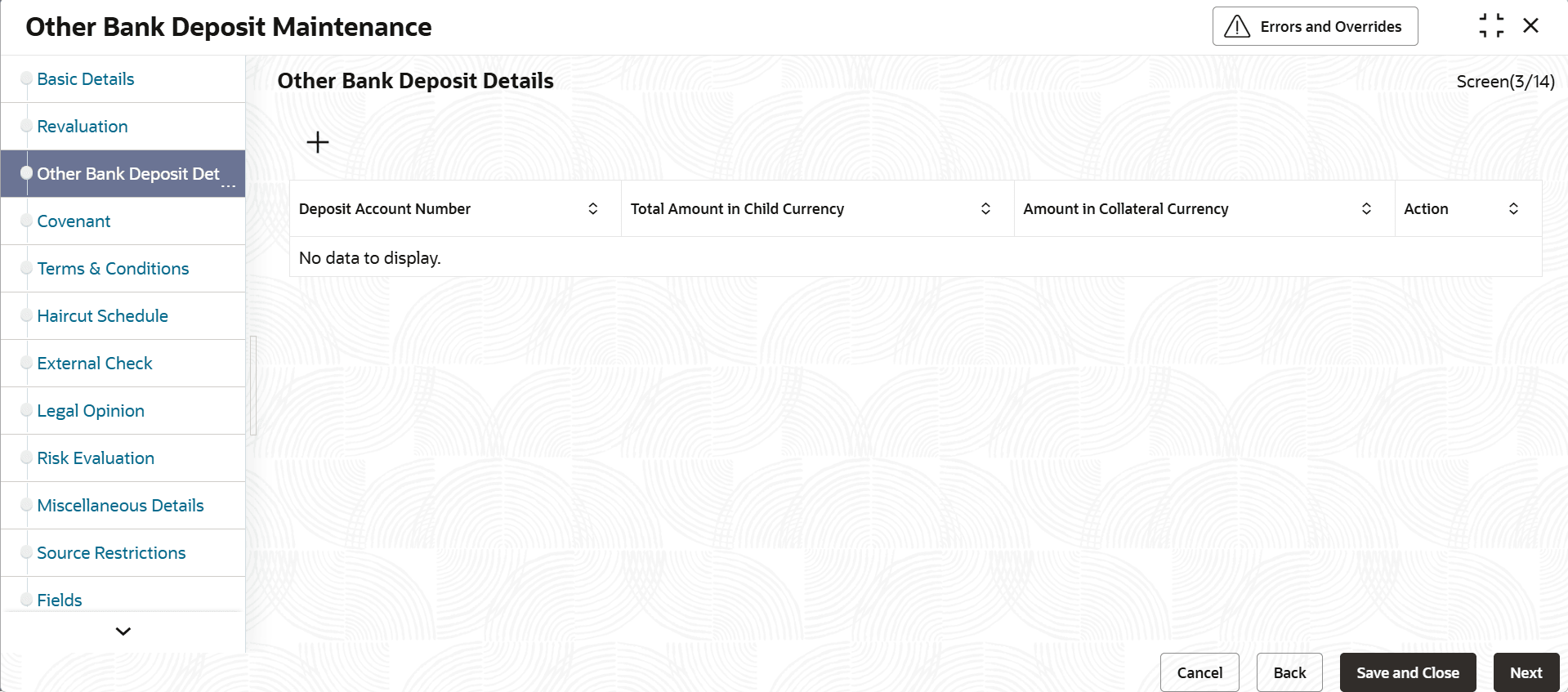

3.11.2.16 Other Bank Deposit

This topic provides systematic instructions about Other Bank deposit.

- On Home screen select Limits and Collaterals. Under Limits and Collaterals, select Collaterals. Under Collaterals, select Maintenances.

- Under Maintenances, select Collateral Types. Under Collateral Types, select Other Bank Deposits.

- Under Other Bank Deposits, select Other Bank Deposits

Maintenance.The Other Deposits Maintenance screen displays.

Using this screen, customer collateral of type other bank deposits can be maintained. Multiple other bank deposit records can be linked same customer collateral. Collateral value is updated duly considering total amount of these deposits.

Click

icon.The Other Bank Deposit Details screen is displayed.For more information on fields, refer to the field description table.

