1.1.1.3.2 Saving or Current Product Preferences

This topic describes the saving product preferences details.

The Saving Product Preference screen appears when the user selects the Product Category as Individual to configure loan preferences.

To add saving preference:

- Click Next in Business Product Host Mapping screen to proceed with next data segment, after successfully capturing the data.The Business Product Preference – Savings or Current Account Product screen appears.

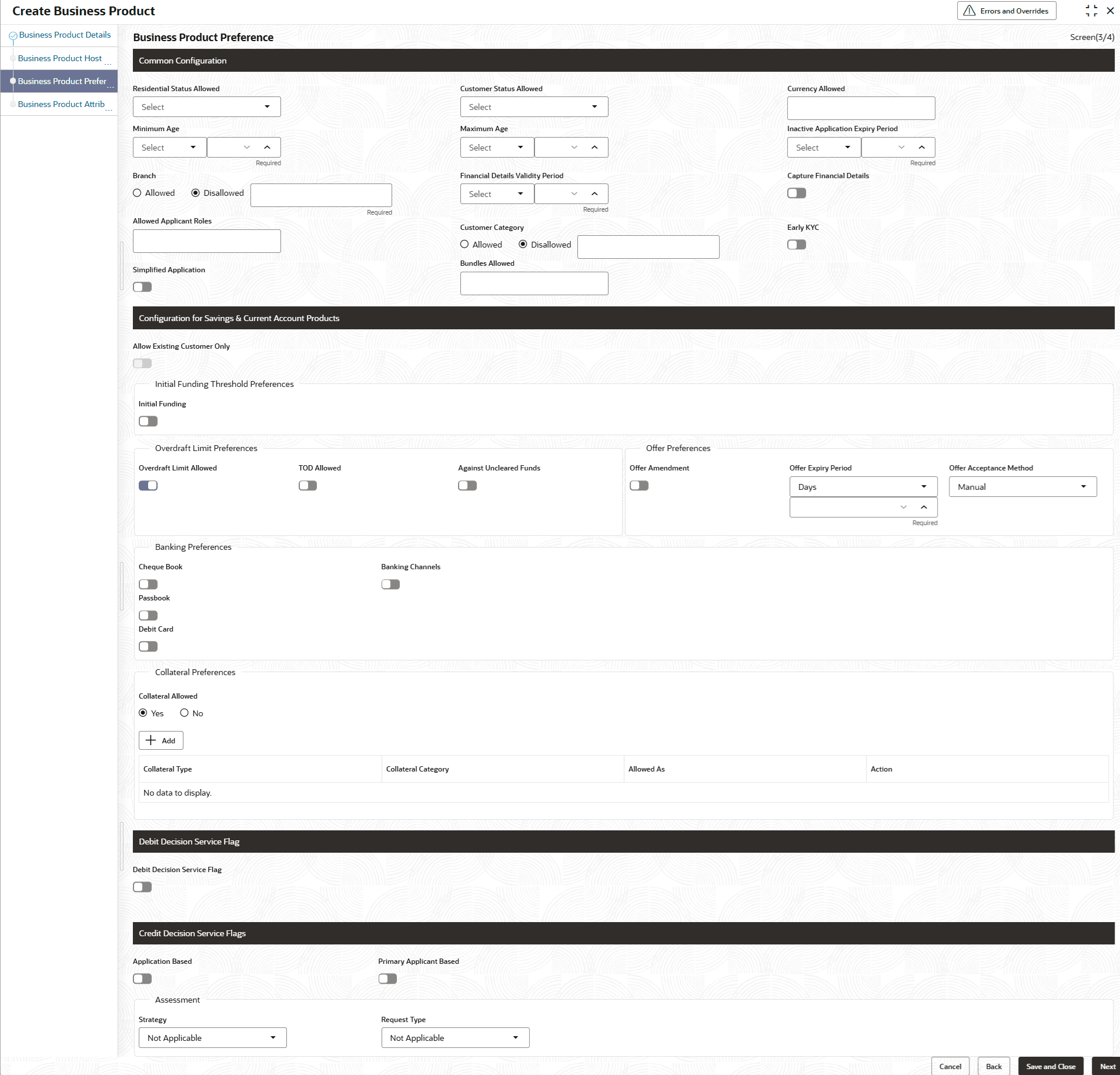

Figure 1-6 Business Product Preference – Savings or Current Account Product

- Specify the details in the relevant data fields.

