2.1.2.1 Facility Details

This topic describes about the detailed information on facility details such as facility creation and amendment.

The system allows user to maintain credit limits for a Line Code - Liability Code combination in the Facilities Details screen .

- On the Menu screen, select Limits and Col laterals. Under Limits and Col laterals, select Limits.

- Under Limits, select Maintenances. Under Maintenance,

select Facility. Under Facility, select

Facility Maintenance.The Facility Details screen is displayed in Facility Maintenance.

- On Facility Details screen, specify the fields.For more information on fields, refer to the field description table.

Table 2-5 Facilities Maintenance - Field Description

Field Description Liability Code Click the  icon and select the liability code for linking the

facility.

icon and select the liability code for linking the

facility.

Note: Incase of backdated facility creation, the liability selected must be available on line start date for successful facility creation.

Liability Name Displays the name based on the selected liability code. Branch Code By default, the system displays the branch code in which facility has to be created. To change, click  the icon and select the branch from the

list

the icon and select the branch from the

list

Line Code Template User can select this option to fetch the line code template and default the details maintained in it. This is non-mandatory step. Post selection, click on the Default button to default the attributes of the selected Line code template.

On Fetch, Line Code Template field's value will get updated in Line Code field which user can override and provide his own. Similarly, all other defaulted values from line code template are overridable at facility level.

Line Code User can enter the required line code for the facility. If you are using the line code template, the Line Code Template field's value will get updated in Line Code field which you can override and provide your own. This line code will get associated to the liability code and allocating credit limits for the line-liability combination can then be done. The customer(s) who fall under this liability code avails credit facilities under this Credit line. Bylinking a credit line to a liability code, the customer also gets linked to the credit line. This is true because a liability code has been assigned to every credit seeking customer and the credit facilities granted to the customer are defined and tracked with this code

Serial Number Each time a Liability - line code combination is specified. System always defaults 1 as serial number. Thus, for every new record entered for a Liability No-Line Code combination, a serial number is defaulted to 1. The Liability - Line- Serial number forms a unique combination for facility identification. Note: If a second facility is created with the same line code and for the same liability, then an error appears on clicking Save. To create multiple facilities, user can also select the line code from the list of values and default the values by clicking on Populate button. The value of line code can then be changed and saved.

Description Provide the description that would help you easily identify the facility or give you related information.

Line Currency Click the  icon and select the currency from the list. The

currency that has been selected have the following

implications:

icon and select the currency from the list. The

currency that has been selected have the following

implications:

- The limit amount that has been specified for this Line-Liability combination is taken to be in this currency.

- The line that has been defined is available for utilization only in currencies as specified in currency restrictions under Currency Restrictions in this screen.

Once the entry is authorized user cannot change the currency.

If the limit allotted to this Line-Liability combination can be utilized by accounts and transactions in currencies other than the limit currency, the limit utilization is arrived at by using the rate for the currency pair as of that day.

For more details, refer to Cross Currency Behavior section in Common user manual.

Main Line Code Click the  icon and select the main line code, if the facility

to be created is a sub-line.

Following mainline and sub-line combinations are supported:

icon and select the main line code, if the facility

to be created is a sub-line.

Following mainline and sub-line combinations are supported:- Revolving Main line and Revolving Sub-line

- Non-revolving Main line and Non-revolving Sub-line

- Revolving Main line and Non-Revolving Sub-line

- NRS Main line and Revolving Sub-line

- NRS Main line and Revolving Sub-line

- Revolving Main line and NRS Sub-line

Note:- Non-revolving lines cannot be added as part of a facility hierarchy branch, if an NRS line is part of the same hierarchy either as main line or sub-line at any level

- Non-revolving lines can be part of separate tree under the same revolving main line, where an NRS sub-line is part of different hierarchy with same revolving main line

- In case of backdated facility creation, main line must be available as on backdated facility start date

Table 2-6 For Example

Main Line Sub-Line (Level 1) Sub-Line (Level 2) Sub-Line (Level 3) Revolving Revolving Revolving Non-Revolving - NRS Revolving Revolving Class Code Click the  icon and select the fee class from the list.

icon and select the fee class from the list.

The list displayed here is based on maintenance done in Fee and Accounting Class Maintenance screen for facility.

In case of attaching fee class to the backdated facility, the fee class must be available on the line start date (back value date) as well as active on book date.

Category Click the  icon and select the facility category from the

list. The list displayed here is based on maintenance done

in Category Maintenance screen.

icon and select the facility category from the

list. The list displayed here is based on maintenance done

in Category Maintenance screen.

