- India RTGS User Guide

- RTGS Outbound Transaction Input

- RTGS Outbound Transaction Input

- India RTGS Outbound Transaction Input

- Main Tab

Main Tab

- On Main Tab, specify the fields.

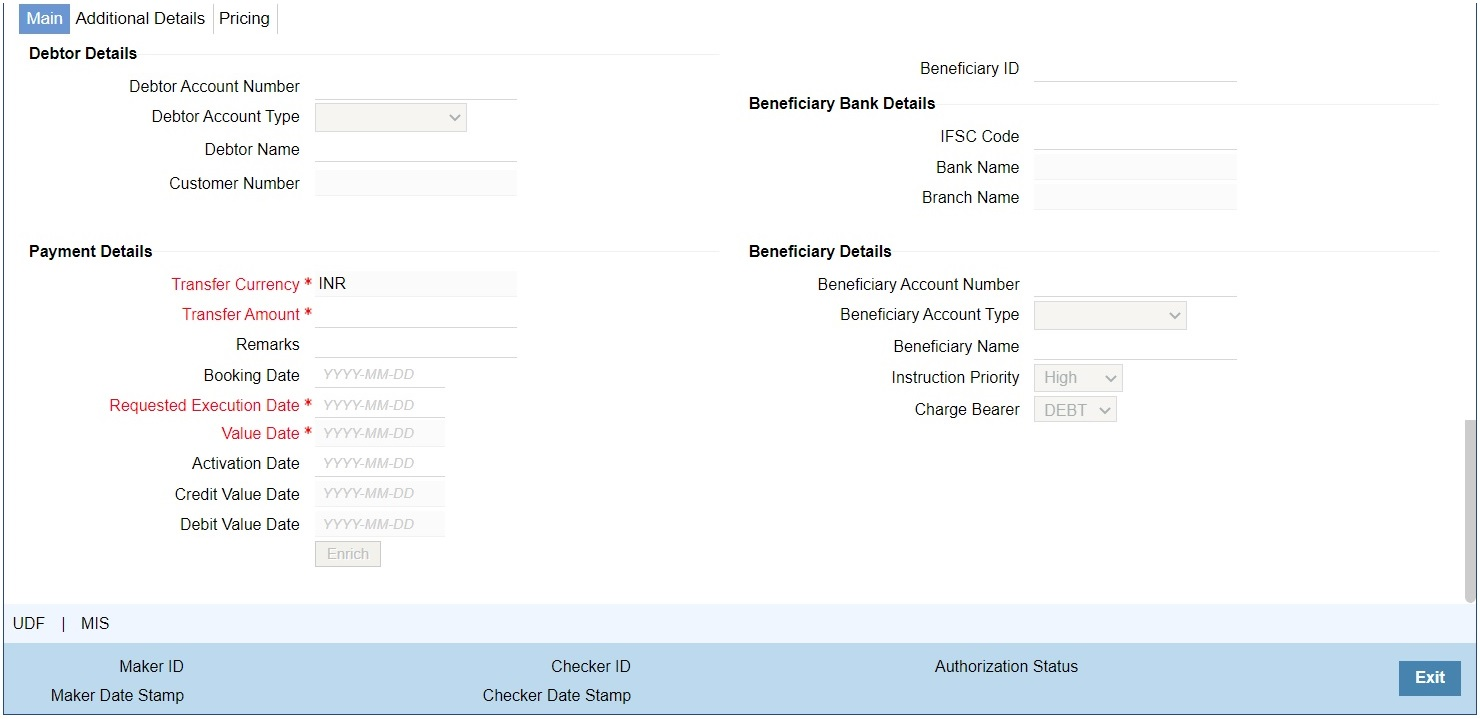

Figure 3-2 RTGS Outbound Payment Input Detailed - Main Tab

Description of "Figure 3-2 RTGS Outbound Payment Input Detailed - Main Tab"Table 3-2 RTGS Outbound Payment Input Detailed_Main Tab - Field Description

Field Description Debtor Details -- Debtor Account Number Specify the Debit Account Number. Alternatively, you can select the debit account number from the option list. The list displays all open and authorized accounts. Debtor Account Type Select the Debtor Account Type from the list of values displayed. Following are the options: - Savings Bank (10)

- Current Account (11)

- Overdraft (12)

- Cash Credit (13)

- Loan Account (14)

- NRE (40)

- Cash (50)

- Credit Card (52)

Debtor Name System defaults the Debtor Name of the account selected. Beneficiary ID Specify the Beneficiary ID from the list of values. All the valid, Beneficiary ID’s are listed here.

If Beneficiary registration has been done already for the debtor’s account, Beneficiary ID can be picked up from the LOV here. All the other details such as beneficiary account number, account type, beneficiary name, beneficiary bank details such as IFSC code, Bank name, Branch Name will be defaulted based on the beneficiary registration maintenance.

Beneficiary Bank Details If Beneficiary registration maintenance is done and the beneficiary id is entered, the below mentioned details are defaulted. If not, it has to be entered.

IFSC Code Specify the IFSC code of the Beneficiary Bank. Bank Name System defaults the Beneficiary Bank Name. Branch Name System defaults the Beneficiary Branch Name. Payment Details -- Transfer Currency System defaults the currency as INR. Only INR is allowed for RTGS India Payments. Transfer Amount Specify the Transaction Amount. Booking Date System defaults the Booking Date as application server date. Activation Date System defaults the Activation Date same as application server date. Requested Execution Date Specify the Requested Execution Date. Value Date The system defaults this date as application server date and the payment will be processed on the Instruction Date.

You can modify the date to a future date, if required. Back valued payments will not be allowed. Instruction date will be validated for network holidays maintained and error message will be thrown. User will be forced to change the instruction date to a working date for the network.

Credit Value Date System would derive the credit value date as part of transaction processing. This field is disabled for user input. Debit Value Date System would derive the debit value date as part of transaction processing. This field is disabled for user input. Beneficiary Details If Beneficiary registration maintenance is done and the beneficiary id is entered, the below mentioned details are defaulted. If not, it has to be entered.

Beneficiary Account Number Specify the Beneficiary Account Number. Beneficiary Account Type Select the Beneficiary Account Type from the list of values. Following are the options: - Savings Bank (10)

- Current Account (11)

- Overdraft (12)

- Cash Credit (13)

- Loan Account (14)

- NRE (40)

- Cash (50)

- Credit Card (52)

Beneficiary Name Specify the Beneficiary name. Instruction Priority Instruction priority is maintained here. Allowed values are High, Normal. System defaults the value as ‘High’. Charge Bearer For RTGS, charges bearer information is maintained here. Allowed values are CRED/DEBT/ SHAR/SLEV. System defaults the value as ‘DEBT’.

Parent topic: India RTGS Outbound Transaction Input