3.2.1.14 Remittance Information Tab -Referred Document Amount - View Details Button

This topic explains the View Details button under the Referred Document Amount header in the Remittance Information tab of the RTGS ISO Outbound FI to FI Customer Credit Transfer Input Detailed screen.

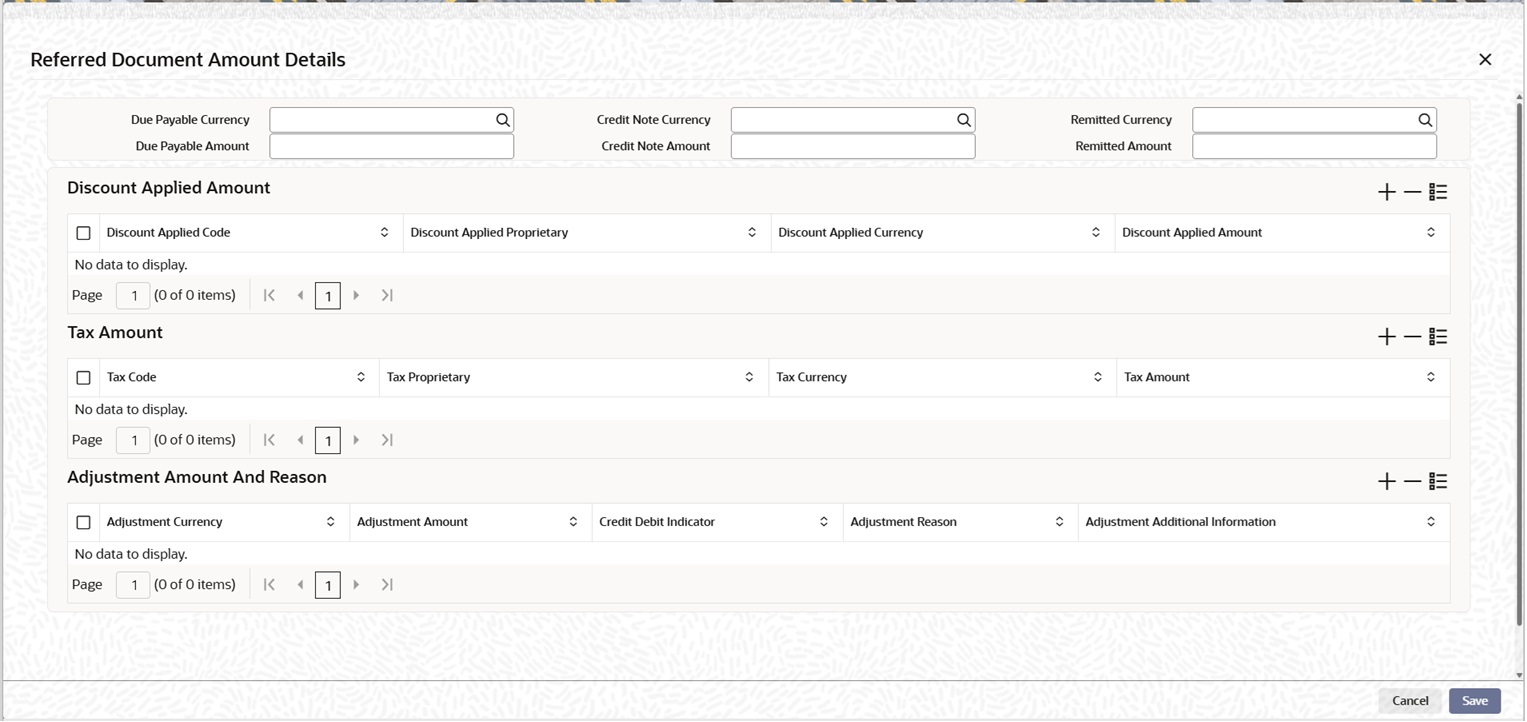

- Click the View Details button in the Referred

Document Amount header.The Referred Document Amount Details screen is displayed.

Figure 3-151 Remittance Information Tab_Referred Document Amount_View Details - Referred Document Amount Details

Description of "Figure 3-151 Remittance Information Tab_Referred Document Amount_View Details - Referred Document Amount Details" - On the Referred Document Amount Details screen, specify

the fields.

Table 3-131 Remittance Information Tab_Referred Document Amount_View Details - Field Description

Field Description Due Payable Currency Select the Due Payable Currency of remittance from the list of values. Due Payable Amount Select the Due Payable Amount of remittance. Credit Note Currency Select the Credit Note Currency of remittance from the list of values. Credit Note Amount Specify the Credit Note Amount of remittance. Remitted Currency Select the Remitted Currency of remittance from the list of values. Remitted Amount Specify the Remitted Amount of remittance. Discount Applied Amount This section displays the following fields. Discount Applied Code Select the Discount Applied Code of remittance from the list of values. Discount Applied Proprietary Select the Discount Applied Proprietary of remittance. Discount Applied Currency Select the Discount Applied Currency of remittance from the list of values. Discount Applied Amount Specify the Discount Applied Amount of remittance.

Note:

If you enter information for Discount Applied Amount, you must provide either Discount Applied Code or Discount Applied Proprietary.

If you enter information for Discount Applied Amount, you must provide Discount Applied Amount and Discount Applied Currency.

Tax Amount This section displays the following fields. Tax Code Select the Tax Code of remittance from the list of values. Tax Proprietary Specify the Tax Proprietary of remittance. Tax Currency Select the Tax Currency of remittance from the list of values. Tax Amount Specify the Tax Amount of remittance.

Note:

If you enter information for Tax Amount, you must provide either Tax Code or Tax Proprietary.

If you enter information for Tax Amount, you must provide Tax Amount and Tax Currency.

Adjustment Amount And Reason This section displays the following fields. Adjustment Currency Select the Adjustment Currency of remittance from the list of values. Adjustment Amount Specify the Adjustment Amount of remittance. Credit Debit Indicator Specify the Credit Debit Indicator. Adjustment Reason Specify the Adjustment Reason of remittance. Adjustment Additional Information Specify the Adjustment Additional Information of remittance.

Note: If you enter information for Adjustment Amount And Reason, you must provide Adjustment Amount and Adjustment Currency.