3.11.2.9 Corporate Deposits

This topic provides the systematic instructions about Corporate Deposits.

- On Home screen select Limits and Collaterals. Under Limits and Collaterals, select Collaterals. Under Collaterals, select Maintenances.

- Under Maintenances, select Collateral Types. Under Collateral Types, select Corporate Deposits.

- Under Corporate Deposits, select Corporate Deposits

Maintenance.The Corporate Deposits details screen is displayed.

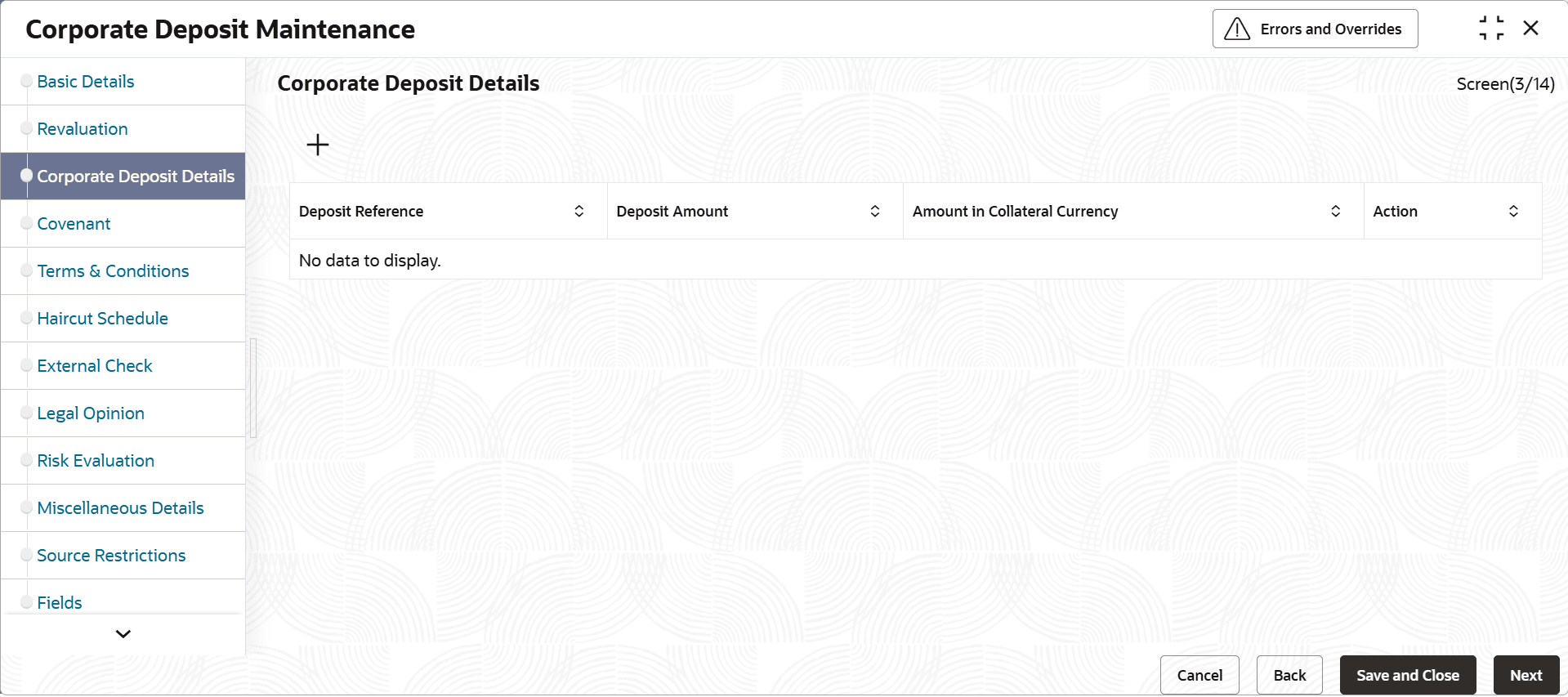

Figure 3-105 Corporate deposits maintenance

Click

Using this screen, you can create customer collaterals of corporate deposits type considering various attributes.

icon. The Corporate Deposits Details screen displays.Multiple corporate deposits can be maintained under corporate deposits. Sum of all these Collateral value is updated duly considering amount of these Corporate Deposits records.

