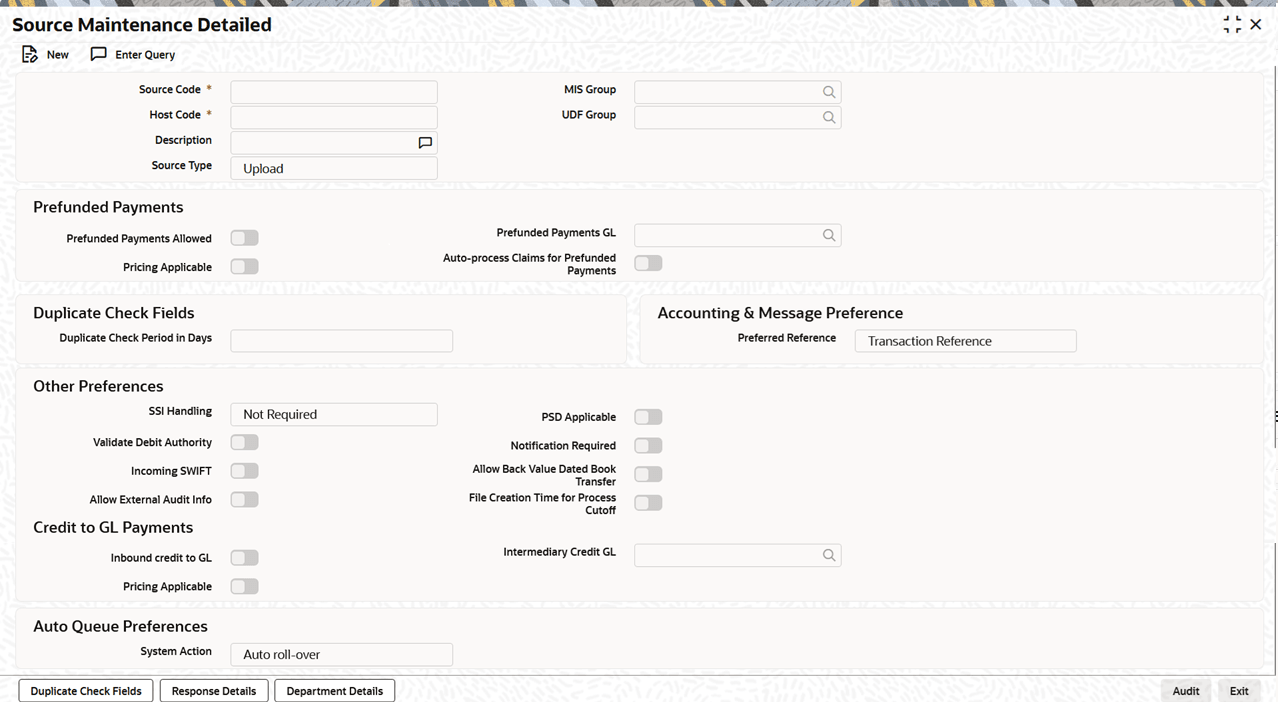

1.3.8 Process Source Maintenance Detailed

Use Source Maintenance Detailed to identify an external system or source from which payments system receives a payment request.

- On Homepage, specify PMDSORCE in the text box, and click next arrow.The Source Maintenance Detailed screen is displayed.

- On Source Maintenance Detailed screen, click New

to specify the fields.For more information on fields, refer to the field description table.

Table 1-29 Source Maintenance Detailed - Field Description

Field Description Source Code Specify a unique Source Code. User has to input a valid source code based on the Source Type selected.

User can select the source type as Manual Input when the Source Code is entered as MANL.

Host Code System defaults the host code of transaction branch on clicking New. Description Specify a brief description on the source code. Source Type Select the Source Type from the following: - Upload

- Manual Input

MIS Group Select the required MIS Group. UDF Group Select the required UDF Group. Prefunded Payments This section displays the Prefunded Payments details. Prefunded Payments Allowed Enable this flag to allow prefunded payments for the source. Prefunded Payments GL Specify the required Prefunded Payments GL from the list of values. The GL specified is defaulted in the Transaction input screens for that Source, when Prefunded Payments allowed checkbox is checked. Pricing Applicable Enable this flag if pricing is applicable for prefunded payments. This flag is available only when the Prefunded Payments Allowed flag is checked.

For US ACH Credit transactions, charges configured for the Network will apply only if the Pricing Applicable flag for Prefunded Payments must be enabled.

Auto-process Claims for Prefunded Payments Enable this flag to automatically process inbound charge claims when the original payment is prefunded.

Duplicate Check Fields This section displays the Duplicate Check Fields. Duplicate Check Period in Days Specify the days used for Duplicate Check.

Note: For the payment types, ACH and NACHA, the days pick up is from Non urgent Preferences. For all other payment types, the days pick up is from urgent preferences.

