2.1 Bank Parameters Maintenance

This topic explains the systematic instructions for managing bank parameters in the operational ledger.

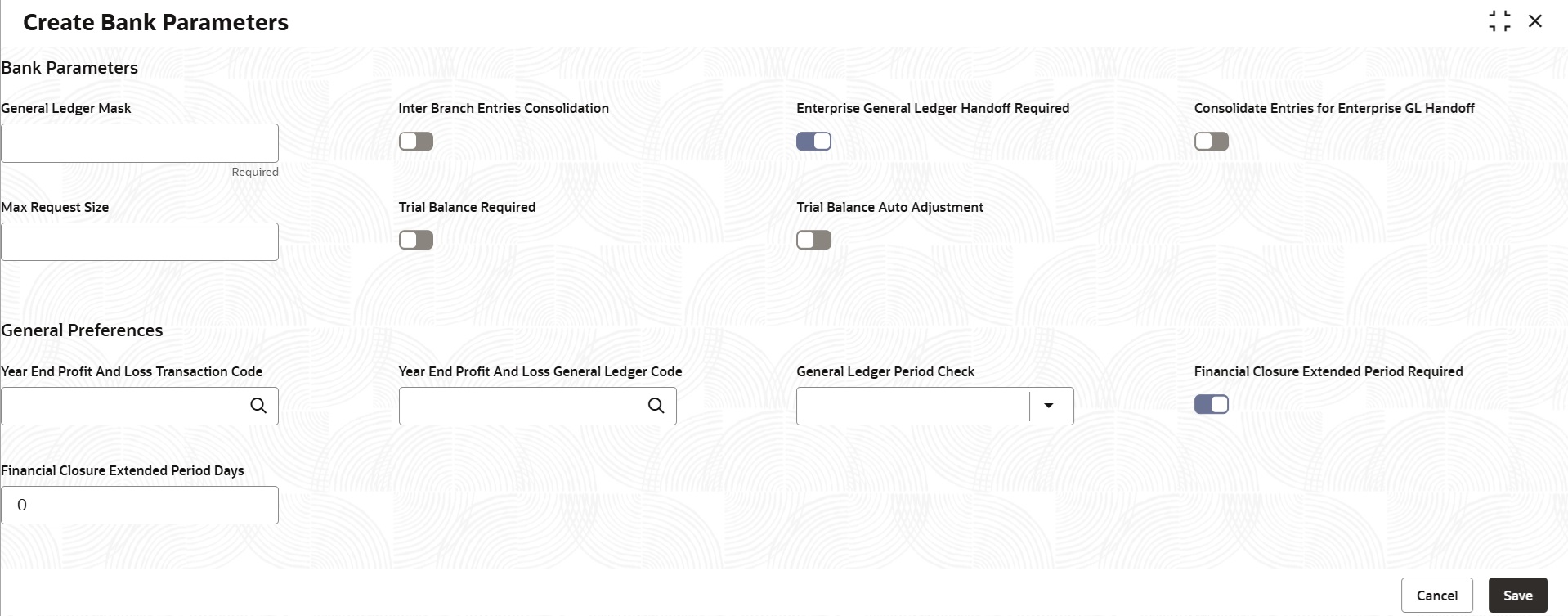

To create the bank parameters

- On the homepage, click Menu and click Operational Ledger, and then click Maintenance. Under Maintenance, click Bank Parameters Maintenance, and click Create Bank Parameters.The Create Bank Parameters screen displays.

- Specify the following details, for more information on fields, refer to the field description table below.

Table 2-1 Create Bank Parameter

Field Description General Ledger Mask Identify the general ledgers in mask format that are maintained at bank level. The mask you define here will be used anytime a General Ledger is created in the Chart of Accounts screen. It can have up to nine alphanumeric characters. GLs can be created with the combination of numbers and letters to represent things like the GL category (includes asset, liability and so on), GLs hierarchical position, and so on.

Each element is used to create the mask that represents an individual character. The alphabet is represented by a, while the number is represent by n.

Note: The field which are marked with Required are mandatory.

Inter branch Entries Consolidation - Switch to

, the system will generate Inter Branch entries in the General Ledgers according to the Inter Branch Parameters for the respective branches involved in the transactions.

, the system will generate Inter Branch entries in the General Ledgers according to the Inter Branch Parameters for the respective branches involved in the transactions.

- Switch to

, the system will defer posting Inter Branch entries during transactions. Instead, these entries will be consolidated and posted during the Enterprise GL Handoff.

, the system will defer posting Inter Branch entries during transactions. Instead, these entries will be consolidated and posted during the Enterprise GL Handoff.

Enterprise General Ledger Handoff Required Switch to  to perform the Enterprise General Ledger Handoff.

to perform the Enterprise General Ledger Handoff.

Consolidate Entries for Enterprise GL Handoff Switch to

to initiate the handoff creation process post the data extraction is completed across all branches.

to initiate the handoff creation process post the data extraction is completed across all branches.

This option is available when you enable the Enterprise General Ledger Handoff Required toggle button.

Max Request Size Set the maximum request size to validate the number of transactions that can be included in a single request. Trial Balance Required -

If you switch the toggle

, the system consolidates all entries for the selected period, calculating the total debit and credit balances for each system account. It then checks whether the overall debits match the credits as part of the trial balance process.

, the system consolidates all entries for the selected period, calculating the total debit and credit balances for each system account. It then checks whether the overall debits match the credits as part of the trial balance process.

-

If you switch the toggle

, the system skips the trial balance process entirely.

, the system skips the trial balance process entirely.

Trail Balance Auto Adjustment - If you switch the toggle

, the system automatically adjusts any discrepancies found in the trial balance.

, the system automatically adjusts any discrepancies found in the trial balance.

- If you switch the toggle

, the system will skip the auto adjustment process for any discrepancy found in the system accounts.

, the system will skip the auto adjustment process for any discrepancy found in the system accounts.

Year End Profit And Loss Transaction Code Select a transaction code from the option list to post the balances in the income and expense accounts to the year-end GL account. Year End Profit And Loss General Ledger Code At the end of the financial year, Oracle Banking Operational Ledger transfers the balances from income and expense accounts to a distinct year-end account for consolidating balances and turnovers. This account is referred to as the Year End Profit and Loss General Ledger Account.

On the Chart of Accounts screen, you need to assign a year-end profit and loss GL general ledger (GL) to each GL account. The year-end account set at the bank level acts as the default Year-End Profit and Loss GL for all GL accounts. If you do not assign the account for posting year-end balances of a particular GL, the balances will be posted to the bank's year-end profit and loss account.

Select a GL code from the list of all assets, liabilities, income and expense GLs available in the Chart of Accounts screen.

General Ledger Period Check Select the General Ledger Period from the drop-down, which determine how unbalanced GL are checked during financial closure. The available options are:- Select A (ALL) to validates mismatches across all financial years and period codes in the balance table.

- Select C (Current) to validate mismatches within the current financial year and period.

Financial Closure Extended Period Required Switch to  to enable Financial Closure Extended Period.

to enable Financial Closure Extended Period.

Financial Closure Extended Period Days Specify the number of days for the extension.

If you provide these values, the system will skip the financial closure on the last working day of the financial year. Instead user can manually close the year during an extended period by initiating a batch process from the Period Closure screen.

This field appears when you enable the Financial Closure Extended Period Required toggle button.

- Switch to

Parent topic: Operational Ledger Maintenance