- ACH Credit Transfer User Guide

- ACH Credit Receipts - Return Processing

- ACH Credit Receipts - Customer Initiated Return

ACH Credit Receipts - Customer Initiated Return

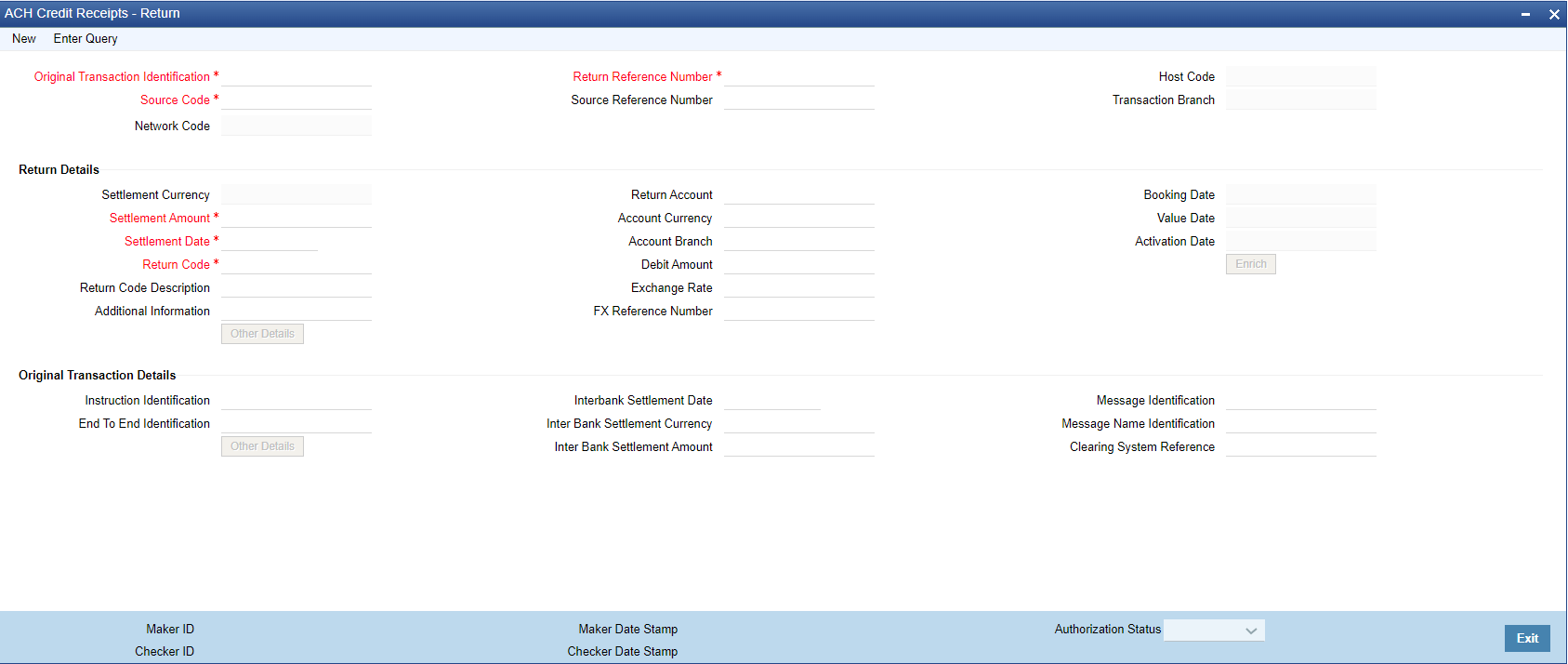

The ACH Credit Receipts - Return screen allows users to specify the Return details for the return transaction to be initiated. When you open the screen from View ACH Credit Transfer Receipts Summary (PYSIVIEW) using the Process Return action, the fields related to the original transaction are pre-populated on the screen. ReST Service is available.

- On Homepage, specify PYDITRTN in the text box, and click next

arrow.ACH Credit Receipts - Return screen is displayed.

- Click New button on the Application toolbar.

- On ACH Credit Receipts - Return screen, specify the fields.

For more information on fields, refer to the field description below:

Table 9-1 ACH Credit Receipts - Return - Field Description

Field Description Original Transaction Identification This field is defaulted as the transaction identification of the selected ACH Credit Receipt record. Return Reference Number Return Reference Number is system generated. Host Code System defaults the Host Code of transaction branch on clicking ‘New’. Source Code Specify the Source Code from the List of Values. Source Reference Code Source Reference Code is system generated. Transaction Branch Transaction Branch is system generated. Network Code System defaults the Network Code based on the Original Transaction Identification selected. Return Details -- Settlement Currency These fields are defaulted as Settlement Currency of original ACH Credit Receipt transaction. Settlement Amount These fields are defaulted as Settlement Amount of original ACH Credit Receipt transaction. However the lesser amount can be modified by the user, if required. Settlement Date If the Original transaction value date is back dated Settlement Date for R-transaction is moved forward to current date If current date is a Network or currency holiday (for debit/credit currencies) the date is moved to next working day for both Network and currency. Return Code All the return codes maintained for the Network are listed. Return Code Description System defaults the Return Code Description based on the Return Code selected. Additional Information Specify any additional Information. Return Account Return Account is populated as the credit account of the original ACH CT Receipt transaction. Based on the Return account, Account Currency & Account Branch details are populated. Debit Amount The Debit Amount calculated based on the exchange rate is populated on Enrich, if the exchange rate pick up is internal. Exchange Rate This field is populated based on whether Exchange rate re-pick up is applicable or not. FX Reference Number You can specify the FX Reference Number, if External exchange rate is applicable, then during FX Reference Number gets validated. Booking Date System defaults to current Date. Value Date This is a system derived field. If the Settlement Date is in the past, it is moved to current date. Value date is same as Settlement Date. If the Value Date falls on a Network holiday, it is moved ahead to the next Network working day. Activation Date This is the date on which the Return transaction is getting processed. This is same as Booking Date initially if it is a Network and Branch working day. Otherwise, it gets moved forward. Other Details Specify the Return Account. Enrich Click on Enrich button upon providing above details. Original Transaction Details: Specify the Origination Transaction Details. - Instruction Identification

- End To End Identification

- Other Details

- Interbank Settlement Date

- Calendar

- Inter Bank Settlement Currency

- Inter Bank Settlement Amount

- Message Identification

- Message Name Identification

- Clearing System Reference