1.4.3 Settlement Instructions

The Settlement Instruction Detailed screen allows users to maintain Standard Settlement Instruction (SSI) for the customer and a beneficiary.

- Beneficiary Institution/Ultimate Beneficiary

- Account with Institution

- Intermediary

- Sender to Receiver Information

- Remittance Details

- Receiver Correspondent

- Payment preferences for gpi payment & charge bearer

- Nostro Correspondent Credit /Debit account

Customer ID and SSI Label are unique combination to identify the settlement party details.

Facility for populating the beneficiary/routing details for a payment transaction based on the customer and SSI Label received in payment request is available.

User can mark one of the Settlement Instructions as the default instruction, and to fetch the beneficiary/routing details based on the default instruction if the SSI Label is not provided in the payment request.

Provision is given for viewing and authorizing the default SSI Label populated by the system when the payment requests are received from channels.

This screen also allows user to maintain the beneficiary details linked to a customer.

- On Homepage, specify PMDSSIMT in the text box, and click next arrow.The Settlement Instruction Detailed screen is displayed.

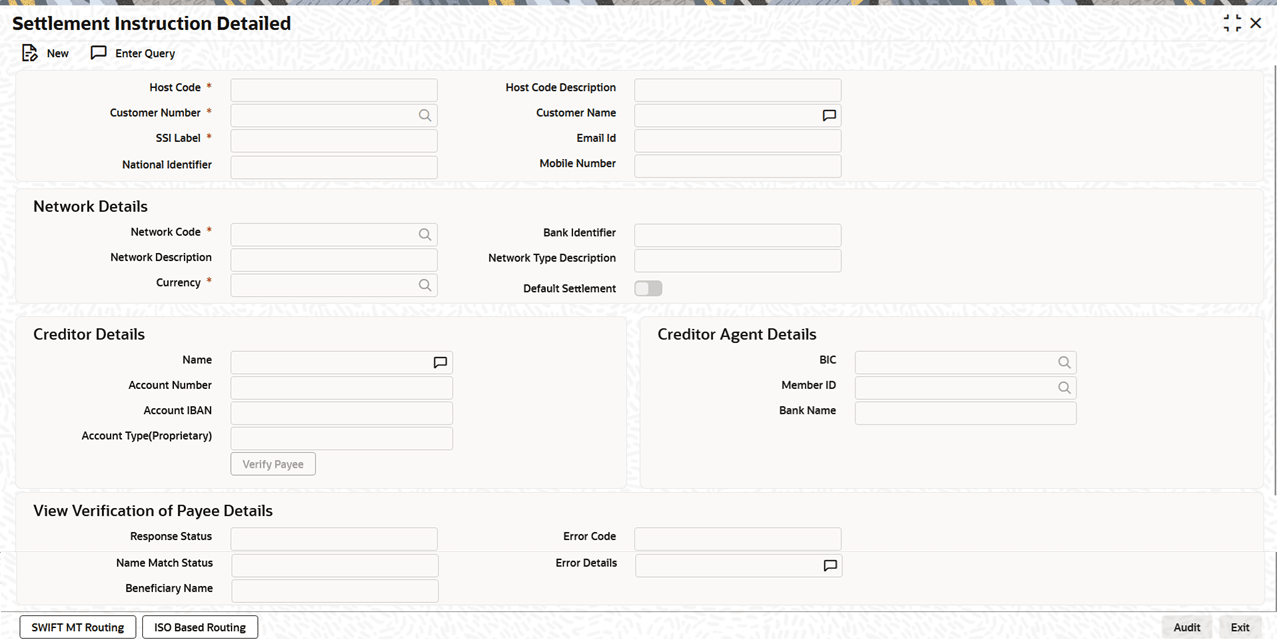

Figure 1-62 Settlement Instruction Detailed

Description of "Figure 1-62 Settlement Instruction Detailed" - On Settlement Instruction Detailed screen, click New to specify

the fields.

Table 1-36 Settlement Instruction Detailed - Field Description

Field Description Host Code System defaults the host code of transaction branch on clicking New. Host Code Description System defaults the description of the Host Code selected. Customer Number Specify the customer number for whom beneficiary details are maintained. Alternatively, user can select from the option list. The list displays all valid customer numbers maintained in the system. Customer Name System displays the customer name for the customer number selected. SSI Label Specify the SSI label. Same SSI Label cannot be repeated for a customer, even though Network maintained is different. Every SSI label is linked to a Network. Email Id Specify the email address of the customer. National Identifier Specify the National Identifier of the customer. Mobile Number Specify the mobile number of the customer.

Note: Email ID, Mobile Number, and National Identifier fields are optional fields.

Network Details This section displays the Network Details. Network Code Specify the network code from the list of values. This is a mandatory field.

Network Description System displays the description of the network based on the network code selected. Currency Specify the currency from the list of values. This is a mandatory field. Network Type Description System displays the description based on the network selected. Bank Identifier System displays the Bank Identifier based on the network selected. Default Settlement Check this box to mark one of the SSI labels as Default Settlement for a customer and network and currency combination. Creditor Details This section displays the Creditor Details. Name Specify the Creditor Name. Account Number Specify the Creditor Account Number.

For the Faster Payments Network of type GN-FPY, this field can be edited by the user only if the bank identifier is set to Account Number in Faster Payments Additional Processing Preferences (PFDNWAPR).

Account IBAN Specify the Account IBAN.

For the Faster Payments Network of type GN-FPY, this field can be edited by the user only if the bank identifier is set to IBAN in Faster Payments Additional Processing Preferences (PFDNWAPR).

Account Type (Proprietary) Specify the Account Type. Verify Payee The Verify Payee button is applicable only when the selected Network Code is of type SCT or SCT Instant. It is mandatory to input Creditor IBAN and Creditor Name before doing verification of payee.

Creditor Agent Details This section displays the Creditor Agent Details. BIC Specify the BIC from the list of values.

For the Faster Payments Network of type GN-FPY, this field can be edited by the user only if the bank identifier is set to SWIFT BIC in PMDNWMNT.

If a Directory Key is linked to the Network in Network Maintenance Detailed (PMDNWMNT), then the list includes all active bank codes linked to the Network Directory Key from ACH Network Directory (PMDACHDR).

Member ID Specify the Clearing Id code.

For the Faster Payments Network of type GN-FPY, this field can be edited by the user only if the bank identifier is set to Local Bank Code in PMDNWMNT.

If a Directory Key is linked to the Network in Network Maintenance Detailed (PMDNWMNT), then the list includes all active bank codes linked to the Network Directory Key from ACH Network Directory (PMDACHDR).

Bank Name System displays the Bank Name based on BIC or Member ID selected. Verification of Payee Response Details This section displays the Verification of Payee Response Details. Response Status Select a Response Status value from the drop-down list. The available options are:- Failed

- Success

Name Match Status Specify the Name Match Status. Beneficiary Name Specify the Beneficiary Name. Error Code Specify the Error Code. Error Details Specify the Error Details.