Maintenance Value Date Specify the value date on which facility amount is modified. That is, the date on which facility amount modified is earlier than Book Date for an active credit line. When an amendment is done on a facility like limit amount, basis, and so on, if maintenance value date is given as a back value date, modification takes effect from the given maintenance value date and appropriately value dated balance is updated. If maintenance value date is not entered during amendment, processing date is default updated. However, maintenance value date cannot be prior to line start date. If limit amount is modified with a back date as maintenance value date and subsequent to this date, limit was already applied based on an existing schedule, then the effect of limit amount change is only till existing and applied schedule as per this schedule date.

In case of future dated lines, if any amendment done between the booking date and line start date, maintenance value date is updated as Line Start Date.

Internal Remarks Specify the internal remarks as required. Populate Click this button to populate the details such as line code template and fee class details. Rating This section specifies the rating details External Credit Rating The primary credit rating from external credit agency (Credit rating agency type as External) maintained in the limit credit rating data segment is displayed here. Internal Credit Rating The credit rating from internal credit agency (Credit rating agency type as Internal) maintained in the limit credit rating data segment is displayed here. Preferences and Drawing Power - Facility Details

Figure 2-7 Preferences and Drawing Power - Facility Details

For more information on fields, refer to the field description table below:

Table 2-7 Facilities Maintenance - Preferences - Field Description

Field Description Revolving Line Switch to  to indicate that the credit line is revolving.

to indicate that the credit line is revolving.

Switch to

A revolving credit line indicates that a repayment of the utilized credit should reinstate the credit limit of the customer. User can modify the preference, as required. to indicate that the credit line is not

revolving.

to indicate that the credit line is not

revolving.

Intra Day Revolving Non revolving line when selected works like intra day revolving and cross day non-revolving. When signified, system considers de-utilization amount for subsequent utilisation during the same day even though it is a non-revolving line. Funded Switch to  enable this parameter.

enable this parameter.

Switch to

disable this parameter.

disable this parameter.

A funded facility involves a lender directly providing money to a borrower for a specific purpose, such as loans, cash credit, or overdrafts, which are then repaid with interest. In contrast, a non-funded facility is a commitment from a lender to cover a borrower's obligation to a third party, without a direct transfer of funds. Examples include letters of credit and bank guarantees, where the lender promises to pay a debt if the borrower defaults, acting as a form of credit support.

Committed Switch to  mark the facility as committed. Switch to

mark the facility as committed. Switch to  mark the facility as non-committed.

mark the facility as non-committed.

This signifies whether the facility is a committed line or non-committed line and accordingly OSUC (Outstanding + Unutilized commitment amount) is calculated and displayed at facility level.

After saving and authorizing the facility creation, the Committed flag will not be available for modification. It is not necessary that the commitment status of the main line and the sub-line to be same. If the main line is committed, the sub-line can be non-committed and vice-versa.

Netting Required Switch to  to enable this parameter.

to enable this parameter.

Switch to

User can select this toggle status to enable netting for the facility. to disable this parameter.

to disable this parameter.

Refer to section - 2.4.14 Including Netting Amount in Facility’s Netting Contributionin processing section.

Unadvised Switch to  to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

System will validate during utilization if facility is Unadvised.

Shadow Limit Switch to  to indicate that utilization amounts should be

updated only for the facility and mainlines for the

facility. Thus, when a utilization request is processed, the

system updates the utilization amount only at the facility

level and leaves the utilization amount at the liability

level untouched.

to indicate that utilization amounts should be

updated only for the facility and mainlines for the

facility. Thus, when a utilization request is processed, the

system updates the utilization amount only at the facility

level and leaves the utilization amount at the liability

level untouched.

Switch to

The mainline and sub-lines of a facility need to have the same preference. This implies that user can enable this option for a subline only if the mainline has this option already enabled. Similarly, user cannot create a sub-line as a Shadow Limit, if the mainline does not have this facility. disable this parameter.

disable this parameter.

Note: User cannot modify this option once the facility is authorized.

Utilization Tracking Signifies if the utilization tracking of the facility is done locally or globally. For NRS lines, Utilization Tracking must be always GLOBAL.

Sub-lines attached to GLOBAL NRS lines can be of type GLOBAL or LOCAL.

Revaluation Required Switch to  to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

The system revaluates only those contracts using FX rate fixing parameters, for which Rate Agreement Required andRevaluation Required are selected.

Rate Agreement Required Switch to  to indicates the rates are taken based on FX rate

fixing.

to indicates the rates are taken based on FX rate

fixing.