Note:

The fields which are marked with Required are mandatory.For more information on fields, refer to the field description table.Table 1-6 Business Product Preference (Savings or Current Account Product) – Field Description

Field Name Description Common Configuration Specify the common configurations for the business product. Residential Status Allowed Select the option for which the business product is applicable for.

The available options are:

- Resident

- Non-Resident

- Both

Customer Status Allowed Select the option for which the business product is applicable for.

The available options are:

- Major

- Minor

- Both

- Not Applicable

Currency Allowed Select the currency or currencies that are allowed for the business product. System allows to select multiple currencies, if applicable. Minimum Age Specify the minimum age of the applicant who are eligible to open the account for the business product being created. Select the period from the drop-down box.

The available options are:

- Days

- Month

- Year

Maximum Age Specify the maximum age of the applicant who are eligible to open the account for the business product being created. Select the period from the drop-down box.

The available options are:

- Days

- Month

- Year

Inactive Application Expiry Period Specify the period after which the application must be marked as Expired.

Select the period from the drop-down box.

The available options are:

- Days

- Month

- Year

Once the application has expired, no further lifecycle activity can happen for that application.

Branch Select one of the following options:

- Allowed – Select it to indicate and specify the branches where the account under the specified Business Product are allowed to be opened.

- Disallowed – Select it to indicate and specify the branches where the account under the specified Business Product are not allowed to be opened.

Financial Details Validity Period Specify the validity period for financial details of the applicant. Select the period from the first drop-down box. Available options are:

- Days

- Month

- Year

Select the numeric period from the second drop-down box.

This field is mandatory for Current Product and non-mandatory for Savings Product.

Capture Financial Details Switch to  to capture financial details for this business product.

to capture financial details for this business product.

Allowed Applicant Roles Specify the applicant roles that are allowed to apply this product. The available roles are as below:- Primary

- Joint

- Guarantor

- Custodian

- Guardian

- Cosigner

The option in this list appears for selection based on the configuration.

This selected roles gets reflected in the Applicants data segment while capturing an applicant information in an application.

Customer Category Select one of the following options:

- Allowed – Select to indicate whether the specified categories are allowed to open an account for selected product.

- Disallowed – Select to indicate whether the specified categories are not allowed to open an account for selected product.

The system allows to select Disallowed and keep it blank so that the Business Product is allowed for all the branches.

Early KYC Switch to  to enable the early KYC feature to speedup KYC process of an applicant.

to enable the early KYC feature to speedup KYC process of an applicant.

If this option is selected, then the KYC call is trigger to Oracle Banking Party Services once the applicant data is captured in the application.

Simplified Application Switch to  to set simple process of account opening for this product.

to set simple process of account opening for this product.

In this process, the Initiation and the Application Entry stages are combined for submitting the account opening application.

Configuration for Savings & Current Account Products Specify the configurations for Savings and Account product. Allow Existing Customer Only By default, this toggle is turned ON based on the host parameter, indicating that eligible accounts are available within the host for opening a Money Market Savings account. When this toggle is turned OFF, the business process of regular savings and a Money Market Savings account are same.

Initial Funding Switch to  to indicate whether the funding process must appears at the initial stage of account opening.

to indicate whether the funding process must appears at the initial stage of account opening.

Fund Post Account Opening Switch to

to indicate the funding process must be performed post account opening.

to indicate the funding process must be performed post account opening.

This field appears if the Initial Funding toggle is turned ON.

Currency Displays the currency based on the Currency Allowed configured in the Common Configuration section.

This field appears if the Initial Funding toggle is turned ON..

Minimum Amount Specify the minimum funding amount if Initial Funding is mandatory for the account origination.

This field appears if the Initial Funding toggle is turned ON.

Maximum Amount Specify the maximum funding amount if Initial Funding is mandatory for the account origination.

This field appears if the Initial Funding toggle is turned ON.

Overdraft Limit Preferences This section user can set the preferences of overdraft limit. Overdraft Limit Allowed Switch to  to indicate if overdraft limit is allowed for the account.

to indicate if overdraft limit is allowed for the account.

TOD Allowed Switch to  to indicate the TOD is allowed.

to indicate the TOD is allowed.

Against Uncleared Funds Switch to  to indicate the action against uncleared funds.

to indicate the action against uncleared funds.

Offer Preferences This section captures the preferences of overdraft offers.

This section appears only if the Overdraft Limit Allowed toggle is turned ON.

