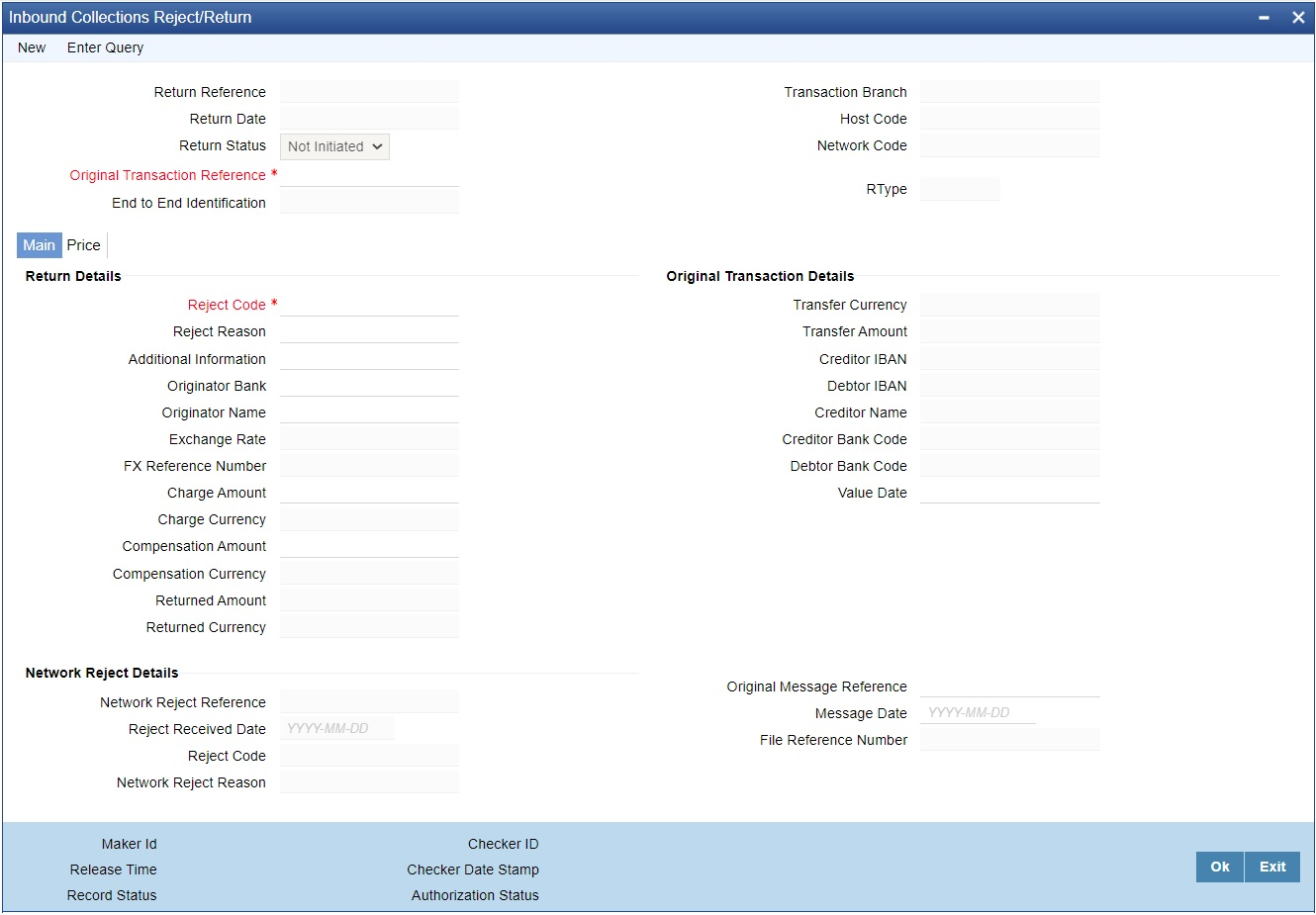

Inbound Collections Reject/Return

Inbound Reject

An incoming collections transaction can be rejected by the debtor bank before

settlement. This is possible on the below scenarios:

- The debtor account is in invalid status / has insufficient fund.

- Sanction check failed on debtor.

- Invalid status of Debtor Mandate / no Debtor Mandate available.

In these cases, the incoming collection transaction moves in to appropriate queue

& does not gets liquidated. If the exception could not be resolved, user need to

cancel the transaction from the current queue and move it to Repair Queue. And from

Repair Queue, the transaction needs to be rejected. On rejection, system triggers

the following actions:

- The transaction is rejected, pre-settlement. Transaction status & collection status is marked as Rejected.

- No accounting entries are posted on the transaction level.

- Pacs.002 message is generated & dispatched that contain the transaction details.

For the pre-settlement rejected transaction amount, debit Nostro & credit Clearing Suspense GL entry is posted, with DCLG event.

The pre-settlement R-Messages must follow the same processing option (either Single Transaction Processing or Batch Processing) as the original Collections.

Inbound Return

An incoming collections transaction can be returned by the debtor bank, post its settlement. The debtor bank initiates the same based on the debtor customer request or due to debtor bank internal reasons.

Return is initiated on or after the value date of the incoming collection transaction. Thus, the transaction is liquidated.

Select the original transaction reference number, via list of values, which needs to

be returned. Fill the reject code, reject reason details. On save & authorize of

this return action the following gets triggered:

- The underlying parent transaction is marked as returned. The accounting entries in the transaction is reversed.

- pacs.004 message is dispatched containing the transaction details.

- File accounting is posted for pacs.004 entries as debit Nostro and credit Clearing Suspense GL, with DCLG event.

Note:

Return action is allowed only before return days stamped in the transaction.