Switch to

to indicate the rates are taken from

Currency Exchange Rates Input

screen based on the maintenance done in

Config Service screen. The

system picks the rate/rate code and updates the

utilization across the facility linked to the

contracts.

to indicate the rates are taken from

Currency Exchange Rates Input

screen based on the maintenance done in

Config Service screen. The

system picks the rate/rate code and updates the

utilization across the facility linked to the

contracts.

Drop Line Limit Switch to indicate that the Limit Schedule is Dropline Limit. Switch to disable this parameter.

Uou can set the Dropline Limit when creating a facility or change it later in a Facility Amendment. But once a facility is marked as Dropline, it can't be changed.

Drawing Power Backed Switch to  indicate the facility is drawing power backed.

indicate the facility is drawing power backed.

Only revolving type of facility can be signified as DP backed. Switch to indicate the facility is not drawing power backed.

Note:- The user cannot modify the facility to a normal one once it is signified as Drawing Power Backed.

- ForDrawing Power (DP) backed facility, Effective Line Amount Basis must be Minimum (limit amount, DP amount). the Effective Line Amount Basis cannot be modified for a DP backed facility.

Drawing Power Specify the drawing power based on the stock statement date, to be considered for new effective line amount calculation. This field is enabled, if the Drawing Power Backed is toggled on.

Last Stock Statement Date Specify the last stock statement date. This field is enabled, if the Drawing Power Backed is toggled on.

Note:

For more information on Drawing Power, refer Drawing Power Based Facility.Amount - Facility Details

For more information on fields, refer to the field description table below:

Table 2-8 Facilities Maintenance - Utilization - Field Description

Field Description Limit Amount Specify the limit for the facility. If user have maintained schedules for limits, the system automatically updates the limit amount here on the dates specified for each limit in the schedule. Collateral Amount The system defaults the Collateral Amount based on the collateral linked in the Collateral Linkage data segment. Refer section – 2.2.9 Collateral linkage

Pool Amount The system defaults the collateral Pool Amount basedon the pools linked in the Pool Linkages data segment. Refer section – 2.2.8 Pool linkage

Effective Line Amount Basis For defining overall limit of line, the elements mentioned below are treated as the basis for the effective line amount calculation. - Limit Amount

- Limit Amount + Collateral Contribution

- Minimum (Limit Amount and Collateral Contribution)

- Minimum (Limit amount, Drawing Power amount)

Table 2-9 Line Amount

Line Amount Collateral Amount Pool Amount Drawing Power 40000 60000 50000 30000 Table 2-10 Effective Line Amount

Effective Line Amount Basis Effective Line Amount Limit Amount 40000 Limit Amount + Collateral Contribution 150000 Min(Limit Amount,Collateral Contribution) 40000 Min(Limit Amount,Drawing Power) 30000 Note:- For Drawing Power (DP) backed facility, Effective Line Amount Basis must be Minimum (limit amount, DP amount). the Effective Line Amount Basis cannot be modified for a DP backed facility.

Effective Line Amount Displays the effective line amount based on the selected Effective Line amount basis. Note:- Based on back value dated transactions, value dated balances of impacted amounts will be updated in addition to updating of book dated balances.

- As book dated balance is considered for backdated transactions like utilization, exchange rate as on book date will be considered for cross currency transactions.

Approved Amount This is the maximum limit amount allowed for the facility and must be specified whenever user maintain schedule limits. The system ensures that neither the Limit Amount maintained here nor the schedule Limit Amount maintained as part of the limits schedule is greater than the approved amount specified here. Approved amount will get updated as Effective Limit Amount when facility is created, and if user does not explicitly specifies it. On modification of limit amount of facility, system validates if the approved amount is lesser than the facility Effective Limit Amount.

Daily Light Limit Specify the daily light limit. The system validates the cumulative of all utilization transactions during the day against this Day Light Limit. It does not allow further utilization, if the Day Light Limit is breached. This is applicable, even for the utilization against NRS available balance available in NRS Lines.

Day Light OD Limit Specify the day light overdraft limit for the line. This is the maximum limit to which the facility can be overdrawn on the facility without getting override. System considers this amount along with available balance during utilization. System will validate if the total amount exceeds this combined balance. When utilization is beyond available amount and against Day light OD limit, available amount is shown in negative. For and NRS line, in case the Day Light OD Limit is specified, the total amount available for utilization = NRS Available amount + Available Amount + Day Light OD Limit.

Transfer Amount The system displays the transfer amount resulting from Facilities Amount Transfer transactions. The value displayed has either the sign "-" or "+", indicating whether the amount is transferred from or to the line. If the sign is "-", then the amount is transferred from the line and if it is "+", then the amount is transferred to the line.