Offer Amendment Switch to  to allow the offer to amend.

to allow the offer to amend.

Offer Expiry Period Select the expiry period of an offer in days, months and years.

Specify the count or select the up and down arrow to increase or decrease the count.

Offer Acceptance Method Select the method to accept the offer.

The available options are:

- Manual

- Auto

Banking Preferences This section captures the preferences of banking details. Cheque Book Switch to  to indicate that cheque book is allowed for the account.

to indicate that cheque book is allowed for the account.

Passbook Switch to  to indicate that passbook is allowed for the account.

to indicate that passbook is allowed for the account.

Debit Card Switch to  to indicate that debit card is allowed for the account.

to indicate that debit card is allowed for the account.

Banking Channels Switch to  to indicate that multiple banking channels are allowed for the account.

to indicate that multiple banking channels are allowed for the account.

Channels Allowed Select the channels that are allowed to the account.

The available options are:

- KISOK Banking

- Direct Banking

- Phone Banking

This field appears if the Banking Channel toggle is turned ON.

Collateral Preferences In this section, the user can capture the collateral preferences for loan product.

Collateral Allowed Select the appropriate radio button whether the collateral allow for the loan product. The options are:- Yes - If this option is selected, the system displays a table and allows user to add collateral details in the table for the loan product.

- No - If this option is selected, the system will not be allowed to add collateral details for the loan product.

Click Add to add rows in the table.

Collateral Type Select the collateral type from the drop-down list. The available option are: - Property

- Guarantee

- Vehicle

- Precious Metal

- Deposits

- Bonds

- Stocks

- Insurance

- Accounts Receivable

- Inventory (Stock of Material)

This field appears if the Collateral Allowed is selected as Yes.

Collateral Category Select the collateral type from the drop-down list. The options are displayed in the drop-down based on the collateral type selected. This field appears if the Collateral Allowed is selected as Yes.

Allowed As Select the allowed as from the drop-down list. The available option are: - Primary

- Additional

- Both

Notes:- Collateral Type-Collateral Category combination can be used only once with any Allowed As option as Primary or Both.

- The system does not allow the duplication of same Collateral Type-Collateral Category combination.

Action Select the actions to perform on the added record.  : To save the added record.

: To save the added record.

: To cancel the added record.

: To cancel the added record.

: To edit the added record.

: To edit the added record.

: To delete the added record.

: To delete the added record.

Debit Decision Service Flag This section captures the debit decision details. Debit Decision Service Flag Switch to  to allow the debit decision service.

to allow the debit decision service.

Credit Decision Service Flags Select the Credit Decision Service Flags.

The below flags appear only if Overdraft Limit Allowed toggle is turned ON.

Risk Based Pricing Applicable Switch to  to allow the Risk based pricing for the loan accounts.

to allow the Risk based pricing for the loan accounts.

Application Based Switch to  to consider the scorecard calculation based on the application.

to consider the scorecard calculation based on the application.

Primary Applicant Based Switch to  to consider the scorecard calculation based on the Primary applicant.

to consider the scorecard calculation based on the Primary applicant.

If the Product Category is selected as Small and Medium Business:

