2.5.1 Create Asset Classification Plan

This section describes the steps for creating asset classification Plan.

Classification preference is identified by a unique plan code, and the plan is linked to a classification criterion. Within the classification criterion, multiple rules can be created. Each rule corresponds to a status code, indicating the status an account should be moved to upon satisfying the rule condition.

For the Classification Criteria - Arrear payment, rules are based on Past Due Tenor. This field refers to the number of days borrower has not paid the arrears due. Lets say, if borrower has not paid arrears for 30 days or more, asset classification status code Doubtful can be attached. If borrower has not paid arrears for say 60 days or more, status code with higher severity say Substandard can be attached. Based on the increasing no of Past Due Tenor, increasing severity status codes to be attached.

- From Home screen, click Retail Lending. Under Retail Lending, click Maintenance.

- Under Maintenance, click Asset Classification

Plan, then click Create Asset Classification

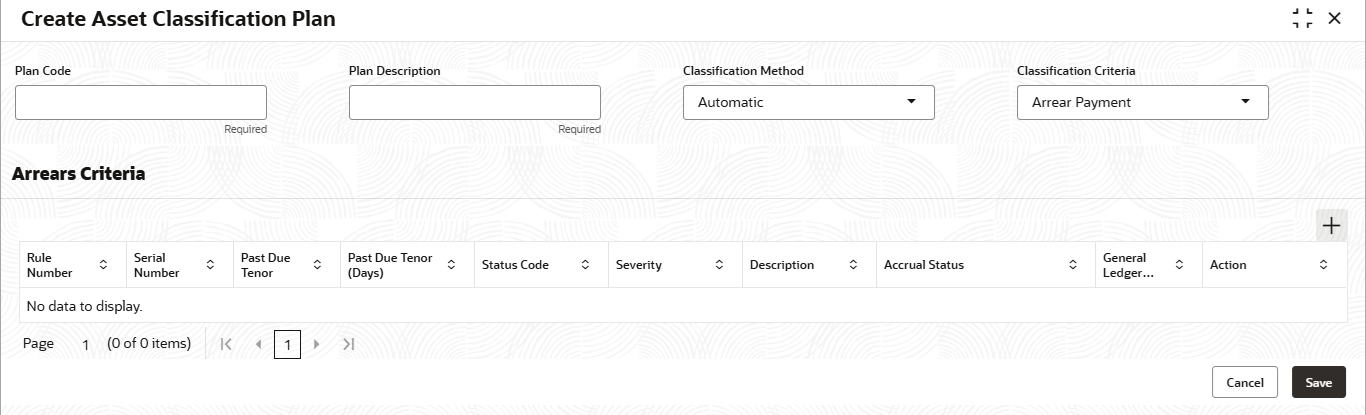

PlanThe Create Asset Classification Plan screen is displayed.

Figure 2-12 Create Asset Classification Plan

- Specify the fields on Create Asset Classification Plan

screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-12 Create Asset Classification Plan - Field Description

Field Description Plan Code Specify the unique plan code. Plan Description Specify the description of plan code. Classification Method Select the classification method from the drop-down list. This field is defaulted to Automatic and is disabled. This means the asset classification will be automatically performed by the system as part of the end of day batch processing, based on the configurations set up.

Classification Criteria Select the criteria from the drop-down list. This field is defaulted to Arrear Payments. This option refers to classifying loan accounts based on tenor (number of days) for which the arrears remain unpaid.

Arrears Criteria Specify the fields under this section. Dues unpaid by the borrower are also referred to as arrears. The fields under this section represent the definition for classification criteria for unpaid arrears

Rule number Displays the total number of criteria associated with the plan. Each classification criteria will be linked to a rule. Serial Number Displays the number of rows defined under the criteria. It will be increased automatically for each new row added under the rule. Past Due Tenor Specify the number of days during which the borrower has not paid arrears owed to the lender. Past Due Tenor (Days) This field refers to the tenor unit of Past Due Tenor. It is defaulted to Days. Status Code Click  icon and select the status code from the list. The

codes are defined in Asset Classification

Codes.

icon and select the status code from the list. The

codes are defined in Asset Classification

Codes.

The first status code is mandatory to defined as NORM.

Severity Based on the selected status code, the system automatically displays the severity associated with that status code. Description Based on the selected status code, the system automatically displays the description associated with that status code. Accrual Status Select the status from the drop-down list. The available options are:- Continue Accrual - The loan accounts transitioning to this status will continue the accrual process for business components configured for accrual, such as interest and fees, in the real ledgers.

- Contingent Accrual -When loan accounts move to this status, the interest accrued to date but not collected continue to reside in the real ledgers while the new accruals will be tracked under the contingent receivable ledgers Enabling this feature is subject to lending policy parameters definition for event based fees.

- Reverse Accrual - When loan accounts move to this status, the accruals recorded up to that point are reversed.

- Stop Accrual - When loan accounts move to this status, the accrual process will be halted for all accruing business components.

General Ledger balance Movement Click the toggle status to enable this parameter. This field determines whether the preference plan enables general ledger balance transfer between a pair of status codes. If enabled, the status change processing event will transfer balances among components, as applicable, using the general ledger codes defined at the segment The balances referred here are for assets, receivables and incomes. This field needs to be understood in conjunction with balance and income transfer features as defined in the lending policy parameters

- Click Save to save the details.The Asset Classification Plan is successfully created and can be viewed using the View Asset Classification Preferences screen.

Parent topic: Asset Classification Plan