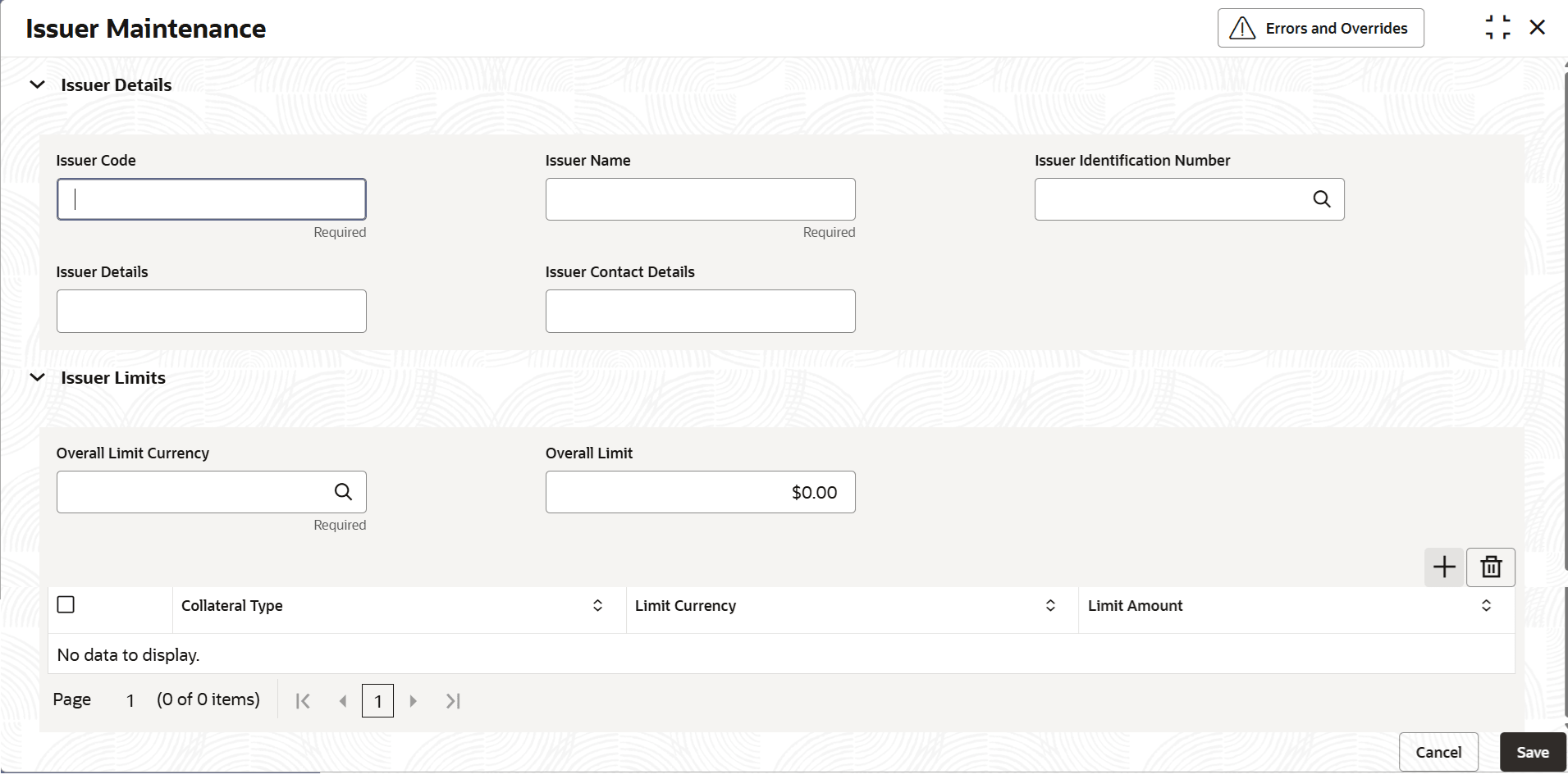

3.5 Issuer Maintenance

This topic provides systematic instructions on issuer maintenance.

A customer is granted credit on the basis of his/her credit worthiness. The credit worthiness of a customer depends on the assets constituting the customer’s portfolio. The type of collateral that a customer offers can be in the form of marketable or non-marketable securities.

Marketable collaterals, driven by market forces, tend to fluctuate unpredictably. You may hence need to monitor your bank’s exposure to issuers of such collateral. The details of the issuer and limit for his securities can be defined using the Issuer Maintenance screen.

- View Issuer Maintenance

This topic describes the systematic instructions to view the issuer maintenance.

Parent topic: Maintenances