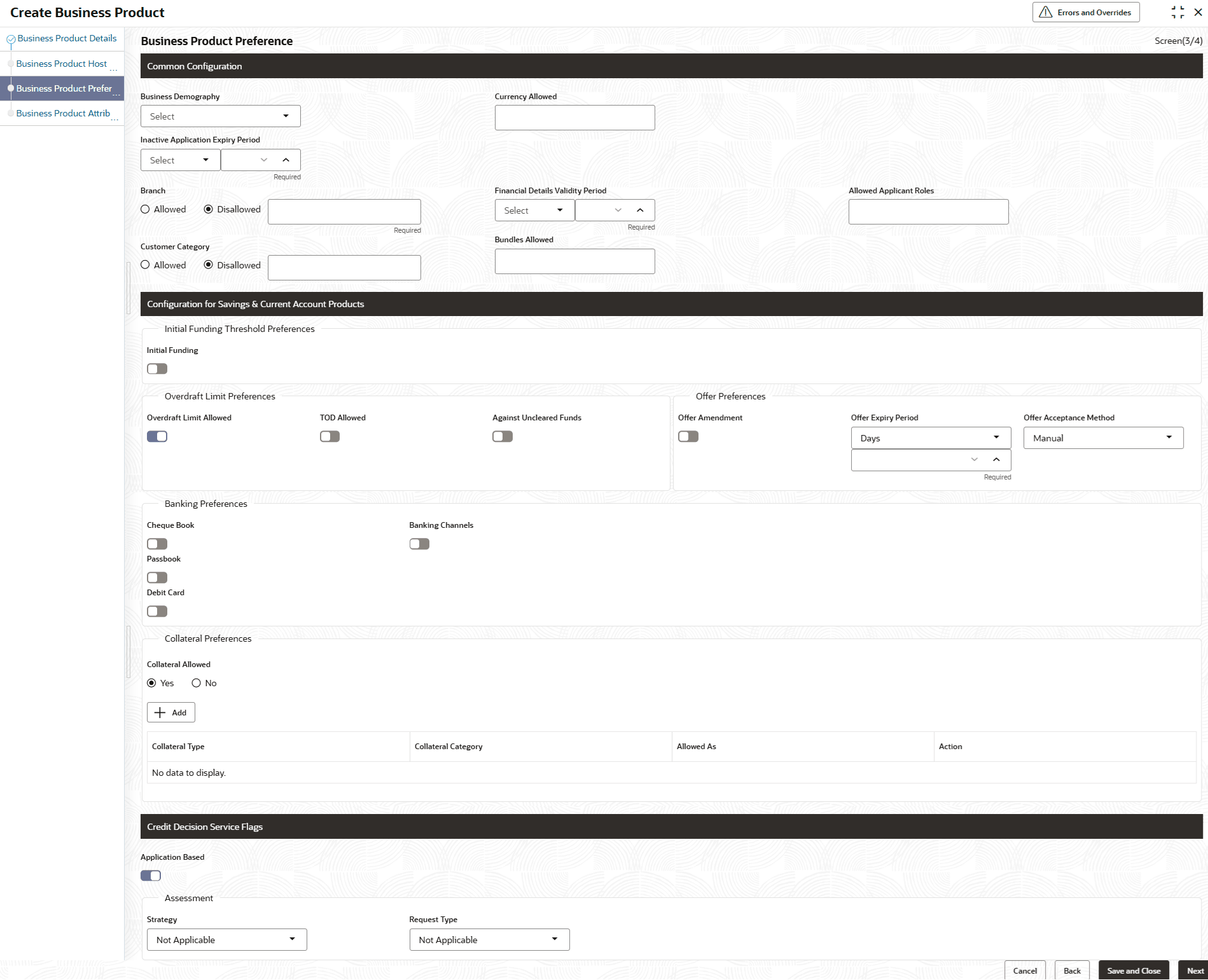

Figure 1-7 Business Product Preference – Savings and Current Account Product (SMB)

Table 1-7 Business Product Details – Field Description

Field Description Common Configuration Specify the common configurations for the business product. Business Demography Select the option for which the business product is applicable for.

The available options are:

- Domestic

- Overseas

Currency Allowed Select the currency or currencies that are allowed for the business product. System allows to select multiple currencies, if applicable. Inactive Application Expiry Period Specify the period after which the application must be marked as Expired.

Select the period from the drop-down box.

The available options are:

- Days

- Month

- Year

Once the application has expired, no further lifecycle activity can happen for that application.

Branch Select one of the following options:

- Allowed – Select it to indicate and specify the branches where the account under the specified Business Product is allowed to be opened.

- Disallowed – Select it to indicate and specify the branches where the account under the specified Business Product is not allowed to be opened.

Financial Details Validity Period Specify the validity period for financial details of the applicant. Select the period from the first drop-down box.

The available options are:

- Days

- Month

- Year

Select the numeric period from the second drop-down box.

This field is mandatory for Current Product and non-mandatory for Savings Product.

Allowed Applicant Roles Specify the applicant roles that are allowed to apply this product. Customer Category Select one of the following options:

- Allowed – Select it to indicate and specify the customer category where the account under the specified Business Product are allowed to be opened.

- Disallowed – Select it to indicate and specify the customer category where the account under the specified Business Product are not allowed to be opened.

The system allows to select Disallowed and keep it blank so that the Business Product is allowed for all the branches.

Configuration for Savings & Current Account Products In this section, user can capture the configurations for Savings and Current account product. Initial Funding Threshold Preferences In this section, user can capture initial funding threshold preferences for saving or current account. Initial Funding Switch to  , if Initial Funding is mandatory for the Account Origination.

, if Initial Funding is mandatory for the Account Origination.

