6.1.1.2 Process Return Details Tab

This topic explains the systematic instructions to process the Return Details tab. This tab is displayed in the Generic Wires ISO Outbound Payment Return Input Detailed screen.

- From the main tab, select the Return Details tab.

Note:

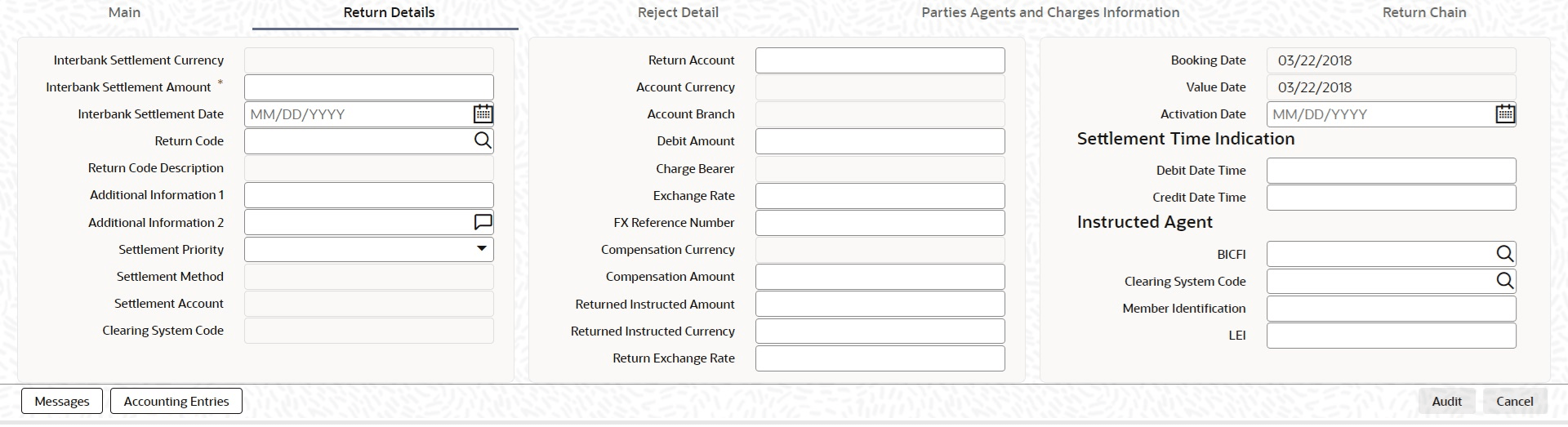

The Return Details tab is not available if Return Message Type field has value as FI To FI Payment Status Report.The Return Details tab is displayed.Figure 6-23 Generic Wires ISO Outbound Payment Return Input Detailed - Return Details Tab

Description of "Figure 6-23 Generic Wires ISO Outbound Payment Return Input Detailed - Return Details Tab" - In the Return Details tab, specify the fields. For more

information on fields, refer to the field description table below:

Table 6-21 Generic Wires ISO Outbound Payment Return Input Detailed_Return Details Tab - Field Description

Field Description Interbank Settlement Currency Displays same as transfer currency. By default, the system displays the settlement currency of original Inbound transaction. Interbank Settlement Amount Displays the final amount resolved. By default, the settlement amount of original inbound transaction is displayed. User can modify the amount to a lesser amount. Interbank Settlement Date Displays the interbank settlement date of return transaction. Return Code Select the Return Code from the list of values. It lists the code of reason for returning the transaction. Return Code Description Displays the description of the selected return code. Additional Information 1 Specify the additional information related to the return reason, if applicable. Additional Information 2 Specify the additional information related to the return reason, if applicable. Settlement Priority Select the settlement priority. The options are: - HIGH

- NORM

- URGT

Note:

For TARGET2 network, the system always populates the field with value as NORM.Settlement Method Select the settlement method. The options are: - INDA

- INGA

- CLRG

Note:

For CBPR network, the system displays the value based on the instructed agent derived.For TARGET2 network, the system displays the field with value as CLRG after selecting the original transaction.

Settlement Account Displays the settlement account for the transaction. The system displays the instructed agent account number present in books. Clearing System Code Select the clearing system code for the transaction from the list of values. The option is: - TGT

Return Account Specify the credit account of the original inbound transaction. Account Currency Defaults the currency of the selected return account. Account Branch Displays the branch of the selected return account. Debit Amount Specify the debit amount. The debit amount is calculated based on the exchange rate. Charge Bearer Select the charge bearer. The options are: - CRED

- DEBT

- SHAR

Exchange Rate Specify the exchange rate if debit account currency is different from transfer currency (or) instructed currency is different from transfer currency. FX Reference Number Specify the FX reference number. Compensation Currency Displays the same as transfer currency. Compensation Amount Specify the final amount resolved. Booking Date Displays the booking date to current branch date. Value Date Displays the value date of the original transaction. Activation Date Specify the activation date. This is the date on which the return transaction is processed. Initially this date remains same as Booking Date, if it is a Network and Branch working day. Otherwise, it moves forward. Settlement Time Indication This section displays the settlement time indication details. Debit Date Time Specify the date and time of debiting the transaction. Credit Date Time Specify the date and time of crediting the transaction. Note:

For above mentioned fields, the time Off-Set is made mandatory for translation purposes.Instructed Agent This section displays the instructed agent details. Swift Bank Identifier Code Select the swift bank identifier code from the list of values. Clearing System Code Select the clearing system code from the list of values. Member Identification Specify the member identification. LEI Specify the LEI of the agent.