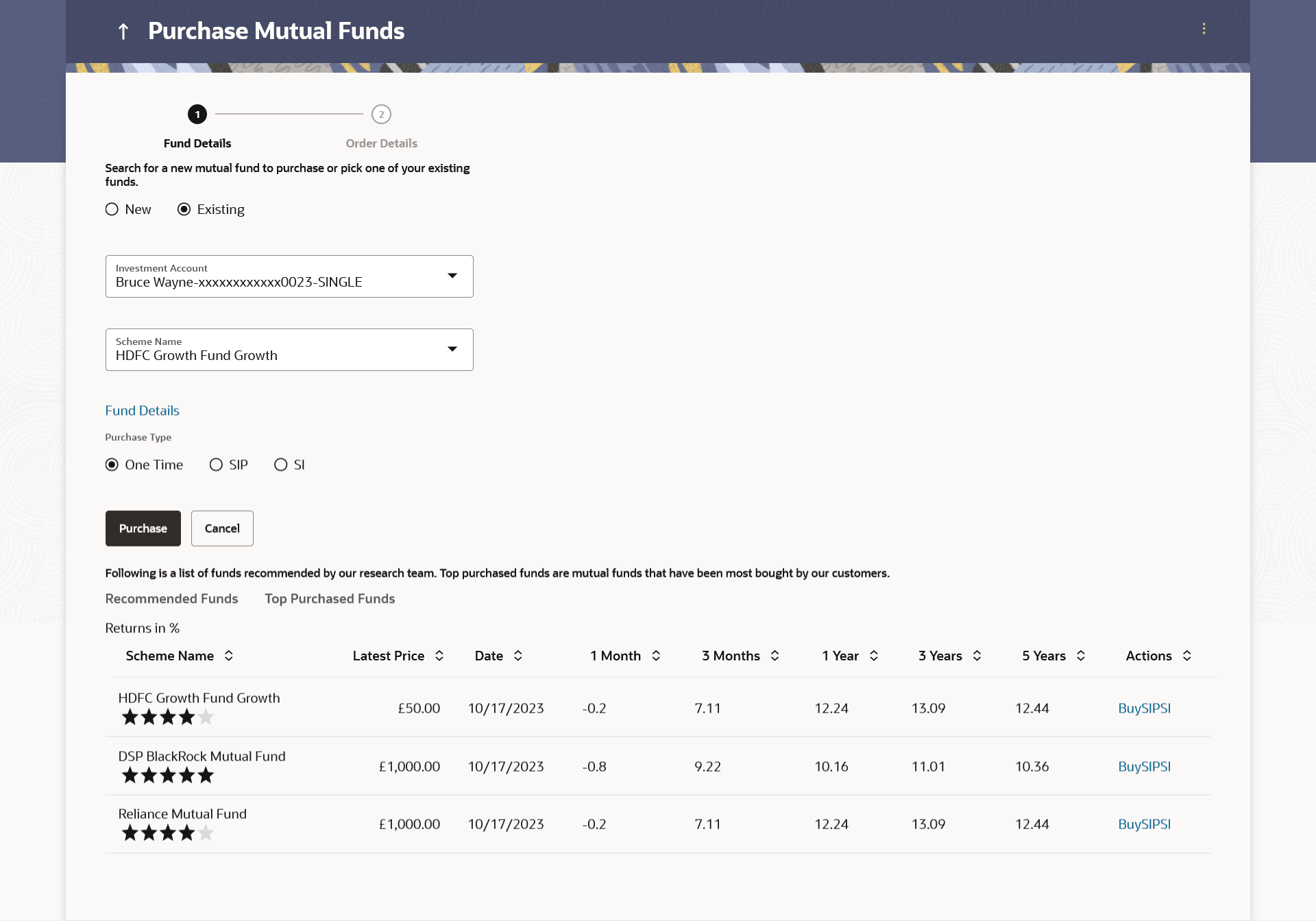

4.1.2 Purchase Funds - Existing

This topic describes the information about Purchase Funds - Existing screen. User can place purchase orders either one time or Systematic Investment Plan (SIP) or Standing Instruction (SI) type with this option.

This option allows the retail investor/ user to place purchase orders either one time or Systematic Investment Plan (SIP) or Standing Instruction (SI) type for buying one or more units of the mutual fund schemes which is currently owned by the investors.

To purchase the mutual funds:

Parent topic: Purchase Mutual Funds