4.1.1.12 Referred Document Amount - View Details

This topic explains the View Details button under Referred Document Amount of Remittance Information tab in the Cross Border Inbound FI to FI Customer Credit Transfer Input Detailed screen.

- Click the View Details button under Referred Document

Amount of Remittance Information

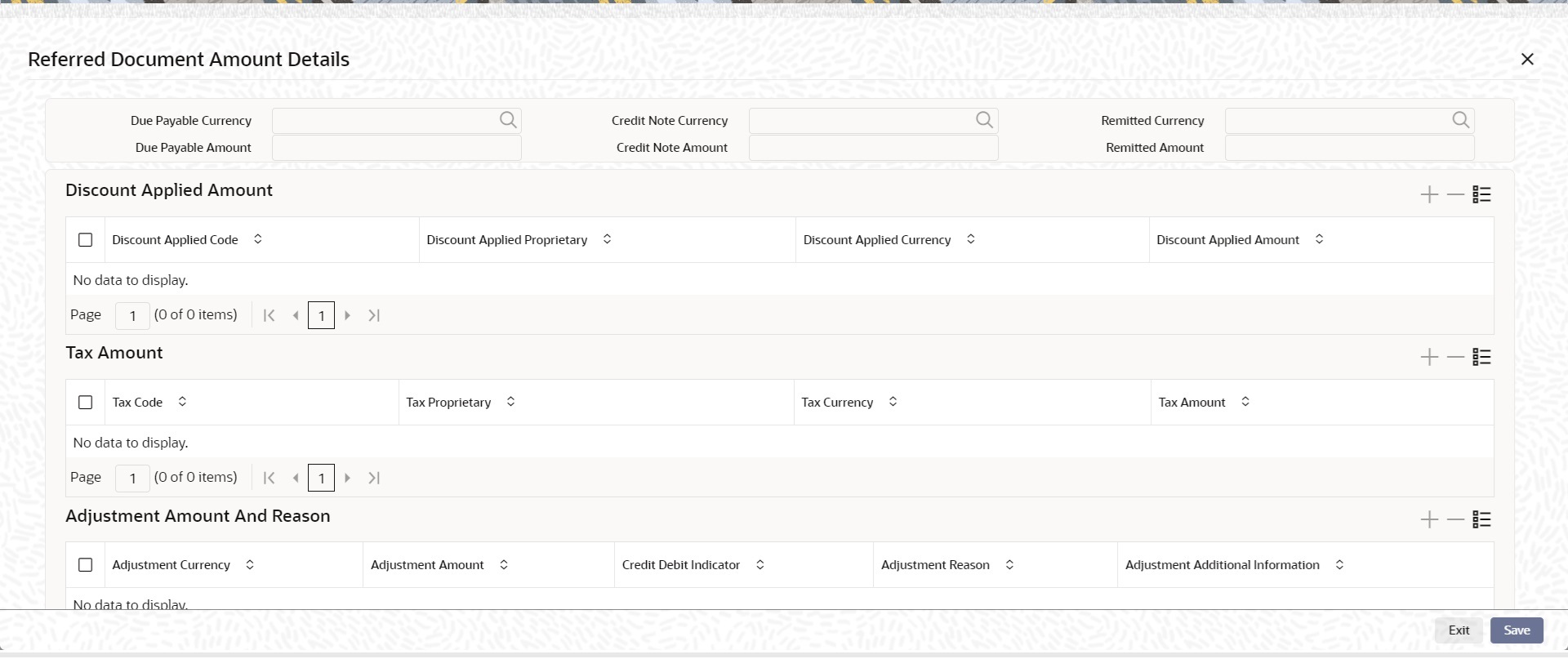

tab.The Referred Document Amount Details sub-screen is displayed.

Figure 4-23 Remittance Information Tab_Referred Document Amount - View Details

Description of "Figure 4-23 Remittance Information Tab_Referred Document Amount - View Details" - On the Referred Document Amount Details screen, specify

the fields.

Table 4-23 Remittance Information Tab_Referred Document Amount_View Details - Field Description

Field Description Due Payable Currency Specify the Due Payable Currency of remittance. Due Payable Amount Specify the Due Payable Amount of remittance. Credit Note Currency Specify Credit Note Currency of remittance from the list of values. Credit Note Amount Specify the Credit Note Amount of remittance. Remitted Currency Specify Remitted Currency of remittance from the list of values. Remitted Amount Specify the Remitted Amount of remittance. Discount Applied Amount This section displays the following fields. Discount Applied Code Specify Discount Applied Code of remittance from the list of values. Discount Applied Proprietary Specify the Discount Applied Proprietary of remittance. Discount Applied Currency Specify Discount Applied Currency of remittance from the list of values. Discount Applied Amount Specify the Discount Applied Amount of remittance.

Note:

If you enter information for Discount Applied Amount, you must provide either Discount Applied Code or Discount Applied Proprietary.

If you enter information for Discount Applied Amount, you must provide Discount Applied Amount and Discount Applied Currency.

Tax Amount This section displays the following fields. Tax Code Specify Tax Code of remittance from the list of values. Tax Proprietary Specify the Tax Proprietary of remittance. Tax Currency Specify Tax Currency of remittance from the list of values. Tax Amount Specify the Tax Amount of Remittance.

Note:

If you enter information for Tax Amount, you must provide either Tax Code or Tax Proprietary.

If you enter information for Tax Amount, you must provide Tax Amount and Tax Currency.

Adjustment Amount And Reason This section displays the following fields. Adjustment Currency Specify the adjustment currency of remittance from the list of values. Adjustment Amount Specify the adjustment amount of remittance. Credit Debit Indicator Specify Credit Debit Indicator from the list of values. Adjustment Reason Specify the adjustment reason of remittance. Adjustment Additional Information Specify the adjustment additional information of remittance. Note: If you enter information for Adjustment Amount And Reason, you must provide Adjustment Amount and Adjustment Currency.