Accounting & Message Preference This section displays the Accounting & Message Preference details. Preferred Reference Specify which reference number needs to be sent on Tag 20 - Sender’s References field, in the outbound cross border messages.- Transaction Reference: The unique transaction reference number generated by the system gets populated on the Tag 20.

- Source Reference: The source reference number that is input/ given by external systems gets populated on the Tag 20 - Sender’s Reference field.

This preferred reference number, is also passed on the accounting entries that are handed off to the DDA system.

Other Preferences This section displays the Other Preferences. SSI Handling Select the option for SSI Handling.

Note:- Not Required-Default SSI label pick up is not applicable for transactions received from this source.

- Default and Verify-The beneficiary/routing details is fetched from default SSI label if the transaction is received without SSI label and if default SSI label is available for the customer network and currency. The transaction is moved to a Settlement Review Queue for user verification.

- Default-The beneficiary/routing details is fetched from default SSI label if the transaction is received without SSI label and if default SSI label is available for the customer network and currency. No verification is required in this case and transaction processing proceeds to the next step.

Validate Debit Authority This flag denotes whether debit authorities to be validated every time for the source. Incoming SWIFT This flag indicates that the incoming SWIFT transactions will be created with the source code flagged for Inbound SWIFT. This flag can be opted for single source per host.

Note:- When the Incoming SWIFT flag is not checked for a particular Source Code, such as MANL or SWIFT, then the uploading or creating an incoming SWIFT transaction will fail.

- When the Incoming SWIFT flag is checked for respective Source Codes, then incoming SWIFT transactions are allowed.

Allow External Audit Info This flag is to Allow External Audit Info transactions.

Note: Refer to theExternal Audit Info Support section for this field details.

PSD Applicable This flag indicates whether PSD charges and claims apply to the source. It can only be selected for sources where it is allowed. Notification Required flag This flag denotes whether notification generation is required for the source. Allow Back Value Dated Book Transfer This flag allows backdated book transfer transactions.

Note:- If Allow Back Value Dated Book Transfer is checked, the Instruction Date is set to the source date and the Branch or Currency Holiday is not applied. Activation Date gets defaulted to the current branch date.

- If Allow Back Value Dated Book Transfer is not checked, the Instruction Date is derived based on Branch or Currency Holiday. Activation Date gets defaulted to the current branch date.

- Even if Allow Back Value Dated Book Transfer flag is set to Yes in the Source Maintenance Detailed (PMDSORCE) screen, for cross-currency transactions, the system updates the Instruction Date using the Value Date received from the External Rate system.

File Creation Time for Process Cutoff Enable this flag to specify the time at which the system creates the file for process cutoff. Credit To GL Payments This section displays the Credit To GL Payments. Inbound credit to GL This flag can be checked to replace the credit account of the inbound payments received from the source with the Intermediary Credit GL maintained for that source.

Note:- When a transaction is input or received with the Credit to GL flag checked, the system verifies if Inbound Credit to GL is enabled for the source. If it is not, an error is displayed.

- It is not mandatory to have a credit account orcustomer for the transaction if Inbound Credit to GL flag is checked for the transaction. On enrich or save, the system populates the credit account as the Intermediary Credit GL maintained for the source.

- If credit account or customer is available, it is retained. However, all customer or account related validations are skipped.

- Credit account currency is set same as transfer currency.

Intermediary Credit GL Select the Intermediary Credit GL from the list of values.

Note:- Cutoff processing, price pickup, and external account validation are skipped for transaction with Credit to GL flag checked.

- Sanction screening is applicable by default.

- While posting the credit accounting, the credit account is be considered as Intermediary Credit GL maintained for the source.

Pricing Applicable Select this option if pricing is applicable for Credit to GL payments. This flag is available only when the Credit to GL Payments flag is checked.

For US ACH Debit transactions, charges configured for the Network will apply only if the Pricing Applicable flag for Credit to GL must be enabled.

Auto Queue Preferences This section displays the Auto Queue Preferences. System Action Select the System Action from the drop-down list. The available options include Auto Roll-over, Cancel, and Retain in Queue.

This preference maintained for the source is considered for the prefunded payments in the following scenarios:

- For processing a payment which is pending in cutoff or network cutoff exception queues during end of the day.

- For deciding the next step of processing when a payment is released from SC on a future date.

- When the External Credit Approval status received requires system action preference application.

- Duplicate Check Fields

The Duplicate Check Fields screen allows user to capture Duplicate Check Fields information. - Response Details

This topic explains the Response Details of the Source Maintenance Detailed screen. - Department Details

This topic explains the Department Details of the Source Maintenance Detailed screen. - Source Maintenance Summary

Parent topic: Network & Source Maintenances