3.3.4 Loan Repayment Details

This topic describes systematic instructions to enables the user to capture the loan repayment details.

Loan Repayment Details will enable the user to capture the repayment details.

To capture the loan repayment details:

- Click Next in the previous data segment to proceed with the next data

segment, after successfully capturing the data.

If Account Type is selected as Own Internal Account in Loan Details data segment.

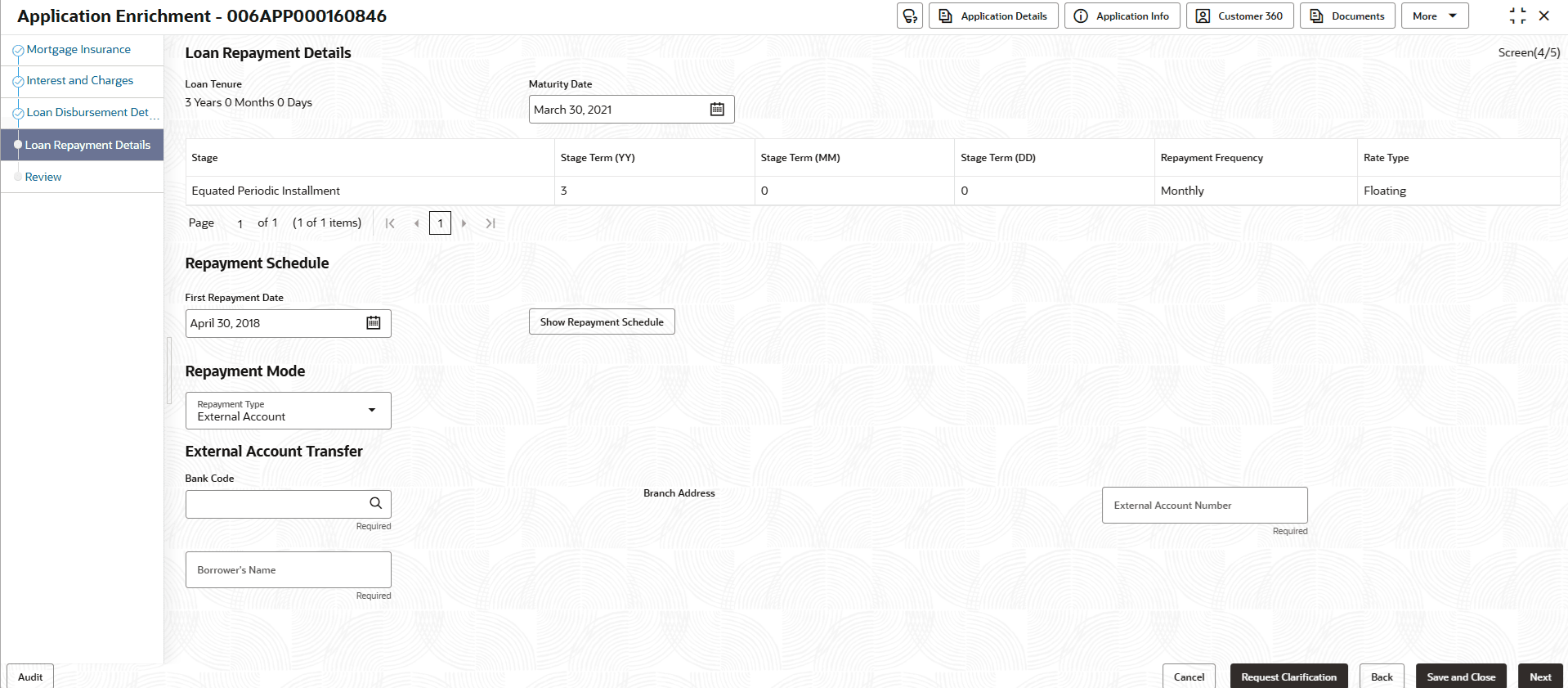

The Loan Repayment Details - Own Internal Account screen displays.Figure 3-30 Loan Repayment Details – Own Internal Account

