1.2.1.1 Main Tab

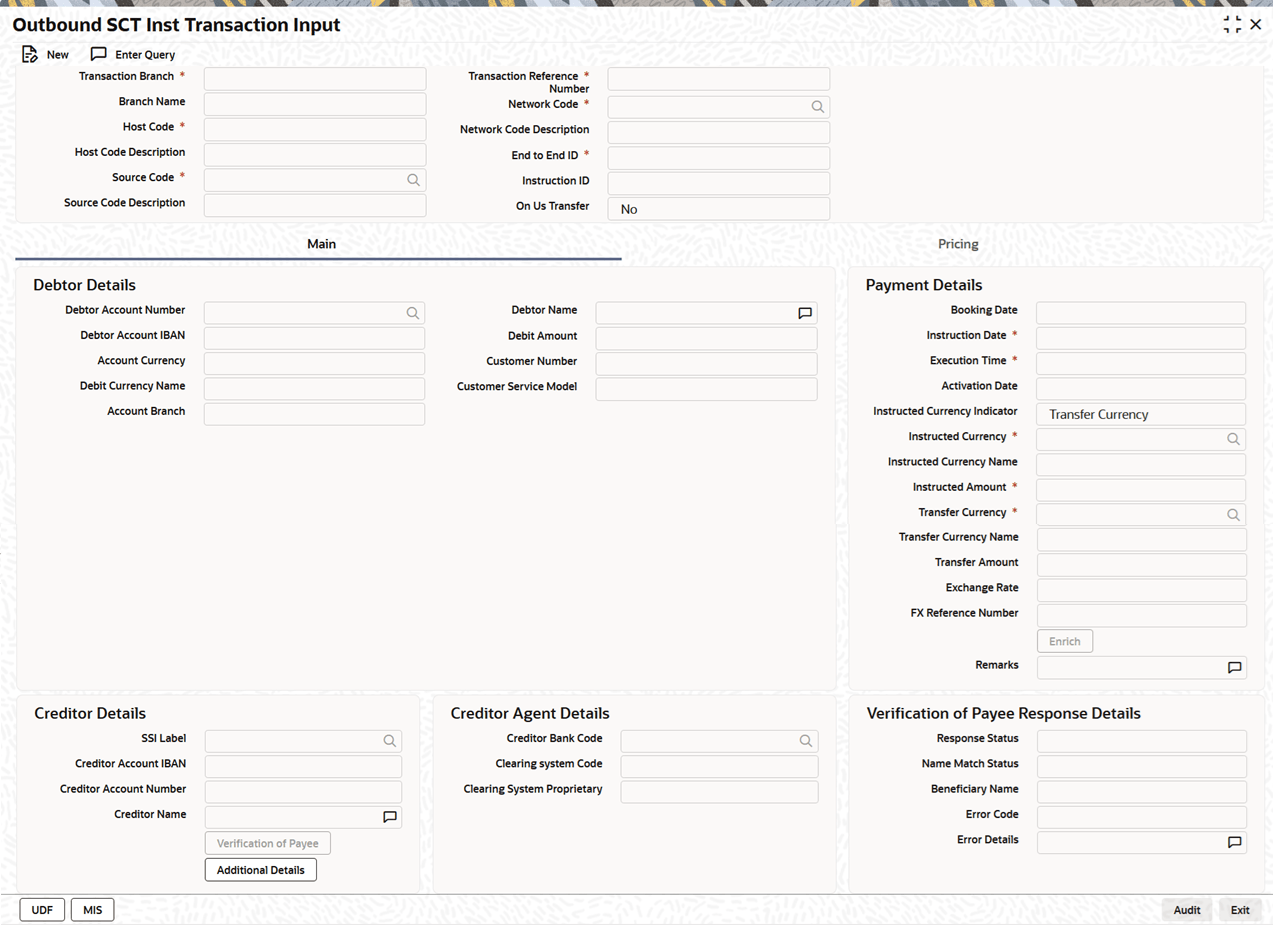

This topic explains the Main tab of the Outbound SCT Inst Transaction Input screen.

- Select the Main tab from the main screen.The Main details are displayed.

Figure 1-2 Outbound SCT Inst Transaction Input - Main Tab

Description of "Figure 1-2 Outbound SCT Inst Transaction Input - Main Tab" - On Main tab, specify the fields.