Refer section – 2.10 facilities Amount Transfer Maintenance

Netting Contribution System displays the sum of all amounts from netting contract in this field. Refer to section - 2.2.22.1 Including Netting Amount in Facility’s Netting Contribution.

Available Amount The system displays the available amount. For a revolving line, available amount gets re-instated to the extent of repayment whenever a de-utilization is done.

Available balance of the facility includes balances from the Effective Line Amount + Transfer Amount + or - Netting Contribution.

For backdated utilization transaction on NRS lines, available amount for the current day is updated only if the utilization amount is more than the NRS available balance zeroed on the value date.

Maximum Available Amount The system displays the maximum available amount. For a subline max available amount is least of available balance at main line and sub line. For NRS lines, maximum available amount considers NRS available amount. Also, the maximum available amount at sub-line level is calculated considering NRS available amount at main line level

Non Revolving Special(Intra-day Revolving) Available For NRS lines, the system displays the total amount de-utilized on the current business day in facility currency. This amount is yet to be utilized and available for utilization on the same day. Utilization transaction on the same day as that of de-utilization transaction first updates the Non Revolving Special (Intra-day Revolving) Available value. For NRS lines, Available Amount is updated only when the NRS amount is zero or completely utilized.

For more information on NRS available balance calculation.Non-Revolving Special Available balance in main line is updated considering de-utilizations at both main and sub-lines.

For sub-line utilization, NRS available amount and available amount at sub-line level is considered. If available amount + NRS available amount at main line level is less than subline, then utilization at subline level is restricted to total availability at main line level.

The system updates the NRS Available balance even after the expiry of facility based on deutilizations. If the facility is made available post expiry on same day as that of de-utilization, NRS Available balance is considered for utilization before the Available Amount.

Note: In the above example, de-utilization is considered on both the expired and active lines, whereas utilization is considered only on the active line.- For backdated utilization and de-utilization transactions, NRS Available amount gets updated on the value date and does not consider the book date.

- Any backdated utilization done after the backdated de-utilization first updates the value dated NRS Available balance. The Available Amount as on current date is updated only if the utilization amount is more than the NRS available amount on that day. NRS Available balance becomes zero during the day itself in case NRS line is closed before EOD.

Uncollected Amount User can capture any uncollected amount if pending from customer. This could be towards the fees or any other. This is only for information purpose. Events Click this button to specify the details under Facility Events. For more information on Events, refer Facility Event Details. Availability - Facility Details

Figure 2-9 Availability - Facility Details

For more information on fields, refer to the field description table below:

Table 2-11 Availability - Facility Details

Field Description Available Switch to

indicate the facilities created are available

for linking to contracts and further transactions

(utilizations and de-utilizations). . This can be the

case of current or backdated facilities.

indicate the facilities created are available

for linking to contracts and further transactions

(utilizations and de-utilizations). . This can be the

case of current or backdated facilities.

Switch to

This toggle status is enabled by default for the backdated facilities as well as the facilities created with current system date as start date. The system will disable this check box if the Line Start Date is provided as future date, that is the credit line is in inactive state, and will enable on the date when the credit line becomes active. to indicate the facilities created are

un-available for linking to contracts and further

transactions (utilizations and de-utilizations). . This

can be the case of future dated facilities.

to indicate the facilities created are

un-available for linking to contracts and further

transactions (utilizations and de-utilizations). . This

can be the case of future dated facilities.

The Oracle Banking Enterprise Limits and Collateral Management system tracks the status of both the Contract and the Facility.

The product processor gives an ASCII file including all the facilities which need to be frozen. Oracle Banking Enterprise Limits and Collateral Management initiates an amendment event and then deselects the Available check box.

Book Date System defaults the date on which the credit line is booked in the system. User cannot modify this date. - For backdated facilities, fee entries will have transaction date as facility book date and value date as corresponding fee liquidation (FLIQ) / fee accrual (FACR) date

Line Start Date Specify the line start date. Line start date can be current business date, back value date or future date. In case of current business date and back value date, the line start date cannot be modified once the facility record is authorized.

In case of future date, the line start date can be modified after the record is authorized. However, it cannot be prior to the current business date.

If the line start date is not specified, system defaults the line start date as the current application date. User cannot modify this system defaulted date after the record is authorized.

The credit line becomes active on the specified line start date. If the line start date falls on a holiday, an override message appears.

For future dated facility, facility initiation event will be triggered on Line Start Date with contingent entries.

For backdated facility, contingent entries for facility creation will be posted with transaction date as book date and value date as facility start date on facility creation date. Accounting entries handed off to UBS will also have transaction date as book date and value date as facility start date and accordingly BDBAL and VDBAL will be updated.