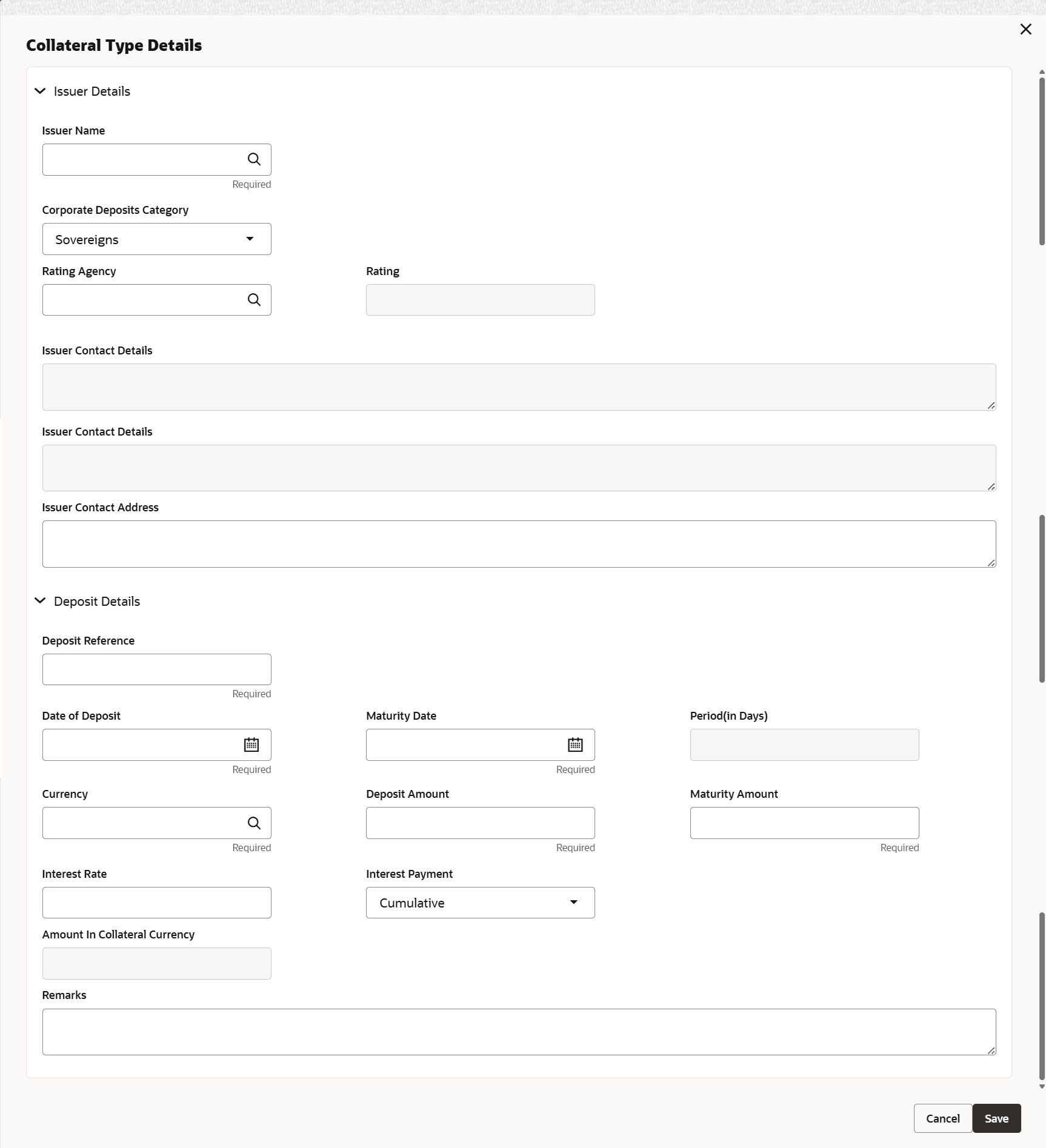

For more information on fields, refer to the field description table.

Table 3-86 Corporate Deposit Details - Field Description

Field Description Issuer Name Issuer code or name is to be fetched from Issuer Maintenance. Only those issuers which have been created for type – corporate deposit will be available. Corporate Deposits Category Select the category from the drop-down list. The available options are: - Sovereigns

- Banks

- Corporates

Rating Agency These details are fetched from the Credit Rating Agency Maintenance screen. Rating These details are fetched from the Credit Rating Agency Maintenance screen. Issuer Contact Details Issuer contact details for the issuer name selected is fetched. Issuer contact address Issuer contact address can be captured. Deposit Details Displays the deposit details under this section. Deposit Reference Specify the deposit reference number which is unique across records of the collateral. Date of Deposit Specify the date of deposit. Future date is not allowed. Maturity Date Specify the maturing date of the deposit. When multiple corporate deposit have different maturity dates, the last date of these maturity dates is updated as collateral end date. On the maturity date of the last date record, collateral value is updated as zero. However, when a particular corporate deposit record linked to a collateral matures first, then the collateral value is reduced to this extent. Maturity date cannot be back dated or current date.

Period (in Days) Based on issue date and maturity date, period (in days) is calculated. Currency Specify the currency details. Deposit Amount Deposit amount is updated as collateral value. After collateral creation, deposit amount cannot be modified. Maturity Amount Specify maturity amount of the deposit. Maturity amount cannot be less than deposit amount. It is equal or greater than deposit amount. Interest Payment Select the interest payment from the drop-down list. The available options are: - Cumulative

- Non-Cumulative

Interest Rate Specify the interest rate of deposit. Amount in collateral Currency When deposit currency is different from collateral currency, same is converted as per exchange rate maintained and deposit amount in collateral currency is displayed Remarks Specify remarks, if any. - Click Save to save the record.

- View Corporate Deposits

This topic describes the systematic instructions to view the corporate deposits.

Parent topic: Collateral Maintenance - Specific Types