7 Buy Now Pay Later

This topic provides the detailed information about Buy Now Pay Later.

What is Buy Now Pay Later?

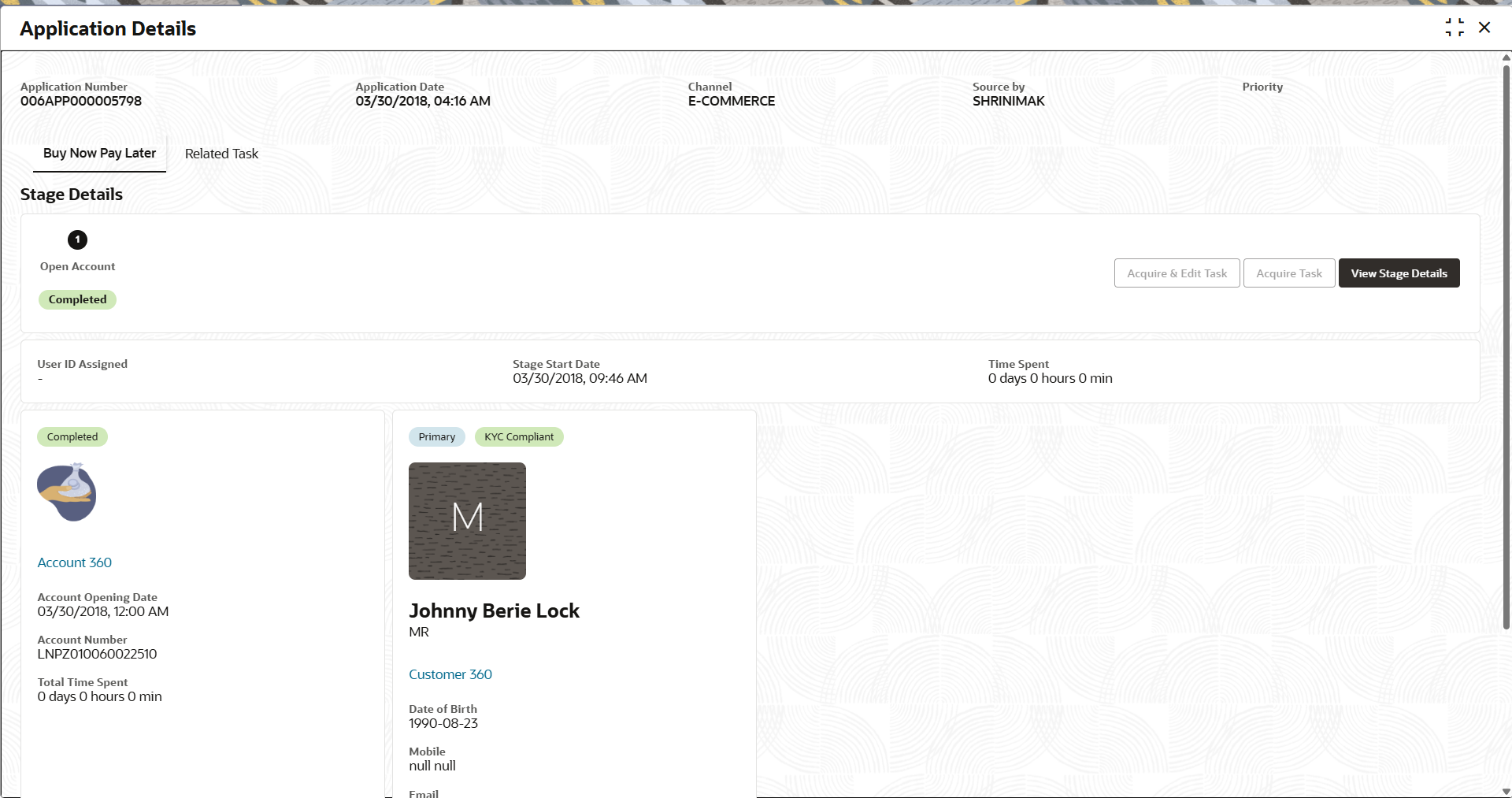

The Buy Now Pay Later option enables customers to start and obtain small loans directly from merchant websites, online banking platforms, and mobile applications. Banks and financial institutions providing this service can utilize the API from oracle banking origination for easy integration.While origination Buy Now Pay Later loan additional features like quick eligibility assessment, risk-based pricing can aslo be enabled.

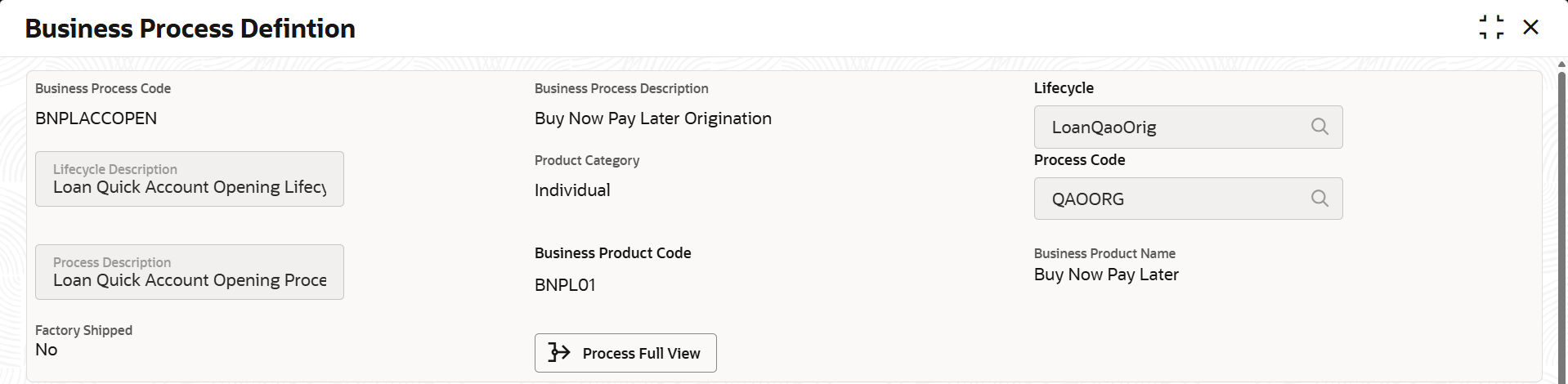

How to configure the Buy Now Pay Later?

To enable a Buy Now Pay Later opening process, select E-Commerce in channel allowed field of Business Product Details screen. Loan simulation, quick assessment, and quick account also needs to be enabled in business product. Additionally, it needs a tailored map for a business process designed specifically for BNPL.