2.2.7 Fee & Accounting Class Maintenance

This topic describes about the procedure for Maintaining fee class screen.

Fee rules configured through fee rule maintenance for an entity are grouped together in fee & accounting class maintenance with additional details like events and accounting entries for these events. Fee class will be associated at entity level as part of maintenance and also Line code maintenance level.

Note:

The fields, which are marked with an asterisk, are mandatory.- On Home screen, select Limits and Collaterals. Under Limits and Collaterals, select Common.

- Under Common, select Maintenances. Under Maintenances, select Fee & Accounting Class.

- Under Fee & Accounting Class, select Fee & Accounting Class

Maintenance.The Fee & Accounting Class Maintenance screen is displayed.

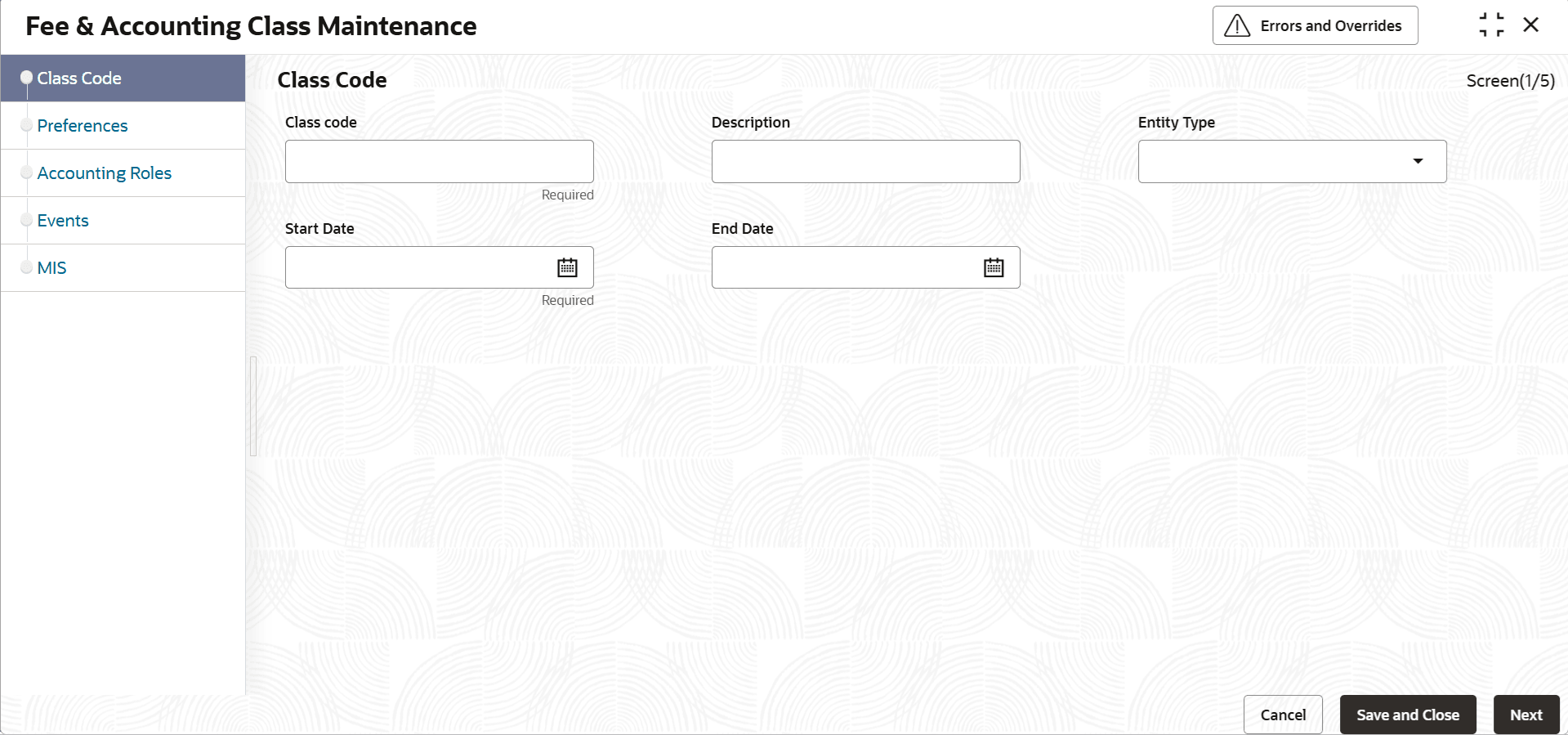

Figure 2-41 Fee & Accounting Class Maintenance

- On Class Code screen, and specify the fields.For more information on fields, refer to the field description table.