Table 1-2 Outbound SCT Inst Transaction Input_Main Tab - Field Description

Field Description Debtor Details This section displays the Debtor Details. Debtor Account Number Specify the account number of the debtor. Alternatively, you can select the account number from the option list. The list displays all valid account numbers maintained in the system. This is a mandatory field. Debtor Account IBAN This field is auto-populated based on the debtor account selected. Account Currency Account currency is defaulted based on the selected debit account. Debit Currency Name This is populated based on Account Currency. Account Branch Account Branch is also defaulted based on the selected debit account. Debtor Name This is populated based on debtor account customer. Debit Amount This field is populated as the transfer amount converted in debtor account currency. The exchange rate pick up is based on network preferences maintained. This field is disabled for user input. Customer Number System indicates the customer linked to the debtor account. Customer Service Model System indicates the service model linked to the customer. Payment Details This section displays the Payment Details. Booking Date The current date is defaulted as Booking Date. This is a disabled field for user modification. Instruction Date This is defaulted to current application server date. You can modify this date. This is the requested execution date by the customer. Back dates are not allowed. Execution Time This is defaulted to the current time in time zone of the logged in Branch. Activation Date This date is derived from instruction date and it is disabled. Since Network / Branch holidays are not applicable for SCT Instant, activation date is the same as instruction date. Payment is submitted to the Clearing Infrastructure (CI) on activation date and processed by the CI on the same date. Instructed Currency Indicator Select the Instructed Currency Indicator from the following:- Transfer Currency - If the Instructed Currency option is Transfer Currency then the instructed amount provided is considered as Transfer Amount.

- Debit Currency - If the option is Debit Currency, then the instructed amount provided is Debit Amount.

Instructed Currency Specify the Instructed Currency from the list of values. Instructed Currency Name System displays the Instructed Currency Name. Instructed Amount Specify the Instructed Amount. Transfer Currency This is automatically populated based on the selected Network Code and the currency maintained in Network Currency Preferences Detailed . This is a mandatory field. Transfer Currency Name System displays the Transfer Currency Name. Transfer Amount Specify the Transfer Amount. Exchange Rate Specify the exchange rate if debit account currency is different from the transfer currency. System retains the input value and validate the same against override and stop variances maintained in the Network preference.

If exchange rate is not specified, then the system populates the exchange rate on enrich or save, if the transfer amount is less than small FX limit maintained.

FX Reference Number Specify the FX Reference Number if the External Exchange Rate is applicable and advance FX booking is done. Enrich Click this button to trigger computation of charges and tax on charges, if applicable based on the maintenance for Pricing Code specified in Network Currency Preferences Detailed (PMDNCPRF).

Exchange rate is fetched if internal rates are applicable.

Remarks Specify the required Remarks.

Note: IBAN Validation for Outbound or Inbound instant payments is done only if IBAN Validation Required field is maintained as Yes in Network Maintenance Detailed (PMDNWMNT) screen.

Creditor Details This section displays the Creditor Details. SSI Label Specify the required SSI label from the list of values so that beneficiary details can appear by default.

This list is populated with valid SSI labels, applicable for the customer and the network. This is an optional field.

Creditor Account IBAN Specify the IBAN of the beneficiary. This is a mandatory field.

This field is editable only for Faster Payment Networks of type GN-FPY when the Account Identifier is set to IBAN in PFDNWAPR.

Creditor Name Specify the name of the beneficiary. This is a mandatory field. Creditor Account Number Specify the Creditor Account Number.

This field is editable only for Faster Payment Networks of type GN-FPY when the Account Identifier is set to Account Number in PFDNWAPR.

Creditor Agent Details This section displays the Creditor Agent Details. Creditor Bank Code Select the required bank code from the list of values.

If a Directory Key is linked to the Network in Network Maintenance Detailed (PMDNWMNT), then the list includes all active bank codes linked to the Network Directory Key from ACH Network Directory (PMDACHDR).

Clearing system Code System defaults the Clearing System Code based on the selected Creditor Bank Code. Clearing System Proprietary System defaults the Clearing System Proprietary based on the selected Creditor Bank Code. Verification of Payee Response Details This section displays the Verification of Payee Response Details. Response Status Select a Response Status value from the drop-down list. The available options are:- Failed

- Success

Name Match Status Specify the Name Match Status. Beneficiary Name Specify the Beneficiary Name. Error Code Specify the Error Code. Error Details Specify the Error Details.

Parent topic: Outbound SCT Inst Transaction Input