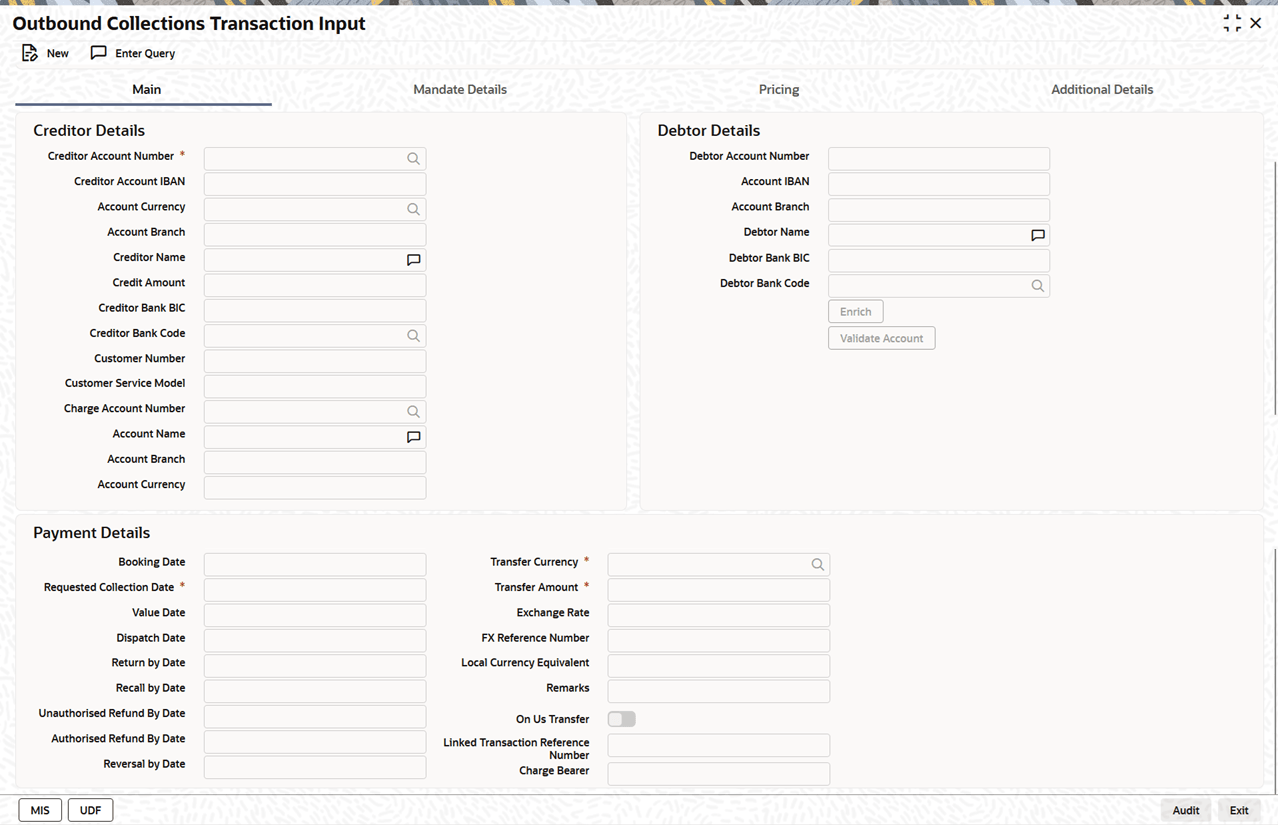

3.1.1 Main Tab

- Click Main tab in the Outbound Collections

Transaction Input screen.The Main details are displayed.

Figure 3-2 Outbound Collections Transaction Input_Main Tab

- On Main Tab, specify the fields.

Table 3-2 Outbound Collections Transaction Input_Main Tab - Field Description

Field Description Creditor Details This section displays the Creditor Details. Creditor Account Number Select both DDA and loan accounts from the list of values as the Creditor Account Number. All open and authorized accounts maintained in External Customer Account (STDCRACC) and External Consumer Loan Account (STDCRCLN) are listed. Note:

- EAC check is skipped, if the Credit account is a Loan account.