Table 2-31 Fee Class Maintenance - Field Description

Field Description Class Code Before defining the attributes of a fee class, user should assign the class a unique identifier, called the Class Code. Class code can be alpha numeric with maximum of 4 characters.

Description A brief description about the class. A description helps user to easily identify the class. Entity Type User can select the Entity Type as Facility or Collateral. Based on this selection, appropriate Rule Code and Rule Type is displayed in the Preferences data segment. Start Date Specify the fee class start date which can be back dated, current dated or future dated. Based on start date, it will be available for linkage at entity level considering its start date. End Date Specify the end of fee class beyond which date same not be available for linkage to entity. - Click Next.The Preferences screen displays.

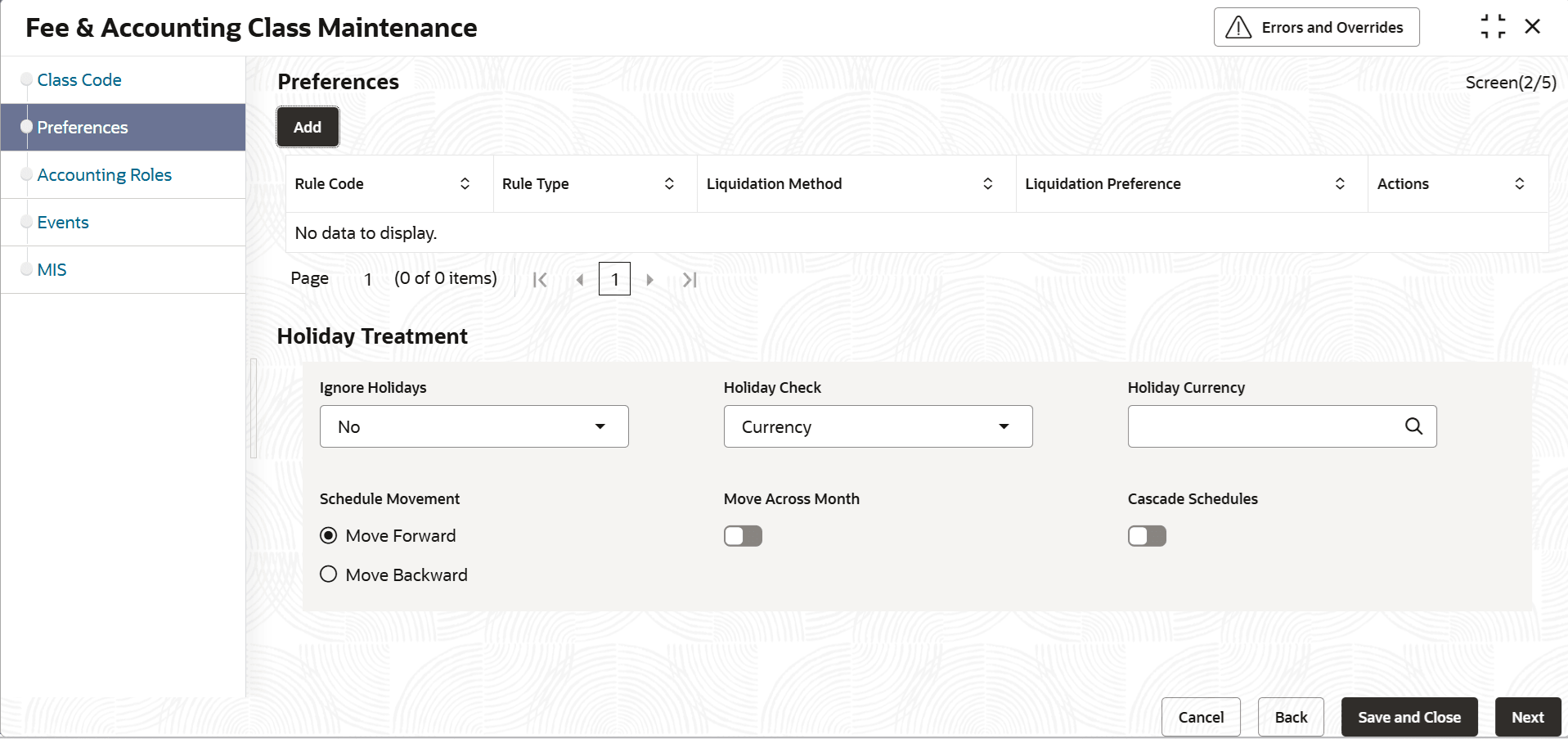

For more information on fields, refer to the field description table.

Table 2-32 Preferences - Liquidation Method - Field Description

Field/Column Name Description Rule Code Displays the rule code selected. Rule Type Display the rule type for rule code. Liquidate Method Display the liquidate method for rue code.

Actions Display the actions like add, edit are shown.. Ignore Holidays If this check box is selected, then holiday treatment is not applied to calculate the next date. If this check box is not selected, then Holiday Preferences settings are validated. Holiday Check If holiday treatment is applicable, then you can select Local, Currency or Both based on your holiday maintenance. If Both is selected and Branch or Currency is holiday, then holiday processing setting is considered.

Holiday Currency If holiday check is maintained as Currency or Both then currency code to be maintained here. Schedule Movement Select the required option to restrict the checklist. Available options are: - Move Forward: In case calculated next date is holiday then date of liquidation will be moved forward.

- Move Backward: In case calculated next date is holiday then date of liquidation will be moved backward.

Move Across Month This is to be read with move forward/move backward setting. When the liquidation date falls on the last working day/first working day of a month which is a holiday, if move across month is selected, system will appropriately move liquidation to next month/previous month considering move forward/backward setting.

Cascade Schedules If cascade schedules is selected, then the next date is calculated on based on previous schedule date instead of originally derived date based on frequency. If fee liquidation date for one of the liquidation cycle is changed based on holiday processing setting and if cascade schedule is selected future liquidation dates of corresponding fee gets modified by applying frequency on the newly arrived liquidation date.

