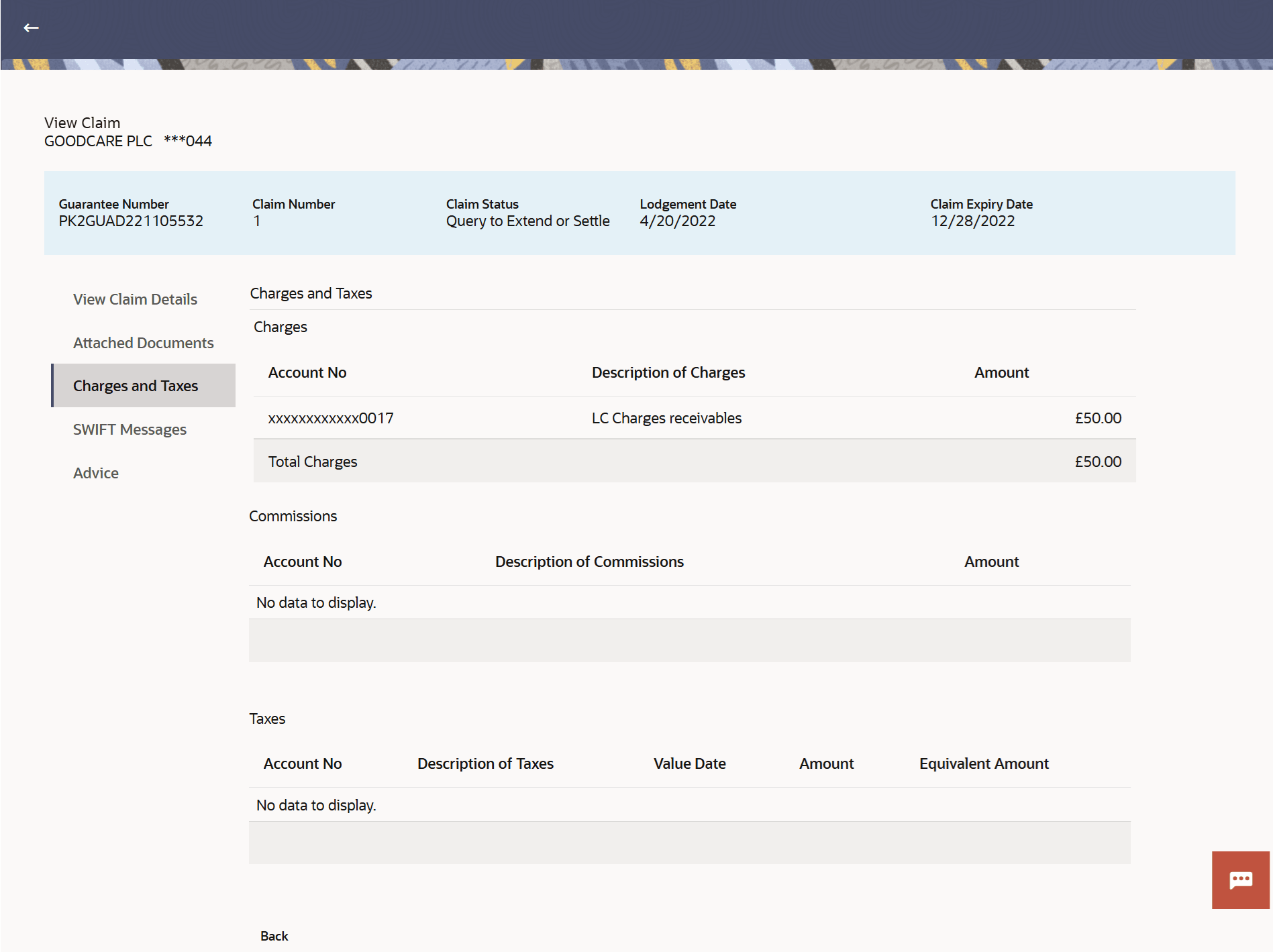

25.4 Charges and Taxes

This topic provides the systematic instructions to view the Charges and Taxes details in the application.

This tab lists charges and taxes specific to claim generated at every respective stage of the claim.

- Navigate to the Charges and Taxes tab.

Figure 25-6 View Claim - Charges and Taxes tab

For more information refer to the field description table below:

Table 25-5 View Claim - Charges and Taxes - Field Description

Field Name Description Charges This section displays the Charges details. Account No Displays the debit account number of the applicant. Description of Charges Displays the description of the charges. Amount Displays the amount that is maintained under the charges. Total Charges Displays the total charge amount. Commissions This section displays the Commission details. Account No Displays the debit account number of the applicant. Description of Commissions Displays the description of commission applicable. Amount Displays the amount of commission. Total Commission Displays the total commission amount. Taxes This section displays the Taxes details. Account No Displays the debit account number of the applicant. Description of Taxes Displays the description of taxes applicable. Value Date Displays the value date of the taxes. Amount Displays the amount of taxes. Equivalent Amount Displays the equivalent amount of taxes. Total Taxes Displays the total Taxes amount. Note:

If there is a Relationship pricing maintained for the customer, the same would be reflected in the charges instead of the standard pricing. - Click SWIFT Messages tab to view the SWIFT Messages details.

- Click Back to go back to previous screen.

Parent topic: View Claims