Note: Line start date of backdated facility cannot be prior to the first day of start month configured in Config service.

Note: Processing Future Dated Credit Line

A future dated credit line is a credit line that has a value date later than the date on which it is booked. User can create credit line with value date as future date for the following lines.- Main-Lines

- Sub-Lines

Line Expiry Date Specify the expiry date for the facility. . Facility gets expired on the provided expiry date and user will not be able to further utilize any limit amount of the facility if the same was not utilized within the specified expiry date. The Available check box at the facility gets deselected. This freezes the line for the respective liability. De-utilizations are allowed on the expired facility.

The freezing of the line code is part of the Oracle Banking Enterprise Limits and Collateral Management EOD Batch.

The Oracle Banking Enterprise Limits and Collateral Management system does not allow the expiry date of a facility to exceed the expiry date of linked collateral(s).

When a Facility record is saved, the system compares the expiry date of all the linked collateral (both collateral directly linked and collateral linked through pool) with the expiry date of facility. An error message is shown if any expiry dates are less than the expiry date of the Facility.

If the expiry date falls on a holiday maintained in the branch, then system displays the override message Facility Expiry Date falls on a branch Holiday.

The facility shall not be available on the maturity/expiry but user can modify the facility on or after the expiry date if required.

Note: In case of backdated facility creation, the line expiry date must be later than the facility book date.

For more details on Facility Expiry and Extension – refer to section 2.2.30 facility Expiry and Closure with fee Handling

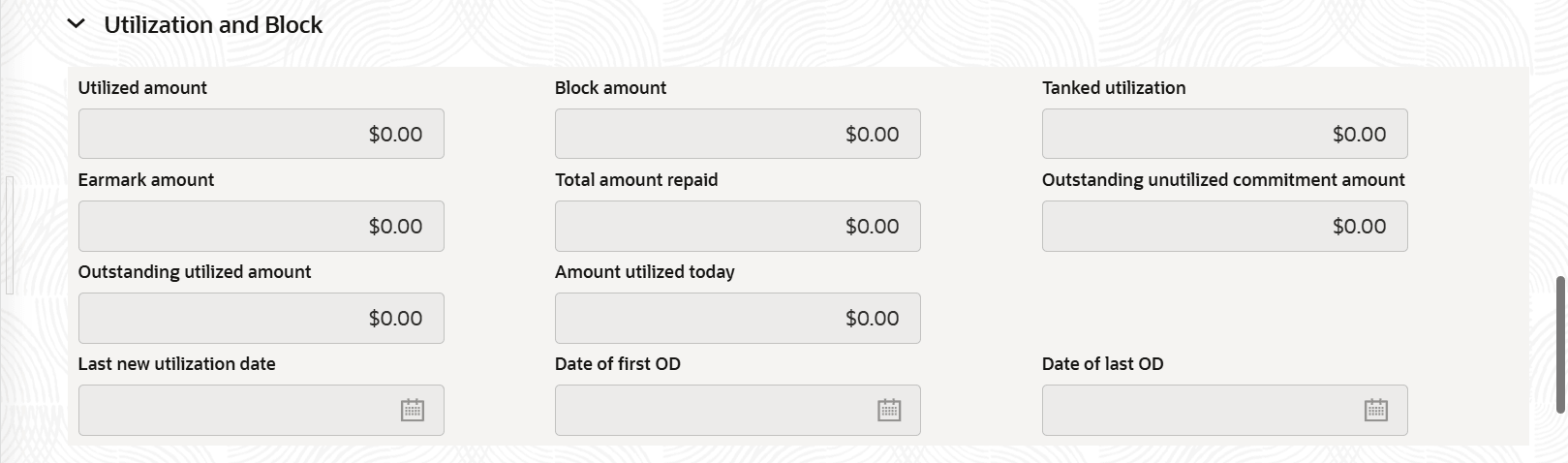

Line Grace Days Line Grace Days can be provided for a facility. Facility will remain Active even after Line Expiry date, if Line Grace days are provided. Utilization on facility can be done during Line Grace days. Line Final Expiry Date Line Expiry date + Line Grace days = Line Final Expiry date. Utilization on facility cannot be done after Line Final Expiry date and facility will not be available De-utilizations on the expired facilities are allowed. Availment Date Specify the availment date before which the first utilization should take place. If the limit amount assigned to the facility is not utilized within the specified availment date then the available check box is disabled. This freezes the line for the respective liability. Renewal Date Specify Renewal date. Utilization and BlockThis section displays the net, peak, and average utilization of the facility in facility currency based on predefined logic.