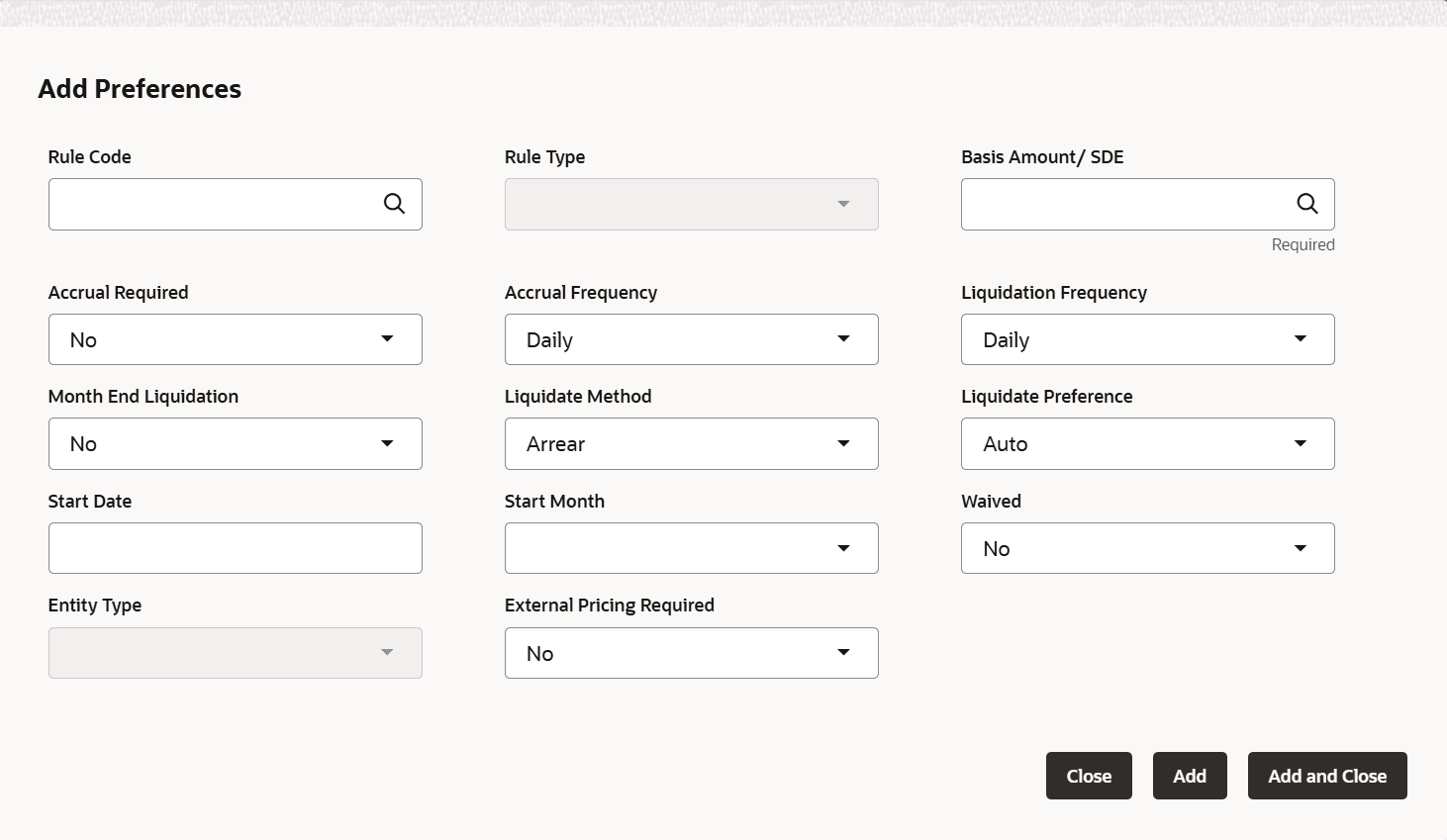

- Click Add.The Add Preferences screen displays.

For more information on fields, refer to the field description table.

Table 2-33 Add Preferences

Field Description Rule Code Select the rule code from LOV.

Based on entity type selected for fee class, appropriate fee rules from rule maintenance will be available for configuring.Rule Type Based on rule code selected, rule type is defaulted from rule maintenance. Basis Amount/SDE This is applicable for collateral fee rules. Collateral fee is supported on COLLATERAL_VALUE and this is to be selected for configuring a fee rule. Accrual Required Signify whether accrual is required for this fee rule. For advance fee/event based fee, accrual works like amortization as fee would have been liquidated in advance. Accrual Frequency If accrual required is selected as yes, signify the accrual frequency for fee rule. Liquidation Frequency Signify the applicable liquidation frequency for fee rule. For event based fee, it will be one time.

For collateral fee which is recurring in nature, select the appropriate frequency.

Month End Liquidation Select this if fee to be liq undated on month ends. This is applicable for facility fees. Liquidate Method Select the appropriate liquidation method for the fee rule from the available values: - Arrears

- Event Based

Liquidation Preference For collateral fees, the Rule Type of Fee user can select Liquidation Preference as Auto or Manual for expiry event fees, liquidation preference AUTO is allowed Start Date Specify the start date from which the fee need to be liquidated. Start Month This is to be read with start date specified above, to signify month & date of first liquidation. This is applicable for recurring fees and not for event based fees. Waived Particular fee can be waived by selecting waived at fee class level which gets defaulted at entity level. Entity Type Entity type either Facility or Collateral gets defaulted based on fee rule selected. External Pricing Required This value is defaulted based on the rule selected in Fee Rule Maintenance and user cannot modify this value. - Click Next.The Accounting Roles screen displays.

