2.1.8 US ACH Debit Mandate

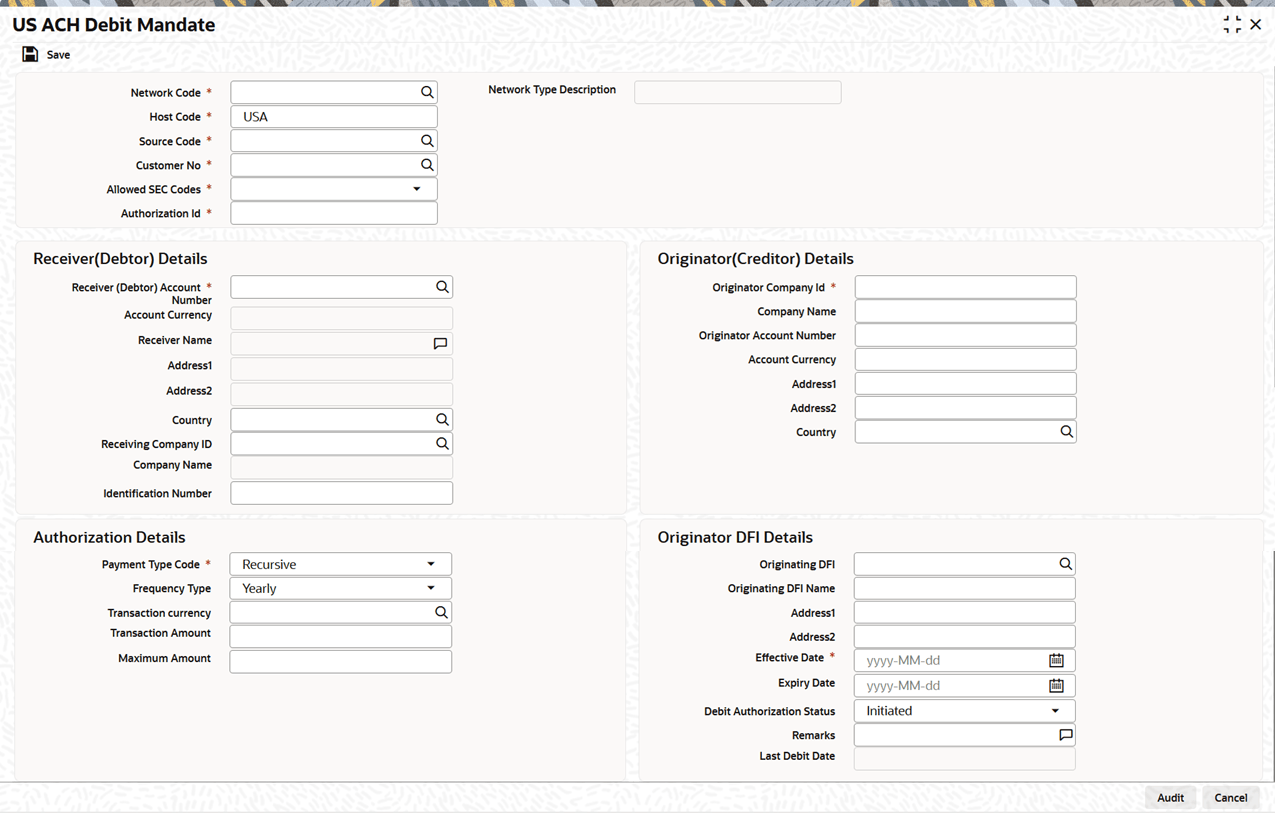

Use US ACH Debit Mandate screen to capture ACH Debit Authorization (Debit Mandate).

- On Homepage, specify PNDDMAND in the text box, and click next

arrow.The US ACH Debit Mandate screen is displayed.

- On the US ACH Debit Mandate screen, click New to

specify the fields.For more information about the fields, refer to field description table.

Table 2-15 US ACH Debit Mandate - Field Description

Field Description Host Code System defaults the Host Code of transaction branch when the user clicks the New button. Source Code Select the Source Code from the list of values. Network Code Select the Network Code from the list of values. Customer No Select the customer number from the list of values. Allowed SEC Codes Select the Allowed SEC Codes from the drop-down list. The available options are: - CCD

- CTX

- PPD

- ARC

- BOC

- POP

- CCD

- WEB

- TEL

- RCK

- XCK

Authorization Id Specify the Authorization Id. Network Type Description System defaults the Network Type Description based on the selected Network Code. Receiver (Debtor) Details This section displays the Receiver (Debtor) Details. Receiver (Debtor) Account Number Select the Receiver (Debtor) Account Number from the list of values that lists all active accounts of the specified Customer. Account Currency Account Currency gets auto populated on selecting Receiver (Debtor) Account Number. Receiver Name Receiver Name gets auto populated on selecting Receiver (Debtor) Account Number. Address1 Address gets auto populated on selecting Receiver (Debtor) Account Number. Address2 Address gets auto populated on selecting Receiver (Debtor) Account Number. Country This field gets auto populated on selecting Receiver (Debtor) Account Number. Receiving Company ID Select the Receiving Company ID from the list of values, which displays the companies mapped to the selected Debtor Customer or Account in theCompany ID - Account Mapping Detailed (PMDCIACC) screen. Company Name Gets auto populated on selecting Receiving Company ID. Identification Number Specify the Identification Number. Originator (Creditor) Details This section displays the Originator (Creditor) Details. Originator Company Id Select the Originator Company ID from the list of values, which displays the companies mapped to the selected Debtor Customer or Account in theCompany ID - Account Mapping Detailed (PMDCIACC) screen. Company Name Gets auto populated on selecting Originator Company ID. Originator Account Number Gets auto populated on selecting Originator Company ID. Account Currency Account Currency gets auto populated on selecting Originator Company ID. Address1 Address gets auto populated on selecting Originator Company ID. Address2 Address gets auto populated on selecting Originator Company ID. Country Country gets auto populated on selecting Originator Company ID. Authorization Details This section displays the Authorization Details. Sequence Type Select the Sequence Type from the drop-down list. The available options are: - Recursive

- One Off

Frequency Type Select the Frequency Type from the drop-down list. The available options are: - Yearly

- Monthly

- Quarterly

- Half Yearly

- Weekly

- Daily

- Adhoc

- Intra Day

- Fortnightly

Transaction Currency Select the Transaction Currency from the list of values. Transaction Amount Specify the Transaction Amount. Maximum Amount Specify the Maximum Amount, if required. Originator DFI Details This section displays the Originator DFI Details. Originating DFI Select the Originator DFI from the list of values that lists all valid Routing Number from ACH directory. Originating DFI Name Originating DFI Name gets auto populated on selecting Originating DFI. Address1 Address gets auto populated on selecting Originating DFI. Address2 Address gets auto populated on selecting Originating DFI. Effective Date Specify the date from when the authorization is effective for receiving Debit transactions on the receiver account. Ensure that the settlement date of the inward debit transaction is greater than or equal to this date. Expiry Date Specify the date when the authorization expires or no longer remains effective. Ensure that settlement date of the inwarddDebit transaction is less than or equal to this date.

If Expiry Date is not specified, the mandate is treated as open-ended, and debit requests will be honored until the user manually marks the mandate as expired.

Debit Authorization Status Select the Debit Authorization Status from the drop-down list. The available options are: - Initiated

- Active

- Expired

- Used

- Cancelled

Remarks Specify the Remarks, if any. Last Debit Date This field displays the date of the most recent debit. On honoring a debit request against the mandate, the settlement date is updated in this field during processing of each debit request.

Parent topic: US ACH Maintenance