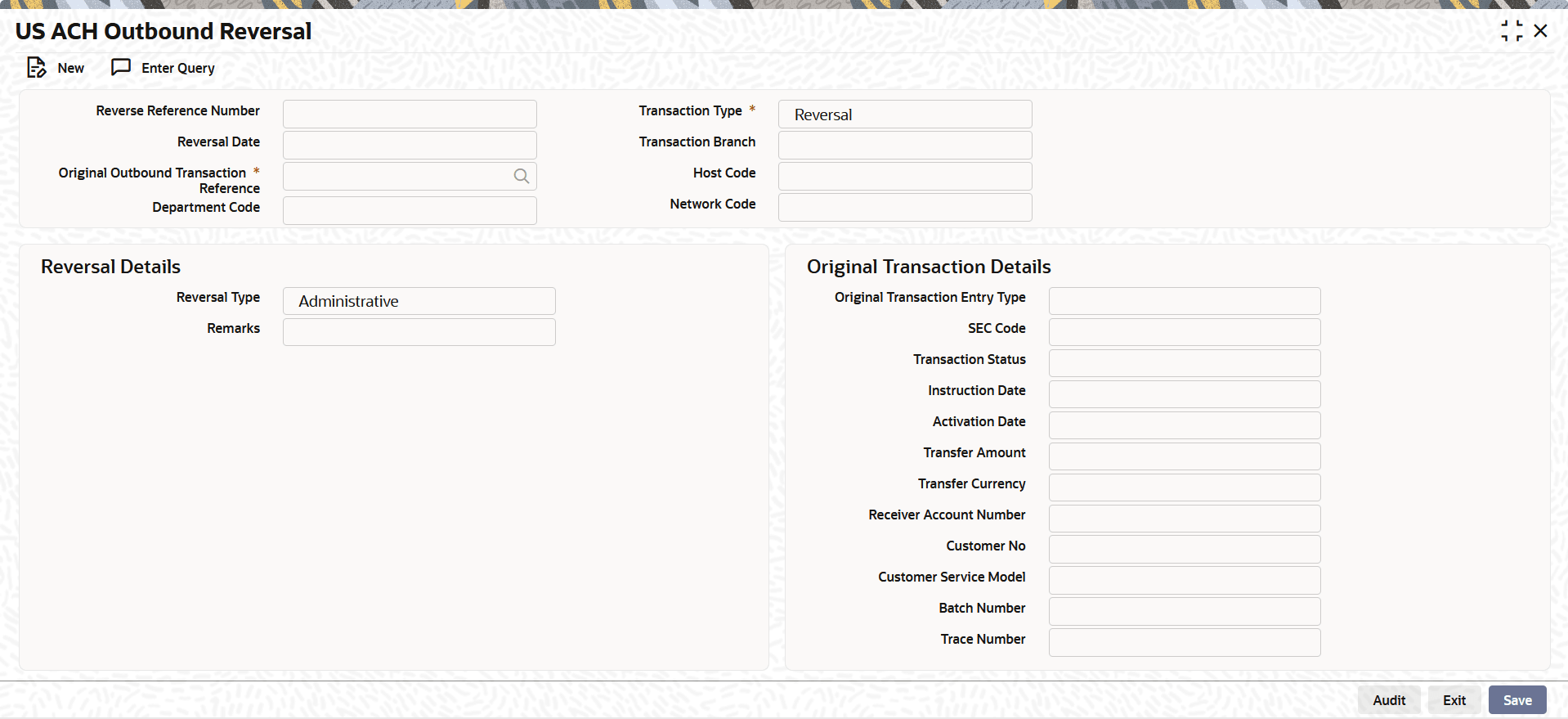

2.5.4 US ACH Outbound Reversal

Use US ACH Outbound Reversal screen to initiate a reversal request for both credit and debit entries.

- On Homepage, specify PNDOREVR in the text box, and click next

arrow.The US ACH Outbound Reversal screen is displayed.

- On US ACH Outbound Reversal screen, specify the

fields.

Table 2-98 US ACH Outbound Reversal - Field Description

Field Description Reverse Reference Number System defaults the Reverse Reference Number. Transaction Type Displays the Transaction Type of the transaction. Transaction Branch This field gets defaulted on Host Code selected. Reversal Date This field displays the date to current date. Host Code System defaults the Host Code to which the logged in branch is associated. Original Outbound Transaction Reference Specify the Original Outbound Transaction Reference from the list of values. The list of values lists all outbound credit entries and for which no R-Action is received or taken.

Select the credit entry to be reversed.

Network Code Specify the Network Code. Department Code System displays the Department Code based on original transaction. Reversal Details This section displays the Reversal Details. Reversal Type This field displays the Reversal Type of the transaction. Remarks Specify the Remarks. Reversal Reason Code Specify the Reversal Reason Code from the list of values. The list of values lists the Reason Codes maintained in Reject Code Detailed (PMDRJMNT) for the ACH network. Reversal Reason This field displays the description of the selected reason code. Additional Information You can specify the remarks for the reversal action. Reversal Transaction Code This field displays the Reversal Transaction Code mentioned in the Inbound Return Entry Detail Record. Original Transaction Details Following fields are defaulted from the original underlying outbound credit transaction:- Original Transaction Entry Type

- SEC Code

- Activation Date

- Transaction Status

- Instruction Date

- Transfer Amount

- Transfer Currency

- Receiver Account Number

- Customer No

- Customer Service Model

- Batch Number

- Trace Number

- US ACH Outbound Reversal Summary

This topic explains the US ACH Outbound Reversal Summary screen.

Parent topic: ACH Payments Return