR Specify the value for Military Annual Percentage Rate (MAPR). The MLA (Military Lending Act) applies to active duty servicemembers (including those on active Guard or active Reserve duty), spouses, and certain dependents. Servicemembers have specific rights under the Military Lending Act (MLA). Financial institutions cannot charge more than a set Military Annual Percentage Rate (MAPR), which includes costs such as fees, premiums, and other applicable charges when calculating the interest rate, with some exceptions.

This field applicable for US Entity.

Interest Rate for SCRA Specify the maximum interest rate that may be charged on during the period of the servicemember's qualifying military service. The SCRA offers additional safeguards for servicemembers to protect their rights when legal or financial transactions negatively impact them during military or uniformed service.

Under the Servicemembers Civil Relief Act (SCRA), the maximum interest rate that can be charged on certain types of loans.

This field applicable for US Entity.

Asset Classification Specify the fields under this section. Asset Tracking Select the asset tracking from the drop-down list. Specify the value for Status change batch processing for delinquency. The available options are:- Account - The asset classification applies specifically to the account in question, regardless of the status of other accounts held by the same Party.

- Party - The asset classification must consider all accounts, determine the worst status among them, and apply that classification at the Party level.

The allowed values are defined by the lookup type DQ_TRACKING.

Balance Transfer Specify the fields under this section. Retail lending supports balance transfers from one ledger bucket to another based on pre-configurations. The support is in the form of an asset classification plan wherein the lender can define the days past due, status codes and accrual status in the form of Continue accruals, Contingent accruals, Stop Accruals, and Reverse Accruals. Further, the interface provides an option to the lender to opt for balance movements among the various status codes. Income Switch

to enable the income. Balance transfer, as a

feature, will apply to the Income category across

interest and fee components due to a status change.

to enable the income. Balance transfer, as a

feature, will apply to the Income category across

interest and fee components due to a status change.

Switch

to disable the income. Balance transfer, as a

feature, will not apply to the Income category across

interest and fee components due to a status change.

to disable the income. Balance transfer, as a

feature, will not apply to the Income category across

interest and fee components due to a status change.

Event Based Fees Switch

to include the fees based on events. This means

that balance transfer for receivable components, in the

event of a status change, will apply to fee components

classified as event-based in the business component

definition for fees. Consequently, the auto-population

of accounting entries for these components will be

performed at the Product Segment level.

to include the fees based on events. This means

that balance transfer for receivable components, in the

event of a status change, will apply to fee components

classified as event-based in the business component

definition for fees. Consequently, the auto-population

of accounting entries for these components will be

performed at the Product Segment level.

Switch

to exclude the fees. This means that balance

transfer for receivable components, in the event of a

status change, will not apply to fee components

classified as event-based in the business component

definition for fees.

to exclude the fees. This means that balance

transfer for receivable components, in the event of a

status change, will not apply to fee components

classified as event-based in the business component

definition for fees.

Provisioning Details Specify the fields under this section. Provisioning Frequency The process of building reserves to mitigate against events like borrower defaults is known as provisioning. Specify the value for Provisioning as per a pre-defined frequency. Select the frequency from the drop-down list. The available options are:- Monthly

- Quarterly

This feature applies to Non-Billing Accounts. To enable or disable the Billing Feature, refer to the Product Segment Preference settings.

The allowed values are defined by the lookup type PROV_FRQ.

Provisioning Criteria Specify the value for provisioning as per a pre-defined criteria. Provisioning Batch will process to compute provisions as per the predefined frequency and Criteria. Select the criteria as Calendar from the drop-down list. The allowed values are defined by the lookup type PROV_CRITERIA.

Inter System Settlement Preferences Specify the fields under this section. Settlement Mode Select the destination system to which Retail Lending application needs to communicate for settlement of funds. Select the settlement mode from the drop-down list. The allowed values are:- Ledger Account

- Current Account and Savings Account

- Automated Clearing House

- Excess Settlement Mode

The allowed values are defined by the lookup type SETTLEMENT_MODE.

System Code Click  icon and select the system code from the

list.

icon and select the system code from the

list.

Settlement General Ledger Click  icon and select the general ledger from the list.

icon and select the general ledger from the list.

Accounting is posted to this Inter-system Legder account while settlement of funds.

Directory Key Specify the directory Key for referring bank directory values maintained for Automated Clearing House. The Common Core Local Bank Directory screen records the Bank Directory, allowing multiple products to reference the data and validate the Local Bank Code before forwarding payment requests to OBPM. The participant banks for different networks are distinguished using the Network Directory Key.

For more information, refer Common Core User Guide.

- Next Working Day -

1

- Click Save to save the details.The Retail Lending Policy is successfully created and can be viewed using the View Retail Lending Policy screen.

Parent topic: Retail Lending Policy