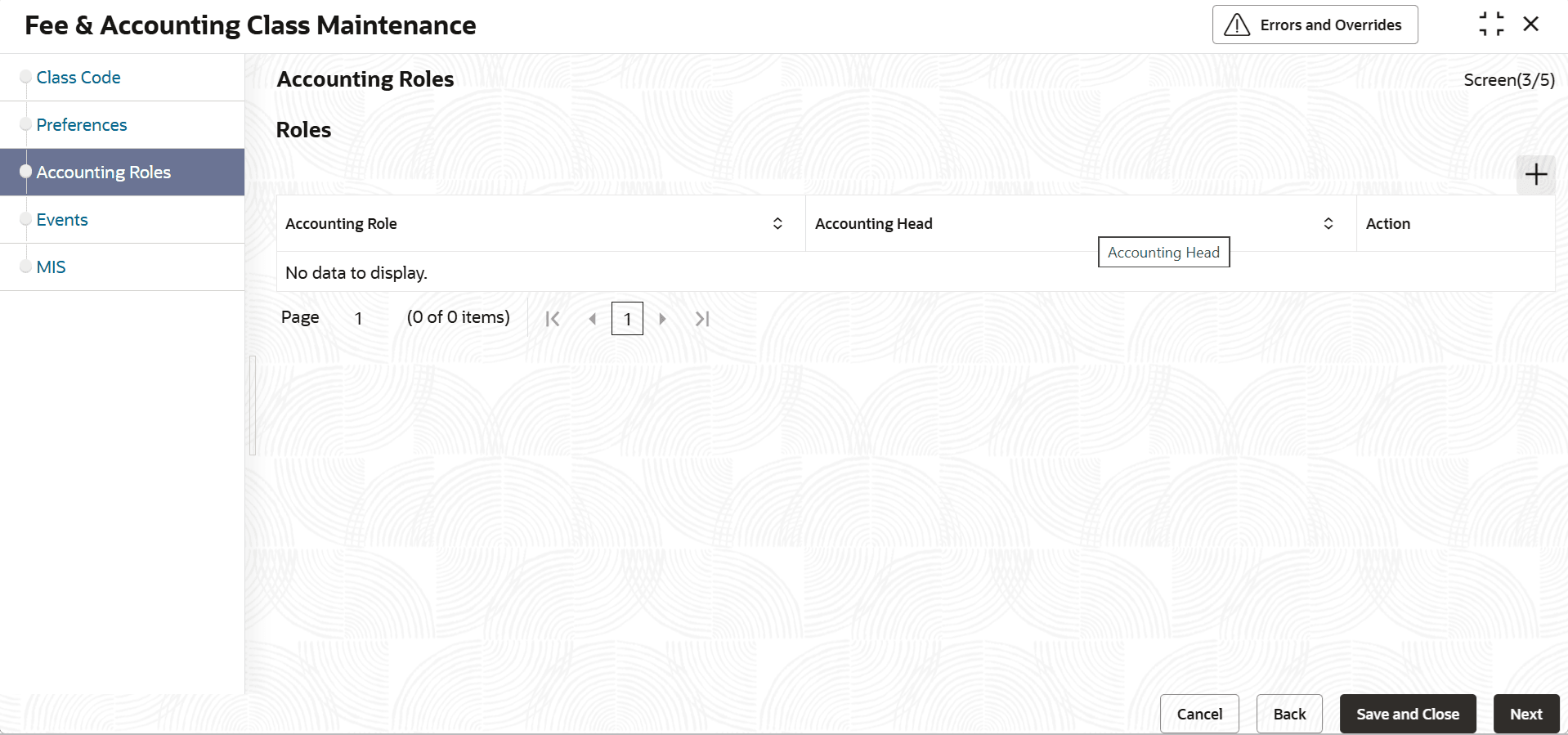

For more information on fields, refer to the field description table.

Table 2-34 Accounting Roles - Field Description

Field Description Accounting Role Accounting Roles are tags that identify the type of accounting entry that is posted to an accounting head. Based on fee rules added in fee preferences data segment, dynamic accounting roles generated by system will be available for configuring and signifying accounting head.