- During initial validations, loan account check is done before account re-direction.

Account IBAN System defaults Account IBAN on the Creditor Account Number selected. Account Currency Specify the Account Currency from the list of values. Account Branch System defaults Account Branch on the Creditor Account Number selected. Creditor Name System defaults Account Name on the Creditor Account Number selected. Credit Amount Specify the Amount specified for the credit transaction. Creditor Bank BIC Specify the BIC of the Creditor Bank. Creditor Bank Code Specify the Bank Code of the Creditor Bank from the list of values. Customer Number Creditor customer number is displayed based on the account selected. Customer Service Model If Service model is linked to the customer number, the same is displayed. Charge Account Number Specify the Charge Account Number from the list of values. Account Name System defaults Account Name based on the Charge Account Number selected. Account Branch System defaults the Account Branch based on the Charge Account Number selected. Account Currency System defaults Account Currency based on the Charge Account Number selected. Debtor Details This section displays the Debtor Details. Debtor Account Number Specify the Debtor Account for the transaction is initiated. Account IBAN Specify the Account IBAN for which the transaction is initiated. Account Currency Specify the Currency of the account. Account Branch Specify the Branch of the debtor account. Debtor Name Specify the Debtor Name. Debit Amount Specify the Amount to be debited. Debtor Bank BIC Specify the BIC of the Debtor Bank. Debtor Bank Code Specify the Debtor Bank Code from the list of values. Validate Account Validate Account button is enabled only if following conditions are satisfied:- The Host allows Virtual Identifiers AND

- Transaction is not Credit to GL AND

- Credit account is not valid based on core accounts /VAM accounts available

If the account is valid enrich of the details happens. Account currency and account branchdetails are populated.

Payment Details This section displays the Payment Details. Booking Date Specify the Booking Date of the Collections transaction. Requested Collection Date Specify the Instruction Date of the transaction. This field identifies the original value date that was provided by the creditor during the instruction. Value Date Specify the Value Date of the transaction. This fields identifies the date on which the transfer to be made. Dispatch Date Specify the Dispatch Date of the Collections transaction. This field denotes the date on which the message to be dispatched. Dispatch date will be derived based on the sequence type specified in the transaction. - If the Sequence type is of ‘OOFF’ or ‘FRST’, then dispatch date is derived as the value date minus the no of days specified in First collection dispatch days.

- If the Sequence type is of ‘RCUR’, then dispatch date is derived as the value date minus the no of days specified in Recurrent collection dispatch days.

Return by Date This field denotes the date by which the Return request to be received for an outgoing DD transaction. This date is derived by value date plus the return days based on the calendar basis. Recall by Date This field denotes the date by which the Recall to be initiated for an outgoing DD transaction. This date is derived by value date minus the recall days based on the calendar basis. Unauthorised Refund By Date This field denotes the date by which the refund request to be received for an outgoing DD transaction. This date is derived by value date plus refund days based on the calendar basis. Authorised Refund By Date This field denotes the date by which the refund request to be received for an outgoing DD transaction. This date is derived by value date plus refund days based on the calendar basis. Reversal by Date This field denotes the date by which the reversal request to be initiated for an outgoing DD transaction. This date is derived by value date plus reversal days based on the calendar basis. Transfer Currency Specify the Currency in which the transfer is initiated from the list of values. Transfer Amount Specify the Amount to be transferred. Exchange Rate Specify the Exchange Rate.

Note: Exchange rate processing is done as part of settlement date processing.

FX Reference Number Specify the FX Reference Number. Local Currency Equivalent This field displays Local Currency Equivalent of the Transfer Amount. Remarks Specify any Remarks, if any. On Us Transfer Enable this flag to allow processing of On Us Transfers transactions. Linked Transaction Reference Number In case of On Us transfers, incoming DD transaction booked as part of outgoing will be stored in Linked Transaction Reference Number field. This would be auto populated by the system on save, if Dispatch On Us transfer is ‘Not checked’ at PCDNWDDP. Charge Bearer These are service level charges and is charged by banks to its respective customers. Service level charges are defaulted.

Parent topic: Outbound Collections Transaction Input