3.7.1 Manual Assessment

This topic provides the systematic instructions to modify the account details and recommend for the approval / reject the loan application.

Manual Assessment is the data segment which enables the bank user to modify the loan details and recommend for the approval/reject the loan application. The user can acquire the application from Free Tasks list and assess all the View Only data segments.

To capture manual assessment:

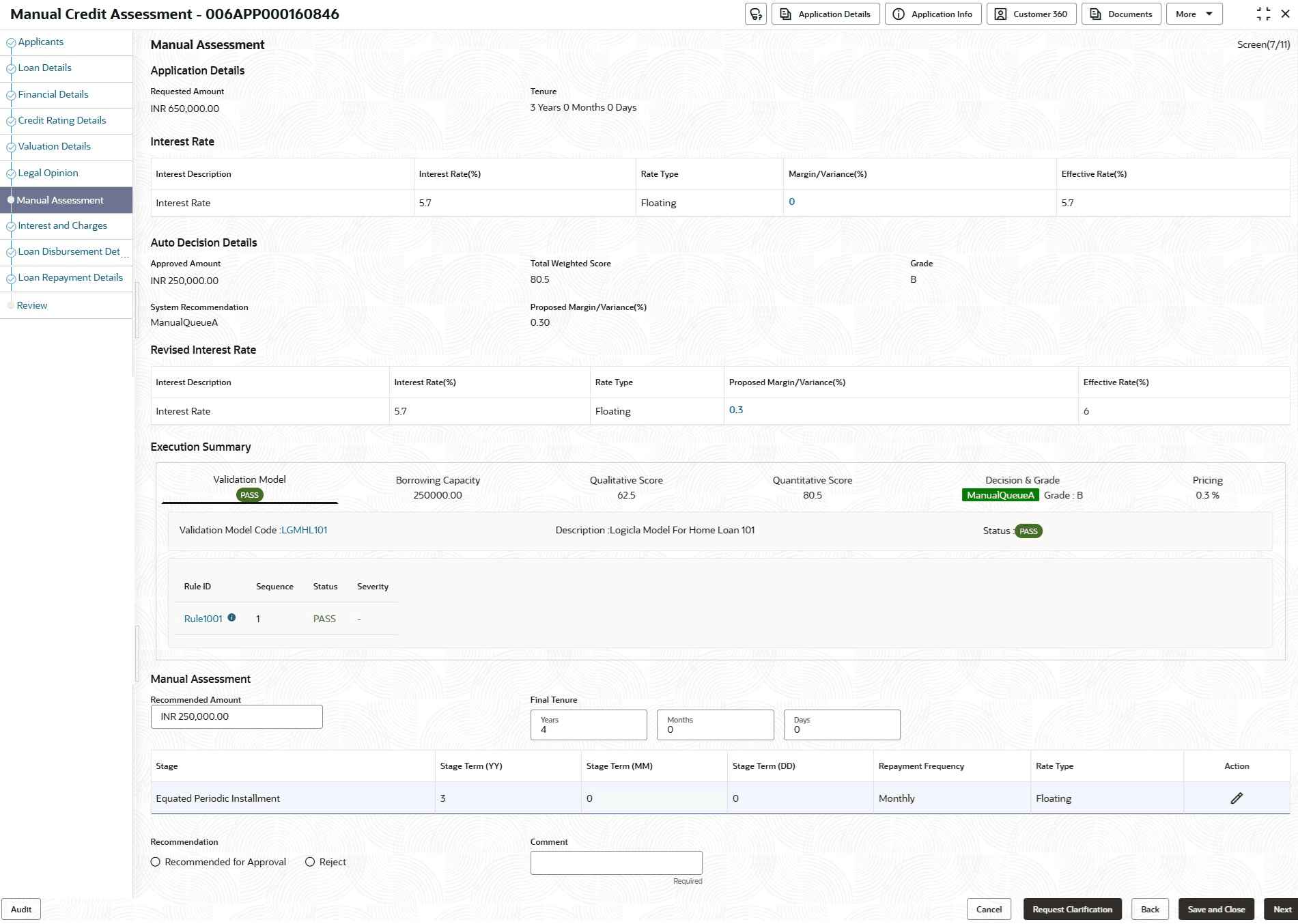

- On acquiring the Manual Credit Assessment task from the Free Tasks.The Manual Credit Assessment screen displays.

- Specify the fields on Manual Assessment screen.For more information on fields, refer to the field description table. Refer to Assessment Details screen for the detailed explanation of Validation Model, Borrowing Capacity, Qualitative Score, Quantitative Score, Decision & Grade, and Pricing tabs.

Table 3-33 Manual Credit Assessment – Field Description

Field Description Requested Amount Displays the requested amount. Tenure Displays the loan tenure. Interest Rate This section displays the following details of interest rate. Interest Description Displays the interest description of the selected interest rate code. Interest Rate (%) Displays the interest rate. The system validates the Floor and Ceiling rates for each interest component.- If the effective rate is less than the floor rate, the system stamps the floor rate for that component.

- If the effective rate is greater than the ceiling rate, the system stamps the ceiling rate for that component.

Rate Type Displays the type of interest rate which is applied. Margin / Variance (%) Click the link of margin or variance in percentage. It displays the pop-up list of all margins.- Product Margin

- Risk based Margin

- Discretionary Margin

- Relationship Benefit Margin

- Bundle Margin

The Margin field appears if the Rate Type is selected as Floating.

The Variance field appears if the Rate Type is selected as Fixed.

The Bundle Margin is displayed in the drop-down list only if loan is opened as part of a bundle application and bundle margin benefit is applicable.

Effective Rate (%) Displays the effective rate of interest. Auto Decision Details This section displays the following details of auto decision. Approved Amount Displays the approved amount. This field will be blank for Manual Assessment.

Total Weighted Score Displays the total weighted score. System Recommendation Displays the system recommendation for auto credit decision.

Revised Interest Rate This section displays the revised interest rate based on the details updated in Manual Assessment section. Proposed Margin/Variance (%) Displays the margin/variance proposed by Decision service in percentage. This field displays Margin (%) if the Rate Type is selected as Floating.

This field displays Variance (%) if the Rate Type is selected as Fixed.

Execution Summary This section displays the execution summary of loan assessment details. For more information, refer to the Assessment Details topic Recommended Amount Specify the recommended loan amount. Final Tenure Specify the final tenure. The stage grid reappears when the final tenure changes, allowing the user to enter the revised tenure details.

Recommendation Select the recommendations. Available options are:

- Recommended for Approval

- Reject

Comments Specify the comment for the recommendation. Reject Reason Select the reject reason. Credit Appraisal Memorandum Click the Credit Appraisal Memorandum Advice link under Quick Links to generate the Credit Appraisal Memorandum. The Credit Appraisal Memorandum summarizes the borrower’s profile, credit assessment and decision details. User can view it under the Advices link. - Click Next to navigate to the next data segment, after successfully capturing the data. The system will validate all mandatory data segments and data fields. If mandatory details are not provided, the system displays an error message for the user to take action. User will not be able to proceed to the next data segment, without capturing the mandatory data.

Parent topic: Manual Credit Assessment