2.1.2 Account Details

This topic provides the systematic instructions to capture the account related information for the application.

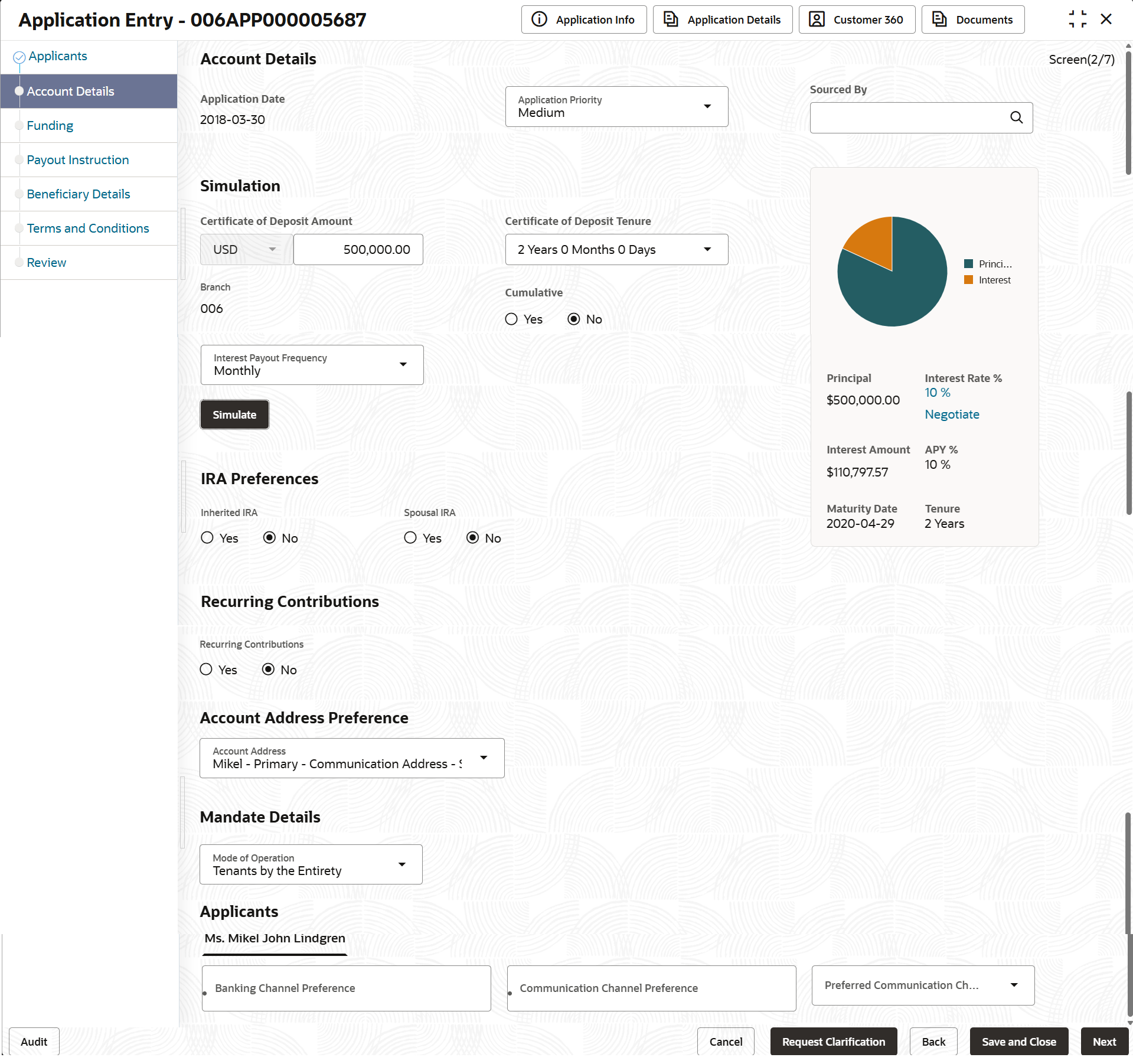

The Account Details data segment displays the account details.

- Click Next in previous data segment screen to proceed

with the next data segment, after successfully capturing the data.The Account Details screen displays.Refer below screen shot if the customer type is selected as Individual:

- Specify the fields on Account Details screen.For more information on fields, refer to the field description table.