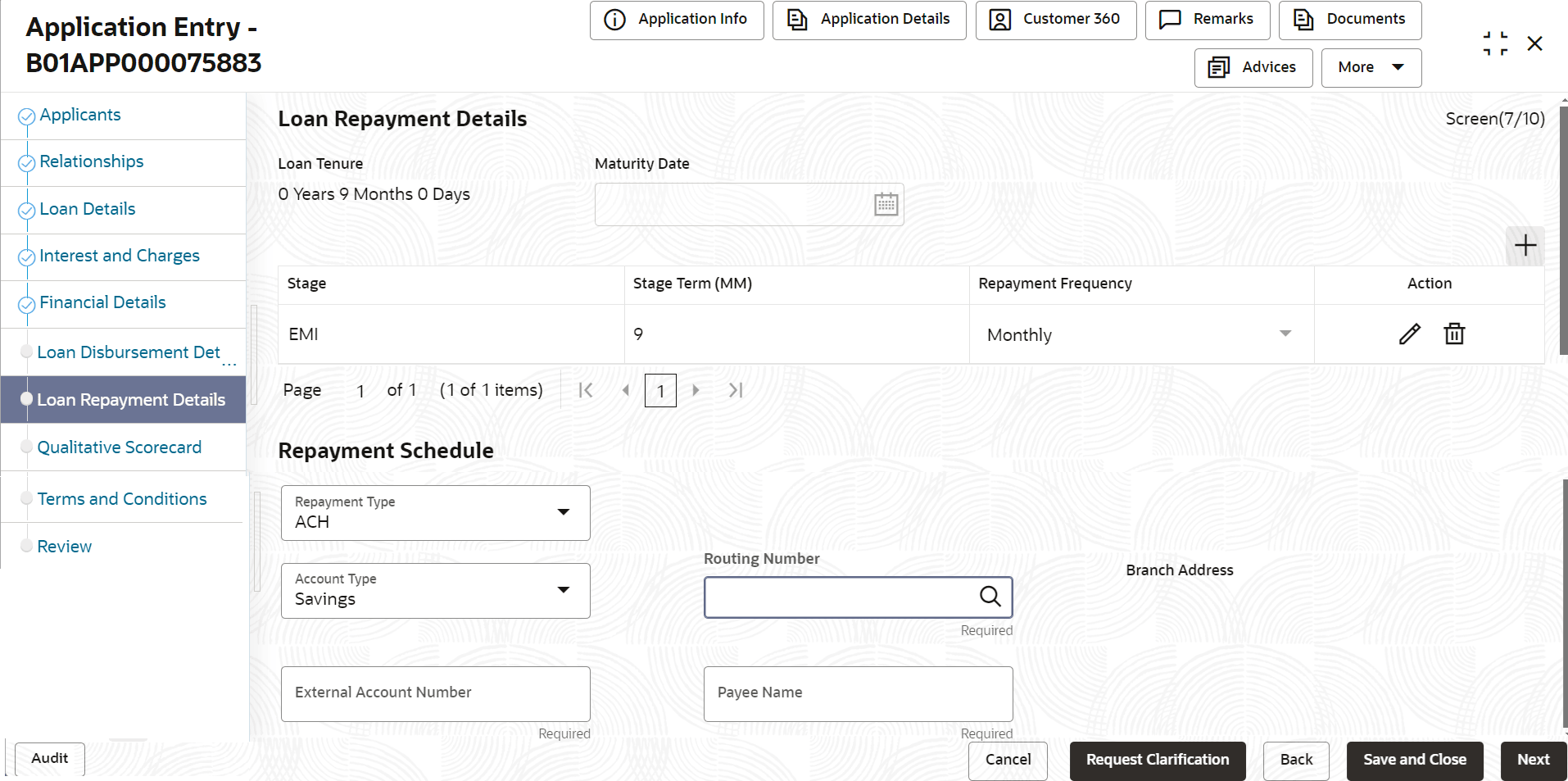

If Account Type is selected as ACH in Loan Details data segment.