Fund Post Account Opening Switch to  to indicate whether the funding stage should be post account opening.

to indicate whether the funding stage should be post account opening.

This field appears only if the Initial Funding toggle is turned ON.

Currency Displays the currency based on the Currency Allowed configured in the Common Configuration panel above.

This field appears only if the Initial Funding toggle is turned ON.

Minimum Amount Specify the minimum funding amount.

This field appears only if the Initial Funding toggle is turned ON.

Maximum Amount Specify the maximum funding amount.

This field appears only if the Initial Funding toggle is turned ON.

Overdraft Limit Preferences This section user can set the preferences of overdraft limit. Overdraft Limit Allowed Switch to  to indicate if overdraft limit is allowed for the account.

to indicate if overdraft limit is allowed for the account.

TOD Allowed Switch to  to indicate the TOD is allowed.

to indicate the TOD is allowed.

Against Uncleared Funds Switch to  to indicate the action against uncleared funds.

to indicate the action against uncleared funds.

Offer Preferences This section captures the preferences of overdraft offers.

This section appears only if the Overdraft Limit Allowed toggle is turned ON.

Offer Amendment Switch to  to indicate whether the offer is allowed to amend.

to indicate whether the offer is allowed to amend.

Offer Expiry Period Select the expiry period of an offer in days, months and years.

Specify the count or select the up and down arrow to increase or decrease the count.

Offer Acceptance Method Select the method to accept the offer.

The available options are:

- Manual

- Auto

Banking Channels Preferences In this section, user can capture the banking channel preferences for saving or current product. Cheque Book Switch to  to indicate that cheque book is allowed for the account.

to indicate that cheque book is allowed for the account.

Passbook Switch to  to indicate that passbook is allowed for the account.

to indicate that passbook is allowed for the account.

Debit Card Switch to  to indicate that debit card is allowed for the account.

to indicate that debit card is allowed for the account.

Banking Channels Switch to  to indicate that multiple banking channels are allowed for the account.

to indicate that multiple banking channels are allowed for the account.

Channels Allowed Select the channels that are allowed to the account.

The available options are:

- KISOK Banking

- Direct Banking

- Phone Banking

Direct Banking Switch to

to indicate that direct banking is allowed for the account.

to indicate that direct banking is allowed for the account.

Phone Banking Switch to

to indicate that phone banking is allowed for the account.

to indicate that phone banking is allowed for the account.

Kiosk Banking Switch to

to indicate that Kiosk banking is allowed for the account.

to indicate that Kiosk banking is allowed for the account.

Collateral Preferences In this section, the user can capture the collateral preferences for loan product.

Collateral Allowed Select the appropriate radio button whether the collateral allow for the loan product. The options are:- Yes - If this option is selected, the system displays a table and allows user to add collateral details in the table for the loan product.

- No - If this option is selected, the system will not be allowed to add collateral details for the loan product.

Click Add to add rows in the table.

Collateral Type Select the collateral type from the drop-down list. The available option are: - Property

- Guarantee

- Vehicle

- Precious Metal

- Deposits

- Bonds

- Stocks

- Insurance

- Accounts Receivable

- Inventory (Stock of Material)

This field appears if the Collateral Allowed is selected as Yes.

Collateral Category Select the collateral type from the drop-down list. The options are displayed in the drop-down based on the collateral type selected. This field appears if the Collateral Allowed is selected as Yes.

Allowed As Select the allowed as from the drop-down list. The available option are: - Primary

- Additional

- Both

Notes:- Collateral Type-Collateral Category combination can be used only once with any Allowed As option as Primary or Both.

- The system does not allow the duplication of same Collateral Type-Collateral Category combination.

Action Select the actions to perform on the added record.  : To save the added record.

: To save the added record.

: To cancel the added record.

: To cancel the added record.

: To edit the added record.

: To edit the added record.

: To delete the added record.

: To delete the added record.

Credit Decision Service Flags Select the Credit Decision Service Flags.

The below flags appear only if Overdraft Limit Allowed toggle is turned ON.

Risk Based Pricing Applicable Switch to  to allow the Risk based pricing for the loan accounts.

to allow the Risk based pricing for the loan accounts.

Application Based Switch to  to consider the scorecard calculation based on the application.

to consider the scorecard calculation based on the application.

Primary Applicant Based Switch to  to consider the scorecard calculation based on the Primary applicant.

to consider the scorecard calculation based on the Primary applicant.

- Click Next to proceed with next data segment.

Parent topic: Business Product Preferences