RTGS Payments Overview

A RTGS system is defined as a gross settlement system in which both processing and final settlement of funds transfer instructions can take place continuously (i.e. in real time). As it is a gross settlement system, transfers are settled individually, that is, without netting debits against credits. As it is a real-time settlement system, the system effects final settlement continuously rather than periodically, provided that a sending bank has sufficient covering balances or credit. Moreover, this settlement process is based on the real- time transfer of central bank money.

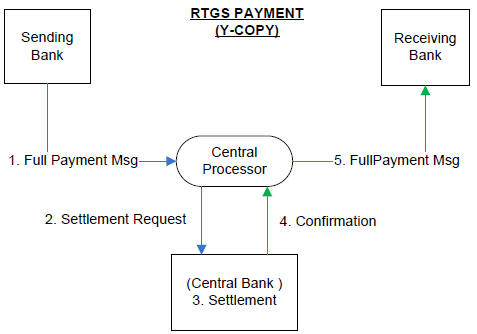

Figure 2-1 RTGS PAYMENT

The RTGS product processor of Oracle Banking Payments processes an RTGS payment transaction initiated by an Operations user from the in-built user interface or by customers in the bank’s Customer Channels like Internet banking or Mobile banking. The payment instructions initiated from the bank Channels are received by Oracle Banking Payments through ReST or SOAP based interfaces. This product processor can process RTGS payments that are exchanged on SWIFT-based RTGS networks that use SWIFT messages.

An outgoing RTGS payment is processed through most of the typical processing steps applicable for a SWIFT payment and additionally some RTGS specific business validations and processing steps. After successful processing, an outward RTGS SWIFT message, say MT103, is generated and sent to the RTGS network. Likewise, Incoming RTGS payment messages from the network can be received and processed resulting in credit of a beneficiary bank account or an outward SWIFT payment to the ultimate beneficiary. The outward SWIFT payment is processed by the Cross-Border product processor which is covered by a separate user manual.

Key Features of RTGS product processor

- Supports incoming and outgoing RTGS payment transactions (within a country or within a region)

- Payment transactions are processed only in specified currencies of the network.

- Payment transaction is processed within the operating hours of the RTGS network and on RTGS working days.

- Provision to do balance check for the remitter account (ECA check)

- Sends RTGS payment message to the clearing network on behalf of a direct participant

- Supports processing of TARGET2 RTGS out of the

box.

- Customer payments processed via TARGET2 are defined as payments in the SWIFT FIN MT103 format.

- Interbank payments processed via TARGET2 are defined as payment messages in the SWIFT Net FIN MT202 and MT202COV format.

- Supports processing of incoming Sender notification message (MT012) and abort notification message (MT019).

- Supports Multi Credit Transfer (MT102 & MT203). For more details, refer to Cross Border User Guide section - 3.2 - Sender Receiver Agreement, section - 4.1.3- Outbound Multi Credit Transfer Consol Summary, and section - 4.1.4 - Outbound Multi Credit Transfer Consol View Summary.

Parent topic: RTGS Maintenances