For each fee rule added in preferences, the following accounting roles are generated dynamically and available for configuring with accounting head.- RULE_INC

- RULE_REC

- RULE_RIA

Accounting Head The different General Ledgers (GLs) and Sub-Ledgers (SLs) maintained in Chart of Accounts are referred to as accounting heads or account heads and to be configured with accounting role. - Click Next.The Events screen displays.

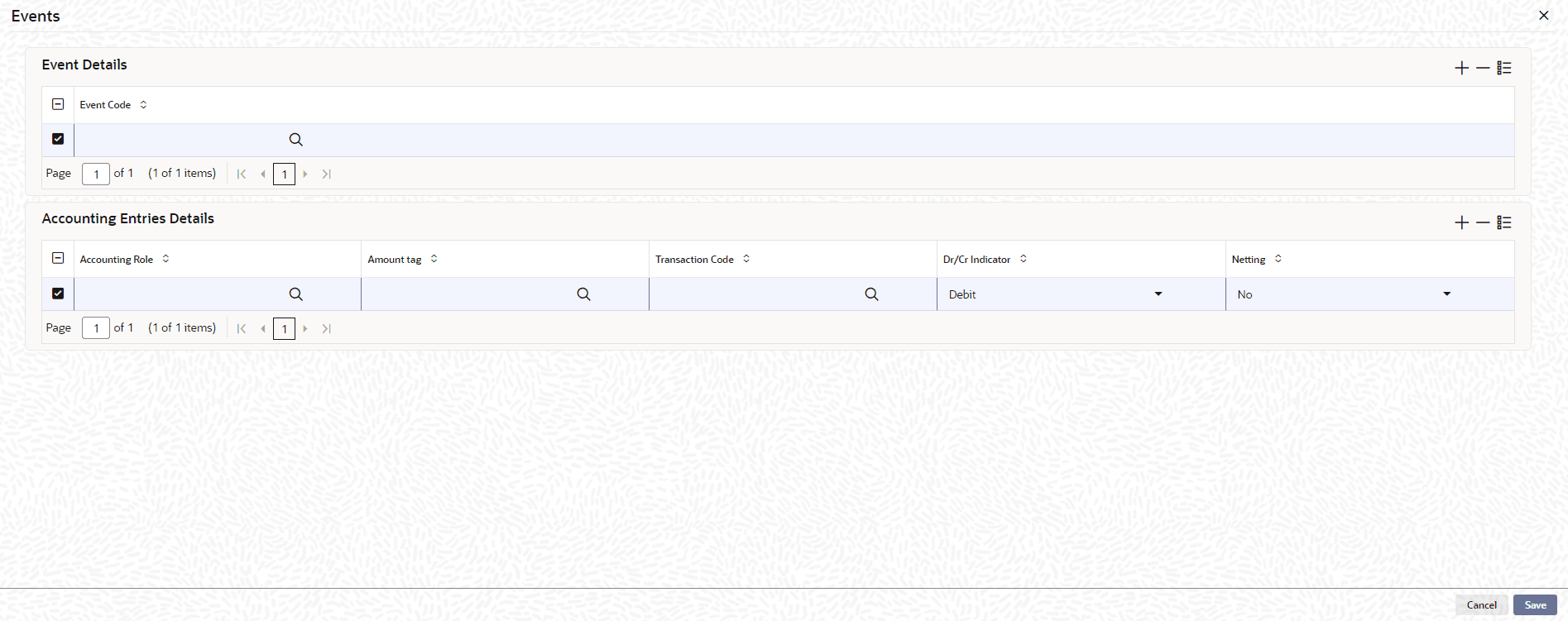

For more information on fields, refer to the field description table.

Table 2-35 Events - Field Description

Field Description Event Code Specify the event code. For collateral fee class, only FLIQ and FACR fee related events are applicable.

Accounting Role Code Specify the accounting role for each fee rule for the event. For FLIQ, customer accounting role is available to configure debit leg. Amount Tag Specify the amount tag. Amount tags for fee can be accrual or liquidation related appropriate amount tag for FLIQ or FACR event for the relevant fee rule to be selected.