Note:

The fields, which mentioned as Required, are mandatory.Table 2-5 Account Details

Field Name Description Application Date Displays the date on which the application was initiated. Application Priority Specify the application priority level. The available options are:- Low

- Medium

- High

Based on the selected option the applications appears in list of the logged in user

Sourced By Specify or select the user ID who initiate this account opening application. Certificate of Deposit Amount Choose the currency and state the term amount. The currency you select from the Currency list will be displayed by default.

Certificate of Deposit Tenure The user can select the certifiacte of deposit tenure, specified in years, months, and days, as configured in the Host Product mapped on the Business Product Configuration screen. The user can choose the Certificate of Deposit Tenure from the drop-down list if the mapped Host Product is Oracle Banking Accounts.

Branch Specify the branch code of this account opening opening application. Cumulative Select to indicate whether the amount is cumulative. The available options are:- Yes

- No

A cumulative Certificate of Deposit accrues interest over time and pays it out at maturity, while a non-cumulative Certificate of Deposit pays out interest at regular intervals throughout the term.

Interest Payout Frequency Displays the interest payout frequency based on business product preferences. Select the interest frequency from the drop-down list.The available options are: - Monthly

- Quarterly

Simulate click the "Simulate" button to compute the value based on the entered details. The section displays visual representations and fields with the computed details:

- Pie Chart: The value of principal and interest is represented visually. You can hover to view the amount.

- Principal

- Interest Rate %: Click the interest rate percentage and it displays the pop-up list.You can view the interest rate of all the margin types.

- Product Margin

- Discretionary Margin

- Relationship Benefit Margin

- Negotiate : You can view the negotiated interest rates by clicking this link. The section for negotiated interest rates appears with the following fields:

- Interest Description

- Interest Rate %

- Margin

- Effective Rate %

- Interest Amount : This amount is calculated based on the applied Effective Rate and Certificate of Deposit Amount.

- Maturity Date

- Tenure

- APY %

IRA Preferences This section displays the details of IRA preferences. Inherited IRA Select the inherited IRA and the available options are: - Yes

- No

Required Minimum Distribution Select the required minimum distributions from the drop-down list. Note: This option displays if inherited IRA is selected as Yes.

Spousal IRA Select the spousal IRA from the available options.The options are: - Yes

- No

Recurring Contributions Select the recurring contributions from the available options. - Yes

- No

Frequency Select the frequency of recurring contributions from the drop-downlist. The available options are: - Weekly

- Monthly

- Quarterly

- Half yearly

- Annualy

Note: This field displays, if Recurring Contribution is selected as Yes.

Recurring Contribution Amount Specify the recurring contribution amount. Contribution Source Details Select the contribution source details from the drop-down list. - ACH

- Internal Account Transfer

Account Address Preference Select the address which is indicated as account address. The applicant data segment displays the addresses indicated as account addresses for selection.The drop-down list displays the address in the following format:

<First Name> - <Applicant Role> - <Address Type> - <Address (Complete address sepearted by ,)>

After the account address is selected:- If the user deletes an address from the Applicant data segment then the system removes that address from this data segment and the user must then select another address as the account address.

- If the Applicant data segment is edited with a new address then the updated address is reflected in this segment.

Mandate Details In this section the user can capture the mode of operation for the account.

Mode of Operations Select the appropriate option from the mode of operations list. Applicants In this section you can set the communication preferences of the applicants involved in an account opening application. The seperate tabs appears for each applicants involved in the application. Banking Channel Preferences Select the preferences for the banking channel.

The channel options appears based on the Business Product Configuration.

Communication Channel Preferences Select the preference of the communication channel. The channel options appears based on the Business Product Configuration.

The available options are:- POST

- SMS

Preferred Communication Channel Select the preferred communication channel. The options in this drop down appears based on the selected options in the Commumncation Channel Preferences fields.

- Proceed by clicking Next to move to the subsequent data segment once the data has been successfully captured. The system will verify all required data segments and fields. If any essential information is missing, an error message will be shown to prompt the user to address the issue. Users must complete the mandatory data before they can advance to the next segment.

Parent topic: Application Entry Stage