1.1.1.4.6 IRA Certificate of Deposit Product Preferences

This topic describes the IRA certificate of deposit product preferences details.

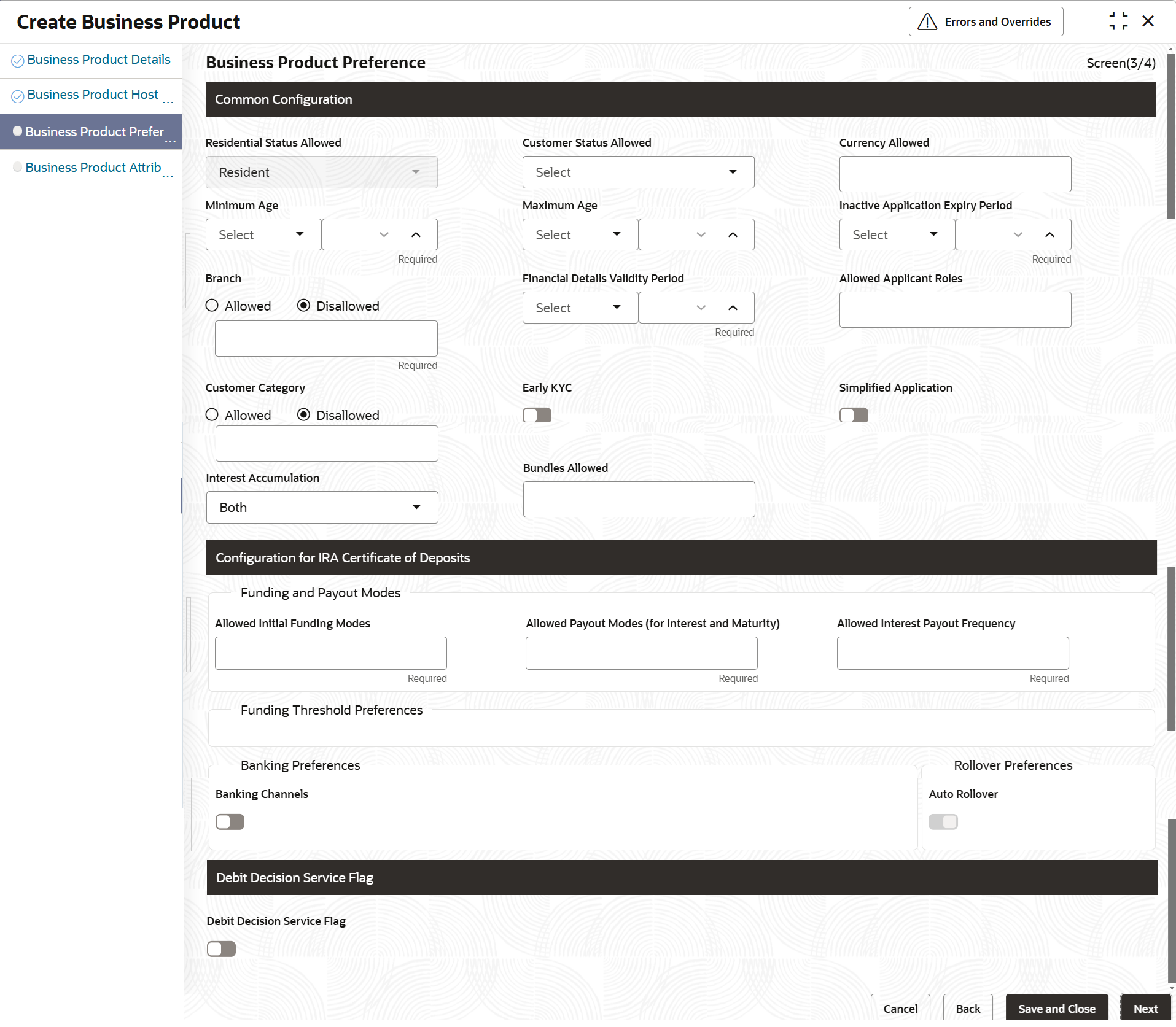

The IRA Certificate of Deposit Product Preference interface is dispalyed when user chooses the Product Category as Indivudual to set up loan preferences.

Figure 1-14 Business Product Preference-IRA Certificate of Deposit

Table 1-14 Business Product Preference – IRA Certificate of Deposit Product- Individual

| Field Name | Description |

|---|---|

| Common Configuration | Specify the common configurations for the business product. |

| Residential Status Allowed |

Select the option for which the business product is applicable for. The available options are:

|

| Customer Status Allowed |

Select the option for which the business product is applicable for. The available options are:

|

| Currency Allowed | Select the currency or currencies that are allowed for the business product. The system enables the selection of multiple currencies, if applicable. |

| Minimum Age |

Specify the minimum age of the applicant who are eligible to open the account for the business product being created. Select the period from the drop-down box. The available options are:

|

| Maximum Age |

Specify the maximum age of the applicant who are eligible to open the account for the business product being created. Select the period from the drop-down box. The available options are:

|

| Inactive Application Expiry Period |

Specify the period after which the application must be marked as Expired. Select the period from the drop-down box. The available options are:

Once the application has expired, no further lifecycle activity can happen for that application. |

| Branch |

Select one of the following options:

|

| Financial Details Validity Period | Select the financial details vadility periods in years, Months, and Days. |

| Allowed Applicant Roles | Specify the applicant roles that are allowed to

apply this product.

The available roles are as below:

The option in this list appears for selection based on the configuration. This selected roles gets reflected in the Applicants data segment while capturing an applicant information in an application. |

| Customer Category |

Select one of the following options:

The system allows to select Disallowed and keep it blank so that the Business Product is allowed for all the branches. |

| Early KYC | Specify whether user wants to enable the early

KYC feature to speedup KYC process of an applicant.

If this option is selected then the KYC call is trigger to Oracle Banking Party Services once the applicant data is captured in the application. |

| Simplified Application | Specify whether user wants to set simple process

of account opening for this product.

In this process, the Initiation and the Application Entry stages are combined for submitting the account opening application. |

| Interest Accumulation | Select the method of interest accumulation from

the drop down list.

The available options are:

|

| Bundles Allowed | Select the allowed bundles from the drop-down list. |

| Configuration for IRA Certificate of Deposits | Specify the configurations for the IRA Certificate of deposit. |

| Funding and Payout Modes | Specify the preferneces of funding and payout modes in this section. |

| Allowed Initial Funding Modes | Select the modes which are allowed for intial funding.

The available options are:

The drop-down values will be configured in look up maintenance. |

| Allowed Payout Modes (for Interest and Maturity) | Select the modes which are allowed for fund

payout after maturity.

The available options are:

|

| Allowed Interest Payout Frequency | Select the frequencies which are allowed for interest payout.

The available options are:

|

| Funding Threshold Preferences | Specify the funding threshold preferences for IRA certificate of deposit product. |

| Banking Preferences | This section provides banking details about banking preferences. |

| Banking Channels | Select to indicate the banking channel service is allowed. |

| Rollover Preferences | This section provides banking details about rollover preferences. |

| Auto Rollover | Select to indicate the auto rollover service is allowed. |

| Debit Decision Service Flag | Select to indicate the debit decision service is allowed. |

| Action Tab | Click Cancel to cancel the added record.

Click Back to view the previous added record. Click Save and Close to save and close the added record. Click Next to move to the next stage. |

- Click Next in Business Product Host Mapping screen to proceed with next data segment, after successfully capturing the data.

- Specify the details in the relevant data fields. The fields which are marked with Required are mandatory. For more information on fields, refer to the field description table.

Parent topic: Business Product Preferences