The Loan Repayment Details - ACH screen displays.If Account Type is selected as Capture Later in Loan Details data segment.

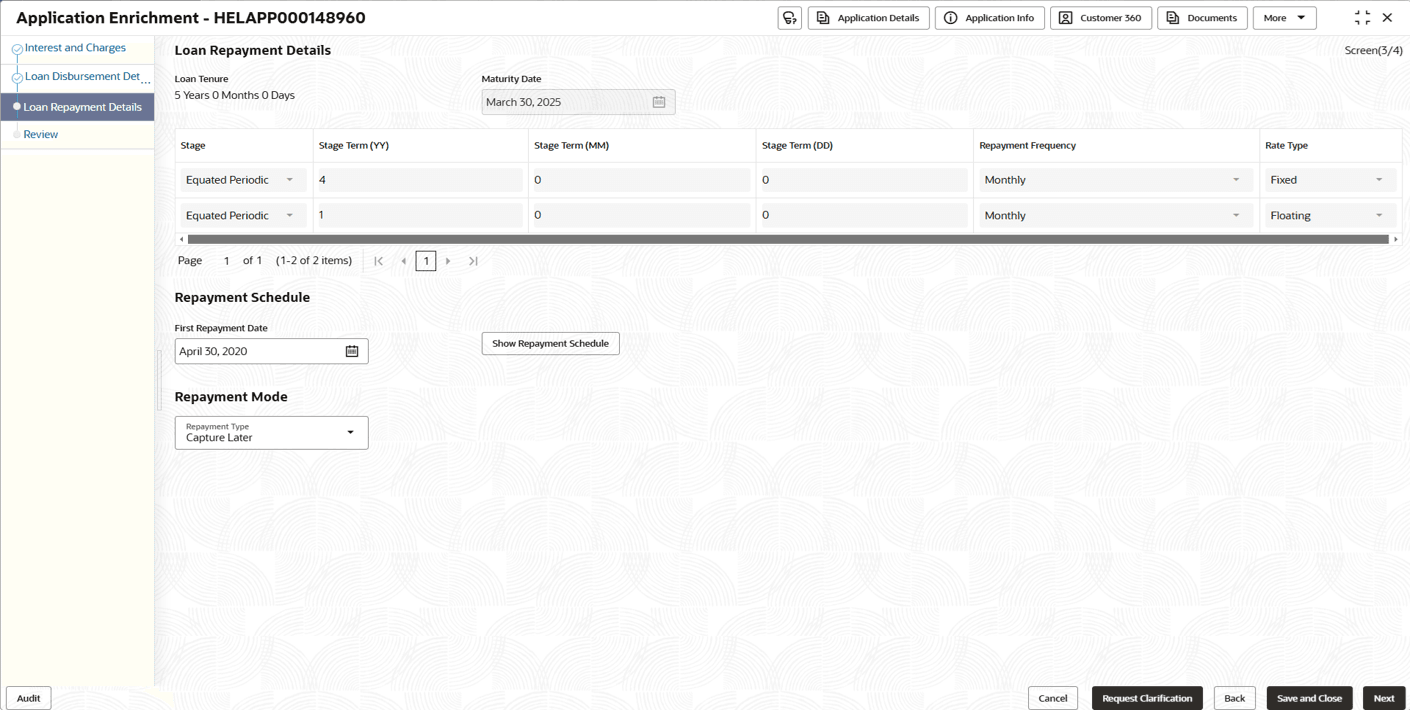

The Loan Repayment Details - Capture Later screen displays.

Figure 3-32 Loan Repayment Details – Capture Later

- Specify the details in the relevant data fields. For more information on

fields, refer to the field description table below.