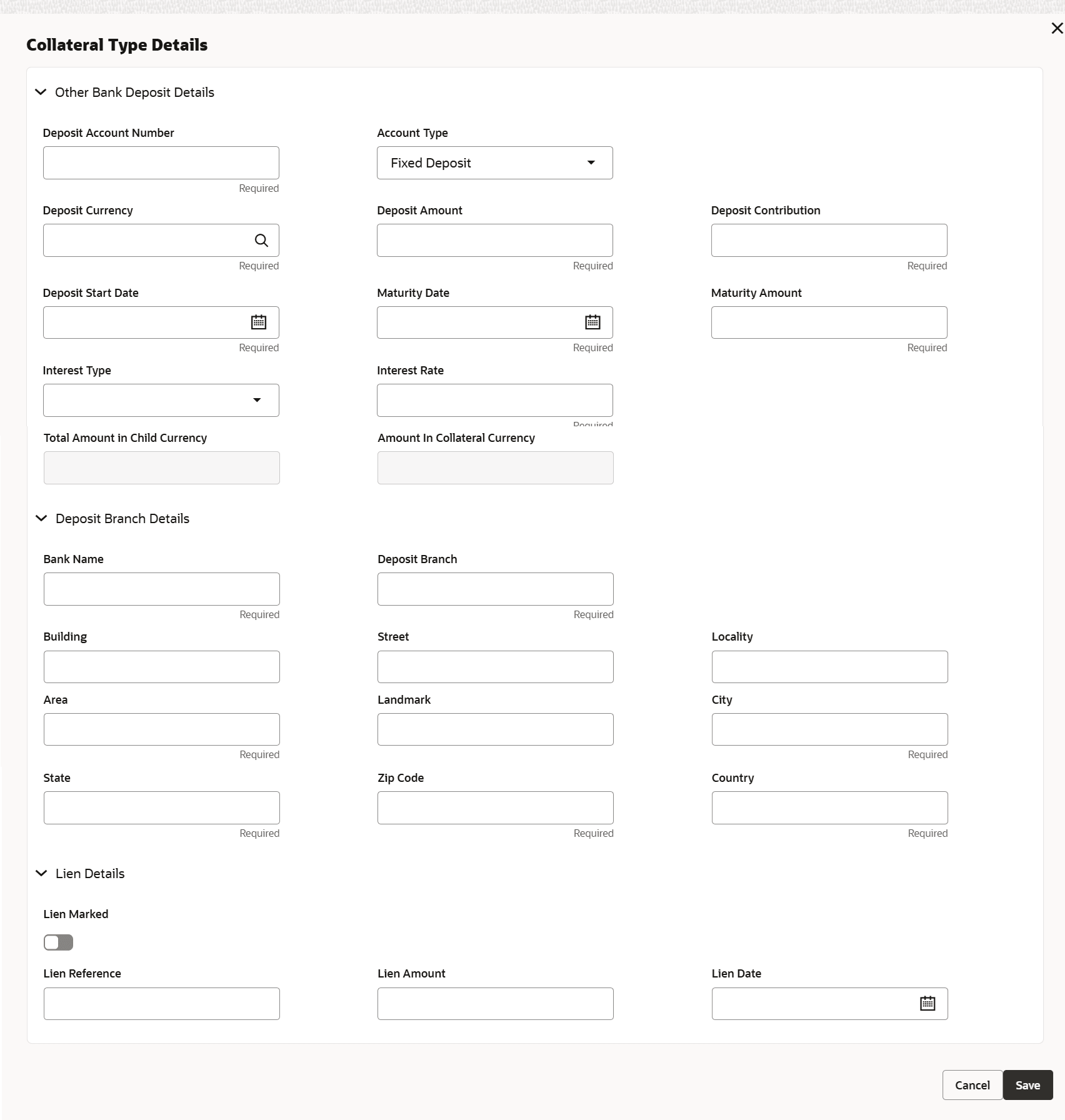

Table 3-105 Other Bank Deposits Details - Field Description

Field Description Deposit Account Number Specify the unique deposit account number for account type across multiple deposit accounts attached to the same collateral. Note: Deposit account number should be unique when deposit type is same.Deposit account number will be used as reference number in sub-systems to signify sub-system record at child collateral level.

Account Type Select the account type from the drop-down list. The available options are: - Fixed Deposit

- Recurring Deposit

- Reinvestment Deposit

Deposit Currency If deposit currency is different from collateral currency, configured rate is considered and converted deposit amount is updated as collateral value. Deposit Amount Specify the deposit amount. Deposit Contribution The deposit contribution is the value of the deposit contributing to the collateral value. If deposit contribution is not mentioned deposit amount itself is updated as deposit contribution which is considered for collateral value.

Deposit Start Date Specify the start date of the deposit.

The deposit start date cannot be future dated.

Maturity Date Specify the maturity date of the deposit. Maturity Amount Specify the maturity amount. The maturity amount cannot be less than deposit amount. Interest Type Specify the interest payout frequency. The available options are: - Weekly

- Monthly

- Quarterly

- Half-Yearly

- Yearly

Interest Rate Specify the interest rate. Total Amount in Child Currency Displays the total amount in child currency considering deposit contribution for the particular deposit collateral. Amount in Collateral Currency Wherever other bank deposit currency is different from collateral currency, other bank deposit value in the collateral is converted to collateral currency as per rate configured and collateral value is updated. Deposit Branch Details Maintain deposit bank and its branch details. Bank Name Specify the bank name. Deposit Branch Specify the deposit branch name. Building Specify the building name. Street Specify the street details. Locality Specify the locality. Area Specify the area. Landmark Specify the landmark. City Specify the city. State Specify the state. Zip Code Specify the zip code. Country Specify the country name. Lien details Provision to note existing lien details against the deposit. Lien Marked Enable the toggle to note lien details. Lien Reference Specify the lien reference. Lien Amount Specify the Lien amount cannot be greater than deposit amount Note:- Collateral value is calculated as deposit contribution minus lien amount.

Lien Date Lien date cannot be prior to 'Deposit Start Date'. Lien date cannot be future dated. Remarks Specify remarks, if any. - Click Save to save the record.

- View Other Bank Deposits

This topic describes the systematic instructions to view the other bank deposits.

Parent topic: Collateral Maintenance - Specific Types