Table 2-12 Facilities Maintenance - Utilization Statistics - Field Description

Field Description Utilized Amount The system displays the utilization amount in this field. For a revolving line, utilized amount gets re-instated to the extent of repayment whenever a de-utilization is done,

For backdated transactions on NRS lines, utilization amount for the current day is updated only if the utilization amount is more than the value dated NRS available balance.Block Amount System displays the block amount as part of all block transactions from contracts against the facility. Tanked Utilization The system computes and displays the utilization amount that can be set in the Tanked Utilization field. As part of EOD process, the utilization amount is set in the Tanked Utilization field. As part of BOD process, the amount is cleared from the Tanked Utilization field and it is updated in the utilization amount.

Earmark Amount Displays the earmark amount. Total amount repaid The system displays the amount which is updated on the facility on account of de-utilization. User cannot edit the amount displayed in this field. Outstanding unutilized commitment amount The system displays the outstanding unutilized commitment amount calculated based on logic provided in the following table. User cannot modify the value displayed in this field. The Outstanding Unutilized Commitment (OSUC) at individual facility level will be calculated for both revolving and non-revolving lines based on the commitment status (Committed / non-committed) of the facility.

For both committed and non-committed NRS lines, OSUC amount is calculated as per the below logic, where NRS Adjustment is the utilization amount out of NRS available amount:

OSUC Amount = Utilized Amount - Matured Amount + NRS AdjustmentOutstanding utilized amount The system displays the outstanding utilized amount of non-revolving facility calculated using the formula utilized amount - repaid amount. The amount displayed in this field cannot be modified. Note: For revolving lines, de-utilized amount is updated back to the facility. Thus the utilized amount field is impacted. Whereas, for non revolving line, de-utilized amount does not impact the utilized amount field as the amount is not ploughed back into the facility. Outstanding Utilized Amount gives a visibility on actual outstanding utilization for the non-revolving line duly considering the utilized amount and the repaid amount.

Amount Utilized Today The system displays the amount utilized on the current date. This gets updated with both utilization and de-utilization transactions during the day for both revolving and non-revolving line. The balance against this field is considered for allowing or disallowing transaction when daylight limit is fixed.

Last New Utilization Date The system displays the last new utilized date when a new contract utilizes the facility in this field. Date of First OD Displays the date of first OD (utilization) in this field. Date of Last OD Displays the date of last OD (utilization) in this field. Table 2-13 OSUC Amount Calculation Logic

Calculation Facility Type Committed, revolving facility Non-committed, revolving facility Committed, non-revolving facility Non-committed, non-revolving facility’s OSUC after facility creation Available amount + outstanding utilized amount Outstanding utilized amount Available amount + outstanding utilized amount Outstanding utilized amount OSUC amount after utilization Available amount + outstanding utilized amount Outstanding utilized amount Available amount + outstanding utilized amount Outstanding utilized amount OSUC amount after payment Available amount + outstanding utilized amount Outstanding utilized amount Available amount + outstanding utilized amount Outstanding utilized amount OSUC amount after block Available amount + outstanding utilized amount + block amount Outstanding utilized amount Available amount + outstanding utilized amount + block amount Outstanding utilized amount OSUC amount after netting Available amount + outstanding utilized amount - netting amount Outstanding utilized amount Available amount + outstanding utilized amount - netting amount Outstanding utilized amount OSUC amount after transfer (in) Available amount + outstanding utilized amount - transfer amount Outstanding utilized amount Available amount + outstanding utilized amount - transfer amount Outstanding utilized amount OSUC amount after transfer (out) Available amount + outstanding utilized amount - transfer amount Outstanding utilized amount Available amount + outstanding utilized amount - transfer amount Outstanding utilized amount Table 2-14 NRS Available Balance Calculation

SL. No Transaction Date Effective Line Amount Utilized Amount Available Amount NRS Available 1 Facility Creation 1st January 10000 0 10000 0 2 Utilization of 6000 1st January 10000 6000 4000 0 3 De-utilization of 2000 1st January 10000 6000 4000 2000 4 Utilization of 1500 1st January 10000 6000 4000 500 5 Utilization of 3000 1st January 10000 8500 1500 0 Table 2-15 For example

SL. No Amount / Transaction 1st January 2nd January (before facility reactivation) 2nd January (after facility reactivation) 1 Facility Status Expired Expired Active 2 Available Amount 1500 1500 1500 3 De-utilization 0 1000 1000 4 NRS Available after de-utilization 0 1000 1000 5 Utilization 0 0 1000 6 NRS Available after utilization 0 0 0 Note:

- In the above example, de-utilization is considered on both the expired and active lines, whereas utilization is considered only on the active line.