Transaction Code Indicates the type of accounting entry associated with every accounting entry. Netting Indicator Select this drop-down list if you need netting for fee liquidation. Dr/Cr Indicator Indicates whether the amount was debited or credited to accounting head. Action Used while creating/amending the record. - Click Next.The MIS Class screen displays.

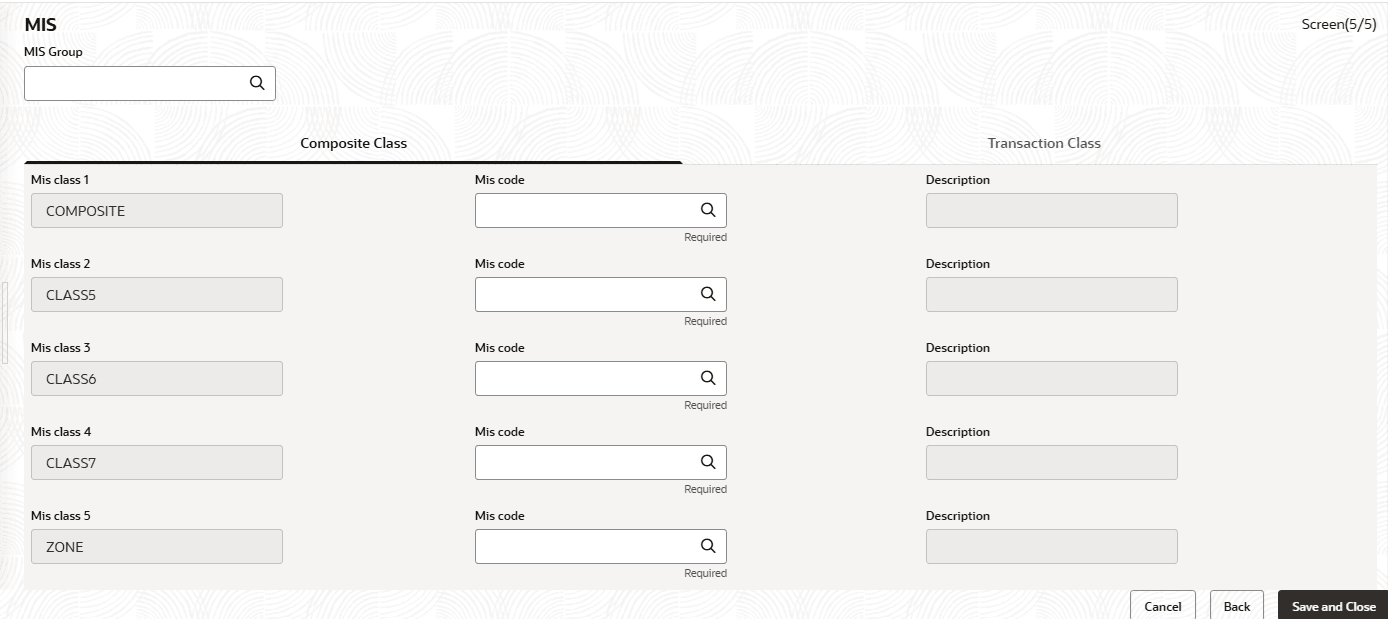

For more information on fields, refer to the field description table.

Table 2-36 MIS Class - Field Description

Field Description MIS Group Select the MIS group from the list of groups configured in MIS Group Maintenance screen. Transaction MIS Displays the transaction type of MIS code based on the selected MIS Group. Composite MIS Displays the Composite type of MIS code based on the selected MIS Group. MIS Code Transaction and Composite MIS codes configured in MIS Class Maintenance or MIS Group maintenance are auto-populated based on the selected MIS Group. The user can also add, modify or delete the MIS codes of type Transaction and Composite. For a fee class, the system allows to configure ten MIS Codes of each transaction and composite type. Note: MIS Codes of Customer and Fund Types will not be populated in the MIS subscreen and the same cannot be used for creating Fee Class.

MIS Class Displays the MIS class based on the selected MIS code - Click Save to save the record.

- View Fee and Accounting Class Summary

This topic describes the systematic instructions to view the Fee and Accounting Class Summary.

Parent topic: Maintenances