Table 3-19 Loan Repayment Details – Field Description

Field Description Loan Tenure Displays the selected loan tenure. Maturity Date Displays the maturity date based on the First Repayment Date and Loan Tenure.

Click this icon to add repayment stage details. Stage Select the type of repayment. All type of repayment methods configured in the Business Product Preferences data segments of the Business Product Configuration screens appears in the drop-down list.

If User Defined Schedule is selected, system will validate with the stage sequence rule maintained in Business Product and will not allow to add additional stages with User Defined Schedule.

Stage Term <Term Unit> Displays the default stage term configured in the Business Product Preferences data segments of the Business Product Configuration screens. The separate column appears for separate term units.

Repayment Frequency Select the repayment frequency from the drop-down list. The available options appears based on the configuration set in the Business Product Preferences data segments of the Business Product Configuration screens:- Daily

- Weekly

- Bi-Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

The above options displays based on initial setup.

Note: If the stage is selected as User Defined Schedule and BULLET, this field is defaulted to Not Applicable.

Rate Type Select the rate type from the drop-down list. The available options are:- Fixed

- Float

Repayment Schedule Displays the repayment schedule details. Manage Installment Details Click this option to capture the user defined schedules. Note: This option is enabled if UDS stage is selected in Business Product Configuration.

First Repayment Date Select the first repayment date of the sanctioned loan amount. - If Type of Repayment is selected as BULLET then the first installment date is defaulted to the Maturity Date and number of installments will be set as one.

- If Type of Repayment is selected as BULLET and in Business Product Configuration screen , Moratorium is allowed for the selected product then Moratorium will be set to Zero.

Note: If User Defined Schedule is selected as stage then First Repayment Date will be hidden.

Repayment Mode Select the repayment mode from the drop-down list. The available options are:- Own Internal Account- If the mode selected as Internal Account, then the system enables the fields for Customer Account and Branch.

By default, the system populates the internal account selected in Disbursement data segment. However, if user wishes to have a different account, he/she can select another customer account of the CIF and account branch displays in the branch field.

- ACH- If the mode is selected in ACH in Disbursement Mode then the system displays additional fields:

- Account Type

- Routing Number

- Branch Address

- External Account Number

- Borrower Name

- Capture Later - If the mode selected is Capture Later, the system will allow to proceed with the loan origination flow without capturing the repayment details.

Note : The system defaults to the GL account in the absence of the repayment account.

The above options displays based on the initial setup.

Customer Account Click Search icon and select the customer account number. This field displays if Repayment Mode is selected as Internal Account.

Branch Code Specify the branch code associated with customer account number. This field displays if Repayment Mode is selected as Internal Account.

Routing Number Click Search and specify routing number to identify a specific financial institution in a transaction. This field displays if Repayment Mode is selected as ACH.

Branch Address Specify the branch address. This field displays if Repayment Mode is selected as ACH.

External Account Number Specify the external account number. This field displays if Repayment Mode is selected as ACH.

Borrower Name Specify the borrower name. This field displays if Repayment Mode is selected as ACH.

- Click the Show Repayment Schedule button to generate the repayment schedule which displays the details of installment amount with the principal and interest break up for the given tenure. Below fields appears in the section and displays the respective details:

- Loans Amount

- Loan Financed

- Term

- Interest Rate %

- Finance Charges

- APR(%)

- Sr No.

- Date

- Installment

- Principal

- Interest

- Outstanding Balance

For more information, refer to the topic.

- Click Next to navigate to the next data segment, after successfully capturing the data. The system validates for all mandatory data segments and data fields. If mandatory details are not provided, the system displays an error message for the user to take an action. The User cannot to proceed to the next data segment, without capturing the mandatory data.

- Repayment Schedule

This topic decribes the loan repayment schedule. - User Defined Schedule

This topic describes the user defined schedule.

Parent topic: Application Enrichment Stage