- For backdated utilization and de-utilization transactions, NRS Available amount gets updated on the value date and does not consider the book date.

- Any backdated utilization done after the backdated de-utilization first updates the value dated NRS Available balance. The Available Amount as on current date is updated only if the utilization amount is more than the NRS available amount on that day.

- Collateral or currency revaluation does not impact the NRS Available balance.

- NRS Available balance becomes zero during the day itself in case NRS line is closed before EOD.

Processing Future Dated Credit Line

A future dated credit line is a credit line that has a value date later than the date on which it is booked. User can create credit line with value date as future date for the following lines.- Main-Lines

- Sub-Lines

System validates that only active main lines can be linked to a future dated sub-line and only active lines are list in LOV against main line.

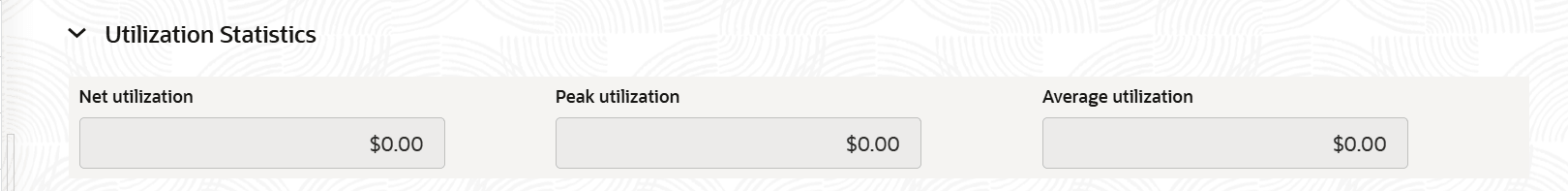

Utilization Statistics: This section displays the net, peak, and average utilization of the facility in facility currency based on predefined logic.For more information on fields, refer to the field description table below:Table 2-16 Utilization Statistics

Field Description Net Utilization Net Utilization is derived by deducting the collateral value against facility from the outstanding utilized amount. For example, if the facility effective limit amount is 100000, current outstanding utilized amount after payment is 60000, and the value of collateral attached to facility is 40000, then the Net Utilization is 20000 (60000-40000). Net utilization amount will be zero, if the linked collateral value is greater than the Outstanding (utilized) amount.

If collateral is not linked to the facility, the net utilization amount is the outstanding utilized amount. The system calculates the net utilization amount everyday while processing BoD batch based on end of day outstanding utilized amount and the collateral value on the previous day.

The Net Utilization will be displayed for both revolving and non revolving lines. In case of revolving lines, utilized amount is the current outstanding (utilized) amount. Whereas for non-revolving lines, the current outstanding (utilized) amount will be arrived by deducting total repaid amount from the outstanding utilized amount.Note:- Revaluation of collateral and facility will be considered while calculating the net utilization amount.

- Net utilization cannot be reset during the life-cycle of facility.

Peak Utilization Peak utilization is the maximum outstanding utilization of a facility over the time period configured in Config Service. For example, if Rollover in Days value is specified as 30 or Frequency is selected as Monthly Config Service, peak utilization is the end of day outstanding utilization amount that is greater than all other end of day outstanding utilization amounts during the configured number of days or in the whole month. The system calculates the peak utilization as a part of BOD batch process. Average Utilization Average utilization is the average outstanding of the end of day balances over the time period configured in Config Service. For example, if Rollover in Days value is specified as 30 or Frequency is selected as Monthly Config Service, average utilization is the average outstanding of the end of day balances over the configured number of days or the month. The system calculates the average utilization as a part of BOD batch process. Utilization Order

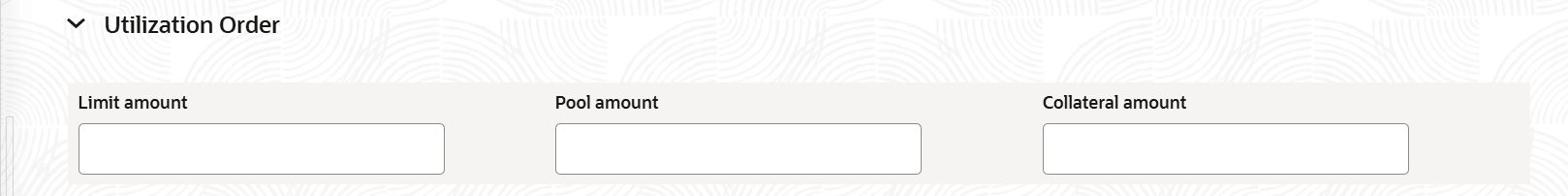

User can specify utilization order of the facility. The Utilization Order is non mandatory. Once specified, the utilization of entity will happen in the mentioned order. The utilization order can be specified as part of facility creation or facility amendment

In case user links collateral and / or collateral pool to the facility and selected Effective Line Amount Basis as Limit Amount + Collateral or Minimum of Line Amount and Collateral, user can specify the order of utilization in this section. The Utilization Order is non mandatory, if the Effective Line Amount Basis is selected as Limit Amount. Once specified, the utilization of entity will happen in the mentioned order.

Note:

- Order has to be mentioned for all three components

- After facility creation, the order of utilization be modified, if the utilization already happened has not been breached and the available balance is not negative.

Utilization OrderFor more information on fields, refer to the field description table below:

Table 2-17 Facilities Maintenance - Utilization Order Field Description

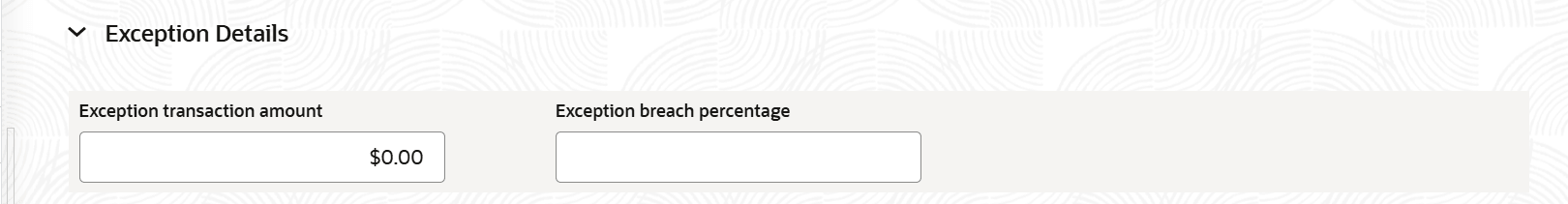

Field Description Limit Amount Specify the utilization order for the limit amount. For example, 1, 2, or 3. Pool Amount Specify the utilization order for the pool amount. For example, 1, 2, or 3. Collateral Amount Specify the utilization order for the collateral amount. For example, 1, 2, or 3. Exception DetailsFor more information on fields, refer to the field description table below:Table 2-18 Exception Details

Field Description Exception Transaction Amount Specify the Exception transaction amount. During utilization transaction when the utilization amount crosses the specified exception transaction amount, there is a breach of the signified transaction amount. This is a credit exception in the transaction. User can use the MultiAuthorization screen for authorizing or rejecting such a transaction. Exception Break Percentage Specify the Exception Breach Percentage. During utilization transaction when overall utilization crosses the specified Exception Breach Percentage, there is a breach of the limit amount. This is a credit exception in the transaction. User can use the MultiAuthorization screen for authorizing or rejecting such a transaction. Limit Review

For more information on fields, refer to the field description table below:

Table 2-19 Facilities Maintenance - Limit Review - Field Description

Field Description Limit Status Click  icon and select the status of the facility (For

example, ACTIVE, CLOSED, EXPIRED and so on) from the list

available. The list displayed here is based on maintenance

done in User Define Status Maintenance screen.

icon and select the status of the facility (For

example, ACTIVE, CLOSED, EXPIRED and so on) from the list

available. The list displayed here is based on maintenance

done in User Define Status Maintenance screen.

User can initiate logical closure of facility by selecting the Close status.

Refer - 2.2.30 Facility Expiry and Closure with Fee Handling.

Review Frequency Select the frequency at which the limit should be reviewed. The options available are: - Monthly

- Quarterly

- Half Yearly

- Yearly

- Blank - if user select this, user need to specify the next review date.

Next Review Date The system displays the next limit review date Based on the review frequency. This date is derived by adding the frequency days to the current date. If user do not select any of the provided review frequency and set it to blank, then user need to manually enter the next review date.

Status Changed on Specify the date on which user want to change the status. The status changed on will be updated to the current System date whenever Limit Status is modified – example during logical closure of facility where status is updated as Closed Freeze Reason Specify the freeze reason of limit. If the closure reason is captured in the CAMS process flow in OBCFPM, the same is displayed here. Closure Reason Specify the reason for limit closure. If the closure reason is captured in the CAMS process flow in OBCFPM, the same is displayed here. - Click Save and Close to save the record. Click on Next to navigate to next data segment. Click on Cancel to cancel the record creation.

Parent topic: Facilities Maintenance