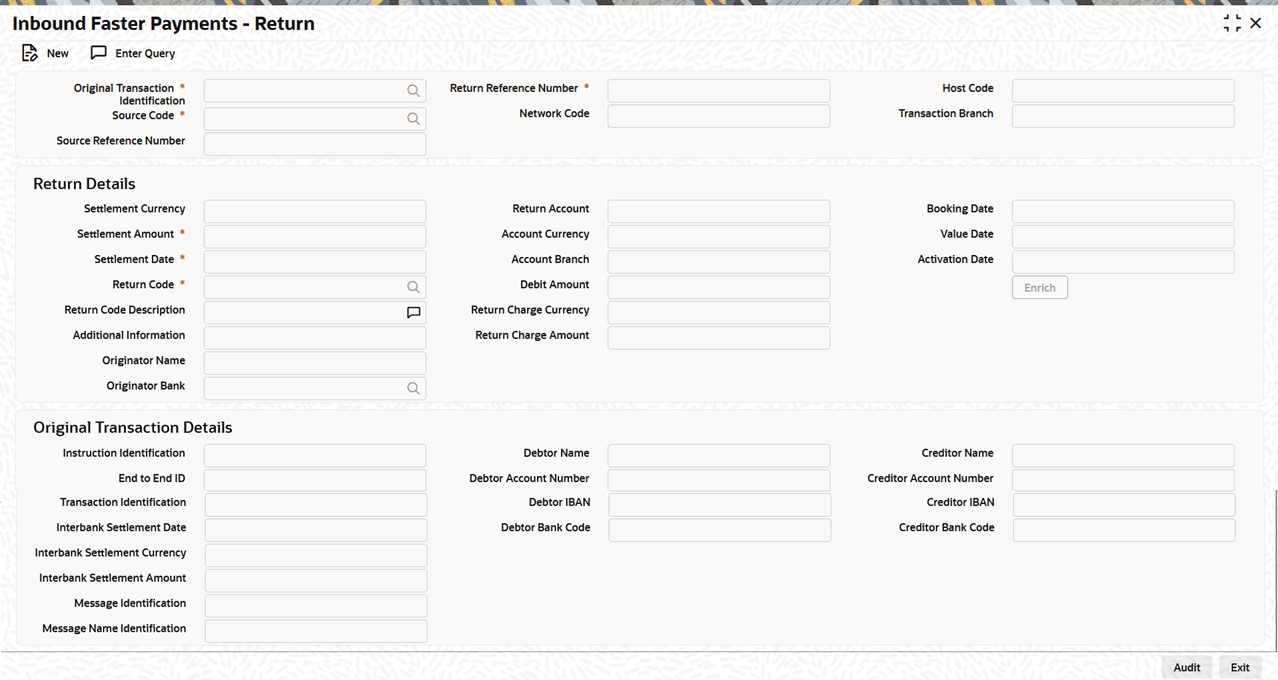

1.4 Inbound Faster Payments - Return

Use Inbound Faster Payments - Return screen to initiate Return of an already processed incoming faster payment of type GN-FPY.

- On Homepage, specify PFDITRTN in the text box, and click next

arrow.The Inbound Faster Payments - Return screen is displayed.

Figure 1-24 Inbound Faster Payments - Return

- On Inbound Faster Payments - Return screen, specify the

fields.For more information about the fields, refer to field description table.

Table 1-13 Inbound Faster Payments - Return_ Field Description

Field Description Original Transaction Identification Select the Original Transaction Identification from the list of values. Return Reference Number This is a system-generated field that automatically assigns a unique identifier to each record for tracking and reference purposes. User cannot modify this field. Host Code System defaults the Host Code of the current branch. Transaction Branch System defaults the Transaction Branch. Source Code Select the Source Code from the list of values.

The list includes all active source codes from PMDSORCE for the current host.

Source Reference Number Specify the Source Reference Number. Network Code System defaults the Network Code based on the selected original transaction. Return Details This section displays the Return Details. Settlement Currency System defaults the Settlement Currency based on the selected original transaction. Settlement Amount This is the amount to be returned. System computes this amount when the user clicks the Enrich button. Settlement Date System defaults the Settlement Date based on the current branch date. Return Code Select the Return Code from the list of values.

The list includes all active return codes from PMDRJMNT for the current host and selected network.

Return Code Description System displays the description based on the selected return code. Additional Information Specify the Additional Information. Originator Name Specify the Originator Name. Originator Bank Select the Originator Bank from the list of values.

The list includes all active BIC codes from BIC directory.

Return Account System defaults to the credit account from the original transaction. Account Currency System defaults to the currency of the return account. Account Branch System defaults to the branch of the return account. Debit Amount This is the amount to be debited from the return account. System computes this amount when the user clicks the Enrich button. Return Charge Currency System defaults this field when the user clicks the Enrich button, provided that the Recall Acceptance Price Code is configured. Return Charge Amount System computes this amount when the user clicks the Enrich button.

User can modify this amount after clicking Enrich, but it must be less than the return amount.

Booking Date System defaults to the current branch date. Value Date System defaults to the current branch date.

When the user clicks the Enrich button, value date is updated to the Settlement Date.

Activation Date System defaults to the current branch date. Original Transaction Details This section displays the Original Transaction Details. Instruction Identification Defaults from the original transaction. End to End ID Defaults from the original transaction. Transaction Identification Defaults from the original transaction. Interbank Settlement Date Defaults from the original transaction. Interbank Settlement Currency Defaults from the original transaction. Interbank Settlement Amount Defaults from the original transaction. Message Identification Defaults from the original transaction. Message Name Identification Defaults from the original transaction. Debtor Name Defaults from the original transaction. Debtor Account Number Defaults from the original transaction. Debtor IBAN Defaults from the original transaction. Debtor Bank Code Defaults from the original transaction. Creditor Name Defaults from the original transaction. Creditor Account Number Defaults from the original transaction. Creditor IBAN Defaults from the original transaction. Creditor Bank Code Defaults from the original transaction. Note:

The system validates and displays an error if a return is initiated after the allowed Recall Response Days. During the Authorization action, the system also validates and displays an error if the original transaction has